GDP Upgrades for Large Economies

Global growth has been overall stronger year-to-date, with GDP upgrades in the 3 largest economic blocs: US from +1.6% to 2.5%, EU from +0.6% to +0.8% and China from +4.5% to +5.2%. Furthermore, in addition to stronger growth, stickier services inflation (which is now dissipating) has led to a push out in rate cuts from the Federal Reserve. The good news is the recent US inflation data has been lower than expected with the much focused on super core services inflation falling back to flat on a month-on-month basis.

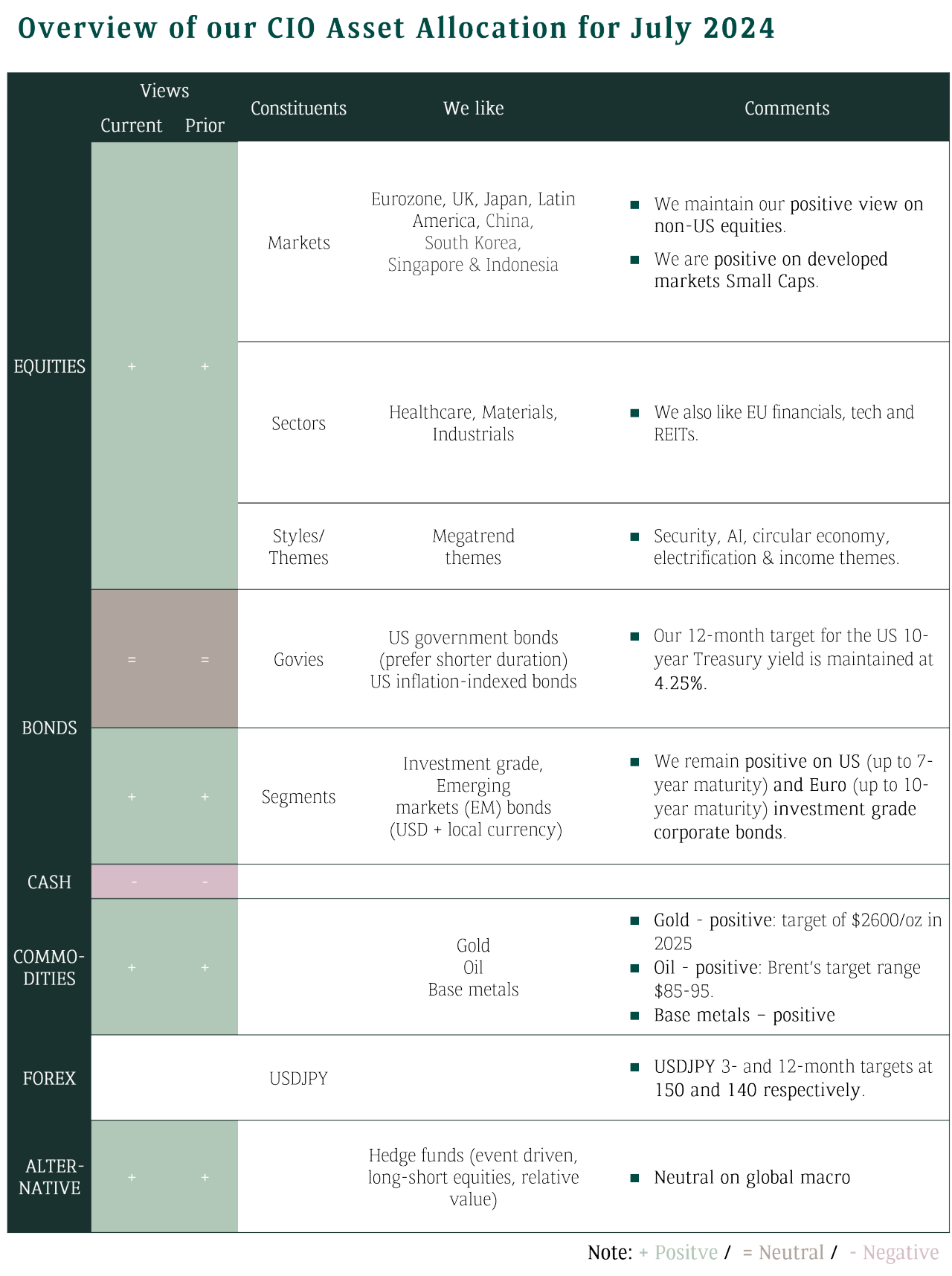

Our forecast for the Federal Reserve presently is for one rate cut in September 2024 and four additional cuts in 2025.

The key is if the US economic data continues to slow. Recently, PMIs fell below 50 for both service and manufacturing, and continuing claims, a future indication of unemployment, has increased. It is possible for some rate cuts from 2025 to shift back to 2024 if this trend continues.

We expect a growing but slowing economic growth in the US in 2025, and higher year-on-year growth in 2025 for Europe, UK and Japan. Overall, we are likely to see convergence in growth trends.

Strong first half for global equities, gold & commodities

Investors in both stocks and commodities have been rewarded for their risk-taking so far this year, as markets climb the proverbial wall of worry. Thanks to abundant global liquidity and surprisingly strong earnings trends, and the surging AI theme, global stocks have strong returns with leadership from US, Eurozone and Japanese stocks.

Bonds were RANGE BOUND IN 1H 2024. TREASURY YIELDS PEAKED IN OCTOBER 2023 and have made “lower highs” since then.

While returns are more muted, the coupon is being clipped. Investors should continue to BUY QUALITY INVESTMENT GRADE AND GOVERNMENT BONDS.

We remain overweight global equities. Two other over-weights in our asset allocation - Gold glittered by rising 14.7% and Copper by 15.5% YTD.

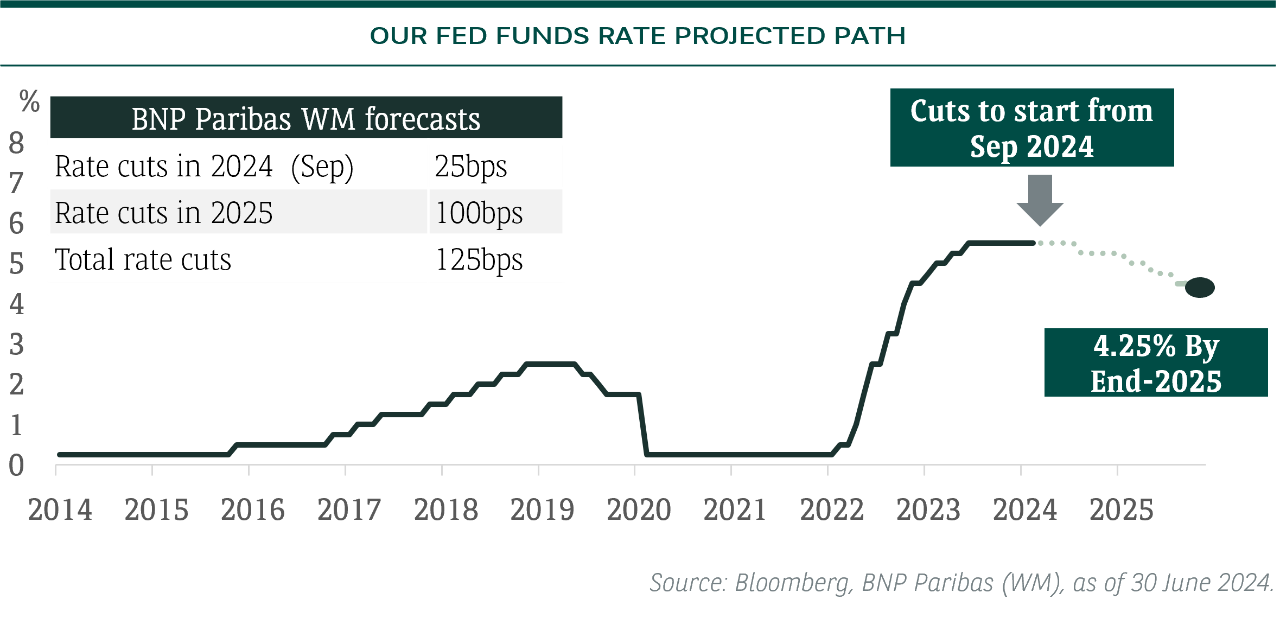

While we favour the “Democratising AI” theme, our best performing theme (+30% as of 28th May), investors should also diversify into other sectors given more attractive risk/reward. There are multiple deep value opportunities in ignored assets. Deep value offers huge potential for patient investors such as UK and Emerging Market stocks, Financial stocks and credit, value & distressed strategy hedge funds.

Our 4 Mid-Year Investment Themes for 2024

Thematic focus on 5 trends

- Inflation homes in on the 2%-3% zone; central banks to lower rates

- Fixed income still offers yields close to 15-year highs

- Unprecedented stock market concentration in the Mag 7

- Commodities rise from the ashes

- Anti-obesity medications revolutionise longevity potential

Click HERE to read the full 2024 Mid-Year Investment Themes update.

With upcoming elections in the second half of the year, the ”Winners in a multipolar world” theme is ever relevant. 2024 is a year of heightened geopolitical tensions and pivotal legislative elections. Tariff war risk also looms which means reshoring. Hedging these risks in portfolios is key.

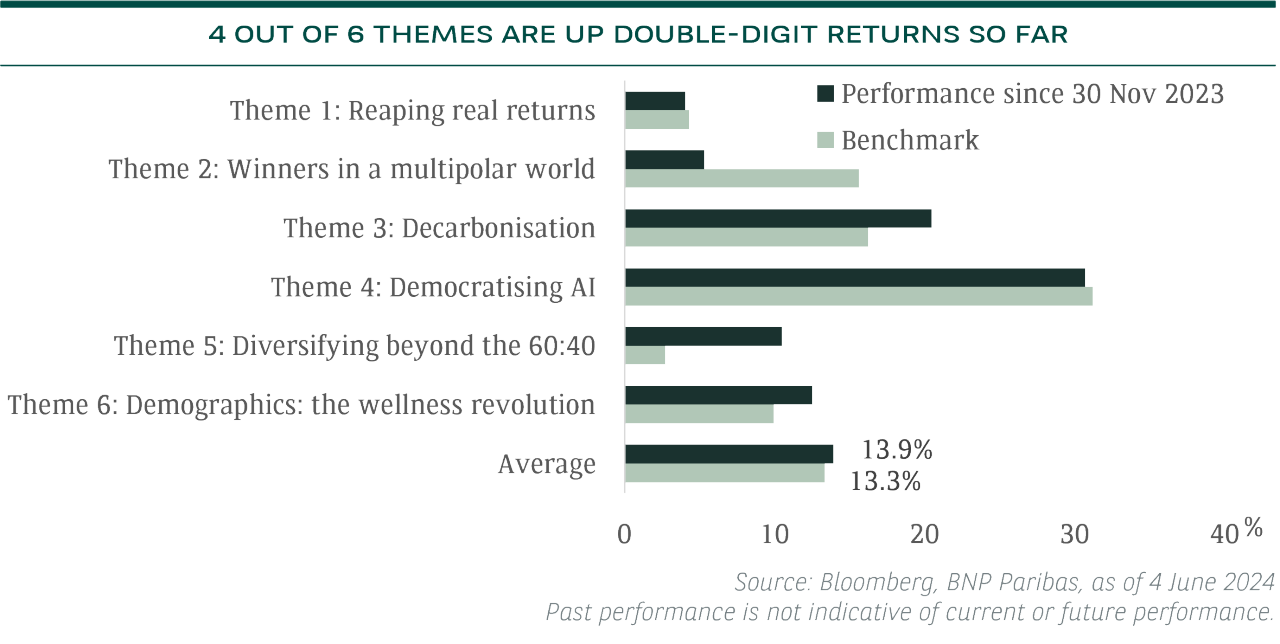

With regards to the upcoming US elections, it is important to focus on policy not politics. We mentioned in January 2024 that US equities are usually up in election years on average. Normally, the market pauses and can fall moderately from September, just before the election in November.

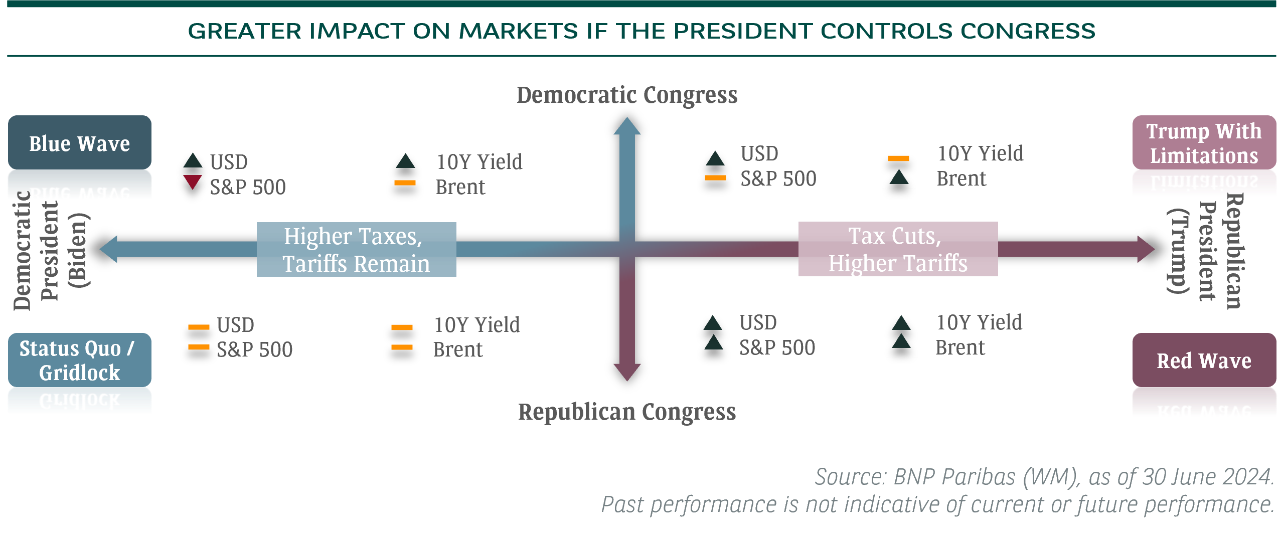

Crucially, the composition of Congress will be key in terms of changes to tax and the level of fiscal stimulus. A President Trump sweep including Congress could lead to a higher stock market in the near term, stronger dollar and higher yields due to rollover of his existing tax cuts, and perhaps additional tax cuts and deregulation. President Biden, if indeed he runs, will likely face a divided Congress and that means a neutral market reaction as it is a status quo result.

Finally, stock markets go up over time whether under Republican or Democratic presidency. Only 3 times since 1932, has the stock market declined in a presidency. That was because of the economic cycle (Great Depression), oil price embargo in the 70s, and great financial crisis. Hence, the economic cycle is much more important than the political cycle.

Conclusion

Global equities boosted by the AI theme, performed strongly in the first half of the year. Better GDP growth boosted earnings in three major economic blocs of the world. Furthermore, two other overweights - gold (on strong central bank buying and risk diversification) and commodities (we favour “green metals”) - registered double-digit returns.

Bonds have been range bound with fluctuating yields but recent benign inflation data has led to lower longer-term yields. Rate cuts are delayed but not derailed. We continue to recommend accumulating quality bonds at this juncture.

Key Risk

Volatility could pick up in the second half of the year after a strong first half for global equities amid elections, the pace of rate cuts, and possible slowing growth in the US. Be more selective and hedge with gold, defensives, deep value equities, and quality bonds.

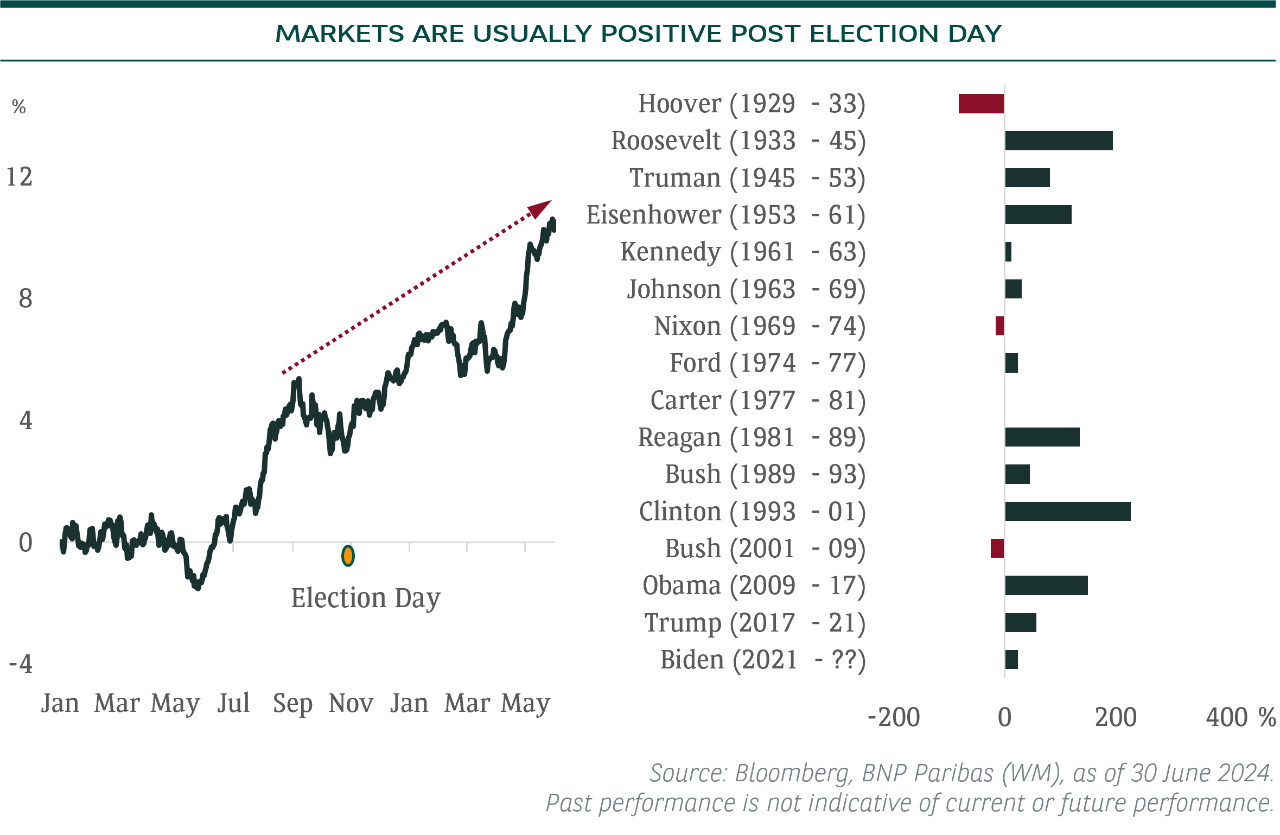

CIO Asset Allocation