Macro Update:

Trump hints on “flexibility” on reciprocal tariffs

President Trump signalled at “flexibility” regarding the reciprocal tariffs taking effect on 2 April, while simultaneously showing reluctance to add more exceptions to these tariffs. China said it is prepared for economic shocks as Trump’s tariff decision looms. We believe Beijing still has a lot of room to roll out stimulus to meet its 5% growth target this year if the trade war with the US intensifies.

Main Upcoming Macro Indicators

Equity Market Updates

US EQUITIES

US stocks gained slightly on Friday, erasing earlier losses, after comments from President Trump provided hope that previously announced tariffs may not be as burdensome as feared.

EUROPE EQUITIES

European shares closed lower on Friday as geopolitical and trade policy uncertainties continue to dampen investor sentiment.

HK EQUITIES

Hong Kong stocks extended their slide on Friday as investors turned more risk averse prior to the weekend amid global uncertainties.

We reiterate our positive stance on HK/China equities in the medium term.

Meituan (3690 HK)

Meituan on Friday reported 4Q24 results that were roughly in line with market expectations. The company’s revenue stood at RMB88.49B vs. RMB87.93B expected, while adjusted EPS was at RMB1.63 vs. RMB1.58 expected.

The Chinese food-delivery giant reported a near tripling of revenue YoY, continuing its run of strong earnings amid fierce competition and a weaker local economy. It has been looking to expand overseas to bolster growth, with its international platform Keeta gaining ground in Hong Kong and Saudi Arabia.

Meituan on Friday also announced that it is developing its own AI model, called “LongCat”, to integrate AI into its work processes and consumer services, competing with rivals such as ByteDance and Alibaba. This will likely be supportive to the company’s share price going forward.

MARKET CONSENSUS: 59 BUYS, 3 HOLDS, 1 SELL, AVERAGE TP HKD207.62

BYD (1211 HK)

Shares of BYD fell on Friday after the EU Commission reportedly opened a preliminary probe investigating whether China provided unfair subsidies to support BYD’s new EV factory in Hungary. The news came after the Chinese government also delayed a decision on approving BYD’s investment in Mexico.

The Hungary plant is critical for BYD to avoid EU import tariffs on Chinese EVs (17.8% on BYD and as much as 38.1% for other Chinese EV makers) and is also crucial for BYD’s international expansion.

Further developments surrounding this topic will be closely watched by the market in the near term. Any hurdles to BYD’s European production may negatively impact the company’s performance going forward.

MARKET CONSENSUS: 37 BUYS, 2 HOLDS, 2 SELLS, AVERAGE TP HKD420.2

NIO (NIO US)

Shares of Chinese carmaker NIO fell on Friday after its 4Q24 net loss unexpectedly widened as higher costs outpaced sales growth amid intensifying competition in the electric vehicle (EV) market.

NIO’s 4Q24 revenue stood at RMB19.70B vs. RMB 20.13B expected, while its adjusted loss per share was at RMB3.17 vs. RMB2.59 expected.

In recent years, the company has tried to set itself apart from China’s crowded EV space by focusing on advancing battery technology. It relies on battery swapping stations rather than charging for better efficiency, but this comes at higher setup costs.

Looking ahead, a solid turnaround plan will likely be required for any upside to NIO’s share price.

MARKET CONSENSUS: 18 BUYS, 13 HOLDS, 2 SELLS, AVERAGE TP USD5.59

BP (BP/ LN)

British oil major BP announced on Friday that Apollo Funds will buy a non-controlling 25% stake in its pipelines business for around USD1B. The transaction is expected to close in 2Q25. BP Pipelines owns a 12% interest in the Trans-Anatolian gas pipeline, which carries natural gas from Azerbaijan across Turkey.

BP said that the proceeds from will contribute to the USD20B divestment program under its turnaround plan.

BP has recently come under pressure from investors to flip its trajectory after the company’s value plunged during CEO Murray Auchincloss’ first year in the role. He now says that the company will return to focusing on fossil fuels after it previously tried moving away from hydrocarbons.

The financial impact of BP’s turnaround plan will be closely watched by the market in the coming quarters.

MARKET CONSENSUS: 7 BUYS, 15 HOLDS, 4 SELLS, AVERAGE TP GBp481.75

AstraZeneca (AZN LN)

European pharmaceutical giant AstraZeneca announced on Friday that it will spend USD2.5B on a research and development hub in Beijing, as the drugmaker scrambles to revive business in its second-biggest market after scandals including the arrest of its China president last year.

The company’s Chief Executive Pascal Soriot was in Beijing and met with the city's mayor to reveal the investment, along with two licensing deals with Chinese companies as well as a joint venture with a third Chinese firm on vaccines, saying they all showed the AstraZeneca’s commitment to the world's second largest economy.

MARKET CONSENSUS: 25 BUYS, 6 HOLDS, 1 SELL, AVERAGE TP GBp14146.06

Earnings Announcements

US Market

-

European Market

-

HK - China Market

BYD, Sunny Optical, BYD Electronic, China Resources Land, Anhui Conch Cement

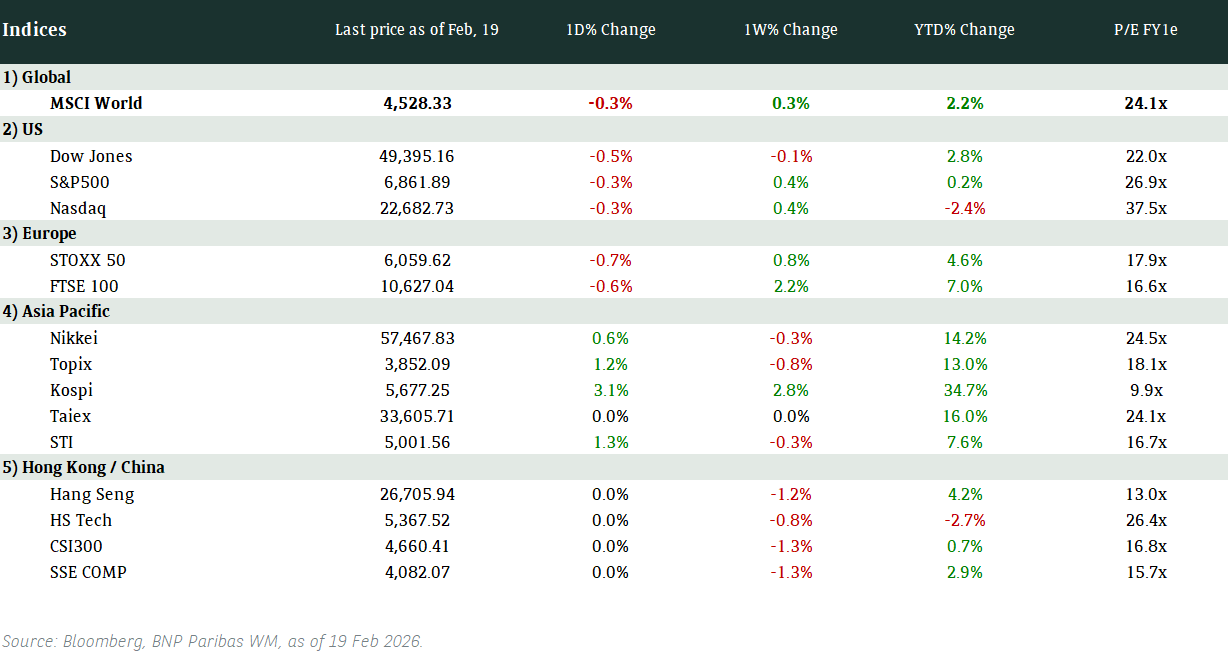

Global Indices Changes (%)

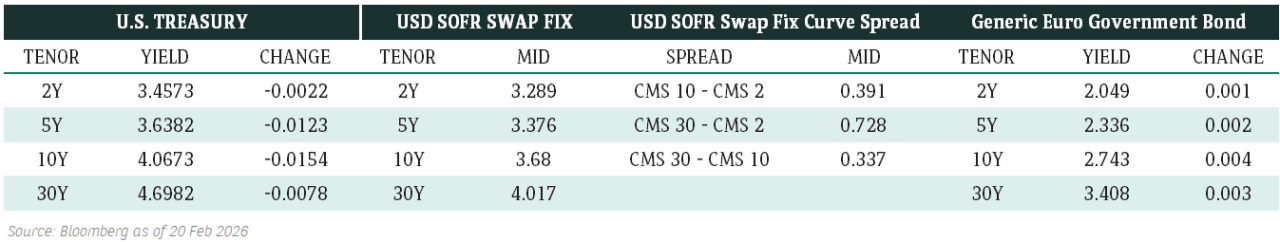

Fixed Income Market Updates

With the Fed cutting back on quantitative tightening last week, it is supporting the dovish sentiment and we would extend duration on bonds whenever US Treasury yields rebound. While we expect a risk-on mode this week, with weaker economic data, tariff and geopolitical uncertainty ahead, we would not miss out on stable fixed income returns. Geopolitical uncertainty spill-off includes Turkey-related bonds that have dropped since the arrest of Istanbul mayor Imamoglu which have erupted into protests.

EUROPEAN BANK COCO (AT1)

AT1 closed the day about 2-3c (cents) lower, with Deutsche Bank (DB) being the only focus. DB AT1 bonds closed 0.25pts (points) higher on average, with the infamous non-called 4.789s bonds about 0.5pts higher. Volumes away from DB were pretty low, with some buying from Asia in high quality paper and some selling from Europe in recent new deals. Over the week, AT1s closed about 30c higher. That is equivalent to about 10bps (basis points) tighter in spread, although that move is concentrated at the shorter end of the curve. Long calls were basically unchanged in spread. The week was dominated by shorter call buyers, from all regions, in all currencies.

ASIA INVESTMENT GRADE (IG)

In South East Asia IG space, spreads were unchanged but some signs of stability around, and most spreads were hovering around unchanged. DBS still continued to be active with PB (private banking) still hunting for the 2028. In regions such as Australia, it was rather a uneventful session but was trading firm. Better buying was seen in domestic recent T2s.

ASIA HIGH YIELD (HY)

Asia HY closed at day lows ,with Greenko new issue around 0.25pt below reoffer. Overall, Asia HY ended the week in a very dull fashion with generally light flows and without much indication in theme and direction. What has been interesting was Resorts World with real money putting cash to work as Vegas probe ended with a mere 11.5m USD fine. That cleared the runway on one of the main overhangs of a complex that was flagged as the widest among all of Asia's cross-over risk.

Forex Market Updates

The dollar index rose on Friday as the Fed signalled no immediate plans to lower interest rates.

USD

The US Dollar edged up on Friday, climbing back after bottoming out near five-month lows around 103.20 last week. The dollar, under pressure this year from worries over the hit to U.S. economic growth from the Trump administration's trade policies, found some respite last week as the Fed indicated it was in no rush to cut interest rates. Fed policymakers signaled two quarter-point cuts later this year. Chicago Fed President Goolsbee said persistent inflation, taxes on intermediate goods, and retaliation by other nations may all impact the Fed’s respond. The base case remains that tariff rates are likely to go up significantly and that this will drive a rebound in the dollar.

The dollar index looks to be range trading for now, fluctuating between 103.20 and 104.50.

GBP

The British Pound extended its decline against the dollar on Friday but was poised to end the week higher, a day after the BoE kept interest rates unchanged and raised concerns about a rise in global trade tensions. BoE governor Andrew Bailey highlighted the sudden lack of visibility about the outlook due largely to Trump's tariffs against global trading partners. He said even though Britain has so far escaped most of the tariff rhetoric from Trump, the next round of U.S. reciprocal tariffs in early April and their potential implications and spillover to the UK economy remain to be seen. Upcoming UK inflation and wage growth data are the key indicators to watch.

The pound could see some near-term weakness and be well supported above 1.2860 for the time being.

CNH

Chinese Yuan the slipped to a one-week low against the dollar on Friday and looked set for a losing week, reflecting a rebound in greenback in overseas markets. The PBoC appeared to dial back its support for yuan via its daily midpoint fixings, with a months-long gap between the official guidance and market projections narrowing. Policymakers are looking to prevent any fast yuan appreciation in a benign dollar environment. Traders said the fears of a possible escalation in trade disputes remained a drag on the yuan sentiment as more tariffs or other actions could be announced after the U.S. administration finishes its various reviews on China's trade. The yuan could be faced with near-term depreciation pressure with additional tariffs effective.

Renminbi could face near-term weakness, with USDCNH increasing towards the 7.2660 level.

XAU

Gold prices fell by 1% on Friday due to a stronger dollar and profit-taking, although lingering geopolitical and economic uncertainties, and Fed rate cut prospects kept bullion on track for a third consecutive weekly rise. The Fed indicated two 25bps cuts by the end of the year on Wednesday. Elsewhere, Israel abandoned a two-month ceasefire and launched an all-out air and ground campaign against the dominant Palestinian militant group. The fundamental of Gold is still strong as it traditionally viewed as a safe-haven investment during times of geopolitical and economic uncertainty, and typically thriving in a low-interest-rate environment.

The precious metal is eyeing the previous high of 3057.21 as the next target.