Macro Update:

Wall Street tumbles for a 3rd session

US stocks failed to recover from earlier losses on a choppy start to the week. Market was dragged down by weakness in tech sector amid concerns over Microsoft's reduced data center spending, while investors await Nvidia's earnings release and guidance update following the recent emergence of DeepSeek from China. US President Donald Trump on Monday also stated that the tariffs he unveiled on Canada and Mexico on 3rd Feb are moving forward as planned next week, resulting in more volatility.

Aside from Nvidia, the upcoming release of PCE on Friday is also highly anticipated, and could shape expectations for rate cuts. We still see 2 Fed cuts for 2025, 25bps each in June and December, with terminal rate at 4%.

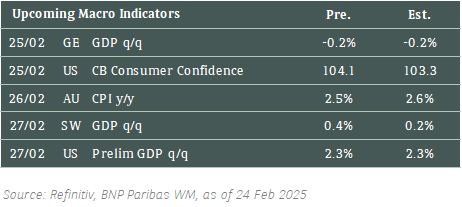

Main Upcoming Macro Indicators

Equity Market Updates

US EQUITIES

US equities ended lower on Monday as investors evaluate President Trump’s latest remark surrounding tariffs.

The market will closely watch Nvidia’s results this week and likely be cautious. We however remain constructive on US equities in the medium term.

EUROPE EQUITIES

European stocks were flat on Monday even as German election results provided relief to the country’s equities. Investors likely stayed on the sidelines due to developments in US trade policy.

HK EQUITIES

Hong Kong stocks fell slightly on Monday amid concerns over Trump’s new America First Investment Policy which could escalate tensions between China and US.

Amgen (AMGN US)

US drugmaker Amgen will invest about USD200M this year in its new technology center in southern India, with further investments planned, CEO Robert Bradway said at the inauguration of the site on Monday.

Amgen announced its plans to open a technology and innovation site in India last year that is focused on increasing the use of AI and data science to support development of new medicines.

The site in Hyderabad city is expected to have a workforce of about 2,000 by year-end, with around 300 employees already working there. This should provide support to Amgen’s share price going forward.

MARKET CONSENSUS: 18 BUYS, 13 HOLDS, 3 SELLS, AVERAGE TP USD319.75

Zoom Communications (ZM US)

Zoom on Monday posted a solid beat in its 4Q24 earnings although its guidance failed to impress investors. The company’s 4Q24 adjusted EPS stood at USD1.41 vs. USD1.31 expected, while revenue was at USD1.18B, roughly in line with expectations.

Zoom forecasts revenue of about USD4.79B for 2026, which was lower than expected, citing that its core video opportunity remains challenged due to market saturation and competitive pressures from Microsoft.

The company’s shares fell around 2% in after market hours, and the lack of momentum is likely to put further downward pressure to its share price going forward.

MARKET CONSENSUS: 15 BUYS, 21 HOLDS, 1 SELL, AVERAGE TP USD92.77

Apollo Global Management (APO US)

Apollo on Monday agreed to buy Bridge Investment Group for about USD1.5B in an all-stock deal as the asset manager expands in real estate. The company agreed to pay 0.07081 of its stock for every Bridge share held, valuing the latter at about USD11.5 per share. The deal is expected to be completed in 3Q25.

Salt Lake City-based Bridge manages about USD50B in assets in real estate products targeting institutional and wealth clients. The real estate company’s executive chairman, Robert Morse, will become an Apollo partner and head its real estate equity franchise as part of the deal. Bridge will also operate as a standalone platform within Apollo’s asset management business.

MARKET CONSENSUS: 17 BUYS, 5 HOLDS, AVERAGE TP USD185.15

Prosus (PRX NA)

Prosus’ shares fell after the Dutch technology investment company said it entered into an EUR4.1B merger with Just Eat Takeaway.com to create the world's fourth-largest food delivery group.

Under the deal, Prosus is offering to buy the online food delivery company's entire issued share capital for EUR20.30 per share. The management and supervisory boards of the target unanimously recommend the offer.

The merger is expected to help strengthen its brands, boost its operations and fuel future growth. The offer memorandum is expected to formally start in the second quarter, with settlement expected by the end of 2025. How this translates into its top and bottom line will be key to watch in the medium term.

MARKET CONSENSUS: 20 BUYS, 3 HOLDS, AVERAGE TP EUR49.64

Alibaba (9988 HK)

Alibaba Group plans to invest more than USD52B on AI and cloud infrastructure over the next three years, in a bid to seize more opportunities in the AI era.

The spending will surpass the company's AI and cloud computing investment over the past decade, Alibaba said on Monday.

Major Chinese tech companies, from Alibaba to Baidu, have been ramping up efforts to spur AI business growth as advancements by homegrown upstart DeepSeek have gained global attention. Alibaba also believes it is well-positioned to capture the influx demand of cloud computing services in the coming years.

Shares of Alibaba is expected to follow its US-listed ADRs lower today, consolidating after its rally last week and as geopolitical headlines surrounding US trade policy also weigh on sentiment.

MARKET CONSENSUS: 40 BUYS, 3 HOLDS, AVERAGE TP HKD158.01

Earnings Announcements

US Market

Home Depot, American Tower, Workday, First Solar

European Market

Fresenius Medical Care, SIG Group, Saipem

HK - China Market

-

Global Indices Changes (%)

Fixed Income Market Updates

Recent weaker-than-expected US economic data, particularly regarding consumer spending and rising jobless claims, has reignited market expectations for two rate cuts this year. We expect increased capital inflows into fixed income as investors seek to lock in yields and adopt defensive strategies amid economic uncertainty.

EUROPEAN BANK COCO (AT1)

The AT1 market opened unchanged amid weak US equity movement last Friday, contrasting with positive risk sentiment from the German election. Technical factors remained supportive for all-in-yield products like AT1 bonds. HSBC announced a benchmark AT1 deal and had a strong book-rebuilding.

ASIA INVESTMENT GRADE (IG)

Asia IG had a quiet morning with rates market closed due to Japan holiday. Some widening in credit spreads was observed following last Friday’s rate movements, with selling noted in Chinese technology and asset management companies. Korean high-beta corporates widened by two basis points, while overall flows remained muted.

ASIA HIGH YIELD (HY)

China HY saw subdued activity as investors remained sidelined. China Vanke experienced a slight uptick, which other Chinese property names remained broadly unchanged. New World Development’s curve shifted 0.5 to 1 point lower. Outside of China, bonds were generally down 0.25 point. In contrast, Indian HY bonds attracted consistent buying, particularly in non-bank financial institutions and the Vedanta complex.

Forex Market Updates

The US Dollar held steady on Monday as political and economic uncertainty grew, with Trump administration turmoil, Musk's budget cuts, and potential Ukraine peace talks influencing sentiment.

USD

The US Dollar held steady on Monday against a basket of other major currencies as market participants assessed the impact of mounting political and economic uncertainty. President Donald Trump's administration continued to face turmoil, with Elon Musk's aggressive budget-cutting measures adding to concerns. Federal workers were asked to justify their roles, and mass layoffs began, contributing to financial insecurity and rippling through the broader economy. Steel prices surged amid anticipation of Trump's tariffs, squeezing US manufacturers and raising costs. Meanwhile, discussions of a potential deal to end the war in Ukraine offered a glimmer of hope, potentially easing sanctions on Russia.

The Dollar Index could see further near term weakness, with USD bears likely to be well supported above 105 handle for now.

EUR

The Euro steadied on Monday after an initial rally following Germany’s conservative election win. Friedrich Merz's expected victory as chancellor shifted investor focus to potentially lengthy coalition talks, with the far-right Alternative for Germany (AfD) securing a historic second place. Markets are now watching how quickly Merz can form a government and address economic reforms amid concerns over Germany’s ‘debt brake’ rule and potential U.S. tariffs. Broader European discussions on boosting defence spending also added to market caution as geopolitical tensions and economic uncertainties persisted.

EURUSD could be well supported above 1.024 handle for the time being.

CNH

The Chinese Yuan weakened against the US Dollar on Monday as broader dollar strength overshadowed strong domestic equity market performance. The currency's recent gains, driven by an AI-fuelled rebound in local stocks and improving market sentiment, have reversed. Analysts expect policymakers to prioritize currency stability ahead of the upcoming National People's Congress, focusing on inflation targets and fiscal support measures. The PBoC maintained a firm midpoint rate, signalling its caution over the yuan’s prior decline. Broader geopolitical developments, including China’s reaffirmed alliance with Russia, also influenced market sentiment

USDCNH looks poised for period of consolidation between 7.2331 and 7.3662 for the time being.

XAU

Gold edged higher on Monday, buoyed by a weaker US dollar as investors awaited a key US inflation report later this week. The metal remained near record highs, supported by strong inflows into bullion-backed exchange-traded funds. The SPDR Gold Trust, a major gold ETF, saw its holdings rise to the highest level since last year, highlighting robust demand for safe-haven assets amid geopolitical tensions and trade war fears. Analysts noted that while gold’s appeal as a hedge against uncertainty remains strong, expectations for Fed policy shifts could influence its momentum moving forward.

The bullion outlook continues to point upward, with gold prices likely to be well-supported above 2855 for the time being.