Macro Update:

China says it has “ample” policy tools

Finance Minister Lan Fo'an said China has more room to act on fiscal policy amid domestic and external uncertainties and vowed to study greater and more precise measures to boost consumption. Hong Kong/China stocks hit new 3-year high, boosted by China techs and potential stimulus policy as a result.

On the contrary, US stocks plunged despite President Trump delaying some tariffs on Mexican and Canadian imports until 2 April. Given further uncertainty from Trump’s tariff polices, we expect the rotation from US to European and China equities will continue in the near term as the latter shows more visibility on governments’ fiscal easing policies.

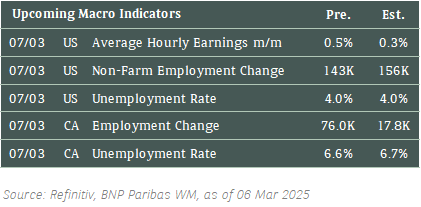

Main Upcoming Macro Indicators

Equity Market Updates

US EQUITIES

US stocks continued their move lower on Thursday as concerns surrounding US trade policy continue to weigh on sentiment.

EUROPE EQUITIES

European equities pared declines to close flat on Thursday after the European Central Bank's interest rate cut boosted bank stocks, offsetting pressures from rising long-term bond yields.

HK EQUITIES

Hong Kong stocks rallied on Thursday, led by consumer and tech stocks, as investors continued to see policy signals from China’s annual parliamentary meeting positively.

We are constructive on Hong Kong / China equities in the medium term.

Broadcom (AVGO US)

Shares of Broadcom surged in aftermarket trading on Thursday after the chipmaker posted FY1Q25 results beats while also providing an upbeat outlook for the current quarter.

This is likely to reassure investors that the historic boom in artificial intelligence spending remains healthy, despite increasing caution so far this year.

Broadcom’s FY1Q25 revenue stood at USD14.92B vs. USD14.61B expected, while adjusted EPS was at USD1.60 vs. USD1.50 expected. Meanwhile, it also forecasts sales of about USD14.9B in the three-month period ending 4 May 2025, citing strong potential spending on artificial intelligence computing.

MARKET CONSENSUS: 43 BUYS, 5 HOLDS, AVERAGE TP USD251.43

JD.com (9618 HK)

JD.com on Thursday reported 4Q24 results that comfortably beat market expectations, with revenue at RMB347.0B vs. RMB332.4B expected while EPS stood at RMB6.47 vs. RMB4.67 expected, boosted by robust demand as deep discounts helped encourage spending from consumers.

The Chinese government has also ramped up fiscal stimulus recently to bolster consumption amid an escalating trade war with the US. More are likely to come throughout 2025. These support measures has (and will continue to) provide further support for JD.com.

MARKET CONSENSUS: 35 BUYS, 1 HOLD, AVERAGE TP HKD198.45

Lufthansa (LHA GR)

Lufthansa's operating profit dropped by over a third in 2024, capping a difficult year during which spiraling costs, limited airspace and delivery delays hit its profitability.

Lufthansa had last year aimed for an operating margin of 8%. The group said it reached a much lower point of 4.4%, citing among the reasons costly strikes and lower-than-usual yields due to an industry-wide increase in capacity.

The company has vowed to turn around its core airline, which posted an operating loss of EUR94M in 2024, dragging on the group's overall results.

It said the restructuring programme at Lufthansa Airlines is expected to make a gross profit contribution of around EUR2.5B by 2028. How this transformation will eventually pan out is key to watch going forward.

MARKET CONSENSUS: 5 BUYS, 18 HOLDS, 3 SELLS, AVERAGE TP EUR6.99

Air France (AF FP)

Air France-KLM reported on Thursday a better-than-expected annual result for 2024 as its ongoing efforts to contain costs paid off with a strong performance in the fourth quarter.

European airlines had strong demand in 2024 but struggled to shake off the impact of labour strikes, rising inflation and maintenance costs.

The group warned in November that its costs in 2024 might be higher than expected, primarily due to higher staff and maintenance costs at Dutch carrier KLM. It reported an operating profit of EUR396M, nearly double the EUR203M expected by analysts, driven by increased passenger numbers and cost containment efforts.

The healthy trajectory is likely to provide support to the company’s share price.

MARKET CONSENSUS: 4 BUYS, 11 HOLDS, 6 SELLS, AVERAGE TP EUR8.84

Zalando (ZAL GR)

Online fashion marketplace Zalando said on Thursday it expected higher profits in 2025, supported by further growth in both its online platform and the business servicing other retailers.

Zalando forecasted adjusted EBIT of EUR530M to EUR590M for the year, up from EUR511M in 2024.

It expects revenue and gross merchandise volume to rise between 4% and 9% in 2025, compared with a 4.2% revenue rise to EUR10.6B and a 4.5% GMV jump to EUR15.3B last year.

The guidance excludes the planned acquisition of rival About You, which is expected to close this summer.

MARKET CONSENSUS: 24 BUYS, 7 HOLDS, 1 SELL, AVERAGE TP EUR38.06

ProSiebenSat (PSM GR)

German media company ProSiebenSat said on Thursday its adjusted core profit fell last year due to lower customer spending on TV advertisements.

The group reported adjusted EBITDA of EUR557M for 2024, down 3.6% from the EUR578M a year earlier.

The result was mainly impacted by weaker investments by TV advertising customers, as these correlate to lesser private consumption in a challenging economic environment.

Adjusted EBITDA in the Entertainment segment declined 12% to EUR416M in 2024, with the biggest hit to the TV advertising business coming in the final quarter, the company added.

MARKET CONSENSUS: 6 BUYS, 9 HOLDS, AVERAGE TP EUR6.61

Earnings Announcements

US Market

-

European Market

BioMerieux, Elia Group

HK - China Market

-

Global Indices Changes (%)

Fixed Income Market Updates

S&P downgraded Longfor Group to BB- from BB with outlook remaining on negative. While China pledges to make continued effort to stem the downturn and stabilize the property market, we think the outlook of the property market remains challenging.

EUROPEAN BANK COCO (AT1)

There was further repricing in EUR-denominated AT1 bonds as EUR rates remained volatile. AT1 bonds saw prices down more earlier in the day and only managed a modest bounce before market close and prices were lower by 0.375-0.75point on average. Selling picked up today compared to previously. However, USD-denominated AT1 bonds remained firm and was relatively unchanged, with prices around +/-0.125point overall.

ASIA INVESTMENT GRADE (IG)

Strong performance in Chinese technology stocks boosted market sentiment which led to demand in 5-year bonds of Meituan, Alibaba and Xiaomi. In Japan IG space, recent new issues continued to perform with Sumitomo Mitsui Trust Bank tightening 2-5bps. Korea IG space saw buying from onshore accounts while selling pressure from offshore asset managers had eased. Overall, spreads were stable as a result. We still prefer IG names with solid fundamentals with duration of around 5-6 years.

ASIA HIGH YIELD (HY)

It was a firm session in China HY with equities trading higher. China HY space were marked around 1.5-3.5points higher with selective buying from asset managers. Away from China, India and Indonesia HY space were relatively unchanged to 0.25point lower although there were selling flows in some higher beta Indian non-bank financials names. While news flows have becoming increasing positive in China HY property space, we still think outlook remains challenging and would not be buyers in this space.

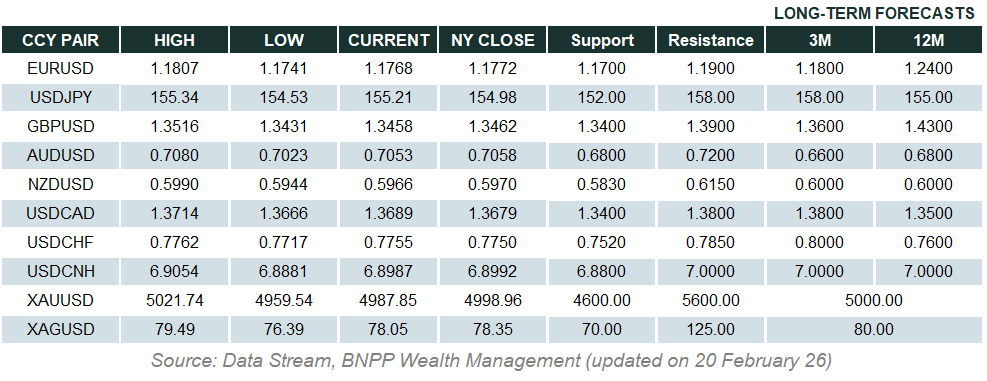

Forex Market Updates

The U.S. dollar index hovered at 4-month lows on Thursday due to renewed worries on the potential negative effects of tariffs on the U.S. economy.

USD

The US Dollar index hovered at 4-month lows, as jittery investors turned increasingly risk-averse amid an extended sell-off on Wall Street, triggered by an escalating trade war initiated by the United States. Investors shifted their view on tariffs and consider it a hindrance to economic growth now due to many U.S. companies being dependent on exports and imports, with worries that the reduction of trade numbers will slow down the US economy.

The Dollar Index could see a further near term retracement towards immediate support around 103.00.

CAD

The Canadian dollar strengthened to a nine-day high against USD on Thursday as Canada's trade surplus widened more than expected and investors weighed prospects of additional reprieves from U.S. tariffs on Canadian goods. U.S. Commerce Secretary Howard Lutnick said the one-month reprieve on hefty tariffs on goods imported from Mexico and Canada that has been granted to automotive products is likely to be extended to all products that comply with the U.S.-Mexico-Canada Agreement on trade. However, tariff risk for Canada is still heavy as Canada sends about 75% of its exports to the U.S. The nation's surplus rose to $4 billion in January as fears of tariffs from the U.S. pushed exports of cars and energy products higher.

The USDCAD could see some further weakness and be well supported above 1.4170.

CNH

The Yuan dipped from a four-month high against the dollar on Thursday, underperforming a broader lift in global peers as persistent worries about even more U.S. tariffs against China overshadowed the reprieve granted to Canada and Mexico. Analyst said Trump's tariff uncertainties are unlikely to dissipate before the start of China-U.S. trade talks. Therefore, despite the previous gains, the overall sentiment for the yuan remains subdued. Investors now focus on the financial policies announced on the National People's Congress. The implementation of a domestic policy package, improvement in economic momentum, and sustained high trade surplus are expected to support the yuan.

The Renminbi may consolidate around the current levels around 7.23 – 7.25 as investors are waiting the NPC policies announcement.

XAU

Gold prices dipped on Thursday due to rising U.S. Treasury yields and profit-taking. The benchmark 10-year U.S. Treasury yield hit a more than one-week high, reducing the appeal of non-yielding gold. Analyst said the underlying fundamentals of Gold are still bullish, the drop just some mild profit-taking pressure from recent gains. Market attention now turns to Friday's payrolls data for insights into the Federal Reserve's monetary policy move.

The precious metal is likely to be well-supported above 2850 for the time being given ongoing economic and geopolitical uncertainty.