Macro Update:

Uncertainty remains over Trump's tariffs

Wall Street struggled for traction as investors weighed the potential impact of upcoming tariffs and economic uncertainties. Monday’s rally, fuelled by optimism over more targeted tariff measures, somewhat faded after US President Trump suggested some countries might receive exemptions from reciprocal duties set to take effect on April 2, while also hinting at fresh tariffs on pharmaceuticals and autos. Adding to market concerns, consumer confidence fell to a four-year low, with future expectations sinking to their weakest level in 12 years. Meanwhile, German business morale hits a 8-month high, on the back of likely increase in fiscal spending. Overall, slower growth can be expected in the US, but recession is still not our base case. Crucially, we still see the Fed cutting rates by twice in 2025, 25bps each in June and December.

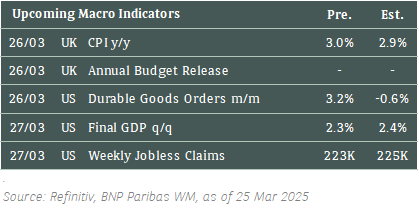

Main Upcoming Macro Indicators

Equity Market Updates

US EQUITIES

US stocks ended higher on Tuesday as investors assessed the country’s latest consumer sentiment data and bet on a more flexible trade policy stance from the Trump administration next week.

EUROPE EQUITIES

Shares in Europe also ended higher on Tuesday as more optimism surrounding US trade policy continued to boost sentiment.

Within Europe, we see value in UK stocks, viewing its defensive merits remaining favourable amid global uncertainty.

HK EQUITIES

Hong Kong stocks weakened on Tuesday with Xiaomi’s planned share sale triggering concerns about stretched valuations across the market.

Meta (META US)

Meta reportedly plans to introduce a monthly fee for ad-free Facebook and Instagram accounts on mobile devices for its European users in the coming months.

The proposed SNA (subscription no ads) plan would give users the option to choose between using Facebook and Instagram for free with personalized ads or paying for the ad-free version, roughly EUR10 for Facebook and Instagram accounts for desktop, with about EUR6 for every additional linked account.

The price for mobile devices would be roughly EUR13 due to the commissions charged by Apple's and Google's app stores for in-app payments.

Meta is reportedly considering these paid options after the European Union privacy regulators limited its ability to display personalized ads without previously getting user consent.

MARKET CONSENSUS: 71 BUYS, 6 HOLDS, 3 SELLS, AVERAGE TP USD765.51

Merck (MRK US)

Merck announced on Tuesday that it will pay almost USD2B for the rights to Jiangsu Hengrui Pharmaceutical’s experimental heart drug, marking the US drugmaker’s second recent foray into China for a novel medicine.

Under the agreement, Merck will pay USD200M up front to develop and commercialise Hengrui Pharma’s pill, now in mid-stage human trials. The company has also promised another USD1.77B tied to regulatory and commercial goals, along with sales royalties.

Called HRS-5346, Hengrui’s new heart medicine blocks lipoprotein, a blood protein that, like some forms of cholesterol, is liked to cardiovascular disease.

How this new agreement will translate into Merck’s top- and bottom-line will be closely watched by the market going forward.

MARKET CONSENSUS: 22 BUYS, 8 HOLDS, AVERAGE TP USD111.13

Shell (SHEL LN)

Shares of Shell traded higher on Tuesday after it announced that it would boost investor returns through the end of this decade and strengthen its global leading position as an LNG trader.

Shell specifically announced that it intends to increase shareholder distributions from the current 30-40% to 40-50% of cash flow from operations, while maintaining progressive dividends of 4% per year. The company also stated that it plans to elevate its structural cost reduction target from USD2B – USD3B by the end of 2025 to a cumulative USD5B – USD7B by the end of 2028.

These announcements will likely add support to Shell’s share price going forward.

MARKET CONSENSUS: 21 BUYS, 5 HOLDS, AVERAGE TP GBp3170.22

Baloise (BALN SW)

Swiss insurer Baloise’s shares rose on Tuesday after it reported that its profit and insurance revenue for FY2024 increased YoY.

Profit attributable to shareholders for the 2024 was CHF384.8M vs. CHD239.6M earlier. EPS stood at CHF8.47 vs. CHF5.29 a year ago.

Meanwhile, the board plans to conduct a share buyback totaling CHF100M, which is supportive to its share price.

MARKET CONSENSUS: 1 BUY, 7 HOLDS, 4 SELLS, AVERAGE TP CHF167.06

AT&T (T US)

US telecommunications company AT&T is reportedly in talks to acquire Lumen Technologies’ consumer fiber operations, valuing the unit at more than USD5.5B, although terms of the deal are yet to be finalised. At a recent conference, Lumen CFO Chris Stansbury told investors that a sale could aid Lumen’s efforts to reduce its debt burden.

Further developments surrounding this transaction will be closely watched by the market.

The news about this deal came amid broader consolidation in the fiber space, with Verizon also proposing an acquisition of Frontier Communications and BCE.

MARKET CONSENSUS: 23 BUYS, 9 HOLDS, 1 SELL, AVERAGE TP USD27

Earnings Announcements

US Market

-

European Market

Aroundtown

HK - China Market

China Southern Airlines, Bank of China, China Life Insurance, Sensetime

Global Indices Changes (%)

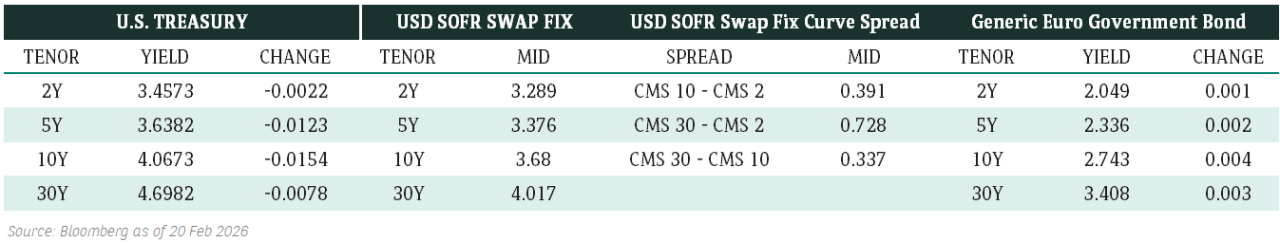

Fixed Income Market Updates

We saw some correction in IG bonds recently as US Treasury yield climbed higher. The market was somewhat relieved after Trump hinted some countries could receive tariff break from reciprocal tariffs. However, we believe geopolitical tension will stay and tend to see this correction as a good buying opportunity.

EUROPEAN BANK COCO (AT1)

European bank coco was quiet. Overall coco demand was still strong, because more investors are switching from equity to coco to stay defensive on the back of volatile market environment. We remain cautious on coco’s expensive valuation and suggest taking some profit after recent rally.

ASIA INVESTMENT GRADE (IG)

It was a stable session for Asia IG. Credit spread was 1-2 basis points wider but we saw particularly weaker sentiment in Korea IG where new bond issuance did not perform. China IG traded largely unchanged but higher beta names like New World Development was 0.5-1 points lower. Overall, we expect demand Asia IG bonds will remain solid on the back of rising geopolitical tension.

ASIA HIGH YIELD (HY)

Asia HY had a weak day. Overall tone was fragile as market sentiment has been weak due to ever-changing headlines around tariff. We saw more profit taking from hedge fund investors and muted demand from institutional investors. China HY was largely unchanged. Indonesian HY was also weak due to a lack of buyers. We remain cautious on HY bonds and expect to see some more weakness.

Forex Market Updates

The US Dollar dipped on Tuesday as impending tariffs weighed on market sentiment.

USD

The US Dollar retreated from three-week highs against a basket of other major currencies on Tuesday amid lingering tariff uncertainty. Following US President Trump’s remarks on Monday that not all of his threatened levies would be imposed on 2nd April and that some countries might get breaks, analysts said that the view that tariffs would be unambiguously bullish for the USD “has been challenged by the price action in 2025”. On the data front, US Consumer Confidence dropped for a fourth straight month in March, with households the most pessimistic about the future in 12 years, reflecting souring confidence in the outlook for US growth due to Trump’s stop-start tariff campaigns. Elsewhere, Fed official Kugler said that progress on bringing inflation back to the central bank’s 2% target has slowed since last summer and the uptick in goods inflation in the latest data is “unhelpful”.

The Dollar Index could see some near term strength towards 104.95 ahead of the deadline for US reciprocal tariffs.

AUD

The Australian Dollar strengthened yesterday, but gains were capped after Australia’s government launched fresh tax cuts on Tuesday and announced other cost-of-living relief in a major push to win back disgruntled voters, tipping the budget back into the red. Treasurer Chalmers projected a robust Australian economy, calling the country’s recent run of strong growth numbers “a story of Australian exceptionalism in the context of global growth headwinds”. The government also expects the unemployment rate Down Under to peak lower at 4.25%, although the increased spending and strong labour market mean inflation is now expected to pop up again to 3% over the next fiscal year before steadying at 2.5%, which reinforces the RBA’s message after last month’s rate cut that further policy easing is not guaranteed.

Ongoing trade war concerns are likely to keep a lid on Aussie gains moving forward, with stiff resistance expected around 0.6400.

EUR

The Euro fell for the fifth consecutive day despite data showing that business morale in Germany rose in March as companies expect a recovery after two years of contraction in Europe’s largest economy. An analyst from Germany’s Ifo Institute said that “the German economy breathes a sigh of relief”, with businesses hoping for greater stability and more investments moving forward after Germany’s parliament approved plans for a massive spending surge last week, throwing off decades of fiscal conservatism. However, other analysts cautioned that while the prospect of fiscal stimulus is boosting sentiment in Germany and outweighing concerns about US tariffs for now, further progress down the line can only happen if there are real structural reforms over a longer period of time.

The common currency should remain well-supported above 1.0625 moving forward.

XAU

Gold prices rose modestly on Tuesday, supported by safe haven demand amid uncertainty over US President Trump’s tariff plans for next week that could potentially drive up inflation. With the Financial Times reporting that Trump is considering a two-step tariff regime next week, recent projections from Fed officials revealed stagflation concerns at the US central bank, with US growth expected to slow, unemployment to rise slightly more than expected and inflation to accelerate in the face of existing and widening tariffs. Analysts say that such concerns around the world’s largest economy and the resulting implications for the global growth outlook, along with ongoing geopolitical tensions in the Middle East, are likely to keep the precious metal well-supported thanks to safe haven demand.

Bullion is likely to see some near term consolidation between 3000 and 3033, with a bias to the upside.