Macro Update:

China and Canada retaliate immediately against Trump’s tariffs

Financial markets were risk-off amid escalating risk of a global trade war after China and Canada retaliated immediately against the US tariffs and Mexico said it will impose retaliatory tariffs with details on Sunday. US Treasury Secretary Bessent’s comments that the President’s policy is not about Wall Street but about Main Street also added to negative market sentiment, implying the Trump administration will not bow to market pressure. The recent softer US economic data, coupled with the growing economic growth risk with the reality of tariffs have led to the change of market expectations to almost three Fed rate cuts this year. Our forecast for two cuts in 2025 remains unchanged.

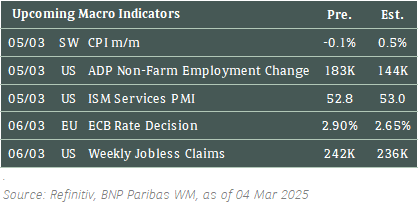

Main Upcoming Macro Indicators

Equity Market Updates

US EQUITIES

US equities continued to trade lower on Tuesday, led by the technology sector, as trade tensions escalated following President Donald Trump's new tariffs on Canada, Mexico and China.

EUROPE EQUITIES

European shares retreated from record highs on Tuesday, joining a global sell-off on the back of investor concerns surrounding US trade policy.

HK EQUITIES

Hong Kong stocks slipped on Tuesday, as new US tariffs on Chinese imports were set to take effect, while investors awaited news from the annual parliamentary sessions.

We remain positive on Hong Kong / China equities in the medium term.

Target (TGT US)

Shares of Target fell on Tuesday after the company announced a mixed set of 4Q24 results and guidance. On one hand, its adjusted EPS in 4Q24 topped analyst expectations at USD2.41 vs. USD2.26 expected, and annual forecasts were viewed as “better than feared” by the market.

On the other hand, however, Target said that February sales were “soft” and warned that 1Q25 would see “meaningful year-over-year profit pressure” due to “ongoing consumer uncertainty and a small decline in February net sales”, along with tariff uncertainty and the expected timing of certain costs within the fiscal year.

On the back of these challenges, whether Target will eventually decide to adjust its full year guidance downward will be key to watch.

MARKET CONSENSUS: 19 BUYS, 20 HOLDS, 1 SELL, AVERAGE TP USD143.47

Illumina (ILMN US)

China announced a ban on Tuesday on imports of genetic sequencers from US medical equipment maker Illumina, just minutes after Trump's additional 10% tariff on Chinese goods took effect.

The ban is part of a series of measures China announced in response to the extra US tariffs and comes after Beijing put Illumina on its "unreliable entity" list in February.

China accounts for about 7% of Illumina's sales. China's commerce ministry said in a statement that Illumina had suspended normal transactions with Chinese enterprises and taken discriminatory measures against Chinese enterprises. The ban takes effect from March 4.

How the company will navigate the tariff barriers will be key in determining its share price trajectory.

MARKET CONSENSUS: 13 BUYS, 14 HOLDS, 2 SELLS, AVERAGE TP USD136.81

Apple (AAPL US)

Apple on Tuesday announced an upgraded iPad Air powered by the M3 chip, promising significantly improved performance. The update represents a faster turnaround than usual, coming only 10 months after the last version as the company looks to sustain tablet growth.

The success of this new iPad Air will likely depend on whether users will be willing to spend for an upgrade just shortly after its previous version was released.

According to the company, the new model is nearly twice as fast as its predecessor with the M1 chip and offers enhanced graphics capabilities, while also being able to run Apple’s AI features.

MARKET CONSENSUS: 35 BUYS, 16 HOLDS, 6 SELLS, AVERAGE TP USD253.46

Continental (CON GR)

German car parts and tire maker Continental reported 2024 earnings slightly below expectations on Tuesday despite a tough market in its core region of Europe.

For 2025, Continental said it expected sales of between EUR38B and EUR41B, and an adjusted EBIT margin of between 6.5% and 7.5%.

Continental, which cut its guidance twice last year, plans to carve out its automotive division and said it would announce new short and mid-term targets at a capital markets day this summer.

MARKET CONSENSUS: 13 BUYS, 9 HOLDS, 2 SELLS, AVERAGE TP EUR78.53

Stellantis (STLAP FP)

Automaker Stellantis said on Tuesday it welcomed the European Commission's announcement that it would propose a softening of the bloc's carbon emission targets for cars. The Commission yielded to pressure from European automakers by announcing that it would give them three years, rather than only one, to meet new CO2 emission targets for their cars and vans.

Stellantis also said the extended compliance period on carbon emission targets was a "meaningful step in the right direction" to preserve the auto industry's competitiveness, while remaining committed to targets and electrification.

MARKET CONSENSUS: 13 BUYS, 18 HOLDS, 4 SELLS, AVERAGE TP EUR13.74

Seven & i (3382 JP)

Shares of Seven & i tumbled as much as 12% on Tuesday, following a report the 7-Eleven owner plans to reject a USD47B takeover offer from Canada's Alimentation Couche-Tard, although the Japanese company said it was still considering the offer.

In a statement, a Seven & i spokesperson said it "remains committed to exploring all opportunities to unlock value for shareholders and continues to assess a full range of strategic alternatives, including the proposal" from Couche-Tard.

Further developments surrounding this deal may significantly impct the company's share price going forward..

MARKET CONSENSUS: 4 BUYS, 11 HOLDS, AVERAGE TP JPY2562.31

Earnings Announcements

US Market

Marvell Technology, Zscaler, Veeva Systems

European Market

Adidas, Evonik Industries, SCOR, Bayer

HK - China Market

Uni-President China Holdings

Global Indices Changes (%)

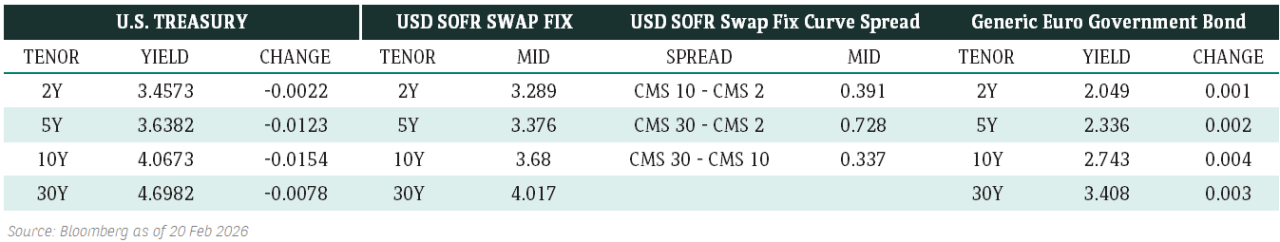

Fixed Income Market Updates

With lower coupon resets for new issuances and significant rates rally over the past two months, the technical outlook for AT1 bonds is increasingly vulnerable to macro volatility. Taking partial profits on AT1 bonds seems prudent while awaiting development in European exceptionalism.

EUROPEAN BANK COCO (AT1)

Over the last two weeks, European bank coco had rallied quite well as 10-year US Treasury yield climbed lower. We believe coco valuation has become somewhat expensive and would suggest selling on this rally. We expect further coco bond upside will be more driven by interest rate movement instead of credit spread tightening.

ASIA INVESTMENT GRADE (IG)

Asia IG had a mixed day. We saw private bank buyers for India and Philippine IG bonds with credit spread 1-2 basis points tighter. On the other hand, Australia IG was weak and spread was 2-3 basis points wider. Overall, IG bond sentiment is somewhat mixed. We expect the market will stay volatile until it finds new direction after US nonfarm payroll release this Friday.

ASIA HIGH YIELD (HY)

Asia HY bond had a decent day. Mongolia Mining recovered from their Friday losses, thanks to the positive outlook assigned by Moody’s. China HY was also well supported and we saw names like Longfor and China Jinmao 0.25-0.5 points higher. New World Development bond complex also rallied well on the back of Debtwire’s report that the company could call back the 6.15% perpetual bonds which rallied 10-15 points. We remain cautious on New World’s credit fundamental and suggest sell on this rally.

Forex Market Updates

The US Dollar retreated on Tuesday as tariffs and growth fears rattled markets.

USD

The US Dollar fell to fresh 2025 lows against a basket of other major currencies on Tuesday as concerns about slowing growth and the impact of tariffs on the US economy outweighed any potential boost from the ramping up of trade levies on Canada, Mexico and China. Both Canada and China have said that they will apply retaliatory tariffs of their own on US goods, with Mexico also expected to follow suit. Elsewhere, US President Trump said he told the leaders of Japan and China that they could not continue to reduce the value of their currencies, as doing so would be “unfair” to the US. In response, Japanese Fin. Min. Kato said that Tokyo was not adopting policies directly aimed at weakening the Yen, while Japanese PM Ishiba said that Japan was not pursuing a “currency devaluation policy”.

The Dollar Index could see more near term weakness towards technical support around 105.50.

AUD

The Australian Dollar posted gains of roughly 0.5% yesterday, thanks largely to steady USD selling as well as strong Retail Sales data from Down Under. Some analysts said that the positive figures came about thanks to the first interest rate cut in over four years, which lowered mortgage payments and lifted consumer sentiment amid a backdrop of slowing inflation and large cuts to income taxes. However, latest RBA minutes revealed that the central bank remains cautious about the prospects of further policy easing as ongoing labour market strength, which should support wages and spending, still poses a hurdle to more rate cuts for the time being.

Ongoing trade war concerns are likely to keep a lid on Aussie gains moving forward, with the 0.6300 handle likely to provide stiff resistance.

GBP

The British Pound climbed to an almost three-month high against the USD, building on the previous day’s gains as European markets rallied after the continent’s leaders drew up a Ukraine peace plan to present to the US. Analysts said that sentiment around Sterling has also been helped by the UK being far down the list of immediate concerns, with market focus squarely on tariff talk and Russia-Ukraine for now, while economists also expect Trump’s protectionist measures to weigh less on the GBP because Britain has a more balanced trade position vis-à-vis the US.

A continuation of broad USD weakness could see Sterling break above the 1.2800 handle in the near term.

XAU

Gold prices rose on Tuesday, trading back above the 2900 handle for the first time in four sessions on the back of broad greenback weakness as well as heightened safe haven demand amid escalating trade conflicts following US President Trump’s imposition of tariffs on Canada, Mexico and China. Amid the ongoing uncertain climate, market focus now turns to Friday’s US NFP data for further clues on the Fed’s interest rate path, with some analysts saying that there could be the possibility of an earlier-than-expected rate cut due to potential economic instability and a weakening job market.

The precious metal is likely to be well-supported above 2835 for the time being given ongoing economic and geopolitical uncertainty.