Summary

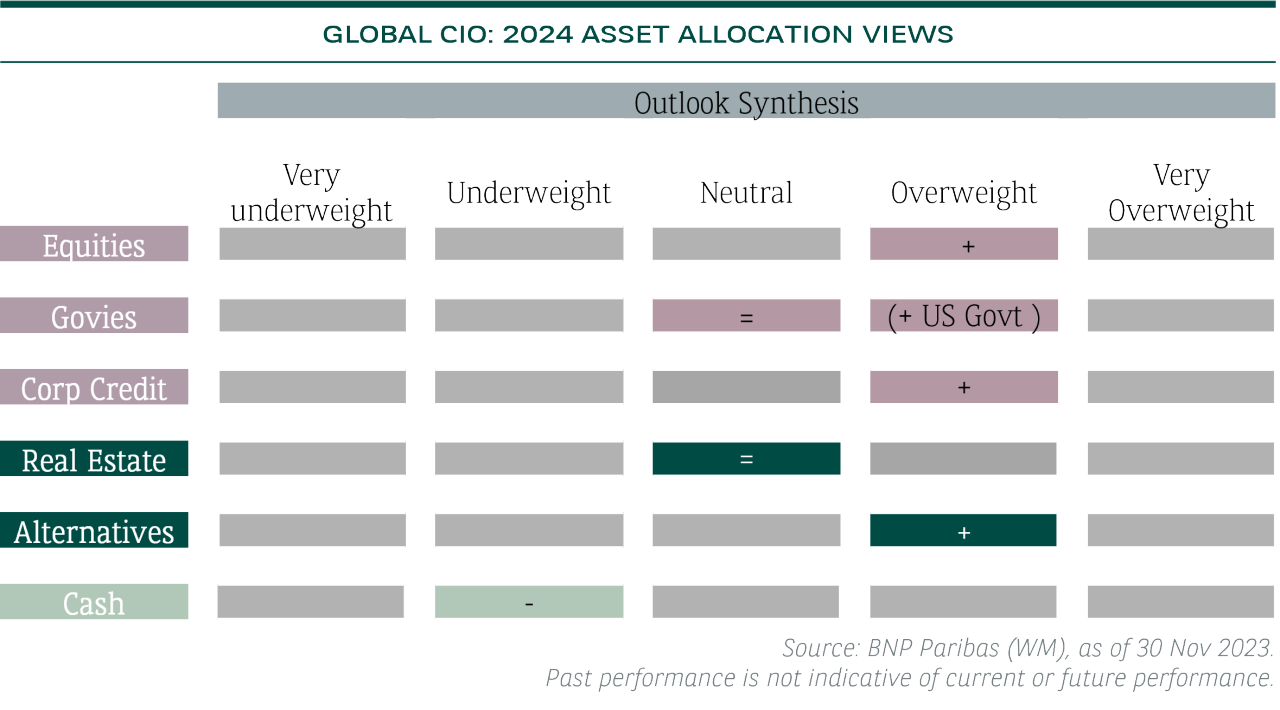

- Going into 2024, we remain overweight in global equities, US government bonds and corporate credit, although 2024 is the biggest election year in history.

- Economic growth and inflation often play a far more important role on the economy and markets in the medium term than elections. However, government policy changes, e.g. fiscal spending, tax cuts/rises, healthcare, energy and climate policy, can have a longer-term impact.

- We believe investors should look beyond the election uncertainty and be prepared to face volatility with a well diversified portfolio that includes alternative investments.

- A US downturn in 1H 2024 is still our base case scenario. That said, any heavy sell-off in US equities as well as bonds would be good buying opportunities as a slowing labour market and softer inflation would allow the Federal Reserve (Fed) to “pivot”.

- Volatility also creates opportunity. Investors can monetise the volatility and play some of our 2024 investment themes via structured solutions which offers tailored risk/reward opportunities.

2023 Review: Non-consensus Global Equity Overweight

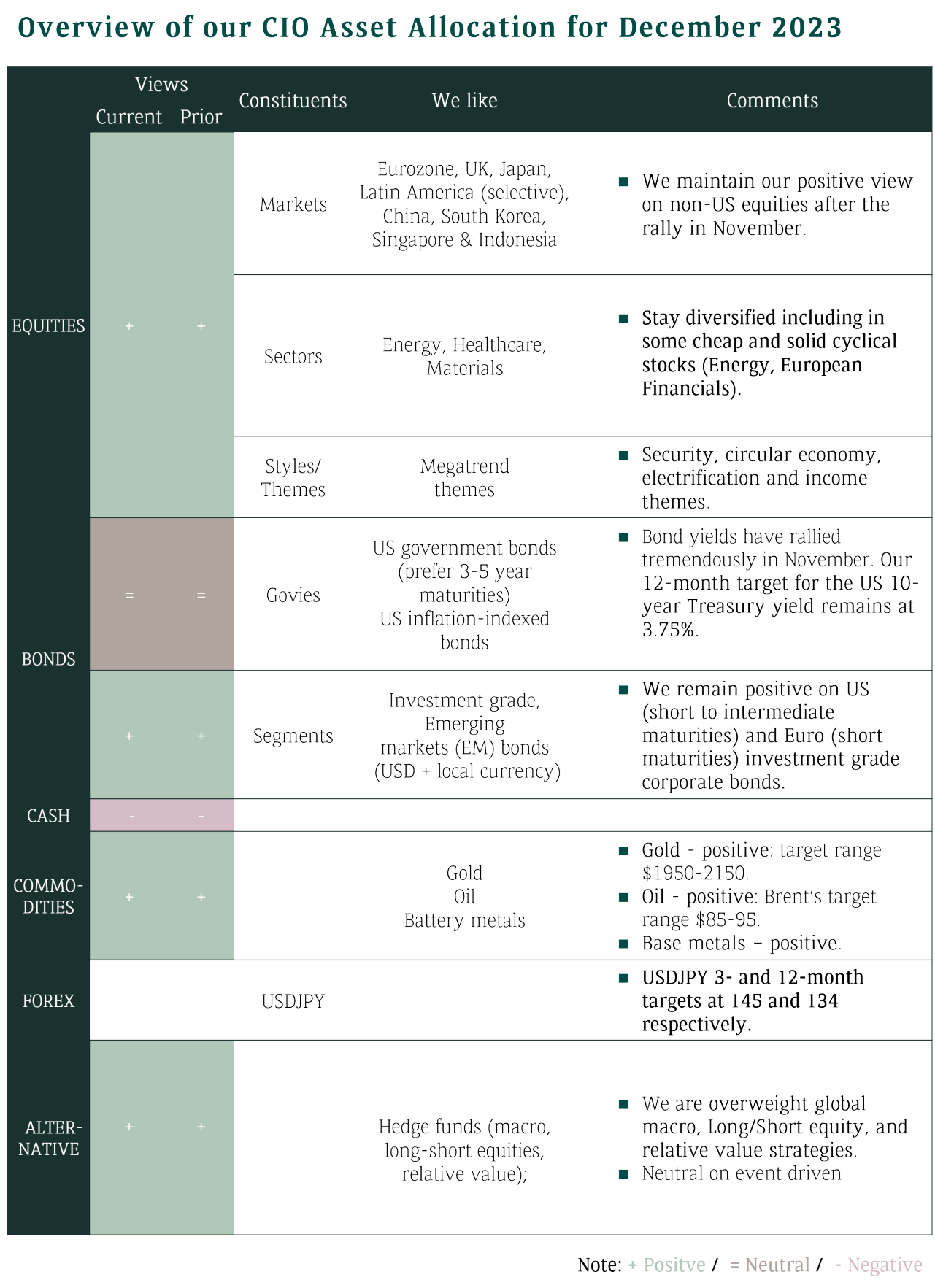

In terms of asset allocation, we upgraded Global Equities to Positive from Neutral since November 2022. This out-of-consensus call (most investors had cautious positioning) worked well in 2023. In particular, European equities (SX5E index +18.9% in dollars) were up slightly more than the S&P 500’s +18.5% (as of 7th December 2023).

Another contrarian call - taking a positive stance on Japan equities - outperformed as well. Our overweight Gold call also shined, hitting all-time highs with double-digit returns this year. However, China and Hong Kong stock markets were disappointing despite re-opening this year.

Furthermore, we downgraded US Treasuries to Neutral from Positive in April 2023 following the US regional banking crisis. US yields, indeed, rose from the bottom in April. We upgraded US Treasuries again in October as we believed yields were overshooting. Overall, we managed to catch the downside and upside of US government bonds in 2023. In fact, November 2023 registered the best monthly return for the Bloomberg Aggregate Bond index since 1985.

2024 Outlook: Expectations of a Fed “pivot” bode well for equities and bonds

Going into 2024, we remain overweight in global equities, US government bonds and corporate credit, although 2024 is the biggest election year in history with elections in countries/nations accounting for ~80% of the world’s market cap, ~60% of the world’s GDP and ~40% of the world’s population.

Economic growth and inflation often play a far more important role on the economy and markets in the medium-term than elections. However, government policy changes, for example, fiscal spending, tax cuts or rises, healthcare, energy and climate policy etc can have a longer-term impact.

Furthermore, deglobalisation is underway. Any changes to the in-sourcing of critical supply will be monitored. Nevertheless, it is unlikely to change in major way as this requires bipartisan support in the US and other parts of the world.

Leaders often run on plans that “once they are elected cannot be enacted” unless they win in a landslide, as after elections, they pare back their plans and make compromises in order to pass policy. Therefore, investors should focus on policy, not politics.

The key is markets don’t like uncertainty. Markets often have discounted the potential election outcomes ahead of elections unless there is a large surprise versus what consensus predicted. Hence, investors should stay grounded and be aware that few geopolitical events purely on their own have had long standing impact on asset allocation. Attempts to go in and out of the markets based on the election-related newsflows have seen investors miss out on longer-term investment gains.

Looking at economic fundamentals, a US downturn in 1H 2024 is still our base case scenario. Very crowded positioning and expensive valuations of the “Magnificent 7”, soft-landing being too much a consensus view, accompanied by strong consensus estimate of a +9.6% earnings growth for 2024 are key risks for US equities, especially ahead of US election in November 2024.

That said, any heavy sell-off in US equities as well as bonds (risk of government shutdown arises again in January) would be good buying opportunities as a slowing labour market and softer inflation would allow the Fed to “pivot” (adopt a dovish stance).

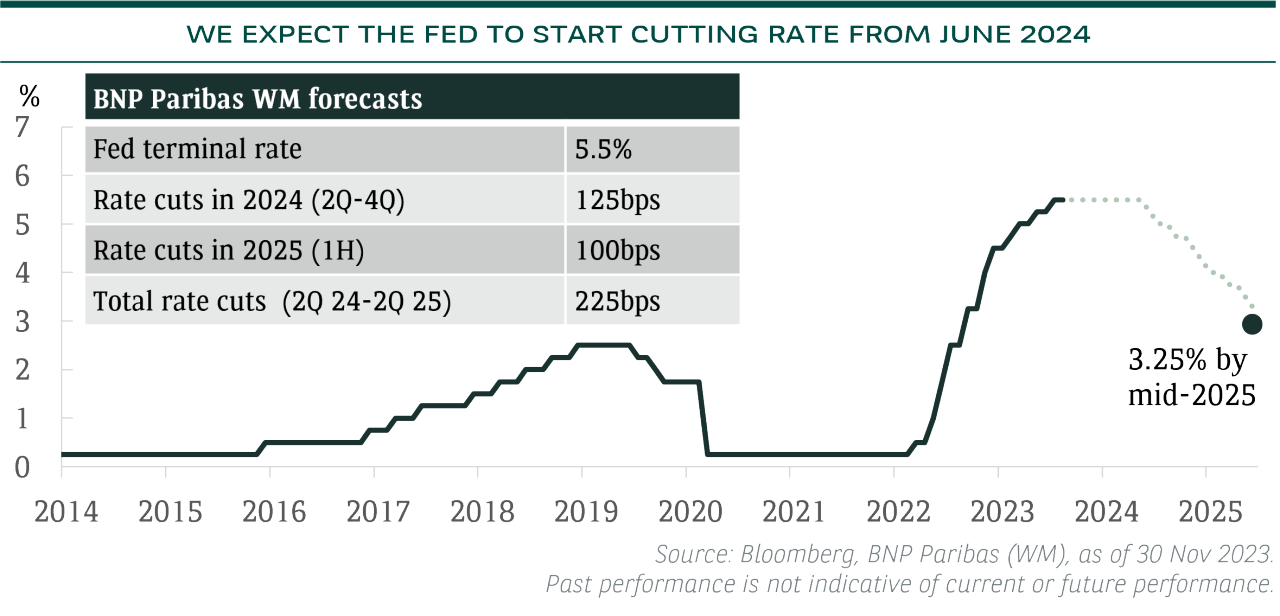

After the strong performance in both bonds and equities in November 2023, we may see a period of consolidation. Market may probably be a bit over-optimistic to price in an earlier Fed rate cut from March next year, in our view.

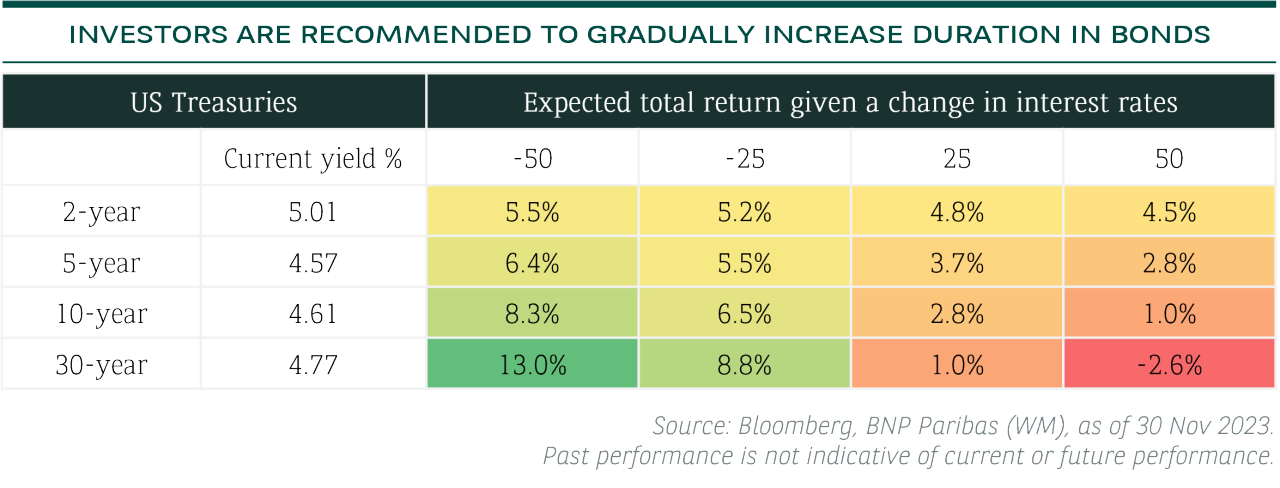

Our forecast is that the Fed Funds rate is already at its peak level and the Fed would start cutting rate from June 2024, with a total of 225bp cuts until mid-2025. We also recommend investors to gradually increase duration in bonds when there is more certainty on the Fed to start the rate cut cycle, as bonds tend to deliver equity-like returns in a rate cut environment with the longer the duration, the better the expected total returns.

Reinvesment risk on deposits and money market funds for investors remains as rate cut expectations increased. In fact, what investors basically earned in deposit for a year was made in one month in bonds and returned twice as much in a 60/40 portfolio in November 2023.

2024 Investment Themes

We believe that there are a select few trends that investors should keep front of mind when looking to the new year:

(1) The highest interest rates in 15 years continue to have huge lagged knock-on effects across the global economy – on real estate prices and on corporate investment. But there are also some beneficiaries of higher interest rates of course, notably investors who can now take advantage of attractive yields not seen since the 2008 Financial Crisis. Our Theme 1 - Reaping real returns underlines the income opportunities particularly in fixed income markets.

(2)The shift away from globalisation and towards national interests will continue as we predicted, potentially triggering shortages of raw materials and goods. This shift is also powering near-shoring and re-shoring of manufacturing production in order to reinforce supply chains, especially of key strategic industries, such as semiconductors. Our Theme 2 - Winners in a multipolar world explores the shift towards national interests, especially in this big election year.

(3) Energy transition momentum continues to accelerate, propelled by a 2023 summer that was the hottest on Earth since records began in 1880. Theme 3 - Decarbonisation and Electrification emphasises opportunities in electrification to achieve carbon emissions targets.

(4) Theme 4 - Democratising AI is our plea for investors to look beyond the Magnificent 7 tech stocks to benefit from the generative AI trend given better valuation support as the non-Magnificent 7 sub-sectors of technology have lagged representing better value after the concentrated performance in 2023.

(5) Theme 5 - Diversifying beyond the 60:40 portfolio highlights the need for investors to include more than just stocks and bonds for true diversification. Key is having a core-satellite asset allocation strategy and continue to diversify into alternative investments.

(6) The arrival of effective medicine to treat obesity promises potentially the biggest improvement in average longevity since global campaigns to persuade smokers to quit were promoted in the 1970s and thereafter. Theme 6 – Demographics: the wellness revolution focuses on opportunities resulting from new drugs and healthy living.

Conclusion

Despite the fact that 2024 will be a year of (many) elections, we believe investors should look beyond the uncertainty and be well prepared with a diversified portfolio that includes alternative investments, such as hedge funds, precious metals and private assets, as their lower/negative correlation with traditional bonds and equities should help lower the overall portfolio volatility.

Although risk of a recession remains, particularly market currently priced in a soft-landing scenario, we, at the same time, see increasing chance of central banks “pivot” in 2024 which should bode well for both bonds and equities. Therefore, any heavy sell-offs offer buying opportunities.

Volatility also creates opportunity. Investors can monetise the volatility and play some of our investment themes via structured solutions which offers tailored risk/reward opportunities.

CIO Asset Allocation