Macro Update:

Bracing for an eventful week

Higher tariffs on Canada, Mexico and China are scheduled to be levied on Tuesday, the same day as President Trump addressing Congress. China’s National People Congress will start on Wednesday and we expect a modest stimulus package with a GDP growth target at around 5%. The ECB is likely to deliver another rate cut on Thursday, followed by US non-farm payroll data on Friday with our forecast of an increase by 170k in February and unemployment rate steady at 4%. Investors can monetise increasing market volatility through structured solutions.

Main Upcoming Macro Indicators

Equity Market Updates

US EQUITIES

US equities closed higher on Friday, recovering from their recent pullback after briefly dipping due to geopolitical developments between the US and Ukraine.

We remain positive on US equities in the medium term.

EUROPE EQUITIES

European shares ended almost unchanged on Friday, capping their tenth straight week of gains as the market continues its stellar run despite recent concerns surrounding US tariffs.

HK EQUITIES

Hong Kong stocks fell on Friday as Trump announced fresh tariffs on Chinese imports and investors booked profit on tech stocks.

Microsoft (MSFT US)

Microsoft announced on Friday that it is planning to discontinue its longtime calling and messaging app Skype, which it acquired 14 years ago, in an attempt to streamline its consumer communications offerings. This could positively impact the company’s performance/operations going forward.

For users, Skype will go offline on 5 May 2025, by which Microsoft will replace it with a free version of Microsoft Teams. As part of the move, the US technology giant will not lay off any employees who worked on the app and enable users to transfer old Skype account data to their new Teams account.

MARKET CONSENSUS: 64 BUYS, 6 HOLDS, AVERAGE TP USD506.15

Allianz (ALV GR)

Allianz said on Friday that its net income and insurance revenue for FY2024 rose YoY.

Net income attributable to shareholders for the FY2024 was EUR9.93B vs. EUR8.54B earlier. EPS moved to EUR25.18 from EUR21.18. The insurance giant's insurance revenue was EUR97.68B vs. EUR91.25B a year ago.

Separately, Allianz said it intended to launch a share buyback program of up to EUR2B starting in March and ending by December at the latest.

For the year ahead, the insurer said it is targeting an operating profit of EUR16B vs. EUR16.02B it reported for 2024.

MARKET CONSENSUS: 15 BUYS, 9 HOLDS, 1 SELL, AVERAGE TP EUR334.77

Shell (SHEL LN)

UK energy major Shell is reportedly exploring a potential sale of its chemicals assets in Europe and the US as part of a continuing drive to refocus its business on its most profitable operations. If implemented, this could support the company’s operations and share price going forward.

The company is currently working with bankers at Morgan Stanley on a strategic review of its chemicals operations, although the process is in its early stages and Shell has yet to commit to any final decisions. Among the assets included in the review is Shell’s Deer Park facility in Texas, with several others in Pennsylvania, Louisiana, the UK, Germany, and the Netherlands.

MARKET CONSENSUS: 21 BUYS, 5 HOLDS, AVERAGE TP GBp3154.08

BASF (BAS GR)

BASF on Friday predicted growth in adjusted operating income of as much as 6.3% this year, as it seeks to slash costs in Europe while facing start-up expenses at a new chemical complex in China.

The German chemicals giant predicted 2025 EBITDA and adjusted for one-off items of between EUR8-8.4B, up from EUR7.9B last year.

The company added it was well on track to achieve a target of EUR2.1B in annual cost savings by the end of 2026.

The German industrial heavyweight is undergoing a massive restructuring programme to cut costs, amid a sluggish industrial outlook for Germany, which could improve its operations and thus share price performance going forward.

MARKET CONSENSUS: 16 BUYS, 9 HOLDS, 3 SELLS, AVERAGE TP EUR53.92

Clariant (CLN SW)

Swiss specialty chemicals maker Clariant reported a higher-than-expected 4Q core profit on Friday, supported by volume growth and proactive margin management, and confirmed its targets for 2025.

Its EBITDA rose 69% YoY to CHF179.0M in the quarter, slightly above analysts' forecast of CHF176.8M.

The energy-intensive chemicals sector has seen an unprecedented drop in order volumes over the past two years as customers sought to reduce their inventories amid soaring energy prices, high inflation and escalating geopolitical tensions.

This year, the European industry will face another challenge in the form of Trump's planned 25% tariffs on imports from the European Union, which will be key to watch going forward.

MARKET CONSENSUS: 13 BUYS, 6 HOLDS, 1 SELL, AVERAGE TP CHF13.69

Earnings Announcements

US Market

-

European Market

-

HK - China Market

-

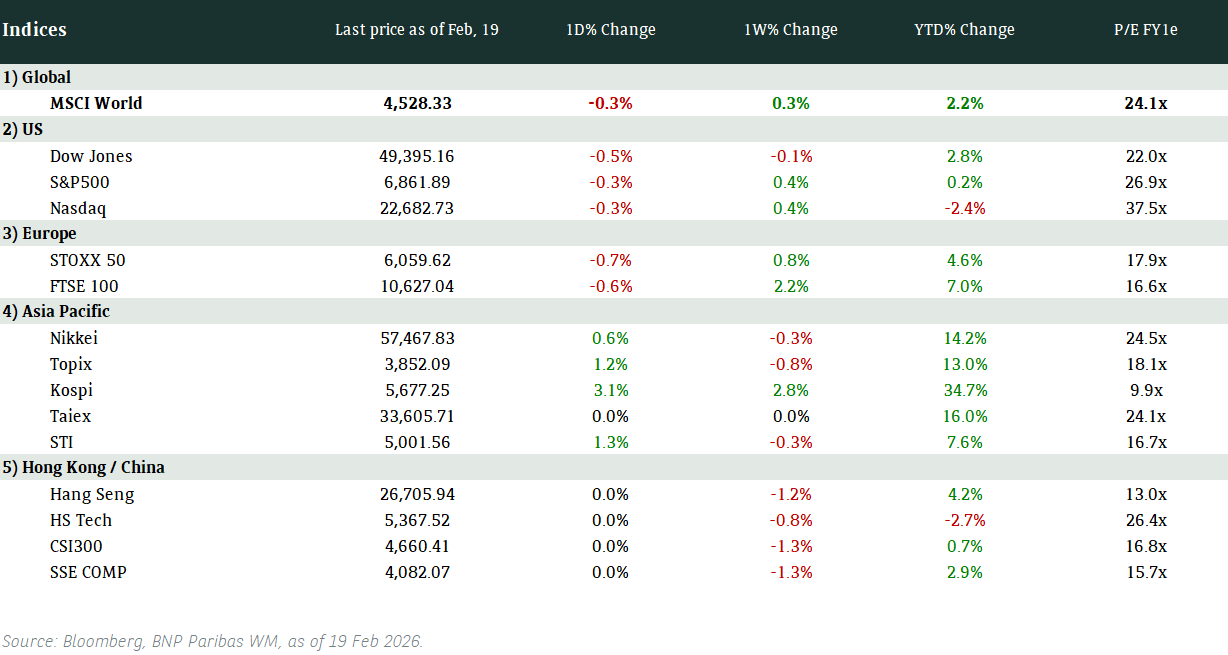

Global Indices Changes (%)

Fixed Income Market Updates

Treasury yields fell after PCE came in as expected but US consumer spending fell. We have the February jobs data this week that will further shed light on whether yields have fallen too far. In the interim, we would take profit on expensive bonds, such as selective AT1's.

EUROPEAN BANK COCO (AT1)

European Bank AT1 space closed the day slightly lower. Over the week, we are closing about unchanged in price terms, with the start of the week being strong before giving back those gains over Thursday and Friday. In spread terms, however, we were about 16bps wider in z-spread to worst, reflecting the strong rally in government bonds over the week. We remain of the view to take profit on selective AT1s, especially those that yield less than 6%.

ASIA INVESTMENT GRADE (IG)

China IG space was at most 10 basis points (bps) wider given the sharp drop in Treasury yields. There were buyers on the sideline. Outside of China, spreads also ended the week broadly 2 - 10 bps with an orderly selling theme. We expect demand to be tepid as this rates rally takes most accounts sidelined.

ASIA HIGH YIELD (HY)

In China HY space, last week was a firm week gaining 25 to 50 cents overall, with Hong Kong names leading the outperformance. New World Development was the key focus after releasing its annual results, which showed cash to short-term debt remained stable at 0.7x. Selling pressure quickly disappeared post-results, driving the curve up 3 to 7 points. Far East Consortium perps were active after the company sold its UK assets, with two-way fast money flows driving trading interest which closed around 90.5/91.5 with low print low 80 handle. Outside of China, there was profit taking in response to global risk-off sentiment. Benchmark spreads were anywhere from 10-30bps wider with the Genting complex underperforming after weak earnings while common high beta longs like Vedanta and Adani were also well off the highs despite the rates rally.

Forex Market Updates

The Dollar strengthened slightly on Friday but saw its largest monthly decline since September as concerns over the US economic outlook rose.

USD

The US Dollar initially edged lower on Friday after a reading on inflation was as anticipated while consumer spending unexpectedly fell, but rose 0.23% later. The dollar was up about 0.9% for the week but down 0.8% for February, its largest monthly decline since September. Market is now pricing in a 79.1% chance of a 25 bps cut in the Fed meeting in June. Investors have renewed worries about US economic growth and inflation as Trump confirmed tariff deadlines on Canada and Mexico and added extra tariffs on China. Investors are also bracing for the labor market impact from actions by the DOGE.

The USD index may find some consolidation around the current levels, with support at 107.

CNH

The Chinese Yuan fell to a two-week low against the dollar on Friday, dragged lower by signs of escalation in trade tensions as Trump proposed extra tariffs on Chinese goods. The fresh tariffs on Chinese imports is now 20%, 10% higher than previously. The PBoC increased the official guidance rate, albeit a broadly stronger dollar, suggested the central bank's determination to keep the yuan steady. A total of 20% extra tariffs is expected to drag China's real GDP growth by 0.46 percentage point, which may prompt Beijing to perk up the stimulus measures. Focus is on the annual gathering of the National People's Congress this week.

The Renminbi could test the next resistance level at 7.33 as the new tariffs are imposed.

GBP

The British pound eased on Friday due to the stronger USD index, but sterling was still heading for its first monthly rise since September, driven by the prospect of UK rates taking longer to fall than those elsewhere. Traders expect the BoE to deliver around two rate cuts this year. In addition, the UK is less exposed to the risk of tariffs than the EU, given that it boasts a trade surplus with the US and most exports are in the form of services. Analyst thinks sterling could continue to outperform the euro and riskier currencies in the short term.

The GBP may see near term consolidation and fluctuate between 1.2500 and 1.2600.

XAU

Gold prices fell over 1% on Friday as the dollar held close to two-week highs after US inflation data came in line with expectations, suggesting the Fed may adopt a cautious stance on additional rate cuts. Moreover, analysts think the profit-taking in week-long liquidation and the strong US dollar index are the main elements that impact gold prices. Stock market losses have also stoked deleveraging pressure in gold perpetuating the sell-off from Monday's record high. However, gold is set for a second consecutive monthly gain, boosted by concerns over Trump's tariff plans.

The XAU could see a further near term retracement towards immediate support around 2800.