Macro Update:

Wall Street plunges on growing recession woes

US stocks extended last week's losses sharply on Monday, as concerns over the US growth outlook continue to mount. In a Fox News interview, President Trump declined to rule out a recession following his administration's tariff policy changes, describing the current economic phase as a "period of transition". The S&P 500 lost 2.7%, the Nasdaq 100 sank 3.8%, and the Dow Jones was down nearly 2.1% as fear creeps into the market. Meanwhile, the US 10y yield declined to around 4.23% amid the rising uncertainty. Markets are likely to remain volatile, as investors now turn their focus to upcoming CPI and PPI data, ahead of next week’s FOMC meeting, where the Fed will release updated economic projections.

Main Upcoming Macro Indicators

Equity Market Updates

US EQUITIES

US equities fell on Monday after comments from President Donald Trump raised concerns surrounding the country’s economy.

Volatility in US stock markets is likely to remain in the short term.

EUROPE EQUITIES

Stocks in Europe also fell to its lowest level in nearly a month on Monday, weighed down by declines in technology shares, as developments in the US subdued investor sentiment.

HK EQUITIES

Hong Kong stocks declined on Monday as mounting deflationary pressures heightened concerns over the country’s economic recovery amid escalating global trade tensions.

Oracle (ORCL US)

Shares of Oracle fell during after-market hours on Monday after it reported disappointing FY3Q25 results and provided a profit forecast for the current quarter that fell short of analyst expectations. The company’s FY3Q25 revenue stood at USD14.13B vs. USD14.39B expected, while adjusted EPS was at USD1.47 vs. USD1.49 expected.

Despite its downbeat results announcement, Oracle still guided for a surge in bookings and said that its growing cloud infrastructure business will boost revenue over the next two fiscal years. It projects that sales will increase 15% in the next fiscal year and 20% in the one after.

Oracle’s actual revenue figures in the next couple years will be closely watched by the market.

MARKET CONSENSUS: 28 BUYS, 15 HOLDS, AVERAGE TP USD198.43

KKR (KKR US)

British healthcare real estate investment trust Assura on Monday said it will likely consider a GBP1.61B offer from KKR and Stonepeak Partners.

In February, KKR and pension fund Universities Superannuation Scheme said they had made four indicative, non-binding proposals to Assura, the last of which was at GBp48 per share, which was rejected by the British company's board.

Monday's offer of GBp49.4 per share from KKR and investment firm Stonepeak is at a 31.9% premium to the closing share price on February 13 when the previous offer was made and is at a 21.3% premium to Friday's close.

Assura said the board has decided to engage in discussions with the consortium and to allow it to complete a limited period of confirmatory due diligence.

MARKET CONSENSUS: 17 BUYS, 5 HOLDS, AVERAGE TP USD169.1

Novo Nordisk (NOVOB DC)

Shares of Novo Nordisk fell on Monday following disappointing Phase 3 trial results for its next-generation weight loss drug CagriSema.

CagriSema helped patients lose 15.7% of their weight over 68 weeks, compared to 3.1% with placebo, but investors had expected figures closer to 20%.

Despite the setback, the company remains committed to its weight loss portfolio and R&D efforts as it aims to seek first regulatory approval for CagriSema in the first quarter of 2026.

MARKET CONSENSUS: 22 BUYS, 10 HOLDS, 2 SELLS, AVERAGE TP DKK817.88

Tracton (8TRA GR)

Volkswagen's truck unit Traton guided for a tepid commercial vehicle market in 2025 on Monday after persistent weakness in Europe, particularly in Germany, weighed on last year's results.

The truck maker forecasts 2025 sales development in a range of -5% to +5% and an operating return on sales of between 7.5% and 8.5%. The outlook is subject to geopolitical developments, particularly in US, it said.

How the US tariffs will alter the outlook of the company will be key to watch going forward.

MARKET CONSENSUS: 12 BUYS, 9 HOLDS, AVERAGE TP EUR37.91

Hon Hai Precision Industry Co. (2317 TT)

Taiwan’s Foxconn said on Monday it has launched its first large language model and plans to use the technology to improve manufacturing and supply chain management.

The model, named “FoxBrain,” was trained using 120 of Nvidia’s H100 GPUs and completed in about four weeks, the world's largest contract electronics manufacturer.

Foxconn said although there was a slight performance gap compared with China's DeepSeek's distillation model, its overall performance is very close to world-class standards.

Initially designed for internal applications, FoxBrain covers data analysis, decision support, document collaboration, mathematics, reasoning and problem-solving, and code generation.

Looking ahead, investors will closely watch Nvidia’s GTC developer conference in mid-March, where Foxconn will announce further details about the model.

MARKET CONSENSUS: 23 BUYS, 2 HOLDS, AVERAGE TP TWD238.29

Earnings Announcements

US Market

Ciena Corp

European Market

Henkel AG & Co, GEA Group, D'ieteren Group

HK - China Market

-

Global Indices Changes (%)

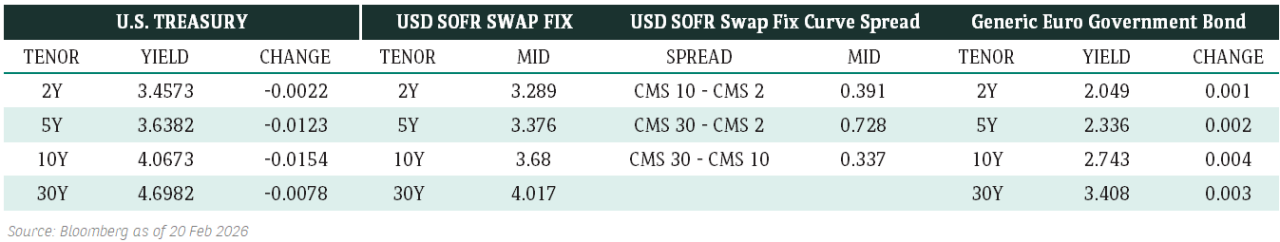

Fixed Income Market Updates

The upcoming US CPI report for February 2025 is set to take center stage as the final inflation reading before the FOMC meeting in March 2025. Notably, the impact of recent tariffs on inflation has not yet fully materialised, meaning indication of sticky inflation could lead to further declines in risky assets. We recommend that investors consider profit-taking on Additional Tier 1 bonds before credit widening kicks in.

EUROPEAN BANK COCO (AT1)

The AT1 market opened strongly, buoyed by positive development in Eurozone fiscal reforms. Robust demand from Asian investors and institutional accounts offset selling pressure from hedge funds and the broader market, particularly for AT1 bonds with high coupons and call dates five year away.

ASIA INVESTMENT GRADE (IG)

In Asia, the credit market remained cautious following the US employment data released over the weekend, with China IG spreads widening by 2 basis points. Trade activity in the technology sector was muted, marked by selling in Alibaba 2035s and buying in Tencent 2030s. Outisde China, IG spreads widened by 1 to 3 basis points, while Korean IG bonds remained stable despite regional equities trending lower. High-beta corporates like SK Hynix saw balanced flows from global fund managers.

ASIA HIGH YIELD (HY)

The China HY market started the week quietly, with market makers adjusting prices to reflect a weaker macro environment. The Macau gaming sector declined by 0.25 points, following a stable outlook revision for Melco Resorts by S&P due to slower EBITDA growth. Outside China, selling in Indian HY focused on renewable energy names, with the Adani complex experienced pressure and prices dropping by 0.15 to 0.25 points.

Forex Market Updates

The US Dollar held steady yesterday as markets weighed trade uncertainties, Fed policy, and government funding debates, while Hassett projected positive Q1 GDP despite concerns.

USD

The US Dollar held steady on Monday against a basket of other major currencies, as markets weighed comments from White House economic adviser Kevin Hassett, who projected positive Q1 GDP despite trade uncertainties. Hassett downplayed recession fears, citing tax cuts and expected investment recovery. However, concerns persist as Trump's tariffs on Canada, China, and Mexico continue to unsettle businesses and investors. With the Fed likely on hold, attention turns to this week’s US inflation data. Meanwhile, government funding debates in Congress add further uncertainty, though a shutdown appears unlikely. Markets remain cautious amid shifting fiscal and trade policies.

The Dollar Index could see further near term weakness ahead of this week's inflation data, with USD bears likely to be well supported above 103.4 level for now.

CAD

The Canadian Dollar started the week with a loss, pressured by political uncertainty and trade tensions with the US. The Loonie traded lower against the greenback, while government bond yields also declined. Former central banker Mark Carney won leadership of the Liberal Party, setting up a confrontation with the Trump administration over tariffs and trade policies. Carney vowed to impose retaliatory measures against US tariffs on steel and aluminium, while Ontario announced a surcharge on electricity exports to American states. Markets remain cautious as Canada braces for potential economic and political shifts under Carney’s leadership amid heightened tensions with Washington.

USDCAD’s recent rebound is likely to run into stiff resistance around 1.4600 handle moving forward.

EUR

The Euro held steady on Monday as European leaders debated the risks of seizing frozen Russian assets to support Ukraine. While politically tempting, concerns over legal precedents and investor confidence weigh heavily. ECB President Lagarde warned that international law will shape market perceptions, though final decisions rest with eurozone governments. Meanwhile, the euro’s role as a reserve currency continues to weaken, with its share of global reserves declining to 20%. Fiscal policy is taking centre stage, as European ministers explore joint borrowing to fund defence, a shift reinforced by Trump’s unpredictable trade stance.

Euro bulls could attempt a test of immediate resistance around the 1.0935 level for now.

XAU

Gold declined on Monday as profit-taking outweighed safe haven demand from geopolitical uncertainty. Spot gold fell to $2,889 an ounce after gaining 2% last week. Analysts noted a slight pause but expect potential safe haven bids amid ongoing market risks. Concerns over US tariffs and recession fears could provide support for gold, while investors focus on key US inflation data this week. Expectations of a Fed rate cut in June continue to underpin bullion’s appeal.

The precious metal is likely to be well supported above 2830 for the time being given ongoing economic and geopolitical uncertainty.