MARKET SNAPSHOTS

Global equity markets experienced heightened volatility in early August 2024, with the VIX index surging to levels reminiscent of the Covid-19 market downturn. This uncertainty was primarily driven by a combination of factors, one of which was the unexpected rate hike from the Bank of Japan (BOJ) that triggered a rapid unwinding of JPY carry trades as investors faced the prospect of a stronger yen which may diminish returns on their positions.

Concurrently, recent US macro data has also dampened market sentiment, with the prevailing narrative shifting from a “bad news is good news” to a “bad news is bad news” environment. Nevertheless, while these developments have created near-term challenges, they also present potential opportunities for selective investment strategies as market dislocations emerge.

HK / China: Steady as she goes

Despite no change in fundamentals, HK market may ironically become a safe harbour when other markets are experiencing storms.

What happened?

Mitigate global market volatility

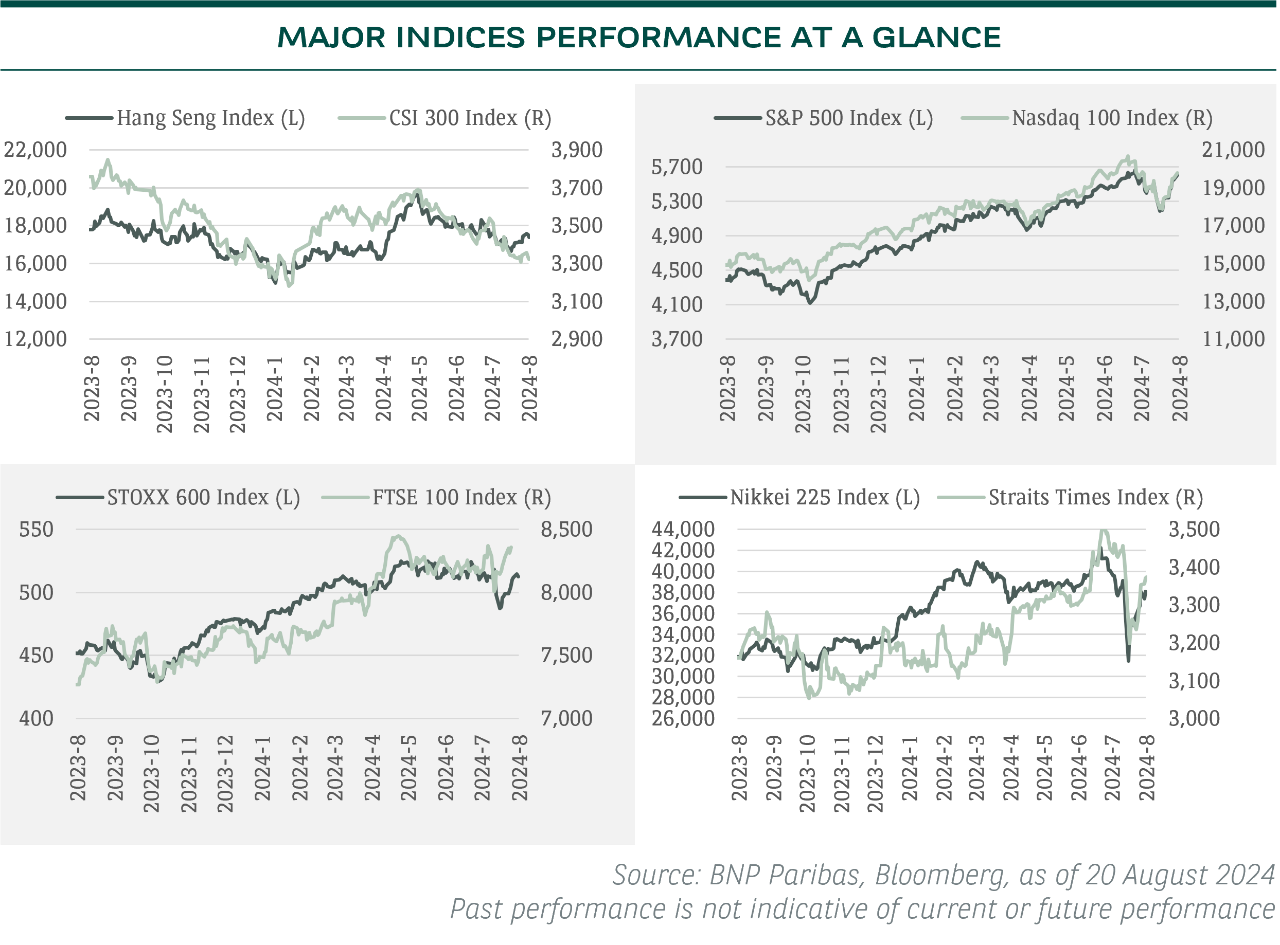

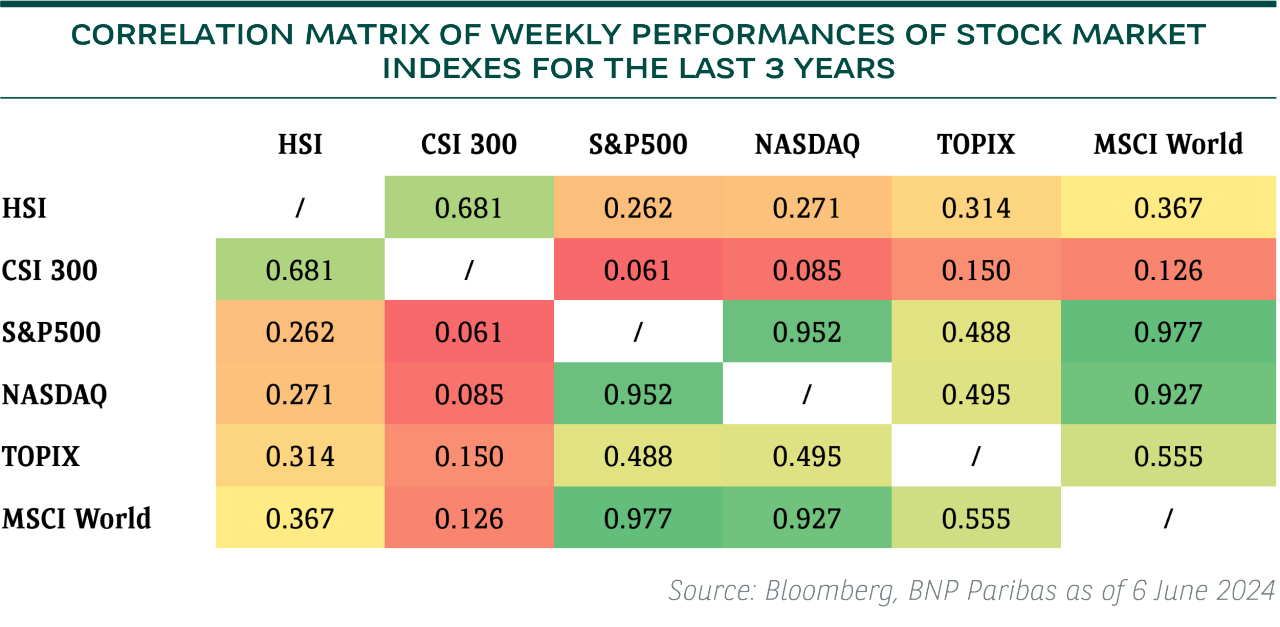

Volatility erupted across all major markets at the beginning of August 2024. A sudden spike in USD/JPY rate triggered the unwinding of carry trades that rocked global stock markets. While there is no convincing risk-off signal, professional investors probably would rebalance their portfolios to enhance risk-adjusted returns. In this perspective, HK/China stock markets may offer much needed diversification to some of the overly-crowded trades. Hang Seng Index (HSI) and CSI 300 Index have demonstrated weak corrections relative to global stock markets (please see Chart below).

No surprise from China’s 3rd Plenum

China’s top leaders concluded the 3rd Plenum in July 2024 without policy surprises. Yet, constructive changes are bubbling up at the local government level. For instance, many cities have withdrawn price controls over new residential properties. We believe this could speed up the execution of previously announced policy of state-owned enterprises (SOE) to buy out unsold housing inventories at cash-stripped developers.

Our view

We stick to our long-held view that bold stimuli are keys to restoring business confidence, which, in turn, would trigger an eventual stock market revival. Interestingly, we notice that copper prices and HSI have been in sync year-to-date. China is the world’s largest copper importer, and thus investors may be using copper demand to gauge economic outlook.

Meanwhile, the upcoming US Presidential election may spawn overwhelming geopolitical risks till November 2024 as the candidates may use hostile diplomatic ideas to gain soundbites.

How to play the game?

Interest rate cut beneficiaries - High dividend yield utilities, HK property and SOE should react positively to rate cuts. However, investors should focus on those with strong free cash flow and avoid overly leveraged ones.

High-beta index constituents - Buy-the-dips between now and November 2024, in anticipation of improved market sentiment by year end.

Notable Developments in Selected Sectors

- China E-commerce: Macro data suggest that China online retail sales growth has slowed in the past few months (as of August 2024). Looking ahead, the rollouts of government-sponsored consumer trade-in scheme, higher new energy vehicle subsidies and lowered borrowing rates may revive domestic consumption in the rest of 2024.

- China Property: Market recovery seems to have halted in July 2024 after a brisk improvement in the previous month. The People’s Bank of China reportedly may fine tune interest rates mechanism soon to further liberalize loan prime rate (LPR), which is the benchmark for mortgage rates.

- HK Property: The sector is clouded by sluggish sales, impairments on investment properties and slowing new project developments. Potential interest rate cut in the coming months may ease financial pressure on property developers.

- Share buyback: HK-listed companies had spent over HKD161 billion on buybacks as of 12 August 2024, which is already 28% above full year 2023.

US: Volatility to stay with Fed pivot & election ahead

US has maintained its outperformance over World equities, underscoring our earlier constructive stance.

What happened?

The equity market has experienced volatility in recent months, with 1) a global chip-driven selloff in July 2024 triggered by geo-political concerns over potentially more chip-related restrictions on China, and 2) a JPY carry trade unwinding in August 2024 which resulted in strong downward pressure on the USDJPY currency pair. However, US equities have continued to outperform world equities this year.

For FY24E and FY25E, consensus forecasts for MSCI US index’s earnings per share (EPS) growth are for 10.3% and 15.2% respectively, higher than World equities’ EPS growth forecast at 8% and 13.2% respectively (estimates as of 2 August 2024).

Traders have trimmed their expectations of late, largely forecasting for a 25-basis point (25bps) rate cut in September 2024 Federal Open Market Committee (FOMC) meeting, which is in line with our house’s base case.

Our view

At a sector level, Information Technology and Communication Services remain leading contributors to overall earnings growth in the US, which is unsurprising given the two sectors’ exposure to the multi-year artificial intelligence (AI) theme. That said, we have seen diverging returns for mega-cap stocks in 2024, which underscore our differentiation in relative preference amongst the “Magnificent Seven” stocks.

We believe key drivers for the market’s relatively limited correction over the past couple of months (as of August 2024) has also stemmed from continued robust earnings growth delivery and supportive financial conditions.

Following the recent correction, the risk reward has improved for investors looking to add fresh positions in leading semiconductor, technology (cloud infrastructure, software) and communication services players, which remain well positioned to benefit from growing chip and AI demand tailwinds over the medium term.

For 2H24, we expect market volatility to remain in play as the Fed is poised to pivot towards rate-cutting mode in September 2024 while market focus would increase on potential policy changes as we approach the US presidential election in November 2024. Recent indications of consumer demand softening is also on our radar, which has weighed on sector returns this year and warrants a more selective stance in the consumer discretionary sector in our view.

How to play the game?

Areas on our radar - Healthcare policies, AI regulation, energy permits, trade and tax policies, consumer demand

Investment implications - To pay attention to core asset allocation and diversification of portfolio holdings.

Notable Developments in Selected Sectors

- Financials: On the back of trends seen in the results season, our preference is maintained for banks with larger bias towards investment banking activities over money center banks due to the latter’s higher sensitivity to the “higher for longer” rate narrative.

- Consumer Staples: We have a relative preference for consumer staples over the discretionary sector in view of the recent softening in US consumption indicators. This is premised on the more defensive characteristics of staples stocks, which could provide relative support for portfolio returns during bouts of market volatility.

- Information Technology: AI continues to be a key narrative driving investor flows in the sector. Following recent selloff in June and August 2024 led by semiconductor stocks which had been amongst key gainers previously, we see some froth removed and believe that the technology sector’s above-market-average growth and falling interest rates ahead should remain supportive. That said, we expect investor scrutiny on firms’ increasing capex plans and AI monetization pace to increase.

Europe / UK: Europe a mixed picture

Investors began rotating out of cyclical stocks into defensives in recent months, a trend that accelerated in August 2024 in anticipation of weaker growth than expected.

What happened?

Select markets within Europe, notably the UK, proved to be relative safe havens during the recent period of high market volatility that saw a sharper sell off in higher-valuation Japanese and US markets.

Macro challenges are still a consideration, given recent mixed datapoints, and the market remains focused on how the European Central Bank (ECB) will respond. This is notable for cyclical markets such as Germany and Italy that face more downside risk as economic confidence deteriorates.

The market expects ECB to cut its deposit rate twice more in 2024.

Our view

Europe

While the macro picture is still mixed, the earnings and valuation pictures are broadly supportive. 2Q24 earnings are on course to have increased 4.5% from the same period in 2023, marking the first quarterly rise since 4Q23. Financials have been a key driver of earnings performance, while the Tech sector has been one of the largest negative contributors to 2Q24 earnings growth.

That said, China remains an important risk factor for revenue, given Europe derives ~8% of revenue from this market (vs. the S&P’s ~2%). Softer consumer demand there has weighed on sectors such as luxury and autos. Germany’s DAX index has a heavy concentration in cyclical sectors such as industrials and autos, where recent earnings reflected uncertainty in China.

European stocks still trade at lower P/E levels (S&P 500 P/E of 22.9x compares with the Stoxx 600’s at 14.2x), supportive during periods of market volatility.

UK

The Bank of England finally cut its base rate, having delayed the move until after the UK general election. The market expects the central bank to ease rates at least once more in 2024 as inflation pressures subside and the outlook for the economy for the remainder of 2024 turns less rosy.

The UK still offers value, trading on 12.1x forward P/E, with the market’s defensive merits looking particularly favourable during periods of increased market volatility. The FTSE 100 declined the least among European benchmarks amid the recent sell off.

How to play the game?

European Market - Healthcare, Industrials, Materials (e.g., Mining & Construction Materials), Financials, Tech and REITs.

Notable Developments in Selected Sectors

- Technology: The sector has retreated in recent months (as of August 2024) on global macro concerns and a rotation out of what had become a crowded trade. However, European names still offer exposure to strong secular growth stories, with lower valuation relative to US peers.

- Financials: Confidence remains healthy, with the banking sector set to return >EUR120bn to shareholders via buybacks and dividends in 2024 on the back of strong earnings. The net interest income story may transition towards UK and French banks, which could be better positioned for falling rates. European insurance names should benefit from higher insurance premia, contained underwriting costs and demand for savings products.

- Materials: A combination of stronger global end-demand and restricted supply fuelled a surge in copper price. The outlook remains bright for copper producers. Meanwhile, we remain selective within Chemicals. The sector should benefit if the uptick in the manufacturing cycle in Europe proves to be sustainable. However, although demand could be picking up, supply from China is also doing so. We prefer Industrial Gases within the sector.