Macro Update:

Market rallied on targeted tariffs hope

Wall Street rallied on Monday as concerns over a full-blown trade war eases slightly. Reports suggest that US President Trump’s upcoming wave of tariffs may be more targeted than his previously threatened broad measures. This fuelled hopes that the new US tariffs set to take effect on 2nd April may be softer than initially anticipated. On the data front, flash S&P Global PMIs showed a sharper expansion in the services sector for March, albeit manufacturing slipped back into contraction territory, with input prices rising sharply due to tariff impacts. We continue to stay positive on global equities, particularly as recession is not our base case.

Main Upcoming Macro Indicators

Equity Market Updates

US EQUITIES

US stocks rose sharply to end at its highest in over two weeks on Monday following signs that the Trump administration might take a more measured approach on tariffs against US trading partners.

EUROPE EQUITIES

European shares were largely flat on Monday as investors remained cautious amid global uncertainties, even as hopes grew that the US may opt for a softer approach with regards to its tariffs.

HK EQUITIES

Hong Kong stocks ended higher on Monday, rebounding from a muted morning session as technology firms led the rally.

We remain positive on HK/China equities in the medium term.

BYD (1211 HK)

BYD on Monday announced strong beats in its 2024 results, with revenue at RMB777.1B vs. RMB766.3B expected, while adjusted EPS was at RMB13.84 vs. RMB13.49 expected. The company’s revenue last year surpassed the USD100B mark for the first time, crucially beating Tesla’s at USD97.7B, boosted by its continued expansion overseas and solid product development.

Looking ahead, BYD forecasts that it can sell 5M to 6M vehicles in 2025, with sales in the first two months of the year already up 93% YoY. This provides further evidence of the Chinese EV giant’s persistent momentum, which is likely to be supportive for its share price going forward.

MARKET CONSENSUS: 36 BUYS, 3 HOLDS, 2 SELLS, AVERAGE TP HKD426.61

Alibaba (9988 HK)

Alibaba-affiliate Ant Group reportedly developed techniques for training AI models using Chinese-made semiconductors on Monday, which could cut costs by around 20%.

The company used domestic chips, including ones from Alibaba and Huawei, to train models using the "Mixture of Experts" machine learning approach, achieving similar results to those of Nvidia's chips.

Ant's models could mark another step forward for Chinese AI development by slashing the cost of inferencing or supporting AI services, while also reducing the country's reliance on US-made chips.

This is likely to be supportive for the Chinese technology sector going forward.

MARKET CONSENSUS: 42 BUYS, 2 HOLDS, AVERAGE TP HKD163.34

Baidu (9888 HK)

Baidu on Monday announced that "Miaoda", the first "conversational" application development platform in mainland China, has officially gone live. Users can simply describe their needs in natural language to automatically generate complete functional code.

The platform also integrates various third-party tools and services, enabling connections with diverse data sources and providing end-to-end support from requirement to deployment. This, along with further developments in its AI technology, are likely to provide support for Baidu's share price.

MARKET CONSENSUS: 25 BUYS, 9 HOLDS, AVERAGE TP HKD105.67

Warner Bros. Discovery (WBD US)

Warner Bros. Discovery is taking a minority stake in Dubai-based OSN Streaming in a bid to capture a slice of the fast-growing Middle Eastern entertainment market.

Warner Bros. will pay USD57M for about a third of OSN Streaming. OSN provides global and local TV series and films, and the unit Warner Bros. is investing in offers streaming services.

The deal will see both firms invest in locally-produced content as they seek to court regional viewers, as well as explore synergies.

MARKET CONSENSUS: 15 BUYS, 13 HOLDS, 1 SELL, AVERAGE TP USD13.73

Ford Motor Company (F US)

The US National Highway Traffic Safety Administration (NHTSA) has reportedly initiated a preliminary investigation into nearly 1.3M Ford F-150 trucks on Monday after it had received more than 100 consumer complaints over unexpected gear downshifts that are accompanied by a temporary rear wheel lock up.

The NHTSA’s preliminary evaluation, which covers Ford F-150 models from 2015 to 2017, comes after prior investigations on other Ford vehicles such as the Ford Flex over claims of rearview camera failures. This may negatively impact the US carmaker’s share price in the short term.

MARKET CONSENSUS: 6 BUYS, 14 HOLDS, 7 SELLS, AVERAGE TP USD10.14

Earnings Announcements

US Market

-

European Market

Kingfisher, TAG Immobilien, Terna

HK - China Market

Wuxi Biologics, China Telecom, Nongfu Spring, Kuaishou, Haidilao

Global Indices Changes (%)

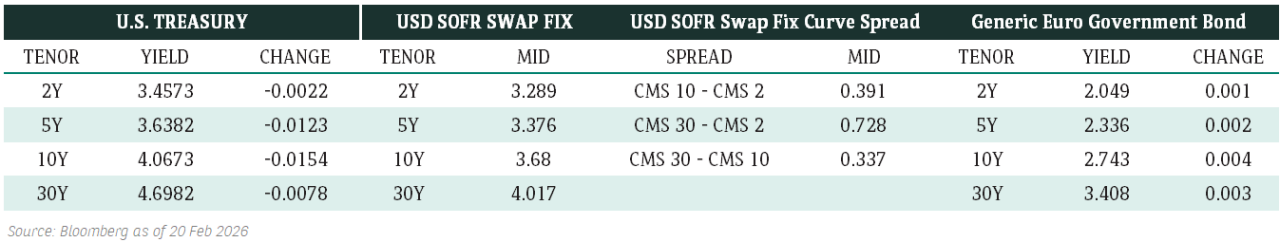

Fixed Income Market Updates

The market is awaiting the implementation of US tariffs on 2nd April. It remains uncertain whether the Trump administration will adopt a narrower approach to mitigate concerns about a US recession that are currently being priced in. Undoubtedly, investors must brace for increased market volatility. Fixed income is expected to continue attracting fund flows as investors seek safe-haven assets.

EUROPEAN BANK COCO (AT1)

The AT1 market opened slightly lower, with balanced flows from Asian investors amid weakness in Treasuries. As no indication of primary supply this week, the market shifted the focus to secondary flows. Recently, Deutsche Bank opted not call its 4.897% perpetual bond, which reset to an 8.4% coupon and rallied by 0.5 points, driven by hedge funds and institutional buying. This rally in response to a negative outcome suggests underweight positioning in AT1 assets amid uncertain tariff policies.

ASIA INVESTMENT GRADE (IG)

It was a quiet Monday morning for Asia IG bonds, skewed towards better offers ahead of a busy week for primary supply. Spreads were mixed among Chinese state-owned enterprises and financial names. ChemChina’s short-dated bonds attracted some buying interest, while BOC Aviation and AVIC Industry-Finance Holdings faced selling pressure. In Korea, flows on the Hyundai Motor curve were balanced, with light trading volume remaining stable after the announcement of a new five-tranche deal. LG Energy Solution experienced slight selling ahead of expected new issuance.

ASIA HIGH YIELD (HY)

In the China HY market, property names remained largely unchanged. New World Development saw a dip due to profit-taking from institutional accounts. The Macau gaming sector exhibited low trading activity, with Studio City receiving mixed flows, while Melco Resorts and Wynn Macau leaned towards selling. Outside China, Indian HY fell by 0.25 points following an overhang from Greenko Energy’s new issuance. Indonesian HY underperformed again due to a weaker onshore equity market, with spreads widening by 5 to 10 basis points back to last week’s lows.

Forex Market Updates

The U.S. Dollar rose to the highest level in three weeks, fuelled by investor optimism that President Trump will adopt a more accommodating stance on tariffs.

USD

The US Dollar jumped to multi-week highs against the euro and yen on Monday after PMI index showed U.S. business activity picked up in March and reports that Trump will be flexible with upcoming tariffs. Trump administration was likely to exclude a set of sector-specific tariffs while applying reciprocal levies on April 2. In addition, Trump said he will soon announce tariffs on automobiles, aluminum and pharmaceuticals. Given that the U.S.'s tariff plans are likely to touch off another round of retaliatory strikes from major trading partners, which will damage the U.S. and global economies, and trigger more turbulence in currency markets, traders are avoiding big directional positions. Volatility levels look likely to remain elevated.

The dollar index could increase towards the 105.20 level in the short term as the deadline of U.S. reciprocal tariffs approaches.

GBP

Sterling climbed on Monday ahead of British finance minister Rachel Reeves' spring budget update later this week and as data earlier in the day showed that business activity in the UK's huge services sector picked up this month. Britain's Office for Budget Responsibility is expected to announce a sharp downgrade to the UK's economic growth this year which, along with higher borrowing costs, is likely to force Reeves to cut her plans for spending increases in the coming years. The BoE is watching closely for the impact of the increase in employers' social security contributions, while markets are also awaiting clarity on U.S. President Donald Trump's reciprocal tariffs on April 2.

The Sterling looks to be range trading for now, fluctuating between 1.2895 and 1.2970.

CNH

The Chinese Yuan hit a two-week low against the dollar on Monday on growing investor concerns about trade disputes between U.S. and China as the deadline for Trump's reciprocal tariffs approaches. However, the yuan has been mostly stable compared to USD recently. Analysts said President Xi's plan to make the yuan the cornerstone of China's financial strategy has helped limit its downside, while 20% U.S. tariffs have capped its upside. The priority of monetary policy has shifted to financial stability and exchange rate stability as uncertainties from external environment rose. Separately, China sought to reassure foreign corporate chiefs of the country's business potential and Premier Li Qiang urged countries to open their markets to combat.

The USDCNH could attempt another near-term push higher towards immediate resistance around 7.2760.

XAU

Gold prices dropped on Monday as the dollar touched an over two-week high, while investors took stock of Trump's more cautious stance on tariffs against trading partners. Gold, traditionally seen as a hedge against geopolitical and economic uncertainties and often thriving in a low-interest-rate environment, has hit 16 record highs this year and reached an all-time peak of $3057.21 last week. Now the market is consolidating these gains. Meanwhile, U.S. and Russian officials held talks in Saudi Arabia aimed at making progress towards a broad ceasefire in Ukraine. Analysts said if the talks in Saudi Arabia do materialize and there is a dip in gold based off that, the gold will be bought up quickly.

The precious metal could see some consolidation between 3003 and 3033 moving forward.