Equity Market Updates

Key in the short-term will be any negotiations by Trump administration on the new tariff levels ahead of the two deadlines of April 5th and April 9th. Short-term there is still valuation issues for the US market and the magnificent 7 derating which began last year in peak AI capex continues. Furthermore, the market will be watching for any new clues from Chair Powell. Stay diversified across asset classes and Treasuries continue to be an excellent hedge for equity allocations.

Equity Market Updates

US equities plunged by the most since the depths of the pandemic as drastic new trade tariffs ignited fears. Russell 2000 dropped into a technical bear after losing more than 20% compared with its record in late 2021.

European stocks suffered their worst day in 8 months after US announced the steepest tariffs in a century, including a 20% rate for the European Union.

Investors are expected to turn to safe havens and defensive shares.

Hong Kong stocks plummeted on Thursday as investors confidence took a hit after US president Trump introduced an additional 34% reciprocal tariff on China. Total US tariffs on imports from China now stand at 54%.

Nintendo (7974 JP)

Nintendo will release its new Switch 2 console on June 5, starting at $450 in the US, an increase from the $300 the company charged for the original Switch.

The company’s first entirely new platform in 8 years, the Switch 2 has the potential to lift sales for game makers and retailers after what has been a lackluster 3 years for the industry.

Shares of Nintendo fell Thursday, part of a broader selloff on fears that tariffs announced by President Trump would harm Asian exporters. Some of Nintendo’s consoles are assembled in Vietnam and Cambodia, which are facing particularly high levies.

MARKET CONSENSUS: 21 BUYS, 9 HOLDS, 2 SELLS, AVERAGE TP JPY11561.3

Siemens (SIE GR)

Siemens has agreed to acquire Dotmatics for $5.1B to provide more AI software to life sciences companies. The transaction is expected to close in 1H26.

The German manufacturer has been exiting heavy equipment businesses and shifting its focus to software to improve profitability. In March, it completed the acquisition of industrial simulation software maker Altair Engineering for an enterprise value of about $10B.

MARKET CONSENSUS: 20 BUYS, 5 HOLDS, 2 SELLS, AVERAGE TP EUR239.21

Volkswagen (VOW3 GY)

Volkswagen plans to add import fees to the sticker prices of its vehicles shipped into the US, indicating Trump’s 25% auto tariffs will have an immediate effect on Europe’s biggest carmaker.

The carmaker reportedly sent US dealers a memo informing them of the fees, as well as moves to temporarily halt shipments of vehicles from Mexico and hold at port cats shipped from Europe.

MARKET CONSENSUS: 16 BUYS, 7 HOLDS, 2 SELLS, AVERAGE TP EUR121.87

Microsoft (MSFT US)

Microsoft has reportedly pulled back on data center projects around the world, suggesting that the company is taking a harder look at its plans to build server farms. The firm has recently halted talks for, or delayed the development of, sites in Indonesia, the UK, Australia, Illinois , North Dakota and Wisconsin, the report added.

Microsoft acknowledged making changes to its data center plans but declined to discuss most of the projects.

MARKET CONSENSUS: 66 BUYS, 5 HOLDS, AVERAGE TP USD505.16

Amazon (AMZN US)

Amazon reportedly anticipates that its AI powered shopping assistant, Rufus, will indirectly add over USD700M to its operating profit this year.

Rufus, integrated into the Amazon Shopping app and website, enhances the shopping experience by answering customer queries and providing product recommendations. While it does not generate direct revenue, its impact is measured through Amazon’s "downstream impact" (DSI) metric, which tracks additional consumer spending driven by a product or service.

MARKET CONSENSUS: 78 BUYS, 4 HOLDS, AVERAGE TP USD267.07

Earnings Announcements

-

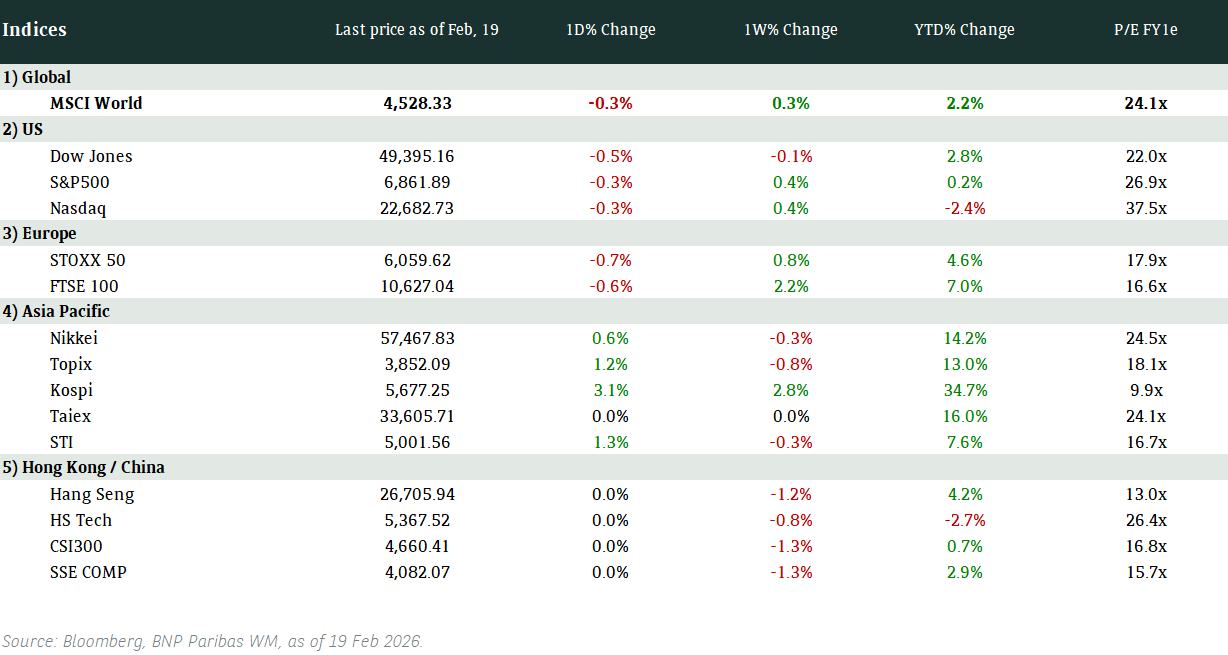

Global Indices Changes (%)

Fixed Income Market Updates

Everything, Everywhere, all at Once - the Tariff edition appeared to be a horror movie on the Asian open. However despite Equity and Rates markets suffering PTSD (Post Tariff Significantly Down) the overall credit market remained fairly stable after an initial widening. For the moment we continue to view tariffs as impacting earnings instead of credit and would look to opportunistically add on dips.

EUROPEAN BANK COCO (AT1)

Massive risk-off sentiment led to weakness in the European Banks AT1 space. USD-denominated AT1 bonds were down 0.375-1point over with credit spreads widening 20-35bps. EUR-denominated AT1 bonds were down 0.375-1.375point overall with the recent Deutsche Bank AT1 bond underperforming the most. Societe Generale AT1 bonds traded heavy as well.

ASIA INVESTMENT GRADE (IG)

"Liberation day" also liberated credit spreads from their tight levels. In China IG space, State-Owned Enterprises were around 5bps wider while Technology, Media and Telecoms names widened 8-10bps. There was a string of upgrades in the Chinese Technology names such as Meituan, Xiaomi. We have been positive on Chinese Technology names for awhile now and continue to favour this sector.

ASIA HIGH YIELD (HY)

China HY property seemed to outperform on a rare occasion with the space trading mostly unchanged to slightly lower despite regional equities markets all in the red. New World Development traded 1-2points lower on the back of hedge funds selling. Outside of China, benchmark renewable and non-bank financial names in India HY space traded around 0.5-1.25point lower before attracting bottom-fishers.

Forex Market Updates

The US Dollar fell sharply on Thursday due to fears of a global trade war, recession risks, and expectations for Fed rate cuts, down nearly 4% this year.

USD

The US Dollar fell broadly on Thursday against a basket of other major currencies, as investors reacted to President Donald Trump's sweeping tariffs, which raised fears of a global trade war and recession risks. The greenback weakened as concerns over inflation and economic slowdown fuelled expectations for Fed rate cuts. The Dollar Index is down nearly 4% this year, marking its worst start since 2016. Uncertainty over potential global retaliation has added to market jitters, with markets closely watching upcoming economic data and Fed signals for further direction.

The Dollar Index could see further near term weakness, with USD bears likely to be well supported above 100.20 for the time being.

CNH

The Chinese Yuan strengthened against the US Dollar on Thursday, despite President Trump's announcement of a 34% tariff on Chinese imports. The yuan closed at 7.2784 per dollar in late New York session, recovering slightly as China's central bank maintained its efforts to stabilize the currency. While concerns over the tariff increase and its potential economic fallout persist, China's intervention in the market helped offset some of the depreciation pressure. Markets are closely monitoring the ongoing developments and the response from China as the trade tensions continue to weigh on the currency’s outlook.

USDCNH could be well supported above 7.2250 for the time being.

EUR

The Euro surged around 2% against the Dollar on Thursday, marking its best performance in over nine years, as President Donald Trump’s announcement of harsher tariffs sent shockwaves through markets. The euro reached a six-month high of $1.1144, with concerns about a global trade war and recession fears driving markets toward safer assets. The euro zone saw modest growth in March, with its PMI rising to 50.9. However, fears linger that the impact of US tariffs could derail the region's recovery. With US tariffs looming, the ECB is expected to cut its deposit rate further at its next meeting on April 17.

The common currency could test its next resistance level around 1.1185 for now.

XAU

Gold fell on Thursday, retreating from an all-time high as market selloffs triggered by President Trump's tariffs weighed on bullion. Spot gold closed at $3,112.83, after earlier reaching a record $3,167.57. The dip was attributed to profit-taking and margin calls in other markets, forcing some investors to sell gold holdings. Despite the pullback, gold’s overall upward trend remains strong, having gained over $500 this year. Central bank buying is expected to continue supporting gold’s rally, with prices forecast to average $3,015 in 2025. Silver, platinum, and palladium also saw declines.

Given the array of supportive factors, gold bulls are likely to target the 3,200 level going forward.

Please read carefully the disclaimer here:

Asia Disclaimer:

https://wealthmanagement.bnpparibas/asia/en/disclaimer1.html

Europe Disclaimer:

https://wealthmanagement.bnpparibas/ch/en/disclaimer.html