Macro Update:

Markets open the week positively

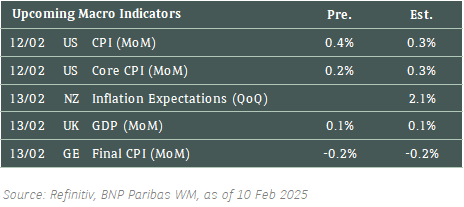

Markets kick start the week on a positive tone, even after investors digests news of possible fresh tariffs. President Trump announced plans to impose 25% tariffs on all imports of steel and aluminium into the US and said new reciprocal tariffs would also be announced this week. Looking forward, CPI, PPI, and retail sales reports this week should provide further insights into price pressures and consumer spending strength. Fed Chair Powell's testimony to Congress will also be eagerly anticipated.

Meanwhile, Chinese stocks extend gains on AI optimism, particularly with companies integrating DeepSeek’s open-source model into their operations. Recent economic data also reported a pickup in consumer inflation for January. We continue to stay positive on Chinese equities.

Main Upcoming Macro Indicators

Equity Market Updates

US EQUITIES

US equities closed higher on Monday, lifted by AI-related stocks, while steelmakers surged after President Donald Trump’s announcement of additional tariffs on steel and aluminum imports.

EUROPE EQUITIES

Stocks in Europe continued closed at an all-time high on Monday, boosted by energy stocks as investors weigh the impact of additional tariffs from the US.

Within Europe, we remain constructive on UK equities, favouring its undemanding valuation and defensive nature.

HK EQUITIES

Hong Kong stocks rose on Monday as optimism around DeepSeek continued to lift tech stocks, while China’s better-than-expected inflation data buoyed investors’ sentiment.

McDonald’s (MCD US)

McDonald’s shares surged on Monday despite posting a slight miss in its 4Q24 results weighed down by the recent E.Coli outbreak in its US outlets. The company’s 4Q24 revenue stood at USD6.39B vs. USD6.45B expected, while EPS was at USD2.80 vs. USD2.84 expected.

Investors were however optimistic on McDonald’s recovery in many international markets as well as the company's handling of the recent E.Coli incident. This is likely to continue supporting share price going forward.

MARKET CONSENSUS: 28 BUYS, 14 HOLDS, AVERAGE TP USD325.88

BP (BP/ LN)

Shares of BP rose sharply on Monday, the most since 2020 after one of the world’s most aggressive activist investors, Elliott Investment Management, had reportedly built a stake in the company, seeking to end years of underperformance.

For the activist investment firm, this is typically the first step in a playbook it has deployed to successfully push for change at many other large companies in the past, and with relative success. The firm’s efforts have led to strategy shifts, CEO departures, and even corporate breakups. Investors are hoping that this is the case for BP as well going forward.

MARKET CONSENSUS: 8 BUYS, 13 HOLDS, 4 SELLS, AVERAGE TP GBp476.2

TSMC (2330 TT)

Taiwan Semiconductor Manufacturing posted TWD293.29B revenue in January, up 35.9% YoY, despite a 6.4-magnitude earthquake caused wafer losses, prompting TSMC to lower its first-quarter revenue forecast.

The company estimates TWD5.3B in earthquake-related losses but maintains its gross profit margin outlook at 57% to 59%.

Despite the setback, the chip maker reaffirmed its full-year outlook and how it can work to recover lost production will be key to its share price trajectory going forward.

MARKET CONSENSUS: 39 BUYS, 1 HOLD, AVERAGE TP TWD1448.07

Hon Hai Precision Industry (2317 TT)

Taiwan's Foxconn, the world's largest contract electronics maker and Apple's biggest iPhone assembler, reported on Monday that its January revenue rose 3.16% YoY.

Foxconn said it sees strong growth in the first quarter due to a higher AI demand, compared with the year-ago period, adding that it has better visibility for the first quarter than it did a month ago.

This resilience is likely to support the company’s top-line going forward.

MARKET CONSENSUS: 23 BUYS, 2 HOLDS, AVERAGE TP TWD240.55

Tencent (700 HK)

Tencent Cloud announced plans to build its first Middle East data center in Saudi Arabia.

In alignment with local industry innovation demand, it will invest over USD50M in the Middle East over the coming years for infrastructure, resources, and related investments to push forward digital economy innovation in the region.

To date, Tencent Cloud has accumulated over 10,000 overseas clients, and its international business has become a new growth engine. This could possibly support the company’s top line going forward.

MARKET CONSENSUS: 71 BUYS, 2 HOLDS, AVERAGE TP HKD517.76

Shiseido (4911 JP)

Japanese cosmetics giant Shiseido said on Monday its full-year profit slumped 73%, partly due to a drop in consumer spending in key overseas market China, a trend the company expects to continue into 2025.

Shiseido said its operating profit came in at JPY7.58B in FY2024, compared with JPY28.13B in the prior year.

The company said its China sales were down 4.6% YoY on a like-for-like basis, excluding the impact of foreign exchange and business transfers, and also forecasted a sales decline in 2025.

Despite Shiseido launched a two-year action plan in Nov 2024 to restore profitability and focus on its core brands, it is likely to continue to face some headwinds this year.

MARKET CONSENSUS: 6 BUYS, 9 HOLDS, 1 SELL, AVERAGE TP JPY2869

Earnings Announcements

US Market

Coca Cola, Marriott International, DoorDash, Fidelity, Gilead Sciences

European Market

BP, Kering, UniCredit, Banco BPM

HK - China Market

SMIC

Global Indices Changes (%)

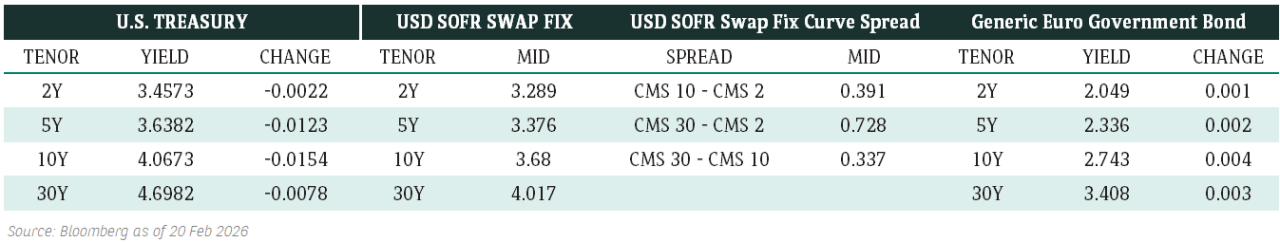

Fixed Income Market Updates

Woori Bank reported FY2024 results and has been in the spotlight recently with the Korean regulator uncovering significant issues in loan practices and internal controls. Rating agency S&P does not expect Woori Bank’s rating to come under pressure in the short-term as it expects Woori Bank to be able to gradually restore its reputation owing to some lapses in internal processes and loose underwriting standards on some of its loans. We have stable credit opinion on major Korean banks in general.

EUROPEAN BANK COCO (AT1)

European AT1 space opened slightly weaker but sentiment improved as the day progressed. Prices were +0.125 to -0.125point in general with lower than average flows. Recent new issues such as the UBS 7% and 7.125% perpetuals outperformed and were up around 0.2point. We do expect more new issues to come in this space which will be good opportunities to pick up some selected names with sufficient new issue premium.

ASIA INVESTMENT GRADE (IG)

Spreads were relatively stable in Asia IG space with more demand in shorter tenor bonds. We continue to like IG names with solid credit fundamentals and will extend duration up to 6 years. Quasi-sovereign names such as Petronas saw buying from asset managers while India names such as Export-Import Bank of India, Indian Railway Finance were in demand as well with the bonds tightening around 1bps in spread terms. In Korea, local demand was resilient.

ASIA HIGH YIELD (HY)

Tone was firm in China HY space led by strong performance in the China/Hong Kong equity markets. China HY space was marked 0.5-2.5points higher on average with buying from hedge funds. New World Development curve traded 0.5-1.5points higher with long end bullets outperforming. On the other hand, sentiment was poorer in India HY space on the back of weaker macro. India HY space closed 0.125-0.25point lower overall with selling from both asset managers and hedge funds. We remain cautious in the HY space and would prefer to make use of rate volatility for yield pickup through structured products.

Forex Market Updates

The US Dollar rose on Monday as Trump's tariff threats fueled safe haven demand for the greenback.

USD

The US Dollar started the week on the front foot, buoyed by safe haven buying after US President Trump announced imminent 25% tariffs on steel and aluminum imports into the US and promised other reciprocal tariffs later this week which would see the US match rates imposed by other countries. With China’s retaliatory tariffs on some US exports also taking effect on Monday and with no sign as yet of progress towards a new trade agreement between Beijing and Washington, most analysts expect the greenback to remain well supported this week. Looking ahead, Fed Chair Powell is likely to remain non-committal given so much uncertainty surrounding US trade policy, although rate cuts should remain on the agenda to a minimal extent.

The Dollar Index could see some consolidation between 107.00 and 109.00 moving forward.

EUR

The Euro remained mired close to recent lows on Monday as another round of tariff threats by US President Trump saw almost all the non-US G10 currencies come under renewed pressure. With the US being the second largest market for EU steel exports, the common currency dipped nearly 0.5% at one point during the Asian session before staging a muted recovery. Speaking on the issue of tariffs, ECB policymaker De Guindos said that the implementation of trade barriers would “create a supply shock” and thus “fundamentally” affect global economic growth. He also reiterated the importance of avoiding a trade war with the US and underlined the need for EU politicians to take a “prudent and intelligent approach”.

The common currency looks poised for more near term losses, with immediate support around 1.0260.

CNH

The Chinese Yuan weakened for the third consecutive day against the USD as China’s retaliatory tariffs on selected imports from the US took effect, with markets being kept to wait for signs of a rapprochement between the world’s two largest economies. The US-China trade war was one of the main drags on the Renminbi during Trump’s first term, with the Chinese currency falling more than 12% against the USD between March 2018 and May 2020. Elsewhere, data released over the weekend showed that China’s consumer inflation accelerated to its highest in five months in January while producer price deflation persisted, reflected mixed consumer spending and weak factory activity.

USDCNH could push higher towards the crucial 7.3500 handle in the near term.

XAU

Gold prices broke above the 2900 handle yesterday, hitting a new record high for the seventh time since the start of the year as US President Trump’s tariff threats heightened fears of a global trade war and fueled safe haven demand for the precious metal. Despite a more than 11% rally in bullion prices since the start of the year, gold analysts are mostly in consensus that there is a low probability of a correction at this juncture given a solid US jobs market, still-elevated inflation and uncertainty over how far the Trump administration will go with its tariff and immigration policies.

The bullion outlook continues to point upward, with gold prices likely to be well-supported above 2780 for the time being.