Macro Update:

Markets tumbled as Nvidia slid while tariff concerns rise

Wall Street declined sharply on Thursday, as the tech sector weighed on the broader market following concerns after the release of Nvidia’s earnings. Sentiment also weakened further after President Trump confirmed 25% tariffs on European autos and new levies on Mexico and Canada starting from 4th March. Meanwhile, US data suggests some softening. Market expectations of Fed rate cut has increased and we think 2 cuts of 25bps in 2025 is likely.

In Europe, sentiment fell following concerns over European auto tariffs. On the monetary policy front, accounts from the last ECB meeting showed some consensus over more rate cuts by the Governing Council. We continue to see 3 more 25bps ECB rate cuts, which should bring us to a terminal rate of 2% by September 2025.

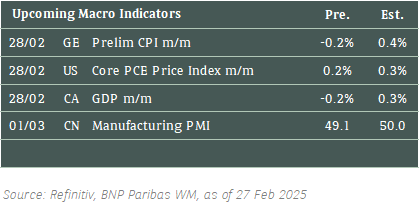

Main Upcoming Macro Indicators

Equity Market Updates

US EQUITIES

US equities tumbled on Thursday, weighed down by chipmaker Nvidia, as investors weigh a continued cooling of the US economy and further tariffs from the Trump administration.

We remain constructive on US stocks in the medium term.

EUROPE EQUITIES

European shares closed lower on Thursday, with automakers leading the declines as trade policy developments in the US subdued sentiment.

HK EQUITIES

Hong Kong stocks slightly pulled back from its highest in over three years on Thursday, with the AI-driven tech rally, boosted by startup DeepSeek, pausing after Nvidia’s earnings on Wednesday.

Dell Technologies (DELL US)

Shares of Dell fell in after-market trading on Thursday as the company’s current quarter revenue outlook, at between USD22.5B to USD23.5B, missed Wall Street expectations. The company also stated that its gross margin is set to decline by about one percentage point due to the high cost of Nvidia chips.

This may continue to put downward pressure to Dell’s stock price going forward.

Dell’s 4Q25 results came in mixed, with EPS at USD2.68 beating the USD2.52 expected, while revenue at USD23.93B missed the USD24.65B forecasted by analysts.

MARKET CONSENSUS: 22 BUYS, 4 HOLDS, AVERAGE TP USD148.76

HP Inc (HPQ US)

Shares of HP fell in after-market trading on Thursday after the company gave a profit outlook for the current quarter that fell short of expectations due to rising component costs and tariffs on goods from China. The company is also set to cut 1,000 to 2,000 jobs through the end of the fiscal year in an attempt to save roughly USD300M.

Continued trade restrictions between China and the US is likely to put pressure on HP’s profit margin and thus share price going forward.

HP’s FY1Q25 was roughly in line with expectations, with revenue at USD13.50B vs. USD13.38B expected, while adjusted EPS was at USD0.740 vs. USD0.744 expected.

MARKET CONSENSUS: 5 BUYS, 11 HOLDS, 1 SELL, AVERAGE TP USD37.23

Rolls-Royce (RR/ LN)

Britain's Rolls-Royce lifted its mid-term targets to reflect confidence in future profit growth as its plan to improve engine performance and lower costs gains traction, helping it beat expectations last year.

The upgrade showed the progress made by Rolls-Royce over the last two years after former BP executive Tufan Erginbilgic took over as CEO, describing the company as a burning platform which was in need of a fundamental turnaround.

The group also on Thursday announced a dividend of GBp6 per share, having flagged last August that it would reinstate the payout after a 5-year pandemic break, and launched a GBP1B share buyback, which is likely going to provide some support to the company’s share price in the near term.

MARKET CONSENSUS: 12 BUYS, 5 HOLDS, 3 SELLS, AVERAGE TP GBp629.06

Aviva (AV/ LN)

British insurer Aviva beat annual profit expectations on double-digit growth in its general insurance premiums in 2024, and said its planned GBP3.7B acquisition of smaller rival Direct Line was on track.

The company reported operating profit of GBP1.77B for FY2024, above analysts' average consensus of GBP1.71B. Aviva's annual general insurance gross written premiums for the year rose 14% to GBP12.2B, while growth at its UK and Ireland insurance, wealth and retirement business also exceeded expectations.

Insurers have enjoyed a profitable year by raising premiums for motor and home insurance in the face of inflation and natural calamities. Meanwhile, Aviva has sold several overseas assets to focus on its core markets of Britain, Canada and Ireland.

The healthy trajectory is likely supportive to Aviva’s share price going forward.

MARKET CONSENSUS: 12 BUYS, 2 HOLDS, AVERAGE TP GBp577.15

ENI (ENI IM)

Italian energy group Eni said on Thursday its 4Q24 adjusted net profit fell 46% from the previous year, hit by lower energy prices and continued weakness at its refining and chemicals divisions.

The adjusted net profit came in at EUR892M in 4Q24, below an analyst consensus of EUR995M. Eni said its pro-forma leverage, which measures total debt in relation to equity taking into account also agreed disposals yet to be completed, fell to 15% at the end of last year.

The company’s CEO has developed a strategy based on dedicated units - or satellites - that aim to independently access capital markets to fund their growth.

MARKET CONSENSUS: 16 BUYS, 14 HOLDS, AVERAGE TP EUR16.24

Earnings Announcements

US Market

-

European Market

Proximus, Amadeus IT Group, Nexi, Clariant

HK - China Market

Melco Resorts, New World Development, Xinyi Glass, Xinyi Solar

Global Indices Changes (%)

Fixed Income Market Updates

With US 10-year Treasury yield at around 4.3% currently, which is close to our CIO's target of 4.25%, we have turned neutral on 10-year duration and would prefer the shorter end of the curve for now.

EUROPEAN BANK COCO (AT1)

European Bank AT1 space closed the day lower, as weak equity markets and government bond markets caused reluctance from investors to add risk. Some of the recent new issues underperformed. We think spreads of subordinated bank bonds have compressed a lot and investors are not adequately compensated for subordination risks compared to the seniors. We would look out for better buying opportunities should the AT1 space correct further.

ASIA INVESTMENT GRADE (IG)

China IG space traded unchanged to 1bps wider as investors turn their focus to new issues. China Chem, Alibaba, Meituan and China Orient were some of the more active names. Chinese state-owned enterprises' perpetuals saw asset managers selling short call bonds and switching into longer call bonds. High beta Hong Kong banks had active flows, skewed to buying. Asset managers and private banks sold long duration bonds of insurers such as AIA.

ASIA HIGH YIELD (HY)

In China HY space, Greentown and GLP traded slightly higher while industrial names were mostly unchanged on the day. India and Indonesia HY space were around 0.125point higher overall with some positive headlines from India onshore. We are still highly selective in this space and would prefer yield pick-up through structured products.

Forex Market Updates

The DXY jumped on Thursday following more tariff news on Thursday. USDCNH increased on Thursday as investors remain cautious about U.S. tariffs and economic policies.The US Dollar jumped on Thursday as Trump reiterated the 25% tariffs on Mexican and Canadian goods will go into effect on March 4 as scheduled.

USD

The US Dollar jumped on Thursday and was poised for its biggest daily percentage gain in more than two months as Trump's latest tariff comments overshadowed signs of slower economic growth. Tariffs will likely confuse people and make them wait for clarity before committing to bigger investments, and that leaves FX a little bit sidelined and more prone to quick catch-ups. The path of interest rate cuts by the Fed has become less clear, with markets pricing in 58 bps of easing by year-end.

The Dollar Index could see a further near term push higher towards immediate resistance around 107.9.

CNH

The Chinese Yuan slipped against the USD on Thursday as investors remain cautious amid uncertainty over U.S. tariffs and broader economic policies under the Trump administration. Trump claimed that China will be charged an additional 10% on March 4. Analyst says the tariff risk may further intensify and remain as a major risk factor for the renminbi exchange rate, which already lost over 2% to the dollar since Trump's election win in November. Once the currency stabilizes at a weaker level, the PBOC could cut policy rates to ease policy and facilitate fiscal stimulus.

USDCNH could attempt another increase towards the previous high level at 7.31.

GBP

The British pound was little changed against the dollar on Thursday, trading just below a more than two-month high hit the previous day, as Trump's tariff threats turn towards the European Union. Late on Wednesday, Trump floated the idea of a 25% tariff rate on goods from the European Union. Analysts expect the pound to outperform in the G10 space because of the smaller trade deficit between the U.S. and Britain and the expectation of relatively fewer rate cuts of BoE. The BoE lowered interest rates this month and markets are pricing in two further 25 bps cuts this year.

GBP may consolidate around the current levels, with support at 1.2550.

XAU

Gold prices dropped to their lowest level in over two weeks on Thursday as the U.S. dollar strengthened, with investors waiting for key inflation data that could shed light on the Federal Reserve's monetary policy path. Analysts said the direction of gold is very evident and these short-term bumps and profit-taking is just a normal part of the cycle. They think Gold is well-positioned to surpass $3,000/oz and this could very well occur within the next 30 to 60 days. Investors' focus now turns to the U.S. Personal Consumption Expenditures (PCE) index due on Friday.

The XAU looks to be range trading for now, fluctuating between 2860 and 2950.