Equity Market Updates

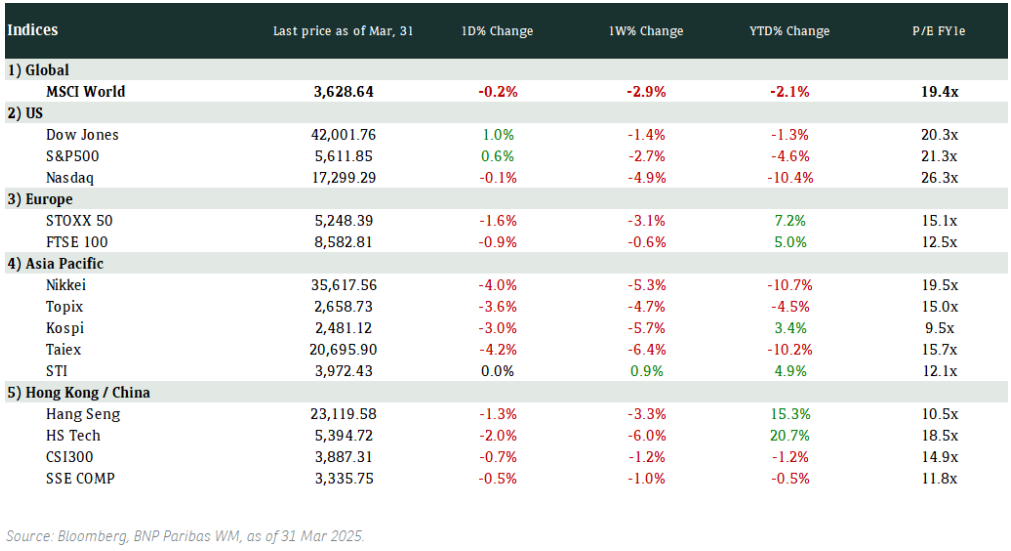

US stocks posted their worst quarter since 2022 on threat of trade war although the S&P 500 and Dow Jones reversed early losses and ended with small gains last night. Trump has offered conflicting signals about the scope of the expected tariffs, but tariff fears hit stocks in Asia and Europe. Trump had raised the possibility that many countries could receive “breaks”, but over the weekend, he appeared to be leaning toward a more wide-ranging plan. Within Asia, China and India stock markets are more domestically orientated, while Japan and Taiwan stock markets are more internationally exposed to the deteriorating outlook.

Equity Market Updates

Major US stock indices traded mostly higher at the closing bell on Monday, with the Dow Jones and S&P 500 clawing back previous losses as investors braced for the upcoming tariffs announcement.

European shares closed lower in Monday trading as investors brace for impending US tariffs.

Auto sector fell sharply on fears of significant auto tariffs.

Hong Kong stocks fell on Monday as sentiment remained weak while investors braced for US reciprocal tariffs set for Wednesday.

Intel (INTC US)

Intel’s new CEO Lip-Bu Tan delivered his first keynote at Intel Vision in Las Vegas, announcing plans to spin off Intel's non-core businesses, possibly later this year, as part of a strategic shift. He outlined Intel's priorities, including advancing client computing, expanding AI applications and strengthening data center capabilities.

The CEO refuse to “sugarcoat” 2024’s results and vows to focus on solutions that will enhance the long term performance of the form.

Moving forward, he said Intel will prioritize developing custom silicon products. He also emphasized the company's goal of building the industry's broadest ecosystem of AI software and driving AI adoption at the edge.

Intel’s share price had positive returns YTD on Lip’s appointment but a stable upwards trend would depend on how the firm manage the turnaround.

MARKET CONSENSUS: 4 BUYS, 40 HOLDS, 5 SELLS, AVERAGE TP USD22.58

AMD (AMD US)

AMD announced on Monday that it completed its $4.9B acquisition of ZT Systems, which will facilitate "a new class of AI solutions integrating AMD CPU, GPU, networking silicon, ROCm software, and rack-scale systems."

"Acquiring ZT Systems is a significant milestone in our AI strategy to deliver leadership training and inferencing solutions that are optimized for our customers' unique environment, ready-to-deploy at scale, and based on our open ecosystem approach that combines open-source software, industry-standard networking technologies and now ZT Systems' leadership systems design and customer enablement expertise," the firm said.

MARKET CONSENSUS: 47 BUYS, 18 HOLDS, 1 SELL, AVERAGE TP USD144.5

Apple (AAPL US)

French antitrust regulators fined Apple EUR150M for abusing its market dominance through the App Tracking Transparency (ATT) tool. The fine marks the first global antitrust penalty related to the feature, which controls how third-party apps track users on Apple devices.

Apple said it is disappointed with the decision and that the regulator hasn’t asked for specific changes to the ATT framework.

The outcome could attract the attention of US President Trump, who has warned he would strike back with heavy tariffs following any “disproportionate” penalties against American tech firms.

MARKET CONSENSUS: 34 BUYS, 18 HOLDS, 5 SELLS, AVERAGE TP USD252.61

Johnson & Johnson (JNJ US)

A federal judge rejected J&J’s 3rd attempt to use bankruptcy to set up a trust fund to pay women who claim they got cancer using baby powder and other products allegedly tainted with a toxic substance.

The judge dismissed the bankruptcy of a small J&J unit called Red River Talc, finding that a vote of cancer victims on the proposal was flawed.

J&J was trying to set aside $9B for victims, but the judge rejected the proposal, which could be reviewed by an appeals court.

MARKET CONSENSUS: 13 BUYS, 14 HOLDS, AVERAGE TP USD170.054

Baidu (BIDU US)

Baidu touts AI speech language model that will lower the industry average inference cost for voice chats by 50-90%, the firm said.

The new AI model powers Baidu’s Ernie Bot, allowing users to interact with the chatbot with voice calls or messages. Its Ernie Bot app has been upgraded to include Baidu’s new flagship models and DeepSeek R1.

MARKET CONSENSUS: 25 BUYS, 14 HOLDS, 1 SELL, AVERAGE TP USD110.63

Earnings Announcements

-

Global Indices Changes (%)

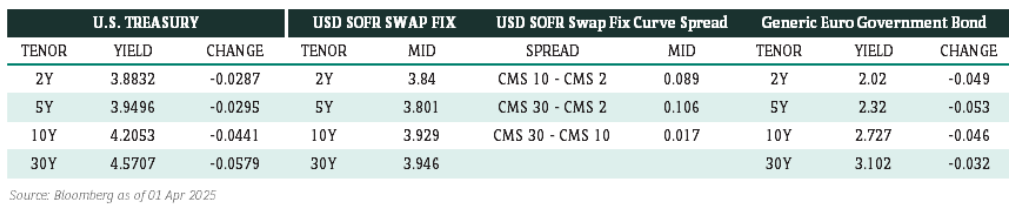

Fixed Income Market Updates

Credit spreads have widened across USD, Euros, and Sterling markets as we approach Trump’s tariff on Wednesday, creating near-term event risks. We anticipate that the correction in credit spreads, fuelled by a rally in rates, will persist amid growing US recession concerns, presenting a favourable buying opportunity for high-quality names.

EUROPEAN BANK COCO (AT1)

Market for European Bank AT1 moved lower in general in response to tariffs but there was no panic selling. Investors were trimming risk positions. Prices were stable on Friday and slightly wider on spread. The recently issued EUR-denominated AT1 bond by Deutsche Bank was the first to be hit with the bonds down more initially but recovered to trade more in line with market. USD-denominated AT1 bonds traded lower as well..

ASIA INVESTMENT GRADE (IG)

We saw material risk-off in New York to finish last week. IG widened 3-7 bps (basis points wider) and we expect a soft tone this week in Asia as well. As mentioned, Bloomberg reported that China had told State-Owned Enterprises to hold off on any new collaboration with businesses linked to Li Ka-Shing and his family, which led CK Hutchison and Hutchison Ports to trade 10-20bps wider and FWD traded 1.5-2points lower.

ASIA HIGH YIELD (HY)

In Asia HY space, Macau gaming and India HY caught a bid but we expect spreads to be wider this week given the weak macro tone. Away from China, Mongolian Mining's 8.44% 5-year non-call 3-year newly issued bond traded 1point lower at market opened and went even lower before bottom fishers came in.

Forex Market Updates

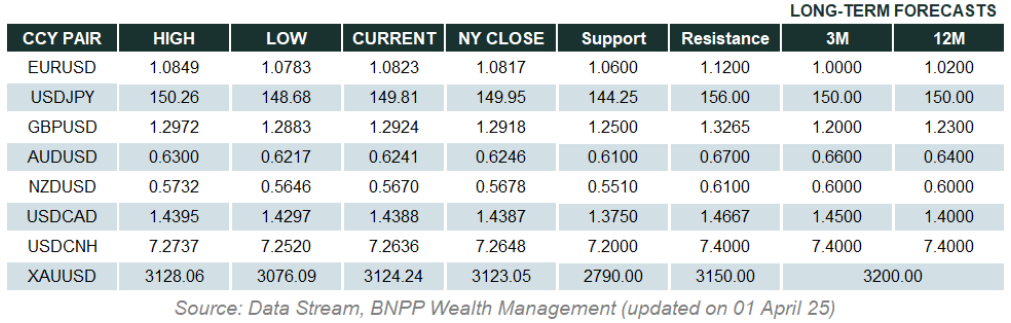

The dollar rose against the yen and the euro on Monday but faced its steepest quarterly drop since mid-2024 due to US tariffs uncertainties.

USD

The US Dollar strengthened against the Japanese yen and the euro on Monday but was set for its largest quarterly decline since July 2024, as uncertainty around U.S. tariffs kept traders mostly on the sidelines waiting for clarity on Trump's trade policies. Trump said on Sunday that essentially all countries will be slapped with duties this week. Along with tariffs, investors are also waiting several economic reports, including jobs and payrolls data, that could shed much-needed light on how the US economy is holding up under a second Trump presidency. As tariffs roil the global economy, some financial institutions raised the probability of a US recession to 35% from 20%. There are also some expectations of three interest rate cuts each from the Fed, up from the previous expectation of two cuts.

The Dollar Index could see some consolidation between 103.40 and 104.67 moving forward.

CAD

The CAD weakened against its US counterpart on Monday, giving back some monthly gains, as investors grew risk-averse ahead of US trade tariffs expected to be unveiled this week. Meanwhile, the price of oil, a major Canadian export, rose 3.2% to $71.58 a barrel after Trump threatened to impose more tariffs on Russia and to possibly attack Iran. For March, the Canadian dollar was up 0.6%, extending its recovery from a 22-year low last month. Analysts said the loonie overall had its initial moves very early on in the (trade war) cycle and the focus has turned recently to how US tariffs will impact other countries, such as those in Europe.

The USDCAD could attempt another near-term push higher towards immediate resistance around 1.4450.

CNH

The Chinese Yuan inched higher from a three-week low against the dollar on Monday, as markets awaited clarity from Trump's reciprocal tariff plan with some economists expecting limited impact on China. Although analysts don't expect a "major" reciprocal tariff announcement targeting China, they still see an escalation of US-China trade disputes following the America First Trade Policy review. Meanwhile, a separate potential 25% tariff on all goods from countries importing Venezuelan oil poses a risk for China. The PBoC has set its official guidance on the firmer side of market projections since mid-November, which is a sign of unease over the yuan's decline. Markets are waiting for more clarity on US tariffs and its influence on China’s export growth.

Renminbi may consolidate around the current level and fluctuate between 7.2500 and 7.2800 in the short term.

XAU

Gold prices extended their stellar run on Monday, topping $3,100/oz to hit another record high, as uncertainty around tariffs that would stoke inflation and hinder economic growth lifted safe-haven demand and kept bullion on course for its strongest quarter since 1986. Analysts said there are certain technical areas of resistance along the way that could cause a little profit-taking or pullback. But the fundamentals remain strong. Bullion has gained around 18% so far this year, supported by a favorable monetary policy backdrop, robust central bank buying and demand for exchange-traded funds. Wall Street big banks have raised their outlook on gold prices, with some expecting gold to surpass $4,500 within the next 12 months under extreme market conditions.

The precious metal is eyeing a new all-time-high level around 3,150 as the next target.

Please read carefully the disclaimer here:

Asia Disclaimer:

https://wealthmanagement.bnpparibas/asia/en/disclaimer1.html

Europe Disclaimer:

https://wealthmanagement.bnpparibas/ch/en/disclaimer.html