Macro Update:

China techs show resilience to escalating trade tensions

Hang Seng Index rose 2.8% at a 2-month high yesterday, led by Chinese tech companies, despite China’s retaliation with additional tariffs of up to 15% on select US imports. There has been increasing optimism on Chinese tech companies as they embrace DeepSeek in the AI self-sufficiency drive. “AI monetisation” is one of our key investment themes in 2025. We expect outperformance of AI software vs hardware within the Asia technology sector.

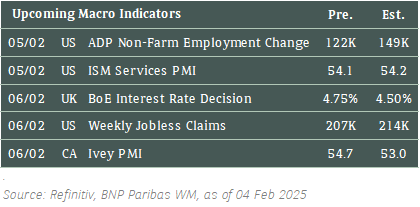

Main Upcoming Macro Indicators

Equity Market Updates

US EQUITIES

Stocks in the US closed higher on Tuesday, recovering from the session a day prior marred by worries about trade tensions.

We see this positive momentum continuing in the medium term.

EUROPE EQUITIES

European shares edged higher on Tuesday as investors shifted their focus to quarterly earnings reports from companies such as UBS and Ferrari among others, even as caution remains over US trade policies.

HK EQUITIES

Hong Kong stocks surged on Tuesday led by tech firms, as hopes of US-China trade talks persist.

Alphabet (GOOGL US)

Shares of Alphabet slid more than 7% in aftermarket hours on Tuesday after it posted 4Q24 revenue that missed analyst expectations as growth in its cloud business slowed. This is despite the company guiding for USD75B in capital expenditures related to data centres and AI infrastructure throughout 2025, exceeding the USD58B analysts had projected.

Looking ahead, investors will likely be watching if Alphabet’s significant AI spend translates to strengthened business momentum.

The US technology giant’s 4Q24 revenue stood at USD81.6B vs. USD82.8B expected, while EPS came out at USD2.15 vs. USD2.13 expected.

MARKET CONSENSUS: 60 BUYS, 14 HOLDS, AVERAGE TP USD220.12

AMD (AMD US)

Shares of AMD fell in aftermarket hours on Tuesday after it gave a disappointing outlook for its data centre business, an area where it is struggling to catch up with rival Nvidia.

This is despite the company posting a 4Q24 revenue beat at USD7.66B vs. USD7.54B expected, while also expecting “strong double-digit percentage” revenue and EPS growth throughout 2025 as new products are to be rolled out in the second half of the year.

AMD has significantly underperformed the US semiconductor space in 2024. Further innovations in its product line will be key to reviving momentum going forward.

MARKET CONSENSUS: 48 BUYS, 16 HOLDS, 1 SELL, AVERAGE TP USD166.35

Nokia (NOKIA FH)

US telecoms operator AT&T and Finnish network equipment maker Nokia have signed a multi-year expansion agreement to upgrade AT&T's voice carriage and 5G network automation in the US, Nokia said on Tuesday.

The deal comes a year after Nokia lost a major contract with AT&T to its Swedish rival Ericsson, which AT&T chose at the end of 2023 to build a telecoms network that will cover 70% of its wireless traffic in the US by late 2026.

Last week, Nokia reported stronger-than-expected 4Q adjusted operating profit and sales, helped by higher demand for telecoms gear from mobile operators in North America and India. This resilience is likely to support the share price going forward.

MARKET CONSENSUS: 15 BUYS, 10 HOLDS, 5 SELLS, AVERAGE TP EUR4.85

UBS Group (UBSG SW)

UBS Group said on Tuesday that its net profit for full-year 2024 decreased, while revenue increased YoY.

Operating profit before tax reached USD1B for 4Q24 and USD6.8B for the year. UBS proposed a dividend of USD0.90 per share, a 29% increase from the previous year and plans to continue share buybacks in 2025.

The bank also said it made progress in integrating Credit Suisse, cutting costs by USD3.4B for the year. Diluted EPS stood at USD0.23 in 4Q24 and at USD1.52 for 2024.

The healthy trajectory could boost its top- and bottom-line going forward.

MARKET CONSENSUS: 13 BUYS, 8 HOLDS, 5 SELLS, AVERAGE TP CHF30.81

DSV (DSV DC)

DSV said Tuesday profit for 2024 fell, while revenue rose YoY.

The transport and logistics company's revenue was DKK167.11B vs DKK150.79B a year ago. EPS moved to DKK47.0 from DKK57.1. The company also said in a statement the situation in the Red Sea remains uncertain, with unforeseen changes potentially impacting DSV's financial results in 2025.

As uncertainty remains high due to the macroeconomic and geopolitical situation, including potential trade barriers and tariffs, this could inject volatility to the company’s share price going forward.

MARKET CONSENSUS: 21 BUYS, 1 HOLD, AVERAGE TP DKK1816.25

Earnings Announcements

US Market

Walt Disney, Emerson Electric, Qualcomm, McKesson

European Market

Novo Nordisk, Banco Santander, GSK, TotalEnergies, Credit Agricole, ARM Holdings

HK - China Market

-

Global Indices Changes (%)

Fixed Income Market Updates

Bond market sentiment has been volatile around news headline on Trump’s tariff. But we begin to see more fund flow into the fixed income space as more investors turn defensive. We expect fixed income will gradually outperform in the next few months as Trump throws out more surprises to investors.

EUROPEAN BANK COCO (AT1)

European bank coco was somewhat weaker. Bond prices were generally 0.125-0.5 points lower. The space has been volatile with news headlines around tariffs on Mexico, Canada and China. We believe any sell-off would be a good opportunity to add exposures given our constructive view on Euroepan bank’s credit fundamental.

ASIA INVESTMENT GRADE (IG)

Risk sentiment was slightly better. Non-China IG performed well with India IG being 1-2 basis points tighter. China IG had a roller coaster day. Credit spread first tightened by 3-5 basis points in the morning but erased all the gain in the afternoon when China imposed tariff on US goods. We expect China IG will stay volatile due to tariff talks between Xi and Trump.

ASIA HIGH YIELD (HY)

Asia HY bond has somewhat recovered from yesterday’s sell off. For India HY, Vedanta was about 0.25-0.5 points higher. In China HY, Vanke continued to perform and was 0.5-1 points higher. CSI property traded 2-3 points lower after the share placement announcement as investors worry about potential liability management for the USD bond maturing in July. We expect the space to stay volatile on the back on headline risk with Trump’s tariff.

Forex Market Updates

The US Dollar weakened broadly after US President Trump delayed planned tariffs on Mexico and Canada.

USD

The US Dollar fell for the second straight day against a basket of other major currencies as markets interpreted US President Trump’s tariff threats as more of a negotiating tactic rather than an end goal, a day after he suspended planned measures against Mexico and Canada. However, the new Trump administration imposed an additional 10% of tariffs on imports from China effective from early Tuesday, with currency analysts mostly in consensus that they expect high sensitivity to tariff developments and volatility to persist. Elsewhere, Fed policymaker Daly emphasized the central bank’s neutral stance, saying that the rate-setting committee has time to study incoming economic data and the impact of any policy shifts from the White House before deciding on its next interest rate move.

The Dollar Index could see a further near term retracement towards immediate support around 107.55.

GBP

The British Pound on Tuesday extended its recent recovery against the USD as markets perceived recent trade developments as de-escalatory despite China’s retaliation to Trump’s tariffs on the world’s second largest economy. Some analysts also said that Sterling was able to retain a solid footing because the UK has little to lose from US tariffs, with British exports to the US accounting for less than 2% of GDP and those to China making up less than 1%. On the central bank front, markets are expecting the BoE to cut rates by 0.25% this Thursday but there remains much uncertainty about the policy outlook further out due to signs of stagflation in the UK economy.

Sterling’s recent rebound is likely to run into stiff resistance around 1.2535 moving forward.

AUD

The Australian Dollar recorded its best daily performance in 11 sessions, rallying to a one-week high of 0.6262 against the USD just a day after plunging to lows not seen since the early days of the Covid pandemic. The rebound came after US President Trump agreed to delay 25% tariffs on Mexico and Canada by one month, sparking hopes that they may be avoided altogether, although additional 10% tariffs on China still went ahead as planned. With China being Australia’s single biggest export market, US tariffs on China are likely to have a negative impact on the Australian economy, which analysts say could prompt the RBA into cutting rates this month instead of starting in the second quarter.

Given the uncertain macro backdrop, markets could look to sell the Aussie on rallies towards 0.6330.

XAU

Gold prices climbed to fresh record highs yesterday, driven by demand for safe haven assets after the new Trump administration’s additional 10% tariffs on China went ahead as planned and China retaliated with its own tariffs on imports from the US. Analysts say that with the disruptive policies of the current White House administration likely to generate more market uncertainty, central banks around the world could increase gold purchases to diversify from USD holdings, lending more tailwinds to what is already a stellar bullish run by the precious metal since the beginning of last year.

Gold bulls could push the precious metal to 2880, especially if there are any further escalations in tariffs.