Macro Update:

Sell off continues as escalating trade tensions spook markets

Wall Street tumbled again on Thursday as investors monitored escalating trade tensions while assessing key economic data. US President Trump threatened a 200% tariff on European wines and spirits, in retaliation for the EU’s planned duties on American whiskey, amplifying concerns over an intensifying trade war. On the data front, producer price inflation data came in softer than expected, reinforcing the cooler CPI report from the previous day, while initial jobless claims stood at 220K, slightly below estimates. The FOMC meeting next week will be widely focused. Market expectations of Fed cuts have increased, but we expect the Fed to hold rates next week, while forecasting 2 more 25bps cuts this year, likely in June and December.

Main Upcoming Macro Indicators

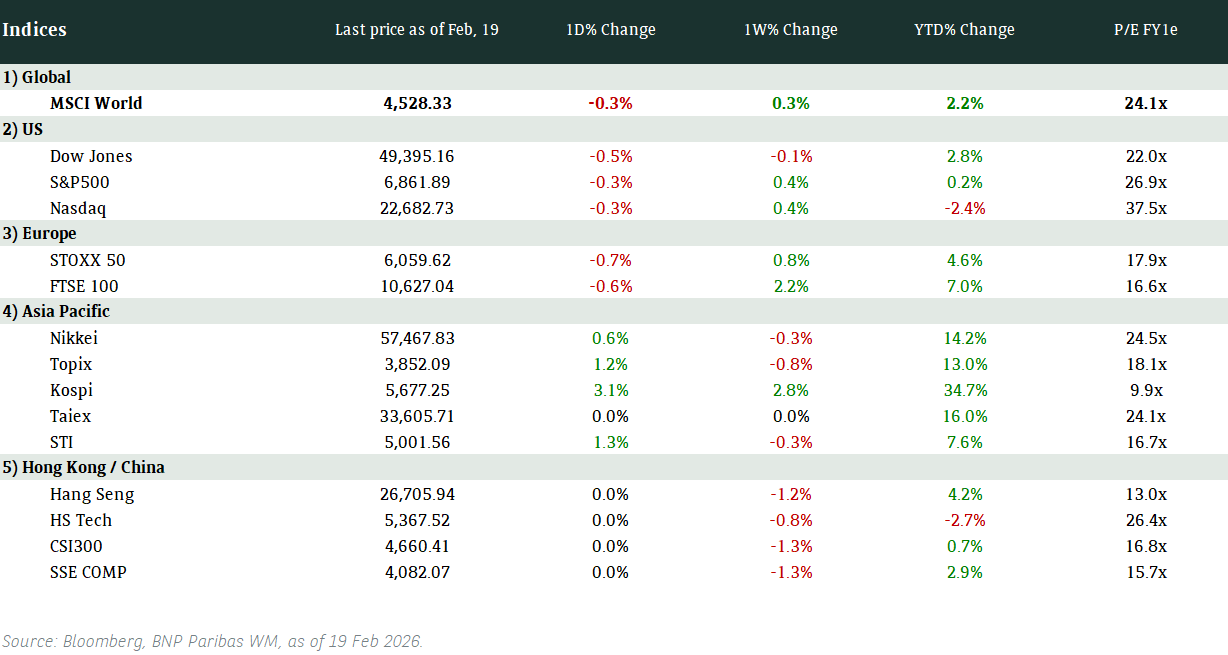

Equity Market Updates

US EQUITIES

US stocks ended sharply lower on Thursday after concerns surrounding an escalating tariff war overshadowed news of cooling inflation in the country.

High volatility in US equities is likely to persist in the short term.

EUROPE EQUITIES

Shares in Europe also traded lower on Thursday after concerns on US trade policy subdued sentiment within the region.

HK EQUITIES

Hong Kong stocks fell on Thursday as tech and AI-related stocks slipped, while tariff concerns prompted investors to adopt a more defensive stance.

Intel (INTC US)

Shares of Intel jumped on Thursday following the appointment of tech veteran Lip-Bu Tan as its new CEO, effective on 18 March 2025. Tan has more than 20 years of experience in the semiconductor and software space. He formerly served as CEO of Cadence Design Systems from 2009 to 2021.

The announcement came on the back of former CEO Pat Gelsinger's retirement in December 2024 after reportedly being forced out by Intel’s board. Tan succeeds interim co-CEOs David Zinsner and Michelle Johnston Holthaus.

Tan’s initiatives to turn Intel around will be key to watch in the next quarters.

MARKET CONSENSUS: 4 BUYS, 40 HOLDS, 5 SELLS, AVERAGE TP USD22.64

Ulta Beauty (ULTA US)

Shares of Ulta Beauty rose in after-market hours on Thursday, recovering all its losses throughout the day, as it announced 4Q24 results that beat expectations, boosted by a robust holiday season.

Ulta’s 4Q24 revenue stood at USD3.49B vs. USD3.46B expected, while EPS was at USD8.46 vs. USD7.12 expected. Nevertheless, the beauty retailer guides for slower-than-expected top- and bottom-line growth this year as it aims to navigate a tougher competitive environment.

Ulta Beauty’s upcoming results announcements will be closely watched by the market.

MARKET CONSENSUS: 15 BUYS, 18 HOLDS, 1 SELL, AVERAGE TP USD450.04

Comcast Corporation (CMCSA US)

Comcast’s NBC division on Thursday extended its TV rights to the Olympics until 2036 in a USD3B deal, locking down the Games for the next decade.

The deal includes not only media rights on all platforms in the US, but also new initiatives and projects, elevating NBC into a strategic partner of the Olympics. This could be supportive to Comcast’s share price going forward.

In the most recent Summer Games in Paris, the Olympics contributed about USD1.3B in advertising revenue to Comcast, with subscribers to its Peacock streaming service rising by about 29% in the quarter that included the Games last year.

MARKET CONSENSUS: 18 BUYS, 15 HOLDS, AVERAGE TP USD43.16

Volkswagen (VOW3 GR)

Volkswagen's core brands, including VW Passenger Cars, Skoda, SEAT/CUPRA and Commercial Vehicles, reported a 4.3% drop in their operating results on Thursday as the carmaker undergoes a restructuring to cut costs.

Its passenger cars brand saw a 27% fall in its operating results, with an operating margin of 2.9%. Still, Czech-based Skoda saw its best-ever financial year with an operating margin of 8.3% and its operating result up 30%.

The cost of new models, upfront costs of reducing personnel in administration and purchase incentives it granted at the start of the year to boost EV sales all dented profitability, the carmaker said.

The Volkswagen Group, which also includes brands like Audi, Porsche and Bentley, reported earlier this week that its operating margin hit 5.9% in 2024 and would at best increase slightly this year given trade tensions and high costs.

MARKET CONSENSUS: 15 BUYS, 8 HOLDS, 3 SELLS, AVERAGE TP EUR117.2

Hugo Boss (BOSS GR)

Hugo Boss said muted consumer sentiment was having an impact on its business in the current quarter as it forecast 2025 sales broadly in line with last year's level on Thursday.

The upmarket fashion company has sought to boost the popularity of its brand through selected marketing investments, while increasing profits by limiting costs, despite weakening consumer demand and a polarization of consumer preferences towards either high-end luxury or cheaper fast-fashion offers.

It sees annual sales development between a 2% decline and a 2% increase, to a range of EUR4.2B to EUR4.4B, following 3% growth to EUR4.3B in 2024.

Looking ahead, how macroeconomic and geopolitical volatilities would impact the business performance will be of investors’ focus.

MARKET CONSENSUS: 10 BUYS, 12 HOLDS, 2 SELLS, AVERAGE TP EUR46.3

Earnings Announcements

US Market

-

European Market

-

HK - China Market

Li Auto

Global Indices Changes (%)

Fixed Income Market Updates

Chinese regulators have asked big four Chinese banks to maintain their existing credit lines to New World Development. While the tone from the top (regulators) seems positive, execution (on individual bank level) remains uncertain. We maintain our cautious outlook on China/ Hong Kong’s property sector.

EUROPEAN BANK COCO (AT1)

Sentiment was weak right from the start of the trading day with recently issued AT1 bonds falling 0.75-1.25point and the rest of the space was down 0.25-0.625point on average. Sentiment deteriorated significantly when US market opened. We have been calling for profit taking in selected AT1 bonds since last week as we believe valuation was tight.

ASIA INVESTMENT GRADE (IG)

Indonesia and Philippines sovereign curves were down 0.5-0.75point with Exchange-Traded-Funds and asset managers being the main sellers. On the other hand, Hong Kong names such as AIA and CK Hutchinson saw their bonds trading 1-3bps tigher on demand from asset managers. In Korea, names such as SK Hynix and Shinhan Financials saw buyers.

ASIA HIGH YIELD (HY)

In China HY space, bonds were holding up despite the move in equities. Property and Industrial names traded broadly unchanged with selective pocket of interest from asset managers. Outside of China, Adani complex traded 0.25-0.5point higher while the rest of the space traded largely unchanged to a slightly higher led by some buying in the Non-Bank Financials space.

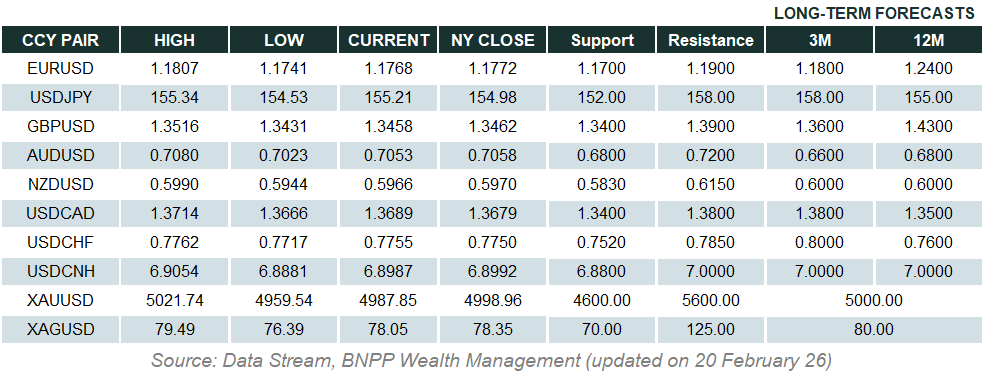

Forex Market Updates

The U.S. dollar rose slightly against most major currencies on Thursday as investors enter a consolidation period after large weakening moves in the previous days and weeks.

USD

The US Dollar rose against most major currencies on Thursday, as investors consolidated positions after selling the greenback for most of this week, but the outlook remained weak amid concerns about slowing growth arising from the Trump administration's trade policies. Trump threatened a 200% tariff on wine, cognac and other alcohol imports from Europe and counter-tariffs on $28 billion worth of U.S. imports from next month after Euro’s retaliation. Moreover, U.S. PPI was unexpectedly unchanged in February, although the tariffs are unlikely to keep prices down in the coming months. Analysts expect further dollar consolidation and rebound, but it will depend on how much the trade policy and tariffs take precedence over the drivers of dollar weakness.

The Dollar Index could see some consolidation between 103.50 and 105.00 moving forward.

GBP

The British pound fell slightly against a firmer dollar on Thursday but remained close to four-month highs, bolstered by the UK's relatively measured approach to U.S. trade ructions. Britain's government did not follow the EU and Canada’s retaliations against Trump's 25% tariffs on all steel and aluminum imports on Wednesday. Analysts highlighted Britain's largely balanced trade position with the U.S., so is not as vulnerable to US tariffs as the European Union, which offers a supportive factor for the pound.

Sterling bulls could attempt another near term push higher towards immediate resistance around 1.3300.

CNH

China's yuan firmed against the dollar on Thursday, underpinned by a rise in domestic bond yields as investors assessed the impact of an escalating global trade war. In addition, recent weakness in the dollar and the success of local startup DeepSeek as reasons behind improved risk sentiment also supports the yuan. However, analysts said the persistence of recent trend is uncertain as Renminbi’s fundamentals remain weak. The trend of stronger yuan and higher bond yields will be more sustainable if domestic demand picks up.

USDCNH looks poised for a period of consolidation between 7.2200 and 7.2600 for now.

XAU

Gold prices raced to a record high within touching distance of the key milestone of $3,000 per ounce on Thursday, with momentum driven by elevated tariff uncertainty and bets on monetary policy easing by the U.S. Federal Reserve. Analysts say Gold is in a secular bull market now and forecast prices to trade between $3,000-$3,200 in 2025 amid Trump's fluctuating trade policies. Focus now turn to the Fed meeting next Wednesday, which market expects it will keep its benchmark overnight interest rate in the 4.25%-4.50% range.

The precious metal is eyeing the psychological barrier of 3000 as the next target.