Macro Update:

Sentiment recovers on better newsflow in US and Europe

Markets bounced back despite a weaker consumer sentiment which reflected concerns over inflation and tariffs in the US. Easing fears of a government shutdown helped lift sentiment on Friday as Senate Minority Leader Chuck Schumer signalled support for a Republican-backed funding bill, reducing political uncertainty. President Trump also stated that he had a “very good and productive” call with Russian President Putin, suggesting the Ukraine-Russia war could finally come to an end.

In Europe, investors welcomed news that Germany had agreed on a debt overhaul and a significant increase in state spending, ahead of a parliamentary vote this week on reforming borrowing rules.

Elsewhere in China, the State Council on Sunday unveiled a "special action plan" to boost domestic consumption, while also mentioning measures to stabilise the stock market albeit no details on this was given just yet. We continue to stay positive on China equities and expect more fiscal measures to be rolled out as to boost domestic demand.

Main Upcoming Macro Indicators

Equity Market Updates

US EQUITIES

US stocks rebounded on Friday, clawing back some of the steep losses seen over the week, as investors got a reprieve from tariff-related headlines.

Volatility will likely remain in US stock markets in the near term.

EUROPE EQUITIES

Shares in Europe also traded higher on Friday, with German equities leading the gains after the country's political parties agreed on a historic deal to ramp up state borrowing.

HK EQUITIES

Hong Kong stocks rose on Friday while investors await a key briefing by Beijing this week for additional measures to enhance domestic consumption.

General Motors (GM US)

The US National Highway Traffic Safety Administration (NHTSA) announced on Friday that General Motors will recall over 90,000 vehicles in the country due to a safety issue concerning Cadillac CT6 cars made in 2019 and 2020, CT4 and CT5 from 2020 and 2021 and 2020-2022 Chevrolet Camaro units equipped with a 10-speed transmission.

According to the NHTSA, the transmission in some of the cars may become damaged internally and cause the front wheels to lock up. Owners of the concerned vehicles will be notified by letter from 21 April 2025.

This could negatively impact General Motors’ reputation and operating performance in the near term.

MARKET CONSENSUS: 16 BUYS, 13 HOLDS, 2 SELLS, AVERAGE TP USD62.48

UniCredit (UCG IM)

UniCredit announced on Friday that it has obtained regulatory permission from the European Central Bank to own up to 29.9% of Commerzbank. The authorization allows UniCredit to move closer to acquiring a direct stake, though converting its current 18.5% derivative-held shares requires further approvals, including from Germany's Federal Cartel Office.

The Italian bank however noted that it is extending its decision on whether to seek an acquisition of Commerzbank “well beyond the end of 2025” due to uncertainty over the sustainability of Commerzbank’s recent stock price rally.

MARKET CONSENSUS: 15 BUYS, 5 HOLDS, 2 SELLS, AVERAGE TP EUR51.02

BMW (BMW GR)

BMW reported on Friday that its 2024 net profit was down 36.9% to EUR7.68B and forecasted profit margins for its automotive business this year below analysts' expectations, factoring in the impact of US tariffs imposed in recent weeks and anticipating an even more intense trade war.

The premium carmaker expects its earnings margin for cars to be 5-7% in 2025, below an estimate of 7.3%.

Its US plant in South Carolina exports cars worth over USD10B, making the company the largest US automotive exporter by value, according to CEO Oliver Zipse.

Having said that, BMW said it still anticipated solid market development in US due to a robust economic situation. The company's earnings announcements in the next few quarters will be closely watched by the market.

MARKET CONSENSUS: 16 BUYS, 10 HOLDS, 3 SELLS, AVERAGE TP EUR88.01

Baidu (9888 HK)

Chinese technology company Baidu on Sunday launched its new AI model, Ernie X1, which excels in daily dialogs, complex calculations, and logical deduction at a relatively low cost, in an apparent bid to regain momentum against rivals like DeepSeek.

Baidu also upgraded its flagship foundation model to Ernie 4.5, which outperforms OpenAI’s GPT 4.5 in text generation. The company will make Ernie AI models open-source staring from 30 June this year.

MARKET CONSENSUS: 25 BUYS, 9 HOLDS, AVERAGE TP HKD106.61

AIA (1299 HK)

AIA Group reported profit for the year attributable to shareholders of USD6.84B for 2024 vs. USD3.76B in the previous year.

Earnings per share was at USD0.62 vs. USD0.33 a year ago. Insurance revenue for the year was USD19.31B vs. USD17.51B in the prior year.

The company declared a final dividend of USD1.31 per share, which will likely be paid out on 12 June. However, the market was disappointed for the YoY decline in share buyback budget, in which AIA repurchased USD4.15B in 2024.

MARKET CONSENSUS: 31 BUYS, AVERAGE TP HKD91.53

Hon Hai Precision Industry Co. (2317 TT)

Taiwan's Foxconn, the world's largest contract electronics maker, forecasted strong revenue growth in the first quarter after reporting a surprise 13% drop in fourth-quarter profit.

In January, Foxconn said October-December revenue jumped 15.2% to a record for that quarter on strong AI server sales.

An escalating global trade war has complicated prospects as Foxconn has a major manufacturing presence in China and Mexico.

Looking ahead, how macroeconomic and geopolitical volatilities would impact the business performance will be of investors’ focus.

MARKET CONSENSUS: 23 BUYS, 2 HOLDS, AVERAGE TP TWD231.94

Earnings Announcements

US Market

-

European Market

-

HK - China Market

WuXi AppTec, Kingdee International Software

Global Indices Changes (%)

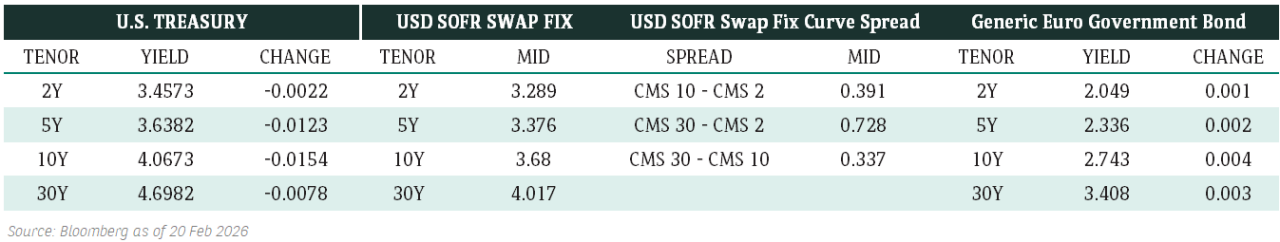

Fixed Income Market Updates

US Treasury yields rose last Friday despite the weaker U.S. consumer sentiment report. We expect yields to likely go higher in the coming week(s) and would extend duration on low beta bonds when we see the ten year Treasury yield in the 4.3% to 4.5% range. While credit spreads may widen, we expect low beta IG bonds to widen the least.

EUROPEAN BANK COCO (AT1)

Sentiment improved last Friday as risk sentiment recovered especially some bonds that were previously sold off at new lows such as the Barlays 7.625% that recovered to 99 bid. While we expect a squeeze higher due to sentiment recovery to continue this week, we continue to advocate profit taking in selected AT1 bonds as we believe valuation is tight.

ASIA INVESTMENT GRADE (IG)

Overall spreads are wider especially higher beta names such as China National Chemical corp, Korea BBB, India's Power Finance, and Thailand's Thai Oil. In general front end is well supported by local accounts. We expect yield buyers to step in this week.

ASIA HIGH YIELD (HY)

In China HY space, it had a weaker session. In China property, survivor benchmarks like Vanke and Longfor was trading 1-2pt (point)lower on the back of both real money and fast money selling. With some bottom fishing from PB accounts, New World Development is anywhere from unchanged to +6pt higher. The step-up perps have outperformed by some bottom fishing from fast money accounts. In India/Indon HY, the space is broadly closing 0.5-2pt lower on the week. The Adani complex is trading 1-2pt lower. Media reported that the Indian government has requested a local court to deliver a U.S. SEC summons to Gautam Adani. Rest of the NBFC/Renewables are also under pressure driven by real money trimming risk, the tighter valuation is vulnerable under the current macro environment.

Forex Market Updates

The US Dollar weakened Friday and year-to-date amid trade uncertainty, slowing economic indicators, and growing expectations of 75 bps in Fed rate cuts.

USD

The US dollar has weakened against a basket of major currencies on Friday, as well as this year, weighed down by concerns over the economic impact of Donald Trump’s tariff policies. While tariffs can sometimes support the dollar, uncertainty around trade relations has dampened investor confidence. Economic indicators suggest growing risks, with business sentiment slipping and manufacturing activity showing signs of strain. The yield curve remains inverted, a signal of economic uncertainty, while consumer confidence has weakened. Markets are increasingly pricing in Fed rate cuts, with expectations building for a total reduction of 75 basis points this year.

The Dollar Index could see further near term weakness, while being supported above 103.20 level ahead of today’s retail sales data and Thursday’s Fed interest rate decision.

GBP

Sterling edged lower against the US Dollar on Friday after data showed the UK economy unexpectedly contracted by 0.1% in January, highlighting ongoing economic fragility. The decline was driven by weakness in industrial output and construction, raising concerns about growth momentum. Despite the soft data, analysts expect the BoE to maintain its cautious approach on interest rates, given persistent inflation risks. While the pound remains supported by expectations of steady policy, uncertainty surrounding fiscal plans and economic resilience continues to weigh on sentiment. Markets now look ahead to upcoming economic forecasts for further direction.

Sterling’s near term outlooks remains bearish, with next support level being around 1.2860 handle, ahead of this week’s BoE interest rate decision.

EUR

The Euro strengthened on Friday, as inflation in the eurozone remained sticky, reinforcing expectations that the ECB will be cautious about rate cuts. February’s final CPI confirmed a 2.6% annual increase, with core inflation at 3.1%, still above target. ECB officials signalled a need for more data before considering easing, pushing back against expectations of an early cut. Markets now see a rate reduction likely in June. Meanwhile, stronger risk sentiment supported the euro, with investors weighing economic resilience in the bloc against a softer U.S. dollar.

The common currency could see some consolidation between 1.0760 and 1.0950 moving forward.

XAU

Gold strengthened slightly, as it surged past the $3,000 mark on Friday, reaching an all-time high of $3,004.86 before easing slightly on profit-taking. The rally was fuelled by investor demand for safe-haven assets amid market uncertainty linked to US tariff policies. Bullion has gained nearly 14% this year, supported by concerns over economic instability and central bank purchases, particularly from China. Expectations of Fed rate cuts have also bolstered gold, with traders anticipating easing to begin in June. With rising geopolitical risks and ongoing market volatility, gold remains a key refuge for investors seeking stability.

The bullion outlook continues to point upward, with gold prices likely to be well-supported above 2880 for the time being.