Macro Update:

Yields dipped following escalation of global trade tensions

Markets closed mixed on Tuesday as concerns over economic growth and escalation of global trade tensions weighed on sentiment. Investor uncertainty deepened after President Trump signalled that tariffs on Mexican and Canadian imports will take effect next week, while also signalling potential new restrictions on China's semiconductor industry. Equities continued to struggle while a surge in safe-haven assets drove the US 10y treasury yield to 4.3%, its lowest level since mid-December. Meanwhile, lingering concerns over the US economic outlook prompted increase bets on Fed rate cuts. Markets are now pricing in 50bps of Fed rate cuts this year, similar to our forecast.

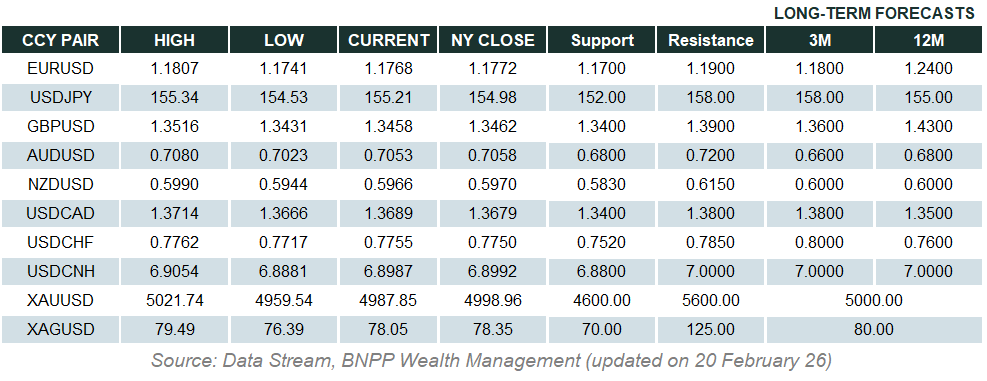

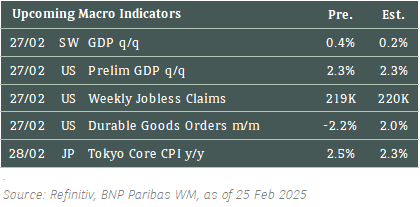

Main Upcoming Macro Indicators

Equity Market Updates

US EQUITIES

US stocks traded lower on Tuesday as a downbeat consumer confidence report continued to subdue sentiment.

We remain constructive on US equities, seeing upward momentum continuing after the current temporary pullback.

EUROPE EQUITIES

European shares closed slightly higher on Tuesday, after gains in banks and healthcare companies offset declines in technology stocks.

HK EQUITIES

Hong Kong stocks extended slide on Tuesday as restrictions on Chinese investments in key US industries fueled a sell-off in technology shares.

Tesla (TSLA US)

Tesla rolled out an update to its driving-assistance software in China, a move that could signal final regulatory approval is forthcoming, as the technology becomes increasingly common in the world's largest EV market.

Tesla said in its mini-application hosted by the WeChat platform on Tuesday that it has pushed out a software update for some users that includes features such as its autopilot driving assistance for city roads, an in-car camera and an updated map.

The updated driving-assistance feature can guide cars to exit ramps and intersections and recognize traffic lights for turns. The update also includes automatic lane changing and can find the best routes to use when drivers do not set a particular route.

With the new update, this should provide some tailwinds to the company as it is likely to further drive popularization of AI-powered driving technology in the Chinese market.

MARKET CONSENSUS: 31 BUYS, 15 HOLDS, 14 SELLS, AVERAGE TP USD370.26

Cisco Systems (CSCO US)

Cisco and Nvidia announced on Tuesday that they intend to broaden its partnership to bring artificial intelligence solutions to enterprises.

The two companies specifically said that the partnership will connect their individual networking structures to make it easier for the customers who work with them. Under the agreement, Cisco would become part of Nvidia's Spectrum-X Ethernet networking platform. Cisco would then build systems combining Nvidia's tools with its own, allowing customers to simultaneously standardize both companies' technologies in a data center.

This partnership could positively impact both companies’ share price going forward.

MARKET CONSENSUS: 15 BUYS, 10 HOLDS, 1 SELL, AVERAGE TP USD70.43

Home Depot (HD US)

Shares of Home Depot rose on Tuesday after it announced solid beats in its 4Q24 results, with revenue at USD39.7B vs. USD39.1B expected, while adjusted EPS was at USD3.13 vs. USD3.03 expected.

The company’s earnings report was by no means a blowout one, but it gave investors enough hope about a gradual recovery in home improvement that it lifted Lowe's shares just ahead of the retailer's own quarterly report. Nevertheless, Home Depot still cautioned that housing demand won’t change significantly in the near term, with 2025 sales growth guidance of 1% missing expectations.

The retailer’s results in the coming quarters will be key to watch for more evidence on the industry’s recovery.

MARKET CONSENSUS: 30 BUYS, 11 HOLDS, 4 SELLS, AVERAGE TP USD431.69

Thermo Fisher (TMO US)

Biotechnology company Thermo Fisher announced on Tuesday that it is buying Solventum Purification and Filtration business for around USD4.1B in cash. The transaction is expected to be completed by the end of 2025 when the unit will be incorporated into Thermo Fisher's Life Sciences Solutions segment.

Solventum’s Purification & Filtration business is a leading provider of technologies used in the production of biologics as well as in medical technologies and industrial applications. It is highly complementary to Thermo Fisher’s bioproductioon business and is likely to provide support to the company’s top line in the future.

MARKET CONSENSUS: 27 BUYS, 5 HOLDS, AVERAGE TP USD663.24

Li Auto (2015 HK)

Li Auto's shares surged more than 12% on Tuesday after the Chinese plug-in hybrid specialist released photos of its first full-electric SUV model, Li Auto i8 model on the company's WeChat account. The model, available in three colors, showcased both the front and rear designs.

The i8 model will be Li Auto's second foray into full-electric vehicles. Li Auto, known for its plug-in hybrid cars, launched its first full-EV model, the MEGA, in March last year. However, sales fell short of market expectations, and the design received negative feedback on Chinese social media.

How this new catalyst can translate into the company’s top and bottom line will be key to watch going forward.

MARKET CONSENSUS: 38 BUYS, 3 HOLDS, AVERAGE TP HKD123.27

Earnings Announcements

US Market

NVIDIA, Salesforce, Snowflake, Synopsys

European Market

Stellantis, ASM, Deutsche Telekom, Danone

HK - China Market

Li Auto, Sino Land, CTF Services

Global Indices Changes (%)

Fixed Income Market Updates

The focus for the week is on the Fed’s preferred inflation gauge: the US Personal Consumption Expenditure (PCE). A downside surprise in the PCE numbers could cause the 10-year Treasury yield to trend lower towards 4.1%. Currently, the 5-year segment of the IG curve remains the optional point to lock in yield.

EUROPEAN BANK COCO (AT1)

The AT1 market opened unchanged amid weak US equity movement last Friday, contrasting with positive risk sentiment from the German election. Technical factors remained supportive for all-in-yield products like AT1 bonds. HSBC announced a benchmark AT1 deal and had a strong book-rebuilding.

ASIA INVESTMENT GRADE (IG)

Asia IG had a quiet morning with rates market closed due to Japan holiday. Some widening in credit spreads was observed following last Friday’s rate movements, with selling noted in Chinese technology and asset management companies. Korean high-beta corporates widened by two basis points, while overall flows remained muted.

ASIA HIGH YIELD (HY)

China HY saw subdued activity as investors remained sidelined. China Vanke experienced a slight uptick, which other Chinese property names remained broadly unchanged. New World Development’s curve shifted 0.5 to 1 point lower. Outside of China, bonds were generally down 0.25 point. In contrast, Indian HY bonds attracted consistent buying, particularly in non-bank financial institutions and the Vedanta complex.

Forex Market Updates

The US Dollar retreated on Tuesday after a disappointing reading on US consumer confidence.

USD

The US Dollar weakened against a basket of other major currencies on Tuesday as uncertainty about trade policy and future growth was reflected in the steepest monthly drop in US Consumer Confidence since 2021. Forecasts of upcoming assessments were also revised lower, with a prominent economist at the Confidence Board noting that “pessimism about future employment prospects worsened” as DOGE and the Trump administration’s trade policies weighed on the short term US growth outlook. On the central bank front, Fed policymaker Barkin said that current uncertainty warrants proceeding with caution and that he will follow a wait-and-see approach to monetary policy until it is clear inflation is heading back to the Fed’s 2% target.

The Dollar Index could extend losses towards technical support around 105.50 in the near term.

EUR

The Euro rose yesterday to trade within the ballpark of YTD highs, buoyed by steady USD selling on the back of poor US Consumer Confidence data as well as supportive comments from central bank officials. ECB policymaker Nagel said that the central bank is “more or less leaving restrictive territory” and would base future decisions around incoming data, echoing remarks made last week by his colleague Schnabel that the ECB is nearing a more neutral stance. Elsewhere, the conversation around the proposed EUR 200bn defense spending from Germany following the country’s weekend elections also helped shift sentiment in the common currency’s favour.

The EUR’s recent rally could run into stiff resistance around 1.0545.

GBP

The British Pound posted a second straight day of gains to hold just shy of a two-month high against the USD, and was little changed against the EUR in fairly calm trading. UK Consumer Board data suggested that British retailers are planning to slash investment on the back of dual hits from high prices and soft consumer spending, while the British Retail Consortium said that up to 160k retail jobs in the UK are at risk of being lost over the next three years due to higher employer taxes and regulatory changes. On the monetary policy front, markets are currently pricing in two more 25bps rate cuts by the BoE between now and the end of the year.

Sterling bulls look poised to test the next level of resistance around 1.2725.

XAU

Gold fell to a one-week low below the 2900 handle on Tuesday before staging a recovery during the NY session thanks to broad USD weakness. Bullion’s decline was driven by profit-taking after the precious metal had climbed to a record high on Monday on renewed uncertainty around US President Trump’s tariff plans. Trump said that tariffs on Canadian and Mexican imports were “on time and on schedule” despite efforts by both countries to beef up border security and halt the flow of fentanyl into the US ahead of a 4th March deadline. With the precious metal complex broadly underperforming, silver prices also shed 2.3% on the day.

The bullion outlook continues to point upward, with gold prices likely to be well-supported above 2855 moving forward.