Macro Update:

Markets struggle on tariff and Powell remarks

Markets had a mixed session on Tuesday as investors reacted to President Trump’s new 25% tariffs on steel and aluminium imports as well as Fed Chair Jerome Powell’s cautious stance on interest rates. US President Trump signed an executive order imposing a 25% tariff on steel and aluminium imports with no exceptions or exemptions, set to take effect on March 4. Countries likely to be impacted the most are Canada, Brazil, Mexico, and South Korea, where the US gets most of its steel from, while Canada and UAE are the largest supplier of aluminium to the US. On the monetary front, Powell reiterated that the Fed is in no rush to cut rates, citing strong economic growth and inflation remaining above 2%. Investors will now turn their focus onto Wednesday’s CPI report, which could influence expectations for future rate cuts.

To get a better perspective on what these 'Tariffs' mean and/or their impact on markets and policies; listen to the podcast from our Global CIO, Edmund Shing.

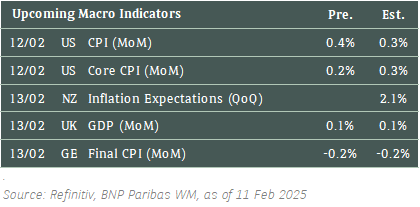

Main Upcoming Macro Indicators

Equity Market Updates

US EQUITIES

US equities ended Tuesday almost unchanged while investors parsed Fed Chair Jerome Powell's latest comments.

We see positive momentum in the US to continue for the medium term.

EUROPE EQUITIES

Shares in Europe logged another record high on Tuesday, even as concerns surrounding recent US tariffs on steel and aluminium remain.

HK EQUITIES

Hong Kong stocks closed lower on Tuesday as investor enthusiasm for AI and chip stocks cooled, while investors also weighed the latest tariff threats from Trump.

Coca Cola (KO US)

Shares of Coca Cola jumped on Tuesday after it posted 4Q24 results that well exceeded Wall Street expectations, helped by both higher demand and prices. Revenue stood at USD11.54B vs. USD10.67B expected, while adjusted EPS was at USD0.55 vs. USD0.52 expected.

The company also expects adjusted EPS to grow by 2% to 3%, and organic sales by 5% to 6% in 2025, a figure well received by the market. Coca Cola’s strong results follow relatively lackluster updates from consumer staples peers so far this earnings season.

This is likely to be positive for Coca Cola’s share price going forward.

MARKET CONSENSUS: 25 BUYS, 6 HOLDS, AVERAGE TP USD72.65

BP (BP/ LN)

BP's fourth-quarter profit fell to USD1.17B on Tuesday, marking the lowest earnings for the oil major in four years as weak margins dented its refining business.

The 61% drop in quarterly profit from last year, coming just days after reports of activist investor Elliott Investment Management building a stake in the company, has heightened investor hopes for board changes and strategic shifts to boost returns, putting additional pressure on CEO Murray Auchincloss.

BP's results were the weakest since 4Q20, when profits plummeted during the pandemic. This has intensified challenges for Auchincloss, who has pledged to improve BP's performance amid investor concerns about its energy transition strategy, which will be key to watch going forward.

MARKET CONSENSUS: 8 BUYS, 13 HOLDS, 4 SELLS, AVERAGE TP GBp476.95

Unicredit (UCG IM)

UniCredit on Tuesday posted better than expected 2024 earnings and said it aimed to keep profit stable this year despite declining rates, promising to increase shareholder rewards in 2025-2027.

The Italian bank forecasted a moderate decline in its 2025 net interest margin, a measure of profit from the gap in lending and deposit rates, due to lower Euro zone interest rates but also efforts to shrink its Russian business.

Under the leadership of CEO Andrea Orcel, an M&A veteran, UniCredit has embarked on an aggressive expansion strategy, building a 28% stake in Germany's Commerzbank and launching an all-share bid for smaller domestic peer Banco BPM. Further developments surrounding these deals will be key to watch.

MARKET CONSENSUS: 15 BUYS, 5 HOLDS, 2 SELLS, AVERAGE TP EUR47.12

Novartis (NOVN SW)

Swiss pharmaceutical giant Novartis has agreed to fully acquire Anthos Therapeutics, a biopharma firm majority-owned by Blackstone's drug development unit, for up to USD3.1B. The transaction is expected to close in 1H25.

Anthos was founded by Blackstone's Life Sciences business and by Novartis in 2019 to develop, manufacture, and commercialize abelacimab, a treatment to prevent strokes and the recurrence of blood clots.

With its deep roots in the cardiovascular space, Novartis is well positioned to advance abelacimab's clinical development and bring this innovative product to healthcare providers and patients, potentially supporting the company’s top line in the medium term.

MARKET CONSENSUS: 10 BUYS, 16 HOLDS, 3 SELLS, AVERAGE TP CHF103.09

Kering (KER FP)

French luxury group Kering reported a 12% drop in 4Q24 sales on Tuesday, dragged lower by its Italian brand Gucci, but flagged a slight improvement in major markets China and US.

Sales at Gucci, which accounts for nearly half of group sales and about two thirds of recurring operating profit, were down 24%, below analyst expectations for USD1.95B as the label's aesthetic overhaul failed to win back shoppers.

Kering's efforts to turn around Gucci with a new, minimalist design approach from De Sarno, who took up the position two years ago, were complicated by a global slump in luxury demand. Investors now await for further signs of recovery.

MARKET CONSENSUS: 4 BUYS, 22 HOLDS, 8 SELLS, AVERAGE TP EUR248.26

Alibaba (9988 HK)

Alibaba’s US-listed shares rose to its highest level since October 2024 on Tuesday after Apple has reportedly chosen the company over DeepSeek to develop its AI features for iPhones in China.

According to the reports, Apple claimed that it previously tested AI models from Baidu, Tencent, ByteDance, as well as DeepSeek, with DeepSeek in particular passed over due to a lack of resources needed to support a large customer like Apple. Alibaba’s vast consumer data, particularly in e-commerce and payment habits, reportedly played a key role in Apple’s decision. This partnership is likely to be positive for Alibaba’s share price.

MARKET CONSENSUS: 39 BUYS, 3 HOLDS, AVERAGE TP HKD118

Earnings Announcements

US Market

CVS Health, Kraft Heinz, MGM Resorts, Cisco

European Market

TeamViewer, EssilorLuxottica, Heineken, ABN AMRO

HK - China Market

-

Global Indices Changes (%)

Fixed Income Market Updates

We expect US inflation to continue trending down gradually, supported by declining US shelter cost and Bessent’s plan to lower oil price. The stabilising inflation should favor the fixed income space. Current sweet spot is 5-10 year good quality IG bonds which will outperform as Treasury yield goes lower.

EUROPEAN BANK COCO (AT1)

European bank coco market flow was more balanced. Bond prices were generally unchanged. However, we expect the space will remain volatile as soon as there is any update on tariff around Mexcio, Canada and China. Any sell-0off would be a good opportunity to add exposure given our constructive view on Euroepan bank’s credit fundamental.

ASIA INVESTMENT GRADE (IG)

Asia IG was firm. China IG credit spread was 2-3 basis points tighter. South East Asia IG Was also firm with spread 2-4 basis points tighter. Japan had a quiet session due to local holiday but was also 1-2 basis point tighter. Overall, market sentiment has improved for IG after Bessent discussed his plan to lower the 10-year US Treasury yield. We expect the positive momentum will continue.

ASIA HIGH YIELD (HY)

Asia HY had a good day. Chian HY sentiment turned positive after Vanke secured USD 384 mil loan from its major shareholder Shenzhen metro. The entire curve weas 2-4 points higher. New World Development was also 1-2 point higher as we saw some hedge fund started to cover short. Overall, the China HY bond market has shifted back to a yield-chasing tone, but we remain cautious that the tone can change on the back of any negative tariff headline news.

Forex Market Updates

The US Dollar fell on Tuesday as Fed Chair Powell kept his neutral tone in his Senate testimony.

USD

The US Dollar retreated on Tuesday in the absence of fresh tariff-related headlines, while comments by Fed Chair Powell on the first day of his testimony that the central bank sees no need to hurry to cut rates did little to support the greenback. Powell added that it is not for the Fed to comment on tariff policy, but did say that the standard case for free trade still makes sense, but “didn’t work that well when we have one large country that didn’t play by the rules”. On the data front, the latest reading of US Small Business Optimism came in lower than the previous month, with tariff uncertainty cited for the decline.

The Dollar Index could see some consolidation between 107.00 and 109.00 moving forward.

EUR

The Euro rose around 0.5% as the EU, alongside Canada and Mexico, condemned the Trump administration’s decision to impose tariffs on all steel and aluminum imports. Ahead of today’s meeting of EU trade ministers, European Commission President Von der Leyen said that “unjustified tariffs on the EU will not go unanswered” and will “trigger firm and proportionate countermeasures”, while German Chancellor Scholz followed in the same vein, pointing out that the EU will respond as one. Elsewhere, ECB President Lagarde commented that European inflation metrics should return to the central bank’s target range sometime this year.

The common currency's recent recovery looks likely to run into stiff resistance around the 1.0400 handle.

GBP

The British Pound strengthened yesterday in the face of broad USD weakness, although dovish comments by BoE policymaker Mann put a lid on Sterling gains. When asked about her surprising decision to vote for a 50bps cut at last week’s BoE policy meeting, Mann admitted that she did so because of her belief that companies will struggle to raise prices this year in response to lower spending on the back of higher unemployment. Elsewhere, the GBP has risen recently against the EUR, mostly on expectations that the Eurozone will have more to lose than the UK in case of US tariffs.

Sterling bulls could attempt a test of immediate resistance around the 1.2500 handle ahead of tomorrow’s UK GDP data.

XAU

Gold prices slipped below the 2900 handle on Tuesday as traders booked profits in the absence of new tariff headlines, but not before notching a new record high just above 2942 during the Asian session. Nevertheless, analysts say that overarching uncertainty from possible new proclamations by US President Trump is likely to support bullion prices, and scenarios like yesterday’s might be seen by bullish traders as a buying opportunity during a price dip.

The bullion outlook continues to point upward, with gold prices likely to be well-supported above 2780 for the time being.