Macro Update:

Market selloff pauses on cooler than expected inflation data

Wall Street rebounded after two days of intense selloffs. The US CPI figure came in at 0.2% MoM and 2.8% YoY. The cooler than expected US inflation data boosted hopes for Fed rate cuts, offering relief to investors. Expectations is for the Fed to keep rates steady next week, while the focus will be on the new economic projections. We continue to see 2 more 25bps rate cuts from now to year end, likely in June and December.

Market sentiment was also slightly lifted by optimism over a potential ceasefire in Ukraine. Kyiv signalled its willingness to accept a US-brokered proposal, after the US restored military aid and resumed intelligence sharing with Ukraine. However, trade tensions worsen. President Trump's steel and aluminium tariffs took effect, prompting Canada to impose 25% retaliatory duties on over $20 billion worth of US goods. The EU also responded by announcing counter-tariffs on €26 billion worth of US imports.

Main Upcoming Macro Indicators

Equity Market Updates

US EQUITIES

US stocks advanced on Wednesday, recovering slightly from its recent selloff, as cooler-than-expected inflation data helped offset concerns surrounding President Trump’s trade policies.

EUROPE EQUITIES

Shares in Europe also bounced back on Wednesday on optimism around a potential easing of the Ukraine-Russia conflict, while the US’ cooler inflation data also helped sentiment.

HK EQUITIES

Hong Kong stocks ended lower on Wednesday as investors locked in profits from recent rallies while evaluating the impact of US tariffs.

We are positive on Hong Kong / China equities in the medium term.

Adobe (ADBE US)

Shares of Adobe fell in after-market hours on Wednesday after it provided a slightly disappointing outlook for revenue growth in the current quarter, with sales expected to be between USD5.77B to USD5.82B vs. USD5.80B expected. This is despite the company’s recent focus on monetising its new generative AI features.

Although guidance missed expectations, Adobe reported solid results for FY1Q25, with revenue at USD5.71B vs. USD5.66B expected, and adjusted EPS at USD5.08 vs. USD4.97 expected.

Looking ahead, Adobe is scheduled to host an event for investors some time next week, where it will provide additional financial information and details of its AI strategy. This event is likely to be closely watched by the market.

MARKET CONSENSUS: 33 BUYS, 13 HOLDS, 2 SELLS, AVERAGE TP USD561.88

Roche (ROG SW)

Roche acquired rights to an obesity therapy by Danish biotech firm Zealand Pharma in a collaboration deal worth up to USD5.3B, as the Swiss pharmaceutical company seeks to boost its prospects in the booming weight-loss market.

The deal covering the compound petrelintide, announced by Roche on Wednesday, marks renewed efforts to catch up with weight-loss market leaders Novo Nordisk and Eli Lilly.

Zealand is currently testing petrelintide in overweight or obese individuals without type 2 diabetes in a mid-stage study. Zealand and Roche will jointly commercialize petrelintide in US and Europe, and the Roche will obtain exclusive commercialisation rights in the rest of the world. This collaboration could potentially provide support to Roche's share price in the future.

MARKET CONSENSUS: 15 BUYS, 9 HOLDS, 4 SELLS, AVERAGE TP CHF311.61

Puma (PUM GR)

Shares of Puma fell more than 19% on Wednesday after a forecast of slower growth this year. The company predicts adjusted operating earnings this year to be between EUR520M and EUR600M, down from last year and below analysts’ estimates, citing trade tariffs, currency swings, and geopolitical tensions.

Looking ahead, the outlook raises doubts about whether Puma will be able to achieve its targeted 8.5% operating profit margin by 2027, a goal that the company had already pushed back by two years. This could put downward pressure to Puma’s share.

In terms of results, Puma’s 4Q24 revenue stood at EUR2.29B, in line with expectations, while net income was at EUR24.50M vs. EUR25.37M expected.

MARKET CONSENSUS: 13 BUYS, 14 HOLDS, 1 SELL, AVERAGE TP EUR40.96

Porsche (P911 GR)

Porsche said on Wednesday that its extensive restructuring, as well as trade tensions and intensifying competition in China, will weigh on 2025 earnings, even before accounting for possible higher US tariffs on EU imports.

The luxury carmaker, whose shares dropped sharply last month when it warned its margin this year would hit just 10-12% because of investments in new internal combustion engine and hybrid models, is in the midst of a cost-cutting drive, shrinking its workforce by just under 4,000 jobs and planning further cuts.

MARKET CONSENSUS: 10 BUYS, 14 HOLDS, 3 SELLS, AVERAGE TP EUR64.47

ICBC (601398 CH)

Industrial and Commercial Bank of China, the world's biggest commercial lender by assets, announced on Wednesday the launch of a RMB80B technology and innovation fund to support the private economy.

The new fund aims to support “hard technology” via equity investment, referring to areas such as semiconductors and advanced manufacturing over "soft" technology such as internet services, according to a statement released by the state-owned bank. ICBC will thoroughly implement directives from central leadership by transforming beneficial policies into concrete actions supporting private enterprises.

This move comes after China last week laid out its major policy priorities for 2025 at an annual parliamentary meeting, including how it plans to spur consumption and achieve technological breakthroughs amid geopolitical tensions between China and the US.

MARKET CONSENSUS: 24 BUYS, 4 HOLDS, 1 SELL, AVERAGE TP CNY7.33

Earnings Announcements

US Market

Dollar General, Ultra Beauty

European Market

K+S

HK - China Market

-

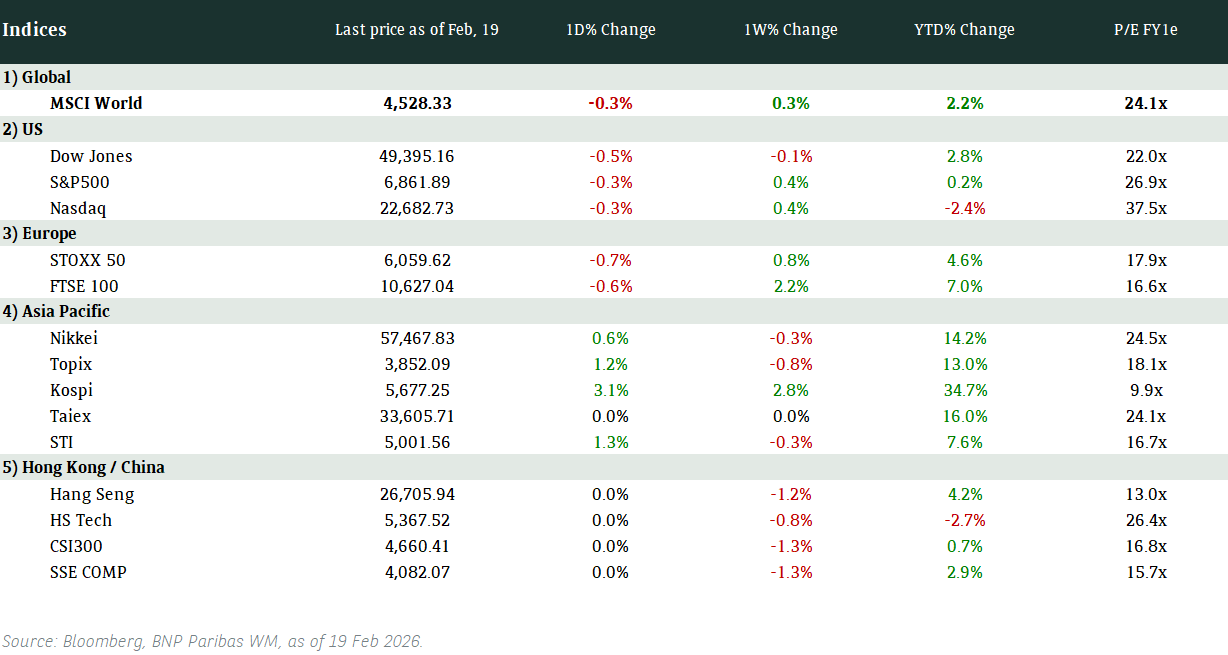

Global Indices Changes (%)

Fixed Income Market Updates

Macro volatility remains elevated with U.S. trade policies being a major driver. A good way to monetise this volatility for additional yield is through structured products.

EUROPEAN BANK COCO (AT1)

Prices of recently issued AT1 bonds and high-beta names went higher during morning trading but the momentum faded as the day progressed. Overall, for EUR-denominated AT1 bonds, prices were 0.125-0.25point off the highs while USD-denominated AT1 bonds fared better with smaller drop in prices. The street still seem to be long inventory for such bonds while investors were not really chasing at those yield levels.

ASIA INVESTMENT GRADE (IG)

Asia IG sovereigns such as Indonesia and Philippines traded 0.375-0.75point lower across the curve due to lack of asset managers' demand while locals were looking at front-end bonds only. In China IG space, Technology, Media and Telecoms names remained the outperformer in 5-year duration while other benchmark names lagged. Bank capital bonds were active in Korea IG with net buying in Korean banks' AT1 bonds.

ASIA HIGH YIELD (HY)

In China HY space, property survivors traded unchanged to slightly lower with asset managers taking profit. Prices of industrial names had stabilised with prices relatively unchanged. Away from China, Adani complex traded 0.25point higher on average after Fitch removed Negative watch on the port. Flows were on the lighter side in HY space in general as investors remained cautious given macro volatility.

Forex Market Updates

The US Dollar held steady as markets assessed trade tensions, inflation concerns, and economic uncertainty, with expectations of stable interest rates and potential cuts later in the year.

USD

The US Dollar held steady as markets assessed trade tensions and the outlook for US inflation. Investors remained cautious ahead of key inflation data, with concerns that rising tariffs could push prices higher while weaker economic indicators might raise recession risks. The latest report showed consumer prices increasing at a slower pace, as lower transportation and energy costs offset gains in housing. However, uncertainty over trade policies and economic growth kept market volatility elevated, with expectations growing that the Federal Reserve will hold rates steady in the near term while leaning toward cuts later in the year.

The Dollar Index looks poised to see more near term weakness, with USD bears likely to target 102.50.

CAD

The Canadian Dollar strengthened on Wednesday after the BoC lowered its key interest rate by 25bps, signalling caution amid rising trade tensions with the US. Governor Macklem warned of economic risks from new tariffs, which have unsettled businesses and consumers. Canada announced retaliatory measures, raising concerns about inflation and slowing growth. The central bank emphasized a careful approach to future rate decisions, balancing inflation pressures with weaker demand. A recent survey highlighted growing job security fears and reduced business investment due to trade uncertainty. Markets remain cautious, with further policy adjustments likely depending on economic conditions in the coming months.

USDCAD looks to be range trading around 1.4176 and 1.4480 level for now.

JPY

The Japanese Yen fell and remained under pressure on Wednesday, as traders positioned for a seasonal USD/JPY rally into Japan’s fiscal year-end. Market sentiment suggests a potential short squeeze, given record short positions in the pair. Japan’s wholesale inflation stayed elevated, reinforcing expectations of a BoJ rate hike, though policymakers remain cautious about economic risks. Rising bond yields reflect market anticipation of further tightening, but global trade uncertainties, including US tariff threats, add to concerns. BOJ Governor Ueda reiterated the need for careful rate adjustments, with markets eyeing potential policy shifts in the coming months amid inflation and wage growth dynamics.

USDJPY could attempt a test of immediate resistance around the 150.00 handle for now.

XAU

Gold strengthened on Wednesday, as safe-haven demand picked up amid persistent trade uncertainties and inflation concerns. The metal gained traction, reflecting its role as a hedge against economic instability, with buyers stepping in to support its momentum. Investors are closely watching upcoming economic data for further direction, but broader concerns over rising costs and trade policies continue to drive demand. While gold remains within a range, heightened uncertainty in global markets reinforces its long-term appeal, keeping sentiment firmly bullish.

Bullion is likely to be well supported above 2835 in the near term.