Macro Update:

Markets mixed as S&P 500 snaps losing streak

Markets were mixed on Wednesday, amid renewed tariff concerns. President Trump announced his plan to hit goods made in the European Union with tariffs of 25% and also confirmed tariffs on Mexico and Canada set to take effect on April 2. Treasury yields fell for a sixth consecutive session as traders reassessed economic risks. Investors are now focused on Friday’s PCE inflation data for further insights into interest rate policy. Markets are currently pricing in approximately 55 basis points of Fed rate cuts this year, and we still maintain our 2 Fed cuts of 25bps forecast for 2025.

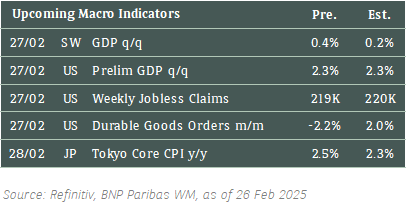

Main Upcoming Macro Indicators

Equity Market Updates

US EQUITIES

US stocks were almost unchanged on Wednesday as investors stayed on the sidelines ahead of Nvidia’s 4Q24 results.

EUROPE EQUITIES

European shares closed at a record high on Wednesday as corporate earnings took centre stage, and investors assessed the impact of a critical minerals agreement between the US and Ukraine.

HK EQUITIES

Hong Kong stocks rebounded on Wednesday as tech rally resumed on the country’s renewed AI push.

We remain positive in Hong Kong / China equities and believe that the current rally still has more room to run.

Nvidia (NVDA US)

Nvidia on Wednesday reported 4Q24 results that beat Wall Street estimates, with revenue at USD39.33B vs. USD38.24B expected, while EPS was at USD0.89 vs. USD0.80 expected. The degree of the outperformance was however less than it has been for a couple of years, leaving the chipmaker’s shares almost unchanged during after-market trading.

On the back of results, Nvidia also gave an upbeat view of its highly anticipated Blackwell lineup, helping reassure investors of the company’s growth prospects going forward. During 4Q24, Blackwell had already contributed around USD11B of revenue, in what the company described as the “fastest product ramp” in history. Contributions of Blackwell in the coming quarters will be closely watched by investors and thus be key to Nvidia’s share price trajectory.

MARKET CONSENSUS: 67 BUYS, 8 HOLDS, 1 SELL, AVERAGE TP USD174.9

Salesforce (CRM US)

Shares of Salesforce fell in after market hours on Wednesday after it gave a FY2026 revenue forecast that fell short of estimates, dimming optimism that the company’s new AI product would spur faster sales growth. The company specifically guided for revenue to be between USD40.5B and USD40.9B for FY2026. Consensus estimates were at USD41.5B.

Salesforce’s most recent FY4Q25 results were also mixed, with a bottom line beat and a top line miss. Its revenue stood at USD9.99B vs. USD10.04B expected, while adjusted EPS was at USD2.78 vs. USD2.61 expected.

MARKET CONSENSUS: 46 BUYS, 10 HOLDS, 2 SELLS, AVERAGE TP USD399.49

Deutsche Telekom (DTE GR)

Deutsche Telekom shares fell on Wednesday after the company's earnings for 2024 and its forecasts for the current year fell short of expectations. The German telecommunications company's net revenue was EUR115.77B, compared with EUR111.97B earlier.

In its home market, Deutsche Telekom added 1.2 million new customers in Germany in 2024. By December 2024, the company had an 11.6% increase in mobile customers and a 7.2% rise in TV customers compared with the previous year. In the fourth quarter, total revenue in Germany declined by 0.2%, with the break-up of the country's coalition government having a noticeable effect, and fewer public contracts awarded, the company spokesperson said.

Looking ahead, Deutsche Telekom anticipates an increase in revenue, with an EPS of EUR2.0 in 2025. The company also aims to achieve an average growth of 4% in revenue from 2024 to 2027, and an EPS of EUR2.5.

MARKET CONSENSUS: 22 BUYS, 1 HOLD, 2 SELLS, AVERAGE TP EUR37.62

Stellantis (STLAP FP)

Stellantis on Wednesday reported full year 2024 results that slightly beat Wall Street expectations, with revenue at USD156.9B vs. USD155.6B expected, while net income came in at USD5.47B vs. USD5.35B expected. Shares of the carmaker still traded lower however as it posted 2025 margin guidance that fell short of analyst expectations.

Stellantis experienced a tumultuous 2024 as it dealt with bloated inventories, pricing pressure and product delays. It struggled to shift cars as it maintained high prices in an auto market beset by waning demand and intense competition.

More significant measures will likely be required going forward for a sustainable turnaround of the company.

MARKET CONSENSUS: 13 BUYS, 18 HOLDS, 4 SELLS, AVERAGE TP EUR13.93

Aston Martin (AML LN)

Aston Martin Lagonda Global said on Wednesday its preliminary loss for the FY2024 grew, while revenue decreased YoY to provide support to the company’s top line in the future.

The British luxury sports car manufacturer's revenue was GBP1.58B, compared with GBP1.63B a year ago. The company confirmed its medium-term financial outlook for FY2028, including expectations for revenue of GBP2.5B.

On top of that, Aston Martin plans to reduce 170 jobs, or 5%, of its global workforce as part of its cost-saving measures.

Its cost-cutting plan and 2025 outlook might disappoint some investors and put downward pressure to the company’s share price going forward.

MARKET CONSENSUS: 3 BUYS, 8 HOLDS, 1 SELL, AVERAGE TP GBp135.08

Earnings Announcements

US Market

Warner Bros, HP Inc, Norwegian Cruise, Viatris

European Market

Engie, Swiss Re, Saint-Gobain, Veolia Entertainment, London Stock Exchange Group

HK - China Market

HKEX, Galaxy Entertainment

Global Indices Changes (%)

Fixed Income Market Updates

Stellantis reported FY24 results which, while continuing to evidence ongoing weakness in the Auto sector, provided some relief in terms of full year outlook with no new additional credit negatives and could flag some bottoming out in the sector.

EUROPEAN BANK COCO (AT1)

There was a decent bounce in the European Bank AT1 space with prices trading up 0.25-0.5point on average. Asian asset managers were buying the recently issued HSBC 6.95% AT1 at market open which set the tone and lifted prices across the sector. NatWest Group came with a GBP-denominated new issue (initial price guide at 8% with books of more than GBP3.5bn) which printed GBP750mn at 7.5%.

ASIA INVESTMENT GRADE (IG)

China IG space traded better, boosted by the rally in Hang Seng Index. High beta technology, media and telecoms, as well as asset management companies traded 1-3bps tighter on demand from asset managers. On the hand, Korea IG space saw more selling from asset managers and banks with quasi-sovereigns and financial perpetuals such as Woori bank, Shinhan Financial Group being sold in sizes. With the US 10-year Treasury yield at around 4.26% currently, close to our CIO's target of 4.25%, we have turned neutral on 10year duration and would prefer the shorter end of the curve for now.

ASIA HIGH YIELD (HY)

Tone in China HY space was firmer, following a strong rebound in equities. China HY space opened around 0.25point higher although flows were relatively light. New World Development curve was 1-3 points higher with the perpetuals outperforming the bullets on the back of buying from private banks. Outside of China, Adani complex opened 0.25point higher as well. With spreads 20-30bps wider this week, there were some bottom fishing at these levels. The rest of the Indian HY space held up well, with renewables and Non-bank Financials around 0.125point higher on net buying from investors.

Forex Market Updates

The US Dollar rebounded on Wednesday as investors focused on the economic outlook and potential impacts of President Trump's tariff plans, ahead of inflation data.

USD

The US Dollar strengthened on Wednesday against a basket of other major currencies, bouncing back from recent 11-week lows as investors assessed the economic outlook and potential impacts of President Trump's tariff plans. The greenback had slipped earlier due to weak consumer confidence data, adding to concerns about US economic strength and persistent inflation. Market focus shifted to upcoming US inflation data and the potential influence on Fed policy. The dollar index rose to 106.47, supported by expectations of limited Fed rate cuts this year and cautious sentiment ahead of further economic developments.

Greenback bulls could extend and push towards the immediate resistance level of 107.70 level for the time being.

CNH

The Chinese Yuan weakened against the US Dollar on Wednesday as authorities introduced new measures to curb capital flight amid mounting currency pressures. Increased scrutiny on overseas investments and rising demand for foreign currency highlighted investor concerns, while broader Sino-US tensions, fuelled by President Trump’s tariff threats, added to market uncertainty. The PBoC maintained a strong midpoint yuan guidance, signalling caution over further depreciation. Meanwhile, China’s planned 400 billion yuan capital injection into major state-owned banks aims to bolster economic growth, with additional stimulus measures anticipated at the upcoming National People's Congress.

USDCNH looks poised for a period of consolidation between 7.2331 and 7.3662 for now.

AUD

The Australian Dollar weakened on Wednesday as mixed local inflation data and global uncertainties weighed on sentiment. While Australia’s inflation showed signs of easing, particularly in housing costs, the data did little to shift expectations for future rate cuts. Analysts noted disinflationary trends, with the RBA likely to remain cautious ahead of its next meeting. Markets are leaning toward a potential rate cut in May, depending on upcoming economic and labour market developments.

AUDUSD looks poised for more near term losses, with immediate support around 0.6280 handle for now.

XAU

Gold strengthened on Wednesday, extending its recent record rally as investors awaited US inflation data and developments on President Trump’s tariff plans. Trade war concerns had previously boosted bullion to a record high earlier in the week. Market sentiment remained cautious ahead of the US Personal Consumption Expenditures report, the Federal Reserve’s preferred inflation gauge. Analysts suggested continued momentum for gold, with central bank actions likely to influence future demand. Meanwhile, Trump’s probe into potential copper tariffs added to geopolitical and economic uncertainty, reinforcing gold’s appeal as a safe-haven asset.

The bullion outlook continues to point upward, with gold prices likely to be well-supported above 2855 moving forward.