Macro Update:

Market gains after Powell cites economic resilience

A weaker than expected jobs report showed 151K job gains in February and a 4.1% unemployment rate. After initial losses, US stocks rebounded as Fed Chair Jerome Powell reassured markets about inflation progress and economic strength while signalling no urgency to cut rates. The US 10y treasury yield also edged up to 4.28% on Friday. Despite so, markets are likely to remain volatile on trade policy uncertainty.

Meanwhile, China's consumer prices fell more than expected, by 0.7% YoY in February 2025. This is the first deflation since January 2024, although the drop is largely attributed to an earlier than usual Lunar New Year celebration. We continue to stay positive on Chinese equities.

Main Upcoming Macro Indicators

Equity Market Updates

US EQUITIES

US stocks ended higher on Friday, rebounding from early declines after positive commentary from Fed chair Jerome Powell. The overall market still however logged its largest weekly decline in months.

We remain positive on US equities in the medium term.

EUROPE EQUITIES

European shares closed lower on Friday as investors continued to grapple with developments surrounding US trade policy and its softening economy.

HK EQUITIES

Hong Kong stocks slipped on Friday but ended the week near the highest level in three years as investors’ enthusiasm towards AI continued to fuel the market.

Walgreens Boots Alliance (WBA US)

Shares of Walgreens rose on Friday after it had reached a deal with private equity group Sycamore Partners to bring the company private, bringing its nearly 100-year run as a publicly traded company to an end.

Sycamore agreed to pay USD11.45 per share in cash for Walgreens, representing an equity value of around USD10B. The total value of the deal, including debt and potential future payouts, would be almost USD24B. Shareholders could also receive up to USD3 more per share in the future from sales of Walgreens' primary-care businesses, including Village Medical, Summit Health and CityMD.

Despite Walgreens’ shares rallying more than 7% on Friday, its share price at USD11.39 sits close to the USD11.45 offered by Sycamore. Further upside may be limited.

MARKET CONSENSUS: 1 BUY, 13 HOLDS, 1 SELL, AVERAGE TP USD11.95

Apple (AAPL US)

Indonesia has issued local content certificates for 20 Apple products, including the iPhone 16, an industry ministry spokesperson said on Friday, although the company still needs permits from other ministries before it can sell the phones.

The issuing of the certificates follows last month's announcement of more than USD300M investments by Apple in Indonesia, including on plants making components for its products and a research and development center.

Indonesia banned iPhone 16 sales last year due to Apple's failure to meet requirements on locally-made components. The company now needs permits from the communications and digital ministry and the trade ministry to be able to sell its products in the country.

Further delays in Apple’s ability to sell products in the world’s fourth most populous country may hurt its top line going forward.

MARKET CONSENSUS: 35 BUYS, 16 HOLDS, 6 SELLS, AVERAGE TP USD253.46

Airbus (AIR FP)

Airbus deliveries for January and February fell 18% YoY to 65 aircrafts, the planemaker said on Friday.

Airbus has warned about relatively weak deliveries in the first quarter after supplies from engine maker CFM were pulled forward to the fourth quarter of last year to help Airbus to broadly reach its annual target.

In February the company delivered 40 jets. Airbus also reported 14 new orders for February, bringing the total this year to 69. After cancellations, Airbus reached 65 net orders in the first two months, up from 33 at the same point last year.

MARKET CONSENSUS: 19 BUYS, 5 HOLDS, 2 SELLS, AVERAGE TP EUR184.92

Allianz (ALV GR)

German insurer Allianz is reportedly in exclusive negotiations to acquire Viridium Group from European private equity firm Cinven for over EUR3B. The timing of the potential deal remains unknown.

Viridium, also based in Germany, buys closed books of old life-insurance policies from other insurers. As a consolidator, the company tries to use increased scale to cut costs and improve investment performance to boost profits and lift returns for policyholders. The company oversees more than EUR67B of assets and generated a net income of around EUR342M in 2023.

Synergies from this deal could be beneficial for Allianz and thus be supportive of its share price going forward.

MARKET CONSENSUS: 15 BUYS, 8 HOLDS, 2 SELLS, AVERAGE TP EUR340.78

BioMerieux (BIM FP)

France's in-vitro diagnostics firm BioMerieux reported on Friday a 10.3% YoY growth in its FY2024 revenues to EUR3.98B. Meanwhile, its recurring operating income was up 20% at constant rates and scope to EUR673M. Both figures beat market expectations at EUR3.95B and EUR626.7M respectively.

Looking ahead, BioMerieux forecasts 2025 growth in profit from recurring operations by at least 10%, while organic sales is expected to grow by around 7%. These figures were largely considered to be conservative by the market. BioMerieux also proposed dividend of EUR0.9 per share.

MARKET CONSENSUS: 14 BUYS, 2 HOLDS, 1 SELL, AVERAGE TP EUR125.94

Earnings Announcements

US Market

Oracle

European Market

LEG Immobilien SE, Traton SE

HK - China Market

-

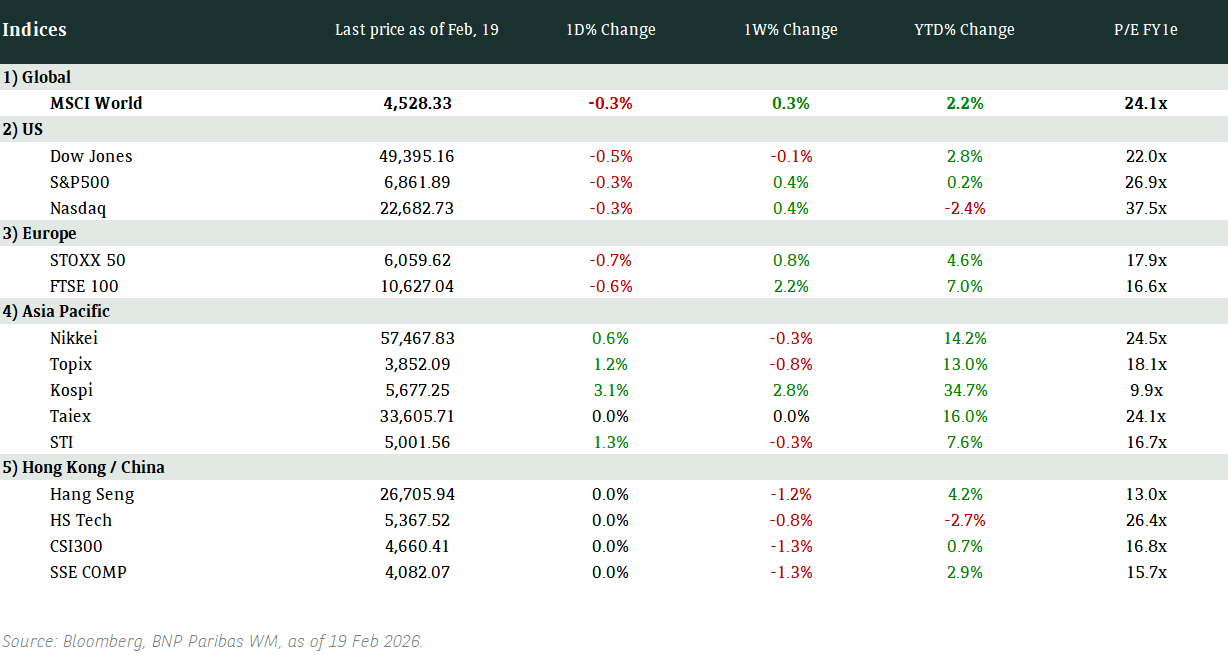

Global Indices Changes (%)

Fixed Income Market Updates

Treasury yields was higher on Friday. However, markets continue to worry about weak economic data, tariff fears and potential US government cuts. We continue to favour areas where we expect credit to remain resilient.

EUROPEAN BANK COCO (AT1)

There was further repricing in EUR-denominated AT1 bonds as EUR rates remained volatile. In spread terms, EUR paper was only 2bps wider, while USD issues were 10bps wider. Sectors with a high concentration of EUR issuers were the underperformers, especially Italian bonds which closed 0.875pts (points) lower. Short call paper, especially USD GSIBs, remain the most sought after with strong buying from Asia all week. Longer call paper was more volatile, with demand only emerging when government bonds were stable. Little prospect of primary re-emerging until there is more stability in macro markets.

ASIA INVESTMENT GRADE (IG)

In general new issue has been performing well, including the Sumitomo Mitsui Trust Bank tranches, MYLIFE 6.1 perp, thanks to decent new issue premiun. Secondary see net selling across region, flow is mostly driven by US Treasury move. Any rally in UST will cause round of spread widen while any rates sell off will bring back buyers in the field. Broadly spreads are 3-5bp wider, high beta 5-30bp wider depending on the name. We still prefer IG names with solid fundamentals with duration of around 5-6 years.

ASIA HIGH YIELD (HY)

Weakness accelerated in ex-China HY, closing unchanged to -1.5pt mostly on real money trimming risks, particularly in India. For example, Adani complex and Vedanta were .50 point lower, especially see weak fundamental names underperforming such as Biocon Biologics. On the other hand, New World Development continue to rally on the back of the news that the Chinese government told banks to support the name.

Forex Market Updates

The US Dollar dropped against most currencies on Friday due to an unexpected weakening in NFP data.

USD

The US Dollar Index dropped to multi-month lows against the Euro and Yen and fell versus most currencies on Friday due to lower-than-expected NFP data last month. Markets are pricing in 78bps worth of Fed rate cuts this year following the data announcement. Elsewhere, Trump announced another reprieve of levies aimed at Mexico and Canada on Thursday, although the exemption expires on April 2 when Trump said he will impose reciprocal tariffs on all US trading partners. However, Fed Chair Powell expressed a cautious attitude about rate cuts and said a one-time jump in prices due to tariffs does not need a monetary policy response.

The Dollar Index looks to be range trading for now, fluctuating between 103.00 and 104.50 in the near term.

CAD

The Canadian Dollar gave back some of its weekly advance against the greenback on Friday as a smaller-than-expected domestic jobs number gain supported bets for another interest rate cut at the next BoC meeting. Investors now see a 75% chance the BoC cuts its benchmark rate by 25 basis points on March 12, up from 71% before the data. Even though US tariffs against Canada were delayed, analysts expected further weakness to be seen in the months ahead due to ongoing trade tensions.

USDCAD may see some consolidation above 1.4260 in the short term.

CNH

The Chinese Yuan eased slightly against the USD on Friday despite the broad Dollar pullback as uncertainties surrounding US tariffs and lower-than-expected exports kept investors nervous. Analysts said that even though CNY has been "better behaved" compared to other Asian currencies, it’s only a matter of time before the currency weakens. The Yuan's recent stability could be shortlived if US tariffs escalate, although the PBoC has reiterated its commitment to maintaining exchange rate stability.

USDCNH could see a near term push higher towards immediate resistance around 7.2560.

XAU

Gold prices eased on Friday but were poised for a weekly gain due to safe haven inflows and lower-than-expected job growth in February, suggesting that the Fed is on track to cut interest rates this year, which will support the precious metal. In addition, a weaker dollar also made greenback-priced bullion less expensive for foreign buyers. Analysts said the market is currently in a consolidation phase with investors looking to gold for stability amidst ongoing uncertainty.

The precious metal is eyeing the previous high of 2951 as the next target given ongoing economic and geopolitical uncertainty.