Macro Update:

US stocks sink while European stocks at record highs

US equity markets fell sharply after President Trump pledged to push through tariffs on top trading partners and the weaker-than-expected ISM manufacturing data. On the contrary, European equities hit record highs, boosted by the prospect of increased EU defence spending after France’s President Macron called on EU member states to increase defence spending to 3-3.5% of GDP.

A sustained elevated tariff not only pushes Mexico and Canada into recession, it also hurts US growth and reignites inflation and we don’t expect the US administration would want to see that. All eyes on any last-minute talks or deals.

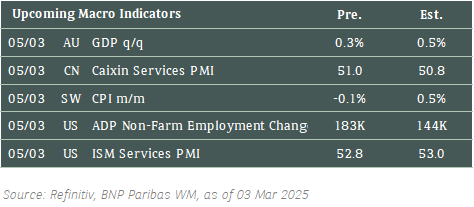

Main Upcoming Macro Indicators

Equity Market Updates

US EQUITIES

US equities sold off on Monday after President Trump announced that 25% tariffs on Canada and Mexico will go into effect today.

We remain positive on US equities in the medium term.

EUROPE EQUITIES

European shares rose to new record highs on Monday, helped by defence stocks after expectations of higher military spending in the region, while the prospect of a Ukraine peace proposal further boosted sentiment.

HK EQUITIES

Hong Kong stocks rebounded slightly on Monday on China’s positive manufacturing data, ahead of the National People’s Congress due to start on Wednesday this week.

Microsoft (MSFT US)

Microsoft on Monday unveiled its Dragon Copilot, an artificial intelligence and assistant intended to enhance clinical workflow, enabling doctors and nurses to automate time-consuming clerical work. This will be available first in the United States and Canada in May, shortly followed by several other countries in Europe.

The company’s launch of the healthcare-focused Dragon Copilot signals that it is taking aim at a lucrative market that peers such as Google have also been eyeing, while also building on its 2022 acquisition of Nuance Communications, which sold conversational AI software for healthcare applications.

How Dragon Copilot fares against competitors will be key to watch going forward.

MARKET CONSENSUS: 64 BUYS, 6 HOLDS, AVERAGE TP USD504.44

Intel (INTC US)

Nvidia and Broadcom are reportedly running manufacturing tests with Intel’s 18A process, demonstrating early confidence in the struggling chipmaker’s advanced production techniques and signifying potential upside for the company.

The two tests, which have not been reported previously, indicate that the companies are moving closer to determining whether they will commit hundreds of millions of dollars' worth of manufacturing contracts to Intel. The decision to do so could generate a revenue windfall and endorsement for Intel's contract manufacturing business that has been beset by delays and has not yet announced a prominent chip designer customer.

MARKET CONSENSUS: 4 BUYS, 39 HOLDS, 6 SELLS, AVERAGE TP USD22.5

TSMC (2330 TT)

US President Donald Trump announced on Monday that TSMC is planning to invest USD100B on “cutting-edge chip-making facilities” in the US over the next four years, on top of the USD65B in investments the company had previously announced.

Prior to the recent announcement, TSMC had already begun constructing three plants in Arizona after the Biden administration offered billions in subsidies. Its first factory in Arizona has started mass production of 4nm chips.

TSMC’s USD100B investment could further isolate the company from US semiconductor restrictions, which is likely a positive going forward.

MARKET CONSENSUS: 39 BUYS, 1 HOLD, AVERAGE TP TWD1450.07

ING Group (INGA NA)

Dutch bank ING said on Monday that it has agreed to buy a 17.6% stake in Van Lanschot Kempen, which would take its total stake in the Dutch private wealth manager to 20.3%.

ING said it viewed the move as a long-term investment and that it supported the current management of Van Lanschot, which predominantly operates in the Netherlands and Belgium.

With this acquisition of stake, ING is trying to execute its goal to enhance position in the private banking and wealth management sector. How this can translate into ING’s top and bottom line will be key to watch in the long term.

MARKET CONSENSUS: 12 BUYS, 11 HOLDS, 3 SELLS, AVERAGE TP EUR18.25

Honda (7267 JP)

Honda has reportedly decided to produce its next-generation Civic hybrid in the US state of Indiana, instead of Mexico, to avoid potential tariffs on one of its top-selling car models.

The change underscores how manufacturers are scrambling to adapt to Trump's proposed 25% tariffs on goods from Mexico and Canada. While several automakers have expressed concerns about the levies, Honda's move is the first concrete measure by a major Japanese car company.

Honda had initially planned to manufacture the next-generation Civic in Guanajuato, Mexico, and the production was slated to start from November 2027.

MARKET CONSENSUS: 15 BUYS, 6 HOLDS, AVERAGE TP JPY1788.89

Earnings Announcements

US Market

Crowdstrike

European Market

Lindt, Continental, PRADA

HK - China Market

Techtronic Industries, SJM Holdings

Global Indices Changes (%)

Fixed Income Market Updates

After 10-year US Treasury yield declining from 4.8% to 4.11%, we are hoping for some rebound in Treasury yields in the short term. However, our wish may not necessarily come true. Thus, those who are still under-allocated to fixed income will need to start buying now, as we expect rising geopolitical tensions will drive more fund flows to the fixed income space.

EUROPEAN BANK COCO (AT1)

Over the last two weeks, European bank coco had rallied quite well as 10-year US Treasury yield climbed lower. We believe coco valuation has become somewhat expensive and would suggest selling on this rally. We expect further coco bond upside will be more driven by interest rate movement instead of credit spread tightening.

ASIA INVESTMENT GRADE (IG)

Asia IG had a mixed day. We saw private bank buyers for India and Philippine IG bonds with credit spread 1-2 basis points tighter. On the other hand, Australia IG was weak and spread was 2-3 basis points wider. Overall, IG bond sentiment is somewhat mixed. We expect the market will stay volatile until it finds new direction after US nonfarm payroll release this Friday.

ASIA HIGH YIELD (HY)

Asia HY bond had a decent day. Mongolia Mining recovered from their Friday losses, thanks to the positive outlook assigned by Moody’s. China HY was also well supported and we saw names like Longfor and China Jinmao 0.25-0.5 points higher. New World Development bond complex also rallied well on the back of Debtwire’s report that the company could call back the 6.15% perpetual bonds which rallied 10-15 points. We remain cautious on New World’s credit fundamental and suggest sell on this rally.

Forex Market Updates

The US Dollar weakened as manufacturing showed strain, with rising costs, supply chain delays, and new tariffs adding to inflation concerns and economic uncertainty.

USD

The US Dollar weakened on Monday against a basket of other major currencies, as manufacturing activity showed signs of strain, with slowing new orders and rising costs raising concerns about inflation. Supply chain pressures intensified, with factories experiencing longer delivery times for materials. Input costs at production facilities surged, suggesting that price pressures could persist. Meanwhile, new tariffs on imports from Mexico, Canada, and China are set to take effect, adding to uncertainty for manufacturers who rely on foreign raw materials. The Fed remains cautious on interest rate cuts as inflation risks and trade disruptions continue to weigh on the economic outlook.

The Dollar Index could see further near term weakness, with greenback bears likely to be well supported above 105.8 handle for now.

CNH

The Chinese Yuan weakened on Monday, hovering near a two-week low as escalating US-China trade tensions overshadowed optimism from strong Chinese manufacturing data. President Trump’s announcement of an additional 10% tariff on Chinese goods, effective on March 4, led to concerns over retaliatory measures from Beijing, including potential tariffs on US agricultural exports. Despite China’s factory activity expanding at its fastest pace in three months, market sentiment remained cautious. The PBoC set the daily midpoint at its weakest since January 20, signalling a cautious stance ahead of the upcoming 'Two Sessions' meeting.

USDCNH’s recent rebound is likely to run into stiff resistance around 7.3390 level for the time being.

EUR

The Euro strengthened on Monday as reports of a Ukraine peace plan and increased Eurozone defence spending boosted sentiment. Ukrainian President Zelenskyy met with European leaders following a tense exchange with US President Trump, while the UK pushed for a diplomatic proposal. EUR/USD rose to 1.0486, rebounding from Friday’s low. Analysts suggested that higher fiscal spending could support economic growth. Meanwhile, Eurozone inflation eased in February, reinforcing expectations that the ECB will cut rates at its meeting on Thursday. Markets anticipate further easing later this year, as policymakers assess the economic outlook amid ongoing geopolitical uncertainties.

Euro bulls could attempt a test of resistance around the 1.0583 handle ahead of Thursday’s policy rate meeting.

XAU

Gold edged higher on Monday as a weaker dollar and escalating geopolitical risks supported safe haven demand. Delays in Ukraine-Russia peace talks and uncertainty over US trade policies kept investors cautious. A disappointing US consumer spending report raised concerns about economic growth, while rising inflation may push the Fed to delay rate cuts. Market focus remains on tariffs set to take effect on Tuesday, which could disrupt trade and add to inflationary pressures. With financial markets on edge, gold continued to attract demand amid growing uncertainty over global economic stability and policy direction.

With the rise in economic uncertainty, the bullion outlook continues to point upward, with gold prices likely to be well-supported above 2740 for the time being.