Macro Update:

Germany’s fiscal “bazooka”

Germany equities rose strongly and German bonds had their worst day in 35 years after the country’s prospective leaders announced a historic deal to loosen its “debt brake” rule to boost spending on defence and infrastructure with EUR 1 trillion or more. A fiscal easing in Europe could help reduce savings as well as boosting investment and consumption.

On China, the government sets 5% growth target in 2025 as expected. Expectations rose that the authorities will be required to implement more stimulus measures to meet the target especially if the tariff impact turns out to be worse than expected. More special CGBs may be issued given the relatively straightforward approval process.

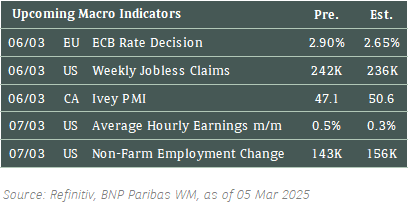

Main Upcoming Macro Indicators

Equity Market Updates

US EQUITIES

US stocks ended higher on Wednesday, recovering from its two-day losing streak, as investors cheered the likely easing of trade tensions between the US and major trading partners.

We are positive on US equities in the medium term.

EUROPE EQUITIES

European shares also bounced back on Wednesday, with German stocks leading gains after the country's leaders agreed to overhaul borrowing rules to boost defence spending and revive growth.

HK EQUITIES

Hong Kong stocks rose on Wednesday after Beijing set an ambitious economic growth target and vowed more support for domestic consumption and the Chinese technology industry.

Moderna (MRNA US)

Shares of Moderna rose almost 16% on Wednesday after CEO Stephane Bancel and board director Paul Sagan bought around USD6M of its stock according to SEC filings.

The company also expects to launch a personalized cancer vaccine, developed in partnership with Merck, by 2027. This cancer vaccine, currently in a mid-stage study, showed that patients with severe skin cancer saw their fatality rate or cancer returning cut by half.

This breakthrough may provide a significant revenue opportunity for Moderna and add support to its share price going forward.

MARKET CONSENSUS: 6 BUYS, 18 HOLDS, 4 SELLS, AVERAGE TP USD54.05

ASML (ASML NA)

ASML, the computer chip equipment maker that has been hit by successive waves of US-led restrictions on exports to China, said in its annual report on Wednesday that uncertainty over export controls had weakened customer demand in 2024.

ASML said that a growing number of entities in China, which accounted for 36% of its sales in 2024, are now subject to restrictions and the company faces ongoing risk from increasingly complex restrictions and possible countermeasures. The company has said it expects China sales to fall by around 20% in 2025.

The company however repeated its 2025 sales forecasts of EUR30-35B, up from EUR28.3B in 2024, with the AI boom boosting demand for its EUV lithography systems, which are needed to create the circuitry of computer chips.

How ASML will navigate the US' export curbs will be key in determining its share price trajectory going forward.

MARKET CONSENSUS: 31 BUYS, 7 HOLDS, 2 SELLS, AVERAGE TP EUR844.46

Adidas (ADS GR)

Adidas forecasted on Wednesday that its sales would slow slightly from a strong 2024 and grow less than 10% this year. This is a rare occurrence under CEO Bjorn Gulden, who led Adidas to repeatedly deliver stronger results than forecast in past quarters. Shares of the company fell in early trading but recovered to close slightly higher yesterday due to Germany’s positive fiscal policy adjustments.

The company’s operating profit forecast was also lower than expected, with Adidas saying it should reach a level between EUR1.7B and EUR1.8B this year, below EUR2.1B analysts had expected.

Adidas, which has been gaining market share while Nike struggles, has said it has the clear ambition of being the top sportswear brand in all markets except the US.

MARKET CONSENSUS: 18 BUYS, 11 HOLDS, 5 SELLS, AVERAGE TP EUR264.5

Bayer (BAYN GR)

Shares of Bayer gained on Wednesday after the company reported 4Q24 results that were ahead of expectations. Its revenue stood at EUR11.73B vs. EUR11.37B expected, while adjusted EPS was at EUR1.05 vs. EUR1.00 expected. This signals that the company’s struggles are not as severe as investors had feared, potentially adding support to its share price going forward..

Bayer forecasts a third straight year of falling profit due to mass litigation, slumping agriculture prices, and competition for its best-selling medicines. However, this is well within the market’s expectations. Throughout 2025, Bayer sees adjusted EBITDA at between EUR9.50B to EUR10.00B vs. EUR9.53B expected.

MARKET CONSENSUS: 7 BUYS, 18 HOLDS, AVERAGE TP EUR25.62

Schaeffler (SHA GR)

German machine and car parts maker Schaeffler on Wednesday joined other auto suppliers in giving a gloomy outlook for 2025, as it sees no rebound for the automotive market during the year.

Europe's auto sector is being tested by multiple hurdles ranging from high production costs and managing the shift to EV to falling demand and rising competition from China.

It recently acquired electric powertrain specialist Vitesco as part of a push to increase its electric mobility market share. Schaeffler is also carrying out a major restructuring effort that includes cutting thousands of jobs and closing plants across Europe, after its operating margin, a key profitability metric, melted from 7.3% to 4.5% in just one year.

MARKET CONSENSUS: NONE

Earnings Announcements

US Market

Macy’s, Costco, Broadcom

European Market

Merck, Elis, Air France

HK - China Market

MTR, JD Health, JD.com, Lee & Man Paper Manufacturing

Global Indices Changes (%)

Fixed Income Market Updates

With US Treasury yields near year-to-date lows, we have seen a more active pipeline in primary issuances. Increased bond supply is a welcomed opportunity to deploy more cash into fixed income. We advocate staying in the Investment grade space with tenor around 5-6 years.

EUROPEAN BANK COCO (AT1)

It was an active session in EUR-denominated AT1 space with the move in rates but overall, prices held up well with the space around 0.25-0.75 point higher (outperforming the move in bunds). Spreads of AT1 bonds with longer call dates widened 15-20bps. In the USD-denominated AT1 space, it was a different story. The space closed firm and ended the trading day up 0.125-0.25point on average. We still think valuation of bonds in the USD-denominated AT1 space to be expensive and will be looking to selectively take profit.

ASIA INVESTMENT GRADE (IG)

IG sovereigns were 0.375-0.75point lower depending on duration as street flows were skewed to sell risk. CK Hutchison bonds were 2bps tighter across the curve post news of sale of its port assets. Asset managers were buying CK Hutchison's bonds. The other low beta names in Hong Kong IG space traded 1-2bps tighter initially but gave up the gains rather quickly as the day progressed. Spreads were stable in Korea IG space largely due to less trading activity as bonds in the BBB space were difficult to move due to light positioning across dealers.

ASIA HIGH YIELD (HY)

Tone was better in China HY space as media reported that the Chinese government is planning a package of measures to defuse debt risk. Survivors in the property space were marked 0.25-0.5point higher although Road King saw profit takers, bringing its bonds 1-2points lower. Outside of China, India and Indonesia HY space had been relatively resilient and were almost unchanged week-on-week. There were more selling flows in the high beta non-bank financials space post the IIFL Finance tap which traded below its tap price.

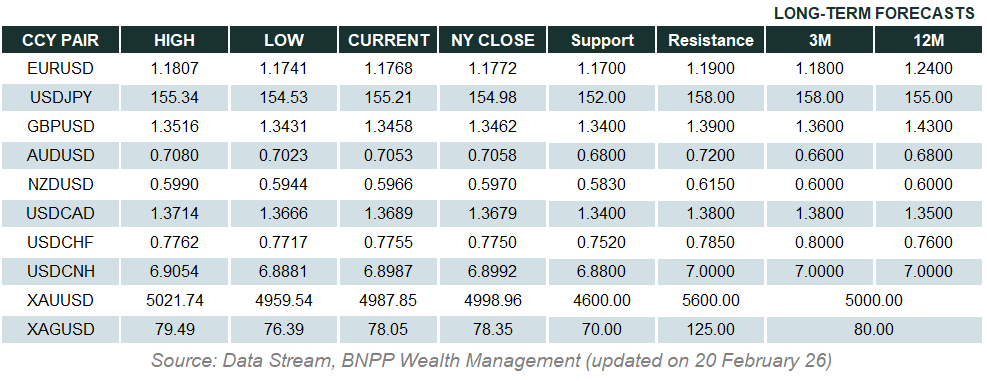

Forex Market Updates

The US Dollar fell on Wednesday, extending losses amid trade policy concerns, weaker payrolls data, and fading safe haven appeal as investors shifted to alternatives.

USD

The US Dollar fell on Wednesday against a basket of other major currencies, extending its recent decline as concerns over trade policy and economic uncertainty weighed on sentiment. The greenback has lost nearly 2.5% this week amid speculation that net-long dollar positions will continue to unwind, according to a Reuters poll. Traders remain cautious after President Trump imposed tariffs on Canada, Mexico, and China, adding to geopolitical uncertainty. Meanwhile, weaker-than-expected private payrolls data signalled slowing job growth, reinforcing expectations for Fed rate cuts. The dollar’s traditional safe haven appeal appears to be fading, as markets turn to alternatives like the euro and yen.

The Dollar Index could see further near term weakness, with USD bears likely to be well supported above 103.40 for the time being.

AUD

The Australian Dollar rose on Wednesday despite concerns over US tariffs and underwhelming Chinese stimulus. The RBA warned that escalating trade tensions could pose risks to the economy, particularly given Australia’s reliance on global trade. Consumer spending showed signs of recovery, helped by easing inflation and government stimulus. However, productivity remains weak, and inflation is still above target, keeping monetary policy uncertain. Markets expect a potential rate cut in the coming months, but the RBA remains cautious, emphasizing the need for more progress on inflation before making further policy adjustments.

Ongoing trade war concerns are likely to keep a lid on Aussie gains moving forward, with the 0.6400 handle likely to provide stiff resistance.

EUR

The Euro continued its rally on Wednesday, reaching a four-month high after Germany proposed a large infrastructure fund aimed at boosting economic growth. Analysts see this fiscal shift as a positive development, potentially reducing the need for aggressive ECB rate cuts. The euro strengthened against major peers as markets grew more confident in the region’s outlook. Despite lingering trade risks, Germany’s move signals renewed momentum for the eurozone economy. With policymakers set to meet later today, markets will be watching for any signs of shifting monetary policy in response to improving economic conditions.

Euro bulls could attempt a test of resistance around the 1.0882 handle ahead of policy rate meeting held later today.

XAU

Gold edged higher on Wednesday as investors weighed US tariff uncertainty and awaited key jobs data for signals on Fed policy. The metal remains supported by geopolitical tensions and ongoing trade concerns, with analysts expecting its upward momentum to continue. Market volatility has increased amid Trump’s tariff threats and China’s stimulus measures, keeping demand strong. While markets look ahead to Friday’s US nonfarm payrolls, only a major surprise is expected to drive significant moves. Gold is likely to remain well supported as economic uncertainty persists, with analysts watching key resistance levels in the near term.

The precious metal is likely to be well-supported above 2835 for the time being given ongoing economic and geopolitical uncertainty.