Market Snapshot

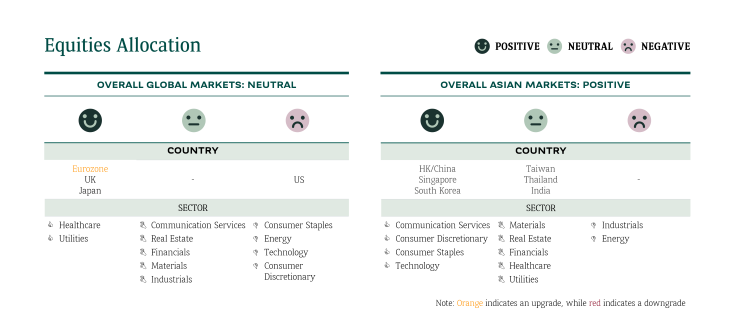

US equities continued their recovery since April 2025 to reach fresh record highs, buoyed by cooling trade/geopolitical tensions as well as a resilient economy. However, with valuations back at relatively elevated levels, we reiterate a selective stance towards the country’s stocks. We continue to favour names exposed to structural themes such as artificial intelligence and reshoring, while preferring quality firms with strong balance sheets, pricing power, and less exposure to tariff headwinds.

We see the continued push higher in US equities as a great opportunity for investors to add geographical diversification. Ample opportunities are present in Europe and HK/China. European industrials should continue to benefit from the region’s fiscal spending story, while massive capital inflows should underpin growth in the Hong Kong stock market. Potential government support could also be a major catalyst for HK/China equities.

HK / China: Hot market meets cool deflation

The Hong Kong stock market gathered strength in a goldilocks scenario of hot IPOs, falling interest rates and abating systematic risks.

What happened?

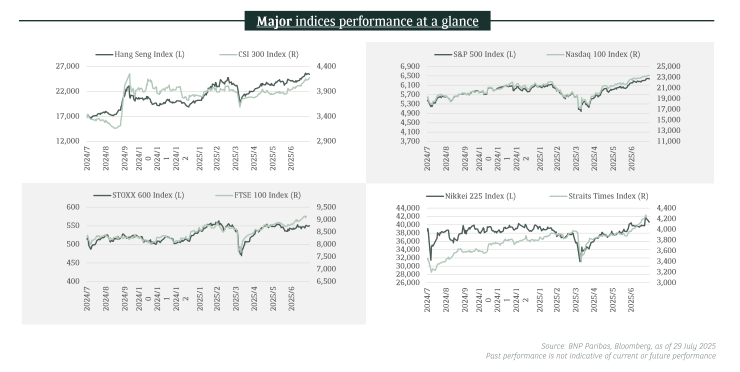

Massive capital inflows and hot IPOs catalysed a stunning comeback of the Hong Kong stock market in 2025. Average daily stock market traded value surged 118% year-on-year to HKD240 billion a day in the first six months of 2025. The benchmark Hang Seng Index has one of the best performance among major developed markets year-to-date. The southern city of China remains the first-choice for offshore listing by Chinese companies, signified by the listing of the world’s largest battery maker in May 2025 and a long list of IPO applicants (190 as of 29 July 2025) which include dozens of multibillion-dollar-valued companies.

The world should have better grasp of China’s medium-term economic and trade policies in the next few months. The Central Committee of the Chinese Communist Party and the government have started drafting the 15th Five-Year Plan, covering 2026-2030, which should be published in the fourth quarter of 2025. We think President Xi’s comments during the latest Central Urban Work Conference have brought important insights to how the top leaders plan to shape China’s economy in the next five years. (https://paper.people.com.cn/rmrb/pc/content/202507/17/content_30088242.html; we recommend non-Chinese readers to use AI-translation tools to break the language-barrier). On the other hand, the agreed US baseline tariffs on Chinese goods of 10% (total 30% if the 20% additional fentanyl-related levies are included) looks low when compared to subsequent deals between the US and other countries.

Our thoughts

Anti-involution is likely to be one of the key themes in the upcoming 15th Five Year Plan, in our view. China’s producer price index (PPI) has been mired in deflation since October 2022 while consumer price index (CPI) has struggled around 0% since February 2023. We think top leaders may even set medium term inflation targets, just like the “carbon neutrality” target in the 14th Five Year Plan, that prevent China from falling into Japan-style lost decades. Consumer staples & discretionary, real estates, financials and materials tend to perform well in a benign inflationary environment.

How to play the game?

Areas on our radar: The upcoming 15th Five Year Plan, amendments to the Pricing Law, fixed asset investments in Western China, and fiscal stimulus.

Investment implications: China’s Five-Year Plan is the blueprint for economic policies that often determine winning and losing industries. For example, the current 14th Five Year Plan unambiguously supports transition to new energy vehicles and curb housing speculation, which led to distinctive performances in these two sectors in 2021-2025. Investors are advised to reconstruct their portfolios according to the 15th Five Year Plan.

Notable Developments in Selected Sectors

- Anti-involution: The government voiced disfavour with the “irrational” price war. Food delivery, new energy vehicles and many other industries are expected to rein in loss-leader pricing strategy.

- Infrastructure and construction materials: China has begun constructing the world’s largest hydropower project in Tibet. The RMB1.2 trillion project will include five cascading power stations with total annual output of 300 billion kWh, that should boost demand for cement and other construction materials in the coming years.

- Childcare and baby products: The government rolled out an annual childcare subsidy of RMB3,600 for every child born on or after January 1,2025, until they turn three-year-old.

- New energy vehicles, artificial intelligence and computation power: President Xi questioned the argumentations for every province to invest in projects in these areas, during the Central Urban Work Conference in July 2025.

- Hong Kong stock market: More than doubled market turnover and red-hot IPOs are strong tailwinds for the stock exchange, securities brokers and local banks.

US: Easing trade tensions drove V-shaped rebound

What happened?

US equities have gone through a roller coaster ride last quarter, with a sharp rebound driven by easing trade tensions, which reversed the strong selloff triggered by the 2 April 2025 Liberation Day tariff announcements that almost brought the S&P index to a bear market correction.

Our thoughts

Despite the stunning V-shaped rebound in the equity market last quarter, year to date returns for MSCI US continues to lag MSCI World, driven by concerns over USD weakening, tariff uncertainties and fund outflows that had favoured international equity markets as global investors trimmed their overweight US positions to diversify their portfolios.

We retain a selective stance on US equities, given valuations are extended and tariff impacts are yet to fully play out as many corporates have largely taken a more wait and see stance during trade talks and not made meaningful changes in their product pricing and business strategies so as not to lose market share from raising prices or impact end consumer demand if prices were raised. We expect firms could try passing on some costs to the end consumer in 2H25 as more trade deals are finalised and the view firms up that higher tariffs are here to stay. Despite our view that we are likely past the peak in trade tensions, we note that the effective tariff rate (including expected sectoral tariffs yet to be finalised) could come close to ~20%, which is a meaningful increase from the 2.3% level at the start of 2025.

As the Q2 reporting season starts, we note that MSCI US earnings growth is forecast at 9% and 14% for FY25 & FY26 respectively in a backdrop of uncertainties over how much tariff costs could weigh on corporate profits and margins. Hence, the trajectory of earnings revisions in the next few reporting seasons and the extent of Fed rate cuts will be important for indications on whether the recent bounce in equities can be sustained, which should be influenced to a large extent by how trade policy negotiations pan out.

With MSCI US index valuations of 21.3x forward price/earnings looking fairly elevated (close to 1.4 standard deviation above its 10-year historical average, as of 18 July 2025), we reiterate a selective stance as well as our earlier call for diversification. We continue to favour key thematic investments of artificial intelligence (AI), ageing population and key industrials automation/reshoring policy beneficiaries. Stocks wise, we prefer quality firms with healthy balance sheets, relative pricing power and less direct exposure to tariff headwinds.

How to play the game?

Areas on our radar: Earnings revisions, economic growth, Fed rate cuts, trade policy developments.

Investment implications: Remain selective stance while continuing to add diversification. Prefer quality firms with healthy balance sheets, relative pricing power and less direct exposure to tariffs. Structural trends remain intact.

Notable Developments in Selected Sectors

- Information Tech – The sector hit all-time highs, propelled by eased AI chip export rules and strong AI optimism. Upcoming earnings are critical, as the market will scrutinise AI capex and monetisation strategies. We remain selective, anticipating potential volatility if earnings reports disappoint. The interplay of AI commentary and ongoing tariff discussions will define near term sector performance.

- Financials – Payment processing names came under pressure due to stories surrounding stablecoins. Reports suggested select retailers are looking to issue their own stablecoins, potentially reducing the amount they pay in credit transaction fees. Separately, Congress passed the GENIUS Act, the first stablecoin legislation to be approved. We expect sector stocks to remain volatile in the near-term, though we don’t foresee stablecoins presenting a material threat.

- Industrials – The sector has been an outperformer year to date, driven by aerospace & defense, electrical equipment and construction & engineering industries. With sector valuations of ~27x forward price to earnings now looking extended vs its past 5-year historical average multiple of 24x, we favour adding fresh positions on pullback.

Europe/UK: Trade deal boosts market optimism

What happened?

We reiterate our overweight rating for European equities with a relative preference for domestically oriented businesses which are geared towards the expansionary fiscal framework. Europe’s encouraging mix of monetary, fiscal and regulatory easing is providing a supportive backdrop.

The US–EU trade deal announced on 27 July 2025 was broadly in line with our expectations at 15%. Another positive is that the deal includes the 15% tariff on auto, semiconductor and pharmaceuticals.

Our thoughts

Aside from the headline tariff announcement, the 50% tariff on steel and aluminum was maintained. In exchange, the EU would plan to import USD750bn of energy, invest USD600bn in the US economy and purchase much more military equipment. The EU would also bring down the tariffs to zero for many US goods. The deal does clearly help to reduce the uncertainty that is weighing on the near-term outlook.

Germany’s fiscal spending proposal on infrastructure and defence expenditure, combined with the EU’s ReArm Europe plan, have played a fundamental part in renewed confidence in the European market. While fiscal spending could remain a key driver for the market, investors have found additional catalysts. For example, stocks aligned with structural themes (e.g., renewable energy, electrification and AI).

Moreover, European stocks still trade at reasonable valuation levels (the Stoxx 600’s Price to Earnings (P/E) of 15.4x, as of 21 July 2025). The 15% tariff that was agreed should be manageable for the eurozone, with the effects more than offset by the greater defence and infrastructure spending over the medium term.

Separately, the current results season has been modestly supportive, with Banks, Industrials and Healthcare beating expectations. Stocks particularly exposed to tariffs and global trade policy uncertainty, though, have led the downgrades.

UK stocks hit a new record high in July 2025, benefiting from investors seeking diversification from US equities, a more favourable tariff regime of 10%, and a rebound in commodity-related stocks. The performance was despite the mixed economic outlook and a pickup in profit warnings related to geopolitics. The UK still offers value, trading on 13.7x forward P/E for the FTSE 100 as of 21 July 2025, with the market’s defensive merits remaining an attraction.

How to play the game?

Areas on our radar: Tariff impact; German fiscal spending on infrastructure clarity; defence spending; earnings momentum in Q2 results season

Investment implications: Remain selective on tariff-exposed names; infrastructure fiscal spending to provide opportunities; defence spending is a key growth story

Notable Developments in Selected Sectors

- Information Tech - Semiconductor names have been navigating uneven demand in recent quarters. Demand for chips to power the data centres behind the AI boom remains robust, but auto and industrial equipment orders have been more mixed. Still, sector names have rallied since the April 2025 lows, benefiting from tariff-beating restocking demand by European customers.

- Financials – Banks remain the best Stoxx 600 performers in 2025, despite some political pushback towards regional sector M&A. Confidence remains healthy, supported by healthy profitability and the sector is a likely beneficiary of Germany’s fiscal spending. The sector continues to also offer substantial shareholder returns through dividends and share buybacks.

- Industrials – The sector remains at the centre of a range of structural growth opportunities, with increased capex spending around defence, electrification, industrial automation and renewables. Germany’s increased fiscal spending is a key support, while the sector would also benefit if we see a resolution to the Ukraine-Russia conflict and a country rebuild.