Please read carefully the disclaimer here:

Asia Disclaimer:

https://wealthmanagement.bnpparibas/asia/en/disclaimer1.html

Europe Disclaimer:

https://wealthmanagement.bnpparibas/ch/en/disclaimer.html

China’s Caixin manufacturing PMI reached a 4-month high of 51.2 in March, due to fiscal support and some front-loading ahead of US tariffs. On the contrary, US ISM manufacturing fell to 49 in March from 50.3 in February. All eyes are on Trump’s reciprocal tariff announcement on the “Liberation Day” today.

Equity Market Updates

US indices ended Tuesday mostly higher in a volatile session as investors awaited clarity on tariff rollout, while weaker than expected economic data added to market pressure.

A rally in the tech sector lifted the stock market.

European stocks closed higher on Tuesday as investors focused on upcoming US tariffs, with tech and industrials outperforming.

Fresh data showed easing inflation and improving factory activity in the Eurozone.

Hong Kong equities closed higher on Tuesday, rebounding from a 4-week low on strong China manufacturing data that showed expansion at the fastest pace in 4 months.

We remain positive on the Hong Kong and China equities market although tariff talks are still expected to cause volatility in the market.

Xiaomi (1810 HK)

Xiaomi’s SU7 EV was involved in a fatal accident on an expressway in China, sparking scrutiny over its smart driving software. Shares dipped 5.5% on close Tuesday.

Shares have slumped almost 18% since Xiaomi raised about $5.5B in an equity sale last week to help fund an expansion of its EV business.

According to Xiaomi’s initial report, the car’s advanced driver assistance function had been engaged less than 20 minutes before the crash. Seconds after another warning and the driver then retook control of the wheel, the crash happened.

Accidents like such is expected to put pressure on car makers, especially as the market expects autonomous driving to be the next big catalyst.

MARKET CONSENSUS: 51 BUYS, 3 HOLDS, 1 SELL, AVERAGE TP HKD62.39

XPeng (9868 HK)

XPeng in March delivered 33,205 smart EVs, marking a 268% increase YoY, surpassing 30,000 units for the 5th consecutive month. For 1Q25, XPeng delivered 94,008 smart EVs, representing a 331% increase compared to the same period last year.

Shares rallied approximately 5.6% on Tuesday.

Overall China EV sales rebounded in March from the seasonally slow Jan-Feb period, affected by Chinese New Year holidays. Sales should continue to trend higher in the spring, with automakers rolling out new and refreshed models.

MARKET CONSENSUS: 32 BUYS, 5 HOLDS, AVERAGE TP HKD106.44

SoftBank (9984 JP)

SoftBank group is seeking a $16.5B loan to fund AI investments in the US, which would be its largest ever borrowing denominated solely in dollars. The loan would help finance a $500B AI infrastructure project in the US, as well as a $40B funding round in OpenAI.

2 rating companies have warned that SoftBank’s financing needs could result in financial strains, with one changing its rating outlook to negative and the other predicting a worsening financial position for the next 6 months to a year.

MARKET CONSENSUS: 17 BUYS, 6 HOLDS, AVERAGE TP JPY11897.44

Visa (V US)

Visa reportedly put forward a $100M offer to Apple to become the tech business' credit card network.

The position is currently free, as Goldman Sachs, Apple's previous credit card issuer, no longer wants to be a part of the consumer lending world. The tech giant will first pick a network and then an issuer to replace Goldman Sachs. According to the sources, Visa offered an upfront payment.

Visa offered a similar payment when Costco was selecting its network about a decade ago.

MARKET CONSENSUS: 39 BUYS, 7 HOLDS, 1 SELL, AVERAGE TP USD384.08

Alibaba (BABA US)

Alibaba reportedly is planning to release Qwen 3, an upgraded version of its flagship AI model, as soon as this month with competition from rivals including OpenAI and DeepSeek heating up.

Alibaba has been releasing AI products actively since going all-in on the technology this year. The firm came out with a new model in its Qwen 2.5 series just a week ago that can process text, pictures, audio and video – and is efficient enough to run directly on mobile phones and laptops. Last month, it also unveiled a new version of the AI assistant Quark app.

AI development remains a significant catalyst for Alibaba and speed to market, coupled with user-friendliness and accuracy, remains paramount to the models.

MARKET CONSENSUS: 45 BUYS, 4 HOLDS, AVERAGE TP USD165.84

Earnings Announcements

Kweichow Moutai

Global Indices Changes (%)

Fixed Income Market Updates

Regal Hotel announced they will defer coupon for its USD perpetual bond due to deteriorating cash flow from its HK hotel portfolio. We believe many highly leveraged HK developers may also face similar liquidity pressure. We could see more HK developers looking to defer perpetual bond coupon. We thus suggest reducing exposures as we believe the sector's credit fundamentals will take time to recover.

EUROPEAN BANK COCO (AT1)

European bank coco continued to go lower. General market tone was heavy and bond prices were 0.25-0.50 points lower. The Bloomberg European Bank Coco Tier 1 Index was also wider by 13 basis points last week. We reiterate our view that coco bond valuation is expensive. We expect to see more correction.

ASIA INVESTMENT GRADE (IG)

It was a quiet session for Asia IG as both Philippines and Indonesia were on holiday. Credit spread was 1-2 basis points wider. We saw more selling from institutional investors to hold more cash ahead of Trump’s US Liberation Day. HK IG was weaker after US sanction news. Spread was 2-3 basis points wider. Hysan Perpetual bond was another 0.375 points lower. We expect the weak momentum for HK IG to stay due to the headline risks.

ASIA HIGH YIELD (HY)

China HY was weaker. China Vanke was 0.25-1 points lower after the weak result. Future Land was down 1-1.5 points after the news about its sister company’s stock suspension. Outside of China, India and Indonesia HY were also weak and we generally saw more selling from institutional investors. Overall, market sentiment remains weak for the space and we remain cautious on Asia HY bonds. We expect to see more weakness.

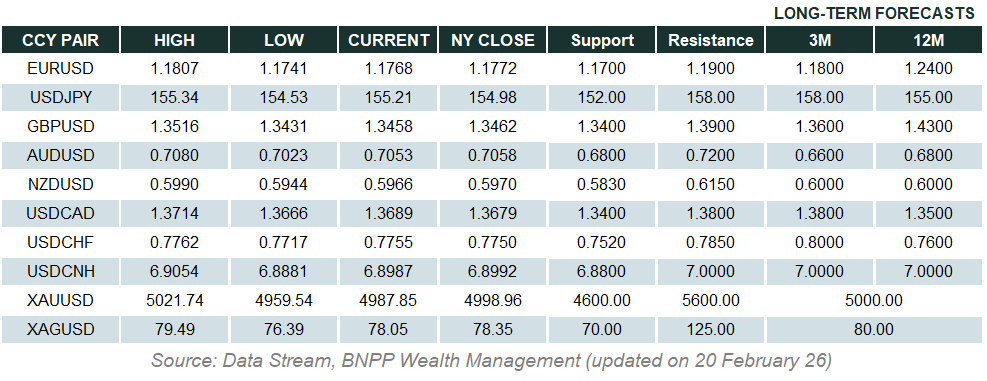

Forex Market Updates

The US Dollar saw muted price action on Tuesday ahead of Trump’s “Liberation Day”.

USD

The US Dollar was little changed against a basket of other major currencies on Tuesday after the White House confirmed that US President Trump will go ahead and impose new tariffs on Wednesday, though it provided little detail about the size and scope of the trade barriers that have markets fretting about an intensifying global trade war. Economists at the Atlanta Fed said a recent survey showed that corporate finance chiefs expect Trump’s tariffs to push prices higher this year while cutting into hiring and growth. On the central bank front, Fed policymaker Goolsbee said that while the “hard data” shows the underlying US economy is solid, with a strong labour market and inflation down from its 2022 peak, the imposition of a broad new set of tariffs could lead to renewed inflation or an economic slowdown. Separately, Fed official Barkin said that he is concerned that the tariffs will push up prices and hurt the job market.

The Dollar Index should see some consolidation above 103.35 for the time being.

GBP

The British Pound traded mostly sideways yesterday within a 0.5% intraday range after UK PM Starmer said that talks with the US on a trade agreement that would help Britain avoid being hit by Trump’s import tariffs were “well advanced”. Analysts are largely in consensus that the UK will escape the worse excesses of Trump’s tariffs, largely due to the UK’s relatively benign trade position vis-à-vis the US, which should keep the GBP better supported relative to other currencies. On the data front, UK Manufacturing PMI figures slid to their lowest since 2023 as British manufacturers endured a torrid March under the spectre of US tariff threats and looming tax increases at home. Elsewhere, BoE policymaker Greene revealed her concern about increases in the public’s expectations for future inflation, but added that they remained anchored.

Sterling should see some near term consolidation between 1.2800 and 1.3000.

AUD

The Australian Dollar halted a run of three consecutive days of losses after the RBA left interest rates unchanged as widely expected in a policy meeting overshadowed by rising concerns of a global trade war. The central bank’s statement assumed a slightly dovish tilt, dropping an explicit reference to being cautious about cutting rates again and omitting a sentence that upside risks to inflation remain, while RBA Governor Bullock added that “at the moment it seems prudent to wait and get a bit more data”. While analysts say that the Aussie economy has moved past its worst, the outlook has been clouded by the spectre of a global trade war ahead of US President Trump’s “Liberation Day”, especially as Australia is a major exporter of resources to China and tariffs on the world’s second-largest economy could hinder growth there and weigh on its demand for commodities.

Ongoing trade war concerns are likely to keep a lid on potential Aussie strength moving forward, with stiff resistance expected around 0.6400.

XAU

Gold prices broke to a fresh record high for the third straight day with psychological levels swept aside by strong safe haven demand on worries about the fallout from impending US tariffs. Also supporting the precious metal’s extraordinary rally are strong demand from central banks, expectations of Fed rate cuts this year and geopolitical instability in the Middle East and Europe. The good news for gold bulls is that given the current macroeconomic environment, analysts say that a continuation of this trend “appears sustainable in the near term”. Data released by the World Gold Council last week also reflected the surging investor appetite for bullion, with February seeing the largest inflows into gold-backed ETFs since March 2022.

Given the array of supportive factors, gold bulls are likely to target the 3,200 level going forward.

Please read carefully the disclaimer here:

Asia Disclaimer:

https://wealthmanagement.bnpparibas/asia/en/disclaimer1.html

Europe Disclaimer:

https://wealthmanagement.bnpparibas/ch/en/disclaimer.html