Macro Update:

Germany passes historic debt reform

German parliament voted in favour of a major fiscal package, which includes changes to long-standing debt policies to enable higher defence spending and a EUR 500 billion infrastructure and climate fund. This will also need to be backed by the country’s upper house in a vote on Friday.

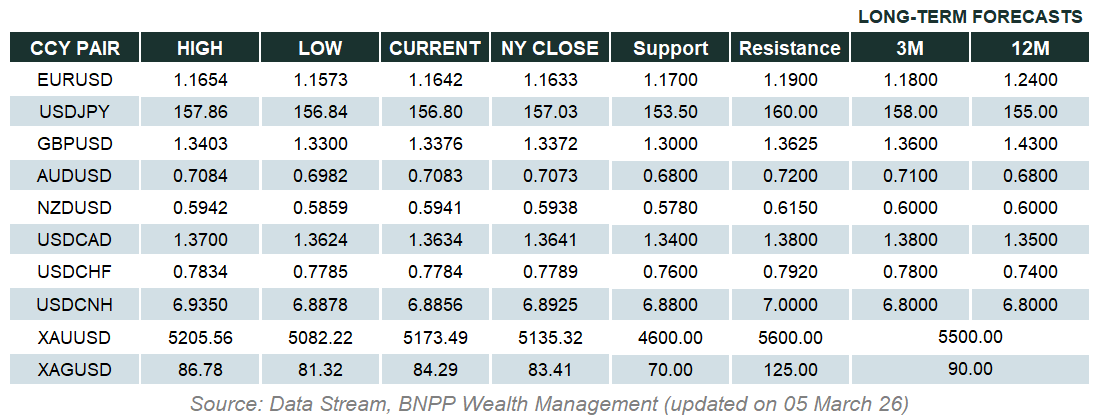

Gold rose to a record high of $3,035 as rising Middle East tensions boosted demand for safe haven assets. We remain positive on gold though there may be a short term consolidation after a sharp rally. Our 12-month target for gold is $3,200/oz.

Main Upcoming Macro Indicators

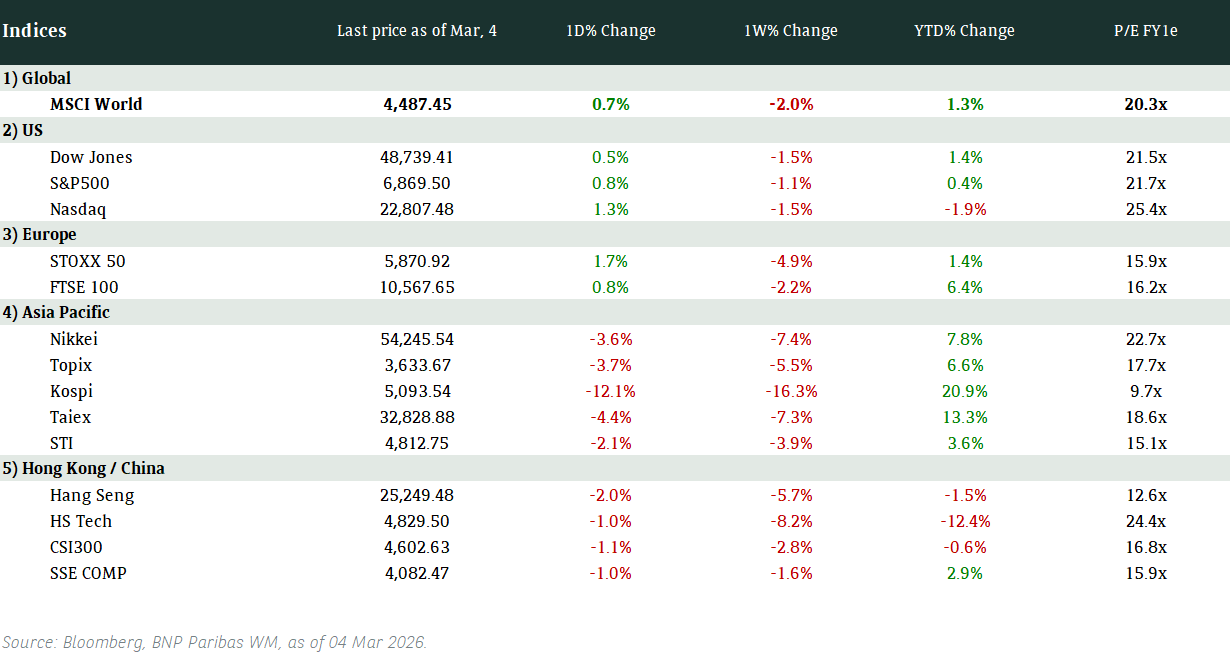

Equity Market Updates

US EQUITIES

US equities ended lower on Tuesday as investors await outcomes from the Fed’s two-day monetary policy meeting.

EUROPE EQUITIES

European equities continued higher on Tuesday after the German parliament approved plans for a massive spending surge, while investors keep a close eye on further developments surrounding a potential Russia-Ukraine peace deal.

We still see value in European equities, with the UK’s defensive merits particularly favourable in our view.

HK EQUITIES

Hong Kong stocks soared to a three-year high on Tuesday, led by gains in technology shares, as investor sentiment was bolstered by China’s fresh stimulus and improving economic data.

Nvidia (NVDA US)

Nvidia announced new AI chips and technology at the company’s annual GTC conference on Tuesday, aiming to address concerns about the cost of AI computing.

During the presentation, CEO Jensen Huang introduced Blackwell Ultra, an upgraded AI chip family set to launch in late 2025, Vera Rubin, a next-generation GPU system expected in 2026, alongside some new software as well as high-profile partnerships.

According to Huang, Vera Rubin will feature Nvidia's first custom-designed CPU, which is expected to provide twice the performance of previous models, while the new version of the Blackwell series will be capable of producing more tokens per second.

Despite the announcements, Nvidia’s stock still closed lower yesterday as investors remain concerned about the sustainability of the company’s growth and the impact of a softer US economy on AI capital spending. Nvidia’s earnings results in the next few quarters will be closely watched by the market.

MARKET CONSENSUS: 70 BUYS, 6 HOLDS, AVERAGE TP USD172.67

Xiaomi (1810 HK)

China's Xiaomi reported a 48.8% rise in fourth-quarter revenue on Tuesday, boosted by strong EV and smartphone sales.

Revenue totaled RMB109.0B in 4Q24 vs. RMB104.4B estimated. Adjusted net profit rose 69.4% YoY to RMB8.32B, vs. RMB6.54B analysts estimated.

Meanwhile, Xiaomi also raised its FY2025 target for EV deliveries to 350,000, up from the 300,000 target set earlier.

This healthy trajectory is likely to be supportive for the company’s share price going forward.

MARKET CONSENSUS: 45 BUYS, 4 HOLDS, 1 SELL, AVERAGE TP HKD56.61

Tencent (700 HK)

Tech giant Tencent on Tuesday unveiled a suite of new AI tools capable of converting text and images into 3D visuals in the latest example of growing Chinese momentum in the field of generative AI.

Tencent released five open-source models based on its Hunyuan3D-2.0 technology, it announced in a statement, including the "turbo" versions which can generate 3D visuals within 30 seconds while maintaining high precision and quality.

Tencent's 3D initiative follows its February launch of Hunyuan Turbo S, a large language model that the company claims processes queries faster than DeepSeek's flagship R1 model.

MARKET CONSENSUS: 70 BUYS, 3 HOLDS, AVERAGE TP HKD539.99

XPeng (9868 HK)

XPeng’s US-listed ADRs fell on Tuesday after the company reported overall 4Q24 results that missed market expectations, with adjusted net loss at -RMB1.39B vs. –RMB1.30B expected, while revenue stood at RMB16.1B vs. RMB16.0B expected.

The company however promises that revenue for the current quarter will surprise to the upside, fuelled by new models under its own brand and Mona, its sub-brand for the mass market. XPeng now expects sales in the first quarter of 2025 of as much as RMB15.7B vs. the RMB14.6B expected by analysts.

How these expectations will materialise is key to watch going forward.

MARKET CONSENSUS: 31 BUYS, 4 HOLDS, 1 SELL, AVERAGE TP HKD97.12

CATL (300750 CH)

Chinese electric vehicle maker Nio announced its partnership with CATL to establish a battery swapping network for cars.

CATL will reportedly support Nio in developing the battery swapping network while the battery giant's Choco-Swap technical standards and network will be introduced to Firefly-branded newly developed models.

The two companies will also pursue capital cooperation, with CATL advancing an investment capped at RMB2.5B in Nio Power. The partnership is likely to provide some support to both companies’ share prices going forward.

MARKET CONSENSUS: 52 BUYS, 2 HOLDS, AVERAGE TP RMB346.98

Fraport (FRA GR)

Frankfurt Airport operator Fraport forecasted on Tuesday only a moderate increase in its 2025 core income and passenger traffic, after missing full-year core income estimates because regulatory costs were higher, and people traveled less towards the end of the year.

The company expects its EBITDA in 2025 to increase moderately and decided again not to propose an annual dividend due to continued high debt levels.

Looking ahead, the company forecasted 2025 passenger numbers in Frankfurt to be 64.0M vs. 61.6M in 2024.

Going forward, new aircraft bottlenecks and excessively high regulatory costs would likely put some downward pressure to the passenger traffic recovery.

MARKET CONSENSUS: 16 BUYS, 6 HOLDS, 4 SELLS, AVERAGE TP EUR64.14

Earnings Announcements

US Market

General Mills

European Market

Vonovia

HK - China Market

Tencent, Ping An Insurance, ANTA Sports, CK Infrastructure, Hong Kong & China Gas

Global Indices Changes (%)

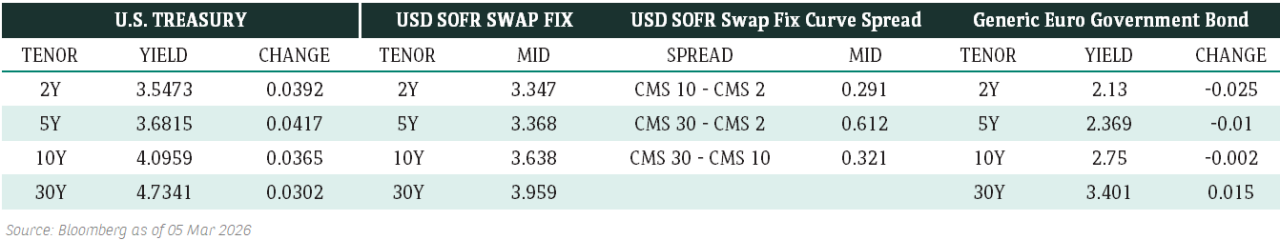

Fixed Income Market Updates

Periods of uncertainty often favour fixed-income investors. This sentiment is reflected in a recent Bloomberg survey, where over 77% of investors reported backing US Treasuries. We expect more volatility and geopolitical tension going forward. Fixed income will likely see more fund inflow as more investors seek defensiveness in this volatile market.

EUROPEAN BANK COCO (AT1)

European bank coco was stable. Bond prices were generally 0.125-0.25 points higher. We saw some multi-asset manager taking profit on equity and reallocate to coco bonds. Having said that, we believe coco valuation is not cheap and would suggest taking some profit. We expect coco bond may underperform if market sentiment further weakens.

ASIA INVESTMENT GRADE (IG)

Asia IG had a good day. We saw good demand on 5-10 years IG bonds due to recent weaker macroeconomic data. Investors were more interested in countries with less geopolitical risk such as Australia. In particular, Australian bank tier 2 paper outperformed and credit spread was 3-5 basis points tighter. We expect geopolitical tension will continue support demand on Australia IG bonds.

ASIA HIGH YIELD (HY)

Asia HY was somewhat weaker particularly in India HY where there was more selling. However, China HY held up quite well, especially some shorter dated high beta names such as China Vanke. Macau gaming weas also stable despite overall weaker market tone. We expect HY will stay weak on the back of investors’ concern on US economic slowdown.

Forex Market Updates

The dollar dipped slightly lower in a subdued market on Tuesday as investors eagerly awaited key announcements from major central banks.

USD

The US Dollar eased against the euro on Tuesday as Germany's parliament approved plans for a massive spending surge on Tuesday and as the Federal Reserve kicked off its March policy meeting that could offer clues to the path of U.S. interest rates. More broadly, currency market moves were largely muted on Tuesday as investors awaited policy announcements from major central banks, including from the Federal Reserve on Wednesday. While analysts expect the Fed to hold its monetary policy stance amid persistent inflation concerns, investors will be looking to new economic projections from Fed officials for evidence of how U.S. central bankers view the likely impact of Trump administration policies.

The Dollar Index could see a further near term retracement towards immediate support around 102.50 ahead of tonight's Fed interest rate decision.

GBP

Sterling hit a fresh 4-1/2-month high at $1.30 against the dollar on Tuesday on rising expectations the Bank of England will not cut interest rates later in the week, while the pound dropped against the euro, which was buoyed by Germany's spending plans. The BoE will likely stick to its mantra of only gradual moves ahead as it grapples with the fallout from U.S. President Donald Trump's trade war and mixed news on Britain's economy. Money markets priced in 54 bps of BoE easing moves in 2025 and an 89% chance of no change in rates this week.

Sterling is testing the psychological barrier of 1.3000 as the next target as the US dollar's weakening continues.

CAD

The Canadian dollar edged lower against its U.S. counterpart on Tuesday, pulling back from an earlier 12-day high, as equity markets fell and investors looked past hotter-than-expected Canadian inflation data. Canada's annual inflation rate rose to 2.6% in February, surpassing expectations for a rate of 2.2%, as a sales tax break that ended in the middle of the month pushed prices higher amid an already broad-based increase. Investors see a 38% chance of a Bank of Canada interest rate cut at its next policy decision on April 16, slightly less than before the data.

The Canadian dollar could attempt another near term push higher, with USDCAD dipping toward immediate resistance around 1.4230.

XAU

Gold prices rose 1% to hit a fresh record high on Tuesday, anchored above the $3,000/oz mark, as rising Middle East tensions and trade uncertainties due to U.S. President Donald Trump's tariff plans fueled demand for the safe-haven asset. The escalation in the Middle East tensions – as Israel launched military strikes on Hamas targets in Gaza, which threatens to undermine the ceasefire – has injected a new demand in gold. Bullion, which had a stellar run last year, has maintained its momentum this year as well, gaining over 15% year-to-date and hitting record highs 14 times.

The bullion looks to have found support at the psychological level of 3000 for now.