Macro Update:

Sentiment dips on growing trade concerns

Markets slipped as fears of escalating trade tensions weighed on investors' sentiment. Trump administration announced a 25% tariff on "all cars not made in the US," set to take effect on 2nd April 2025, and also warned of imposing "far larger" tariffs on the EU and Canada if they coordinated efforts to counter US trade measures. There are growing concerns that these tariffs could hurt the US economy and drive inflation higher. On the data front, Q4 GDP growth was revised slightly higher to 2.4% from 2.3%, while core PCE prices increased slightly less than previously estimated. The PCE inflation data tomorrow will be keenly watched, which should give clues on the Fed's monetary path for the year. We continue to see 2 cuts of 25bps, in June and December of 2025.

Main Upcoming Macro Indicators

Equity Market Updates

US EQUITIES

US stocks continue to trade lower on Thursday as investors digest President Trump’s latest tariff announcements.

EUROPE EQUITIES

European shares also slipped on Thursday, dragged by auto stocks after US tariffs stoked fears of a slowdown in the sector.

HK EQUITIES

Hong Kong stocks traded higher on Thursday as sentiment strengthened after Trump suggested that he may cut tariffs on China to facilitate the sale of TikTok by its owner, ByteDance.

We remain positive on HK/China equities in the medium term.

NIO (NIO US)

US-listed shares of Chinese carmaker NIO fell on Thursday after it announced a proposed offshore equity offering of up to 118.8M Class A ordinary shares. The company stated that it would utilise the net proceeds to strengthen its balance sheet, launch new products, and promote research and development for smart electric vehicle technology.

NIO also said that the shares would not be registered under US securities regulations or in locations like Hong Kong or Singapore.

This action followed the company’s recent set of underwhelming 4Q24 results, which revealed a deeper net loss than expected. Worries surrounding US auto tariffs also contributed to dampening investor sentiment on the stock.

Looking ahead, a major turnaround initiative will likely be needed to revive momentum on NIO’s share price.

MARKET CONSENSUS: 17 BUYS, 14 HOLDS, 2 SELLS, AVERAGE TP USD5.5

Lululemon (LULU US)

Shares of Lululemon fell in aftermarket hours on Thursday after the company delivered a disappointing outlook for this year, citing concerns surrounding consumer spending in the US.

The company expects fiscal year sales to be in the range of USD11.15B to USD11.30B, lower than Wall Street estimates. It is however working to lift demand by expanding product assortment and entering new categories. How much this initiative can help top- and bottom-line will be key to watch going forward.

Despite its downbeat outlook, Lululemon announced solid results for FY4Q25, with revenue at USD3.61B vs. USD3.57B expected, while adjusted EPS stood at USD6.14 vs. USD5.85 expected.

MARKET CONSENSUS: 22 BUYS, 12 HOLDS, 5 SELLS, AVERAGE TP USD402.37

H&M (HMB SS)

Swedish fast-fashion retailer H&M said on Thursday that its profit for the first quarter of fiscal 2025 dropped, while net sales grew YoY.

Profit attributable to shareholders for the three months ended 28 February was SEK590M vs. SEK1.24B a year ago. EPS stood at SEK0.37 vs. SEK0.77 earlier.

H&M said its sales were up just 1% in March after a weaker-than-expected first quarter, in a sign of a slow start to its spring and summer season.

H&M has ramped up marketing spend in a bid to boost its brand but the returns on that investment have been slow to appear, with weaker sales growth and lower profitability.

The hit to profitability is likely put pressure to the company’s share price going forward.

MARKET CONSENSUS: 8 BUYS, 14 HOLDS, 10 SELLS, AVERAGE TP SEK152.13

Hon Hai Precision Industry Co. (2317 TT)

Taiwan’s Foxconn is set to hold a seminar in Japan on 9 April to lay out its strategy on EVs, as it courts more Japanese automakers after winning a deal from Mitsubishi Motors.

The outsourcing deal heralds a major shift in Japan's sprawling auto industry that is a key pillar of the economy, but must grapple with growing competition from nimble Chinese EV makers such as BYD.

Investors will closely watch this tangible order, as it signifies recognition of Foxconn’s manufacturing capabilities in the highly experience-driven automotive industry.

MARKET CONSENSUS: 22 BUYS, 3 HOLDS, AVERAGE TP TWD224.71

SK Hynix (000660 KS)

South Korea's SK Hynix, the world's second-largest memory chipmaker, said on Thursday that some customers have brought forward orders in preparation for new US tariffs on semiconductors.

Meanwhile, in January, SK Hynix had said its shipments of DRAM and NAND flash memory chips would decline by between 10% and 20% in 1Q25 from the previous quarter.

The company also said they saw DeepSeek's emergence as ultimately beneficial to SK Hynix in medium-to-long-term especially for their AI memory chips.

How the US tariffs will alter the outlook of the company will be key to watch going forward.

MARKET CONSENSUS: 39 BUYS, 2 HOLDS, AVERAGE TP KRW281679.63

Earnings Announcements

US Market

-

European Market

Buzzi

HK - China Market

China Longyuan Power, China Construction Bank, CSPC Pharmaceutical, Industrial & Commercial Bank

Global Indices Changes (%)

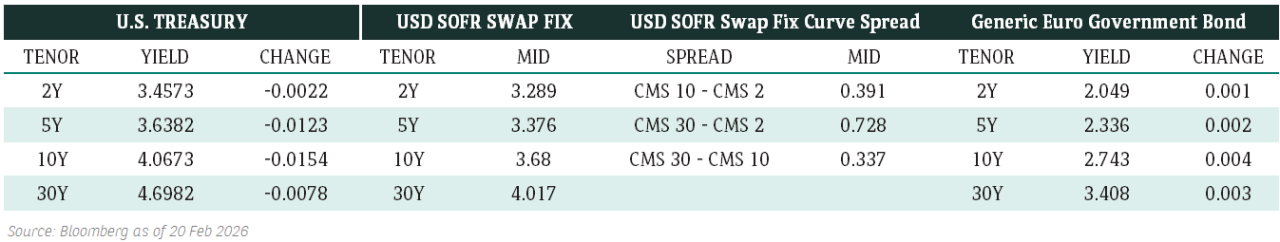

Fixed Income Market Updates

Markets traded mostly sideways as investors prepared for a bout of PTSD (Post Tariff Shaky Debt) this coming 2nd April 2025. Over in Hong Kong, S&P issued a statement that while Hong Kong banks face further pressure on profit and asset profitability from exposure to the Commercial Real Estate sector, most banks should be able to manage higher Non-Performing Loans with a number of defenses such as solid existing profitability and strong capital levels.

EUROPEAN BANK COCO (AT1)

Market for European Bank AT1 moved lower in general in response to tariffs but there was no panic selling. Investors were trimming risk positions. Prices were around 0.125-0.5point lower overall. The recently issued EUR-denominated AT1 bond by Deutsche Bank was the first to be hit with the bonds down more initially but recovered to trade more in line with market. USD-denominated AT1 bonds traded lower as well. .

ASIA INVESTMENT GRADE (IG)

In South East Asia, newly-issued Petronas traded softer initally before London stepped in to buy and closed around 3-5bps tighter. Flows were skewed towards hedge funds selling while asset managers were topping up allocations. Khazanah Capital saw its curve widened 3-4bps post Petronas' new issue with investors rotating out of Khazanah Capital into Petronas. Bloomberg reported that China had told State-Owned Enterprises to hold off on any new collaboration with businesses linked to Li Ka-Shing and his family, which led CK Hutchison and Hutchison Ports to trade 10-20bps wider and FWD traded 1.5-2points lower.

ASIA HIGH YIELD (HY)

In China HY space, Greetown China traded 0.25-0.5point lower after the company revealed that Chairman had stepped down while its equity was down 11%. On the industrials side, prices were broadly unchanged to slightly lower with some profit-taking from investors. Away from China, Mongolian Mining's 8.44% 5-year non-call 3-year newly issued bond traded 1point lower at market opened and went even lower before bottom fishers came in.

Forex Market Updates

The US Dollar weakened on Thursday as Trump announced a 25% car tariff, while the Canadian Dollar and Mexican Peso fell amid trade uncertainty and retaliation fears.

USD

The US Dollar weakened on Thursday against a basket of other major currencies, as traders awaited President Trump's announcement on tariffs next week. The Canadian Dollar and Mexican Peso also fell after Trump unveiled a 25% tariff on imported cars and light trucks, set to take effect on April 3. While market sentiment briefly improved amid expectations of flexibility in tariff negotiations, concerns persist about potential retaliation from major trade partners. This new levy, affecting imports from countries like Canada and Mexico, could lead to higher car prices in the US and add further pressure to the already strained global trade environment.

The Dollar Index could see some near term strength towards 104.95 ahead of the deadline for US reciprocal tariffs.

EUR

The Euro strengthened on Thursday after six straight sessions of losses, finding support near a key technical level as buyers returned. However, downside risks remain, with concerns over US auto sector tariffs and the dollar’s resilience amid rising inflation expectations. The euro has faced pressure recently due to diverging monetary policy expectations, as the ECB considers rate cuts while the Fed remains cautious. Markets are now focused on upcoming US PCE data on Friday, which could influence rate expectations and impact the euro’s recovery. A weaker dollar would support further gains, while stronger US data could renew selling pressure on the euro.

The common currency could be range trading between 1.0620 and 1.0954 for now.

CNH

The Chinese Yuan strengthened on Thursday as the PBoC set a stronger daily fix, while signs of tariff flexibility from President Trump offered mild relief. However, the broader outlook remained cautious amid escalating trade tensions and weak industrial profits. The offshore yuan rebounded after a seven-day decline, but uncertainty lingers ahead of Trump’s tariff deadline on April 2. Analysts expect further policy support as Beijing seeks to stabilize growth, with officials emphasizing domestic demand expansion and financial market stability. Meanwhile, concerns over rising debt and persistent deflationary pressures highlight ongoing economic challenges despite government reassurances of a steady recovery.

USDCNH continues to point upward, and looks to test next resistance level of 7.3070 for the time being.

XAU

Gold reached a record high on Thursday, rising to $3,056.60 an ounce, as global trade tensions and a slump in equity markets followed President Trump's announcement of new auto tariffs. Spot gold briefly touched $3,059.75, marking its 17th record high this year. Safe haven demand surged amid uncertainty surrounding Trump's tariff plans, with investors seeking refuge in the precious metal. Strong central bank demand also supported gold's rally. As market uncertainty continues, gold remains a key hedge against economic and political instability, thriving in a low interest rate environment.

The precious metal looks to be well supported above psychological level of 2890 for now.