Macro Update:

US yields are lower on softer data

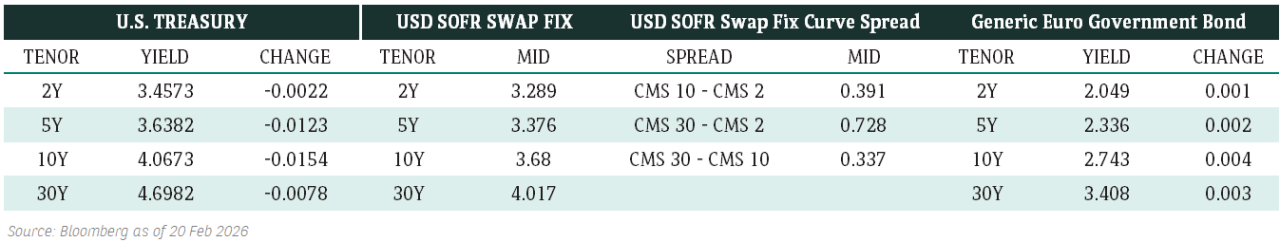

US 10-year Treasury yield has made new lows for 2025 as US economic data released this week have generally been weaker than expected. The JOLTs data in particular confirmed US labour market demand is trending down. The January non-farm payroll report is due out on Friday with consensus estimate of a rise of 170k.

The market is now fully pricing two 25bp rate cuts this year, in line with our expectations. We have also turned positive from neutral on US Treasury after the spike in yields.

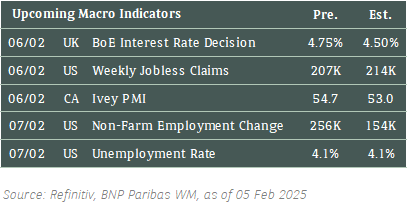

Main Upcoming Macro Indicators

Equity Market Updates

US EQUITIES

US equities traded higher on Wednesday, brushing off disappointing Alphabet earnings as investors weighed the prospect of future interest rate cuts by the Fed.

We remain positive on US equities in the medium term.

EUROPE EQUITIES

European shares ended Wednesday higher as a rise in healthcare companies following their upbeat quarterly results offset losses in carmaker stocks.

HK EQUITIES

Hong Kong stocks fell on Wednesday as investors weighed trade tensions with the US and hype around the domestic AI sector.

Disney (DIS US)

Shares of Disney slipped on Wednesday as the company’s strong FY1Q25 results were overshadowed by caution in its guidance.

Both Disney FY1Q25 top- and bottom-line were strong, with revenue at USD24.69B vs. USD24.57B and EPS at USD1.40 vs. USD1.32 expected. However, the company shied away from raising its earnings forecast, with CFO Hugh Johnston saying that “given the rapidly evolving macro environment, we think it would be premature at this point to change the guidance.”

How Disney navigates this year’s uncertainties will be key to its share price trajectory in the near term.

MARKET CONSENSUS: 32 BUYS, 12 HOLDS, 1 SELL, AVERAGE TP USD128.09

GSK (GSK LN)

Shares of GSK jumped on Wednesday after it forecast sales in 2025 to grow 3%-5% and reported better-than-expected 4Q24 earnings, as strength in its HIV and oncology portfolio offset weakness in its vaccines division.

The British drugmaker posted 4Q24 revenue at GBP8.12B vs. GBP7.90B expected, while adjusted EPS was at GBP0.23 vs. GBP0.20 expected. It also lifted its 2031 sales forecast to more than GBP40B, from GBP38B it targeted earlier, citing progress on its late-stage pipeline. This is likely to support the company’s share price going forward.

MARKET CONSENSUS: 8 BUYS, 13 HOLDS, 4 SELLS, AVERAGE TP GBp1670.83

TotalEnergies (TTE FP)

Shares of French oil and gas company TotalEnergies rose on Wednesday after it reported an overall beat in its 4Q24 net profit despite dropping YoY due to weaker oil prices and shrinking refining margins.

Adjusted net profit in 4Q24 rose to USD4.41B, compared with analysts' expectations of USD4.26B.

The French oil and gas company also said it would target share buybacks worth GBP2B a quarter in 2025. This is likely to support share price in the near term.

MARKET CONSENSUS: 17 BUYS, 12 HOLDS, AVERAGE TP EUR68.28

Credit Agricole (ACA FP)

Credit Agricole SA, France's second-biggest listed bank, beat past quarterly earnings forecasts on Wednesday with a jump in profit, driven by insurance and asset management even as gains in its investment banking business lagged rivals.

Credit Agricole said its net income for 4Q24 rose 27% from a year earlier to EUR1.69B, which is likely to be supportive to its share price.

The strong fourth quarter enabled Credit Agricole to report record full-year sales and net income, the latter totaling more than EUR7.1B. This also brings to a proposed dividend of EUR1.10 per share, up 5% YoY.

MARKET CONSENSUS: 8 BUYS, 12 HOLDS, 2 SELLS, AVERAGE TP EUR16.65

Toyota Motor (7203 JP)

Japan's Toyota Motor raised its full-year operating profit forecast by 9% on Wednesday, in a sign of confidence in its ability to ride out the impact of any potential US tariffs.

The revision reflected efforts to strengthen its earnings power through keeping a lid on incentives, raising prices and stabilizing production, Toyota said in presentation materials. It also expects to gain from a weak yen.

Meanwhile, Toyota said it would establish a wholly owned company in Shanghai to develop and produce EVs and batteries for its luxury Lexus brand, with production set to start in 2027 and have an initial capacity of around 100,000 units a year. These could provide some tailwinds for the company going forward.

MARKET CONSENSUS: 17 BUYS, 9 HOLDS, AVERAGE TP JPY3265.24

Earnings Announcements

US Market

Ford Motor, Honeywell, Eli Lilly, Air Products

European Market

Siemens Healthineers, AstraZeneca, Societe Generale, ING Groep

HK - China Market

Yum China Holdings

Global Indices Changes (%)

Fixed Income Market Updates

Primary markets continue to show resilience in the face of trade tariff policy headlines and a busy earnings season. With 10-year U.S. Treasury hovering lower at ~4.42% during U.S. hours, there were a total of USD 16.7 billion of issuance including UBS' two-tranche AT1 CoCo perpetual, Citigroup's perpetual (preferred), and multi-tranche offerings from IBM and Pepsico. A total of USD 30 billion to USD 35 billion in new issue supply is expected this week, ahead of this Friday's U.S. nonfarm payrolls data. Despite minimal new issue concessions, we expect spreads to continue to grind tighter in the near-term.

EUROPEAN BANK COCO (AT1)

European banks' AT1 CoCo's bond prices were generally 0.25 to 0.75 points higher amidst a supportive market dynamics. New issue supply remains well-absorbed with UBS' two-tranche USD AT1 CoCo deal attracting c.USD 14 billion of orders before the U.S. market opened and almost 10x oversubscribed at close. UBS' existing AT1 curve also rallied with prices closing 0.25 to 0.75 points higher. We suggest to take advantage of any sell-off as an opportunity to gradually add exposures given our overall constructive view on major European banks' credit fundamentals. Yesterday, Banco Santander, Credit Agricole, and Svenska Handelsbanken were among the major banks whose reported revenues exceeded market estimates.

ASIA INVESTMENT GRADE (IG)

A firm risk tone prevailed in Asia IG space following rates rally. China IG spreads were 2-5bps tighter at market close, led by buying flows on technology names like Meituan, Lenovo, Weibo, Xiaomi, and Alibaba from onshore investors. CK Hutchison's 10-year bonds continued to hold up relatively well despite headlines of Panama considering to terminate its operating rights contract with the Hong Kong-based company at its two ports. Meanwhile, Japanese banks' spreads were 1-2bps tighter while insurance hybrids closed 0.25 to 0.375 points while Nissan Motor was in focus again. Nissan's spreads widened 70-90bps during the day as a knee-jerk reaction to headlines of Honda and Nissan potentially withdrawing from merger talks. In Southeast Asia IG space, spreads remained range-bound(unchanged to 2bp tighter), with buying interests mostly around benchmark names like Petronas, Bangkok Bank, and Kasikornbank. In contrast,. Thai Oil USD curve remained heavy and continued to hover at its current wide levels.

ASIA HIGH YIELD (HY)

Asia HY bonds generally traded on a firm tone amid two-way flows. In India HY space, there was some demand for 5 to 7 year bonds of non-bank financials. Vedanta USD bonds were another 0.25 to 0.375 points higher on the back of buying flows. ADANI complex also had a firm session, closing 0.5 to 0.75 points higher. In China HY, bonds of Macau gaming names remained in demand while bonds of property names underperformed (-1 to -2 points). In Japan, Softbank and Rakuten bonds traded 0.125 to 0.375pts higher with USD perpetual bonds outperforming.

Forex Market Updates

The US Dollar weakened as safe-haven demand eased amid reduced trade war concerns. Market focus shifts to US jobs data for Fed policy signals, while tariff uncertainty adds volatility.

USD

The US Dollar weakened on Wednesday, with the dollar index falling to 107.61, its lowest in over a week. Investors scaled back safe-haven demand as trade war concerns eased, weighing on the greenback. Market attention is now on upcoming US jobs data, which could provide further clarity on the Fed policy. Meanwhile, uncertainty over tariffs remains, with fresh levies on China and ongoing trade negotiations with Mexico and Canada adding to volatility. The dollar’s recent pullback reflects shifting market sentiment, though expectations for US economic resilience and interest rate policy continue to support its outlook.

The Dollar Index could see further near term weakness, with USD bears likely to be well supported above 106.90 for the time being.

GBP

Sterling rose to a one-month high yesterday, gaining against both the dollar and euro as markets focused on the Bank of England’s policy decision. The pound benefited from broad dollar weakness, while expectations of a 25bp BoE rate cut to 4.5% remained unchanged. Investors are watching for any signals on future easing, with markets pricing in multiple cuts this year. The UK’s relative resilience to potential US trade tariffs has also supported sentiment. Today’s BoE meeting and updated forecasts will be key in shaping the pound’s next move.

Sterling’s recent rebound is likely to run into stiff resistance around 1.2535 moving forward.

NZD

The New Zealand Dollar edged higher on Wednesday, gaining against the US Dollar despite data showing the unemployment rate rose to 5.1% in Q4, its highest in four years. While employment fell 0.1%, in line with expectations, the market saw little surprise, keeping pressure on the RBNZ to cut rates this month. The NZD closed at $0.5688, supported by a softer US Dollar and resilient risk sentiment. Traders are now watching the RBNZ’s policy stance, with expectations of further easing as inflation pressures ease and economic momentum slows.

NZD/USD looks to be facing a period of consolidation, above technical support around 0.555 for now.

XAU

Gold extended its rally on Wednesday, rising as trade tensions between the US and China fuelled demand for safe-haven assets. Spot gold reached a record high of $2,882 before easing to $2,865.09 per ounce. Investor focus remains on US jobs data, which could influence the Fed’s rate outlook. Meanwhile, concerns over rising inflation and recession risks continue to support bullion. The World Gold Council reported global gold demand hit a record in 2024, driven by strong investment flows and central bank purchases.

Gold bulls could push the precious metal to 2880, especially if there are any further escalations in tariffs.