Macro Update:

China economic data beats expectations

China reported surprisingly robust economic activity to start the year. Retail sales, fixed asset investment and industrial production grew more than expected in January and February, though unemployment rose to a two-year high. Meanwhile, Beijing unveiled a plan to boost consumption, focusing on raising incomes, stabilising property and stock markets, as well as improving medical and pension services, though still lack of details on the implementation. All eyes are on the earnings results and guidance from the China big techs this week to see if earnings will lead the re-rating of the sector.

Main Upcoming Macro Indicators

Equity Market Updates

US EQUITIES

US equities gained for a second straight session on Monday as investors sought bargains in the market while continuing to assess the latest economic data releases.

EUROPE EQUITIES

Stocks in Europe also closed higher on Monday, supported by energy and healthcare sectors, as investors digest Germany's debt reform plans and the latest developments surrounding the Russia-Ukraine conflict.

HK EQUITIES

Hong Kong stocks rose on Monday following optimism over Beijing’s newly-announced action plans to boost domestic consumption.

We remain positive on Hong Kong/China equities in the medium term.

Alphabet (GOOGL US)

Google’s parent company Alphabet is reportedly in advanced discussions to acquire cybersecurity startup Wiz for approximately USD30B.

This would however mark only the latest round of takeover talks between Alphabet and Wiz. In July last year, Wiz turned down a takeover bid of as much as USD23B from the tech giant, deciding instead to stick with its plan for an initial public offering.

If this deal materialises, Alphabet could use Wiz to round out its security offerings and obtain a competitive edge, potentially supporting its share price going forward.

MARKET CONSENSUS: 60 BUYS, 15 HOLDS, AVERAGE TP USD219.72

Berkshire Hathaway (BRK US)

Warren Buffett's Berkshire Hathaway raised its holdings in five Japanese trading houses, regulatory filings showed on Monday, increasing its stakes by between 1.0% and 1.7%. It now holds a stake of between 8.5% and 9.8% in the five companies: Itochu Corp., Sumitomo Corp., Marubeni Corp., Mitsubishi Corp. and Mitsui & Co.

Buffett told shareholders in his annual letter in February 2025 that Berkshire received the Japanese companies' blessing to increase its stake beyond 9.9% and that Berkshire's shareholders would likely see its ownership of all five Japanese companies increase somewhat over time.

MARKET CONSENSUS: 2 BUYS, 3 HOLDS, 1 SELL, AVERAGE TP USD510.25

PepsiCo (PEP US)

PepsiCo announced on Monday that it has entered into an agreement to acquire prebiotic soda company Poppi for USD1.95B, including USD300M of anticipated cash tax benefits. PepsiCo also said that the transaction includes an additional potential earnout consideration depending on certain performance milestones.

This acquisition is part of PepsiCo’s effort to diversify away from standard soda and snacks. Poppi’s functional sodas, which use prebiotics and have 5 grams of sugar less per serving, have been growing in popularity recently, driven by consumer demand for healthier products.

This addition to PepsiCo’s product portfolio is likely to be supportive for its share price going forward.

MARKET CONSENSUS: 11 BUYS, 14 HOLDS, 1 SELL, AVERAGE TP USD164.35

BMW (BMW GR)

BMW Group will integrate Huawei HiCar, the Chinese tech conglomerate's car mobile app connecting devices with vehicles, into its locally produced new models in 2026, the German automaker said on Monday.

The German automaker is also working with its suppliers to achieve more "cross-cycle" cooperation and promote deep integration of local Chinese partners into BMW's global innovation system.

Looking ahead, investors will be focusing on the annual China Development Forum (CDF), where CEO of BMW is expected to meet President Xi on 23-24 Mar in Beijing.

MARKET CONSENSUS: 16 BUYS, 10 HOLDS, 3 SELLS, AVERAGE TP EUR89.23

AstraZeneca (AZN LN)

Pharmaceutical giant AstraZeneca said on Monday it will buy biotechnology firm EsoBiotec for up to USD1B.

EsoBiotec's Engineered NanoBody Lentiviral (ENaBL) platform can genetically modify immune cells directly inside the body, allowing transformative cell therapy treatments in just minutes instead of the current process which takes weeks, AstraZeneca said.

The transaction is expected to close in the 2H25, and it does not impact AstraZeneca's financial guidance for 2025, the company said.

MARKET CONSENSUS: 25 BUYS, 6 HOLDS, 1 SELL, AVERAGE TP GBp14149.76

Earnings Announcements

US Market

-

European Market

Fraport AG Frankfurt Airport

HK - China Market

China Literature, Meitu, Tencent Music Entertainment, Xpeng, Xiaomi

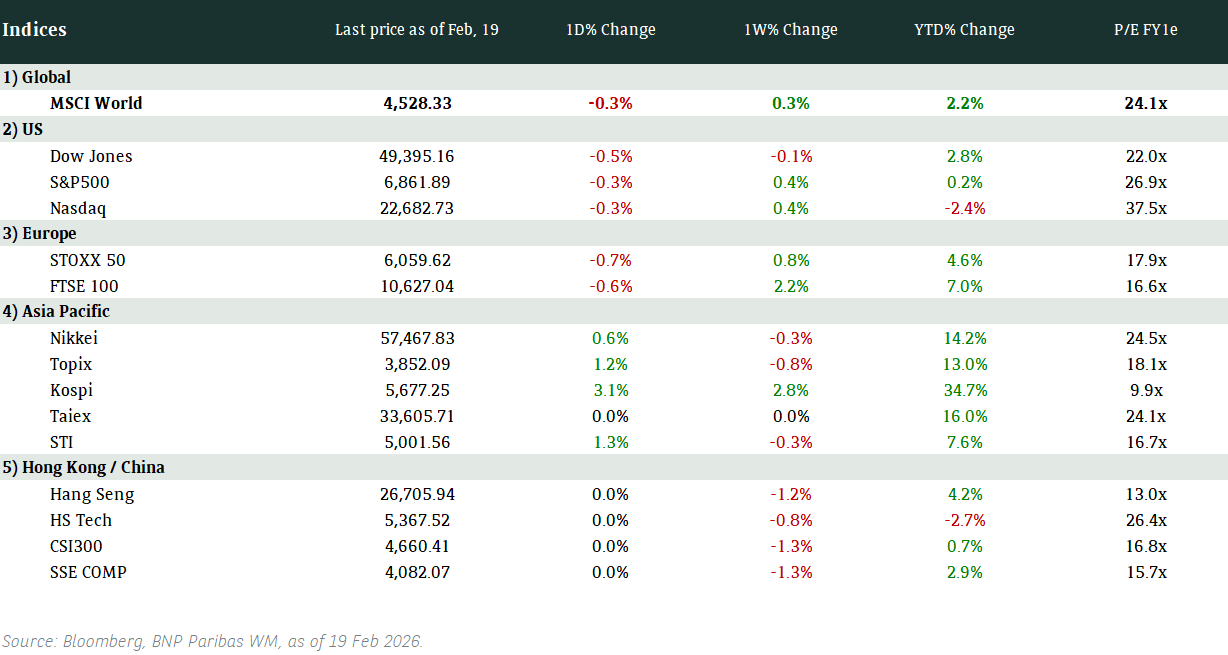

Global Indices Changes (%)

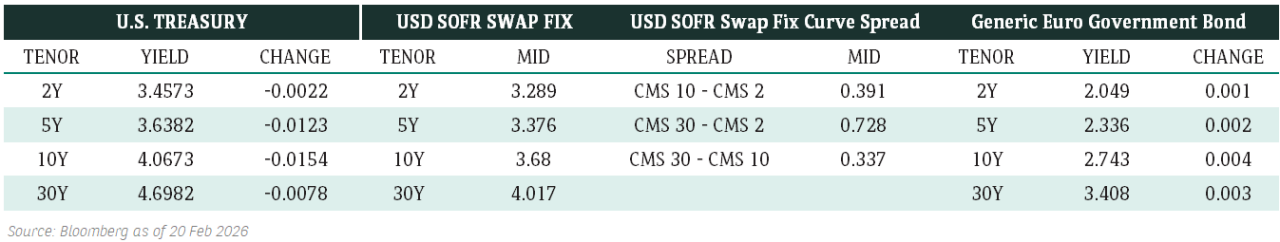

Fixed Income Market Updates

A slight rebound in US retail sales for February may quell recent market chatter about stagflation or recession. This could continue to support a relief rally in risky assets for the week, giving the 10-year Treasury yield a reason to edge up above 4.3%. Investors should seize the opportunity to lock in yields before weak macroeconomic conditions return to the forefront.

EUROPEAN BANK COCO (AT1)

The AT1 market opened unchanged to 0.125 points higher, with early flow from the Middle East and Asia skewed toward buying, thereby supporting the technicals of the market. AT1s finished the previous week on a constructive tone following a series of hedge fund deleveraging that led to a capitulation across the entire AT1 space. The recent correction in AT1s has positioned their valuation more favourably compared to European bank stocks. Meanwhile, the recent rally in European rates is likely to bolster demand for EUR-denominated AT1s.

ASIA INVESTMENT GRADE (IG)

The China IG market had a slow start with mixed sentiment. Credit spreads opened around 1 basis point tighter, but small selling pressure was noted. The technology sector remained robust, while asset management companies faced modest selling. Outside China, spreads tightened by 1 to 3 basis points, though primary flows favoured profit-taking. Some buying along the Bangkok Bank curve following a new 15-year non-call 10-year Tier 2 bond announcement. In Korea, SK Hynix enjoyed healthy two-way flows, while Hyundai Motor widened by 2 to 3 basis points due to US investors selling.

ASIA HIGH YIELD (HY)

In China HY, the property market was stable and largely unchanged for most names, although New World Development faced slight declines from private bank selling. The industrial sector received some buying interest in Fosun International. Outside China, Indian HY spreads stabilized after US equities halted losses last Friday, but subsequent buying was subdued as investors hesitated to commit significant capital amid a volatile macro environment.

Forex Market Updates

The dollar remained under pressure on Monday as lingering concerns over the economic fallout from Trump’s protectionist trade policies continued to weight on market sentiment.

USD

The US dollar remains under pressure and hovered near a five-month low against the euro on Monday as worries about the economic fallout from U.S. President Donald Trump's protectionist trade policies kept investors cautious on the dollar. Traders have re-evaluated their initial expectations that Trump's policies would support the dollar and weaken other currencies. While ruling out the possibility of a financial crisis, Treasury Secretary Scott Bessent said there were "no guarantees" there would not be a recession in the U.S.. The week is packed with central bank meetings, including the Fed, the BoJ and the BoE, all of which are widely expected to hold fire amid the current economic uncertainty.

The Dollar Index could see a further near term retracement towards immediate support around 102.50 ahead of Wednesday's Fed interest rate decision.

GBP

Sterling gained against a broadly weaker dollar on Monday, as traders' attention turns back towards Britain ahead of this week's BoE meeting and next week's update on the country's public finances. The BoE is expected to hold rates on Thursday’s meeting, with investors focusing on whether official remarks may disrupt market expectations of two more 25 basis point rate cuts by year end. Analysts said that the pound's weakening against the euro has been "excessive" and the currency is ripe for a comeback.

Sterling is testing the psychological barrier of 1.3000 as the next target as the US dollar's weakening continues.

CAD

The Canadian dollar strengthened to an 11-day high against its U.S. counterpart on Monday as equity markets rallied and investors cheered China's plan to stimulate consumption. Wall Street rallied as some investors took advantage of the recent selloff to buy stocks at cheaper prices. In addition, China's State Council unveiled a "special action plan" on Sunday to boost domestic consumption. The lack of news on tariff front recently also helps sentiment. However, the OECD still forecasts Trump's tariff hikes will drag down growth in Canada and drive up inflation.

The Canadian dollar could attempt another near term push higher, with USDCAD dipping toward immediate resistance around 1.4230.

XAU

Gold prices firmed on Monday, sitting just below the $3,000-mark that was broken last week, with the focus on trade tariffs and the U.S. Federal Reserve's policy meeting. Analysts expect some consolidation in gold prices as the market is in a 'wait-and-see' mode ahead of the Fed meeting. Elsewhere, Trump plans to speak to Russian President Putin on Tuesday and discuss ending the war in Ukraine.

The bullion looks poised for a period of consolidation between 2980 and 3010 for now.