Macro Update:

Bessent says Trump is focused on lower Treasury yields

US Treasury Secretary Scott Bessent said President Trump is focused on 10-year Treasury yields, not the Fed’s short term rates. He reaffirmed that expanding energy supply will help lower inflation and that reducing the budget deficit will help bring 10-year yields lower. Meanwhile, the Bank of England cut rates by 25bp to 4.5% and revised down its 2025 growth forecast from 1.5% to 0.75%. We have turned positive on US Treasuries and UK gilts after the recent spike in yields. Our 12-month target for US 10-year yield remains at 4.25%.

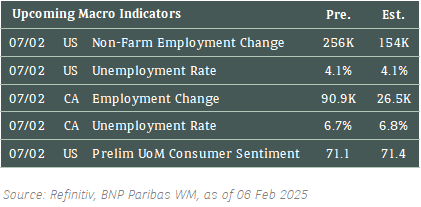

Main Upcoming Macro Indicators

Equity Market Updates

US EQUITIES

US stocks ended higher on Thursday after a choppy session as investors continue to digest the latest corporate earnings reports.

We see this positive momentum continuing in the medium term.

EUROPE EQUITIES

European equities closed at an all-time high on Thursday with mining companies in the lead following a raft of upbeat earnings reports, while investors weighed the likelihood of a Ukraine peace plan.

HK EQUITIES

Hong Kong stocks on Thursday ended to an eight-week high amid mounting optimism around China's AI sector.

Amazon (AMZN US)

Amazon on Thursday reported better-than-expected revenue and profits in 4Q24, but shares dropped in aftermarket trading due to disappointing guidance. The company posted 4Q24 revenue at USD187.8B vs. USD187.3B expected, while EPS stood at USD1.86 vs. USD1.47 expected.

Amazon expects revenue for 1Q25 to be between USD151.0B and USD155.5B, missing analyst expectations at USD158.6B while citing “an unusually large unfavourable impact” from foreign exchange rates. Revenue from the company’s cloud business also slightly missed expectations despite growing by around 19% YoY.

Further developments around US tariffs will be key to Amazon’s share price going forward, both in its retail and cloud fronts.

MARKET CONSENSUS: 79 BUYS, 4 HOLDS, 1 SELL, AVERAGE TP USD258.13

Societe Generale (GLE FP)

Societe Generale doubled its 4Q24 profit YoY due to a retail bank rebound and strong equity trading, allowing the French lender to announce shareholder payouts at the high end of expectations.

The group’s net income for 4Q24 stood at EUR1.04B vs. EUR860.8M expected, while sales grew 11.1% to EUR6.62B vs. EUR6.41B expected.

Societe Generale's better-than-expected results and guidance for 2025 that points to more cost controls should provide confidence that its 2026 targets are in reach. This is likely to support the company’s share price going forward.

MARKET CONSENSUS: 16 BUYS, 9 HOLDS, AVERAGE TP EUR35.72

BYD (1211 HK)

Shares of BYD surged on Thursday after the company announced that they will hold an intelligent strategy launch event in the evening on 10 February 2025 at its Shenzhen headquarters.

The company also said it hopes everyone can experience advanced intelligent driving through its "God's Eye" driving system.

BYD’s new product launch and development in more advanced driver-assistance system this year are key to watch in the near term.

MARKET CONSENSUS: 36 BUYS, 3 HOLDS, 1 SELL, AVERAGE TP HKD340.8

AstraZeneca (AZN LN)

British pharmaceutical major AstraZeneca announced on Thursday that its revenue in 4Q24 rose by 24% YoY to USD14.9B, exceeding analysts' expectation at USD14.2B. For the entirety of 2024, total revenue jumped by 21% to USD54.1B.

The company also said its total revenue is expected to increase at constant exchange rates by a high single-digit percentage in 2025, with core EPS growth at a low double-digit percentage.

With increasing demand for medicines in all key regions which help sustain its growth momentum into 2025, share price is likely to be supported in the near to medium term.

MARKET CONSENSUS: 25 BUYS, 6 HOLDS, AVERAGE TP GBp13508.95

ING Groep (INGA NA)

Dutch banking and financial services company ING Groep said on Thursday that its net income for 2024 fell from EUR7.29B to EUR6.39b, missing analysts’ expectations at EUR6.49B. Revenue stood at EUR22.62B vs EUR22.58B a year ago.

The lower-than-expected 4Q24 profit was weighed by higher operating expenses and loan loss provisions.

Looking ahead, ING Groep said it does not expect its annual total income to grow in 2025, as the European Central Bank continues to cut interest rates on concerns of a muted economy. This may put downward pressure to its share price.

MARKET CONSENSUS: 12 BUYS, 13 HOLDS, 1 SELL, AVERAGE TP EUR18.67

Earnings Announcements

US Market

-

European Market

Vinci SA, APERAM SA

HK - China Market

-

Global Indices Changes (%)

Fixed Income Market Updates

Primary market is expected to slow down ahead of the U.S. nonfarm payrolls data tonight. USD IG new supply reached almost USD 40 billion in total volume this week. We continue to see buying opportunities in the secondary market and prefer the 5-7 year maturity bucket. Post BoE rate cute overnight, we continue to see good value in selective long-dated GBP bonds from better quality issuers.

EUROPEAN BANK COCO (AT1)

There were big two-way flows around UBS' new dual-tranche AT1 CoCo, trading in a tight range of 30-60 cents above their issue price (100) all throughout the day. Older UBS AT1 bonds closed 0.375 points higher in general, with switching opportunities along its curve. Societe Generale's AT1s were the big outperformers with the whole curve repricing higher by 0.75 to 1.50 points higher following good results, exceeding their 2024 targets. Banco Santander's AT1s also had a strong day with more buyers picking up the papers post its strong results for its third consecutive year. The rest of the AT1s closed about 0.125 to 0.375 point higher.

ASIA INVESTMENT GRADE (IG)

Flows in the Asia IG markets were mixed following the rally in rates. Investors continued to add risks within 5-10 year bucket while some took profit on longer dated bonds. Bank of East Asia’s Tier 2 bonds led the rally in Hong Kong IG space. AIA 10-year bonds were in demand while its 30-year bonds saw better selling flows. Risk sentiments in Hong Kong IG perpetual space also improved with fixed-for-life coupon perpetuals moved one point higher at close. CK Hutchinson’s USD curve also tightened up to 3bps as buyers emerged. Japanese bank seniors, insurance hybrid and IG corporates also remained in demand among investors. In Southeast Asia IG space, recently issued Great Eastern USD perpetual continued to underperform and closed below par despite the rates rally. Meanwhile, Australian IG bonds held up well with spreads closing unchanged to 2bps tighter.

ASIA HIGH YIELD (HY)

Risk tone in Asia HY markets remained firm. In India HY space, Adani complex prices were up by 1-2 points on better buying flows. Adani Green’s long-dated USD bonds traded higher following positive developments with the reported refinancing facilities from Power Finance and State Bank of India. In China HY, Vanke bonds closed 2-3 points higher while the rest of the property space were marked 0.25 to 0.5pt higher. New World Development’s bonds were 1-2 points higher on the back of short-covering and a slower pace of selling flows. In Japan HY, Softbank’s and Rakuten’s long dated and perpetual bonds also moved 0.25 to 0.5 point higher at close.

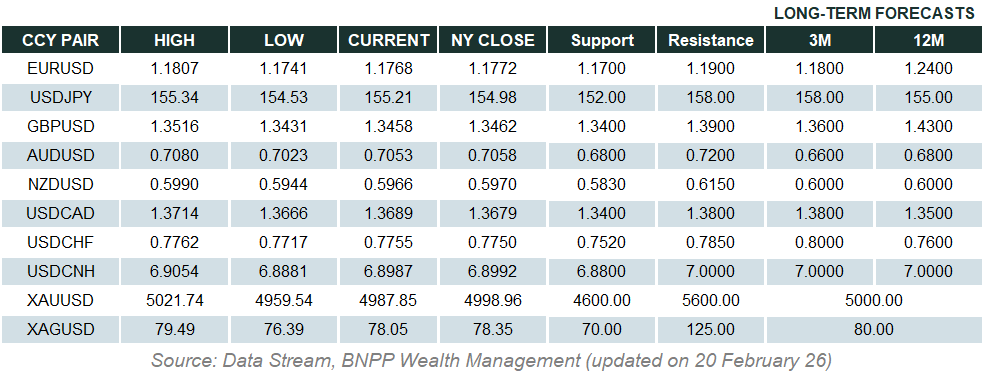

Forex Market Updates

The US Dollar remained weak as markets hope that a global trade war could be avoided, while investors await the release of US jobs data tonight.

USD

The US Dollar was up against a basket of peers at 107.69, but it still hovered near the lowest level since the start of last week, with investors beginning to entertain prospects that a global trade war could be averted. U.S. President Donald Trump suspended planned tariff measures against Mexico and Canada this week, but imposed additional 10% levies on imports from China. In the absence of tariff headlines, markets looked ahead to the release on Friday of key U.S. monthly payrolls figures, the next major test for the U.S. monetary policy outlook.

The Dollar Index could see further near term weakness, with USD bears likely to be well supported above 106.90 for the time being.

GBP

Sterling had the biggest fall in four weeks as investors grappled with a gloomy set of Bank of England forecasts on Thursday that complicate the outlook for UK assets. The BoE lowered rates to 4.5% and halved its growth forecast for this year to 0.75%. But it said inflation would rise "quite sharply" to peak at 3.7% this year, well above a previous estimate. BoE Governor Andrew Bailey rejected the idea that Britain was experiencing a period of "stagflation", a term coined to describe a combination of high inflation and weak economic growth, saying underlying inflation remained on a downward path.

Sterling’s recent rebound is likely to run into stiff resistance around 1.2550 moving forward.

JPY

The Japanese Yen touched an eight-week high versus the dollar on Thursday after a Bank of Japan policy board member advocated continued interest rate hikes. BOJ's Naoki Tamura said the central bank must raise rates to at least 1% or so in the latter half of fiscal 2025 with upward risks to prices rising. The market is currently pricing in a quarter-percentage-point BOJ rate hike by September.

USDJPY could see some consolidation around the 151 level as markets digest this sudden move.

XAU

Gold prices slid 1% on Thursday as the U.S. dollar firmed ahead of a key jobs report and investors took profits, after bullion recorded consecutive record peaks in the previous five sessions on the back of escalating trade tensions between the U.S. and China. Meanwhile, the stock of gold at the Bank of England has fallen by about 2% since the end of last year, its Deputy Governor Dave Ramsden said, citing strong demand for gold stored at the bank to take advantage of international price differentials.

Gold bulls could push the precious metal to 2880, especially if there are any further developments in market uncertainty.