MARKET SNAPSHOTS

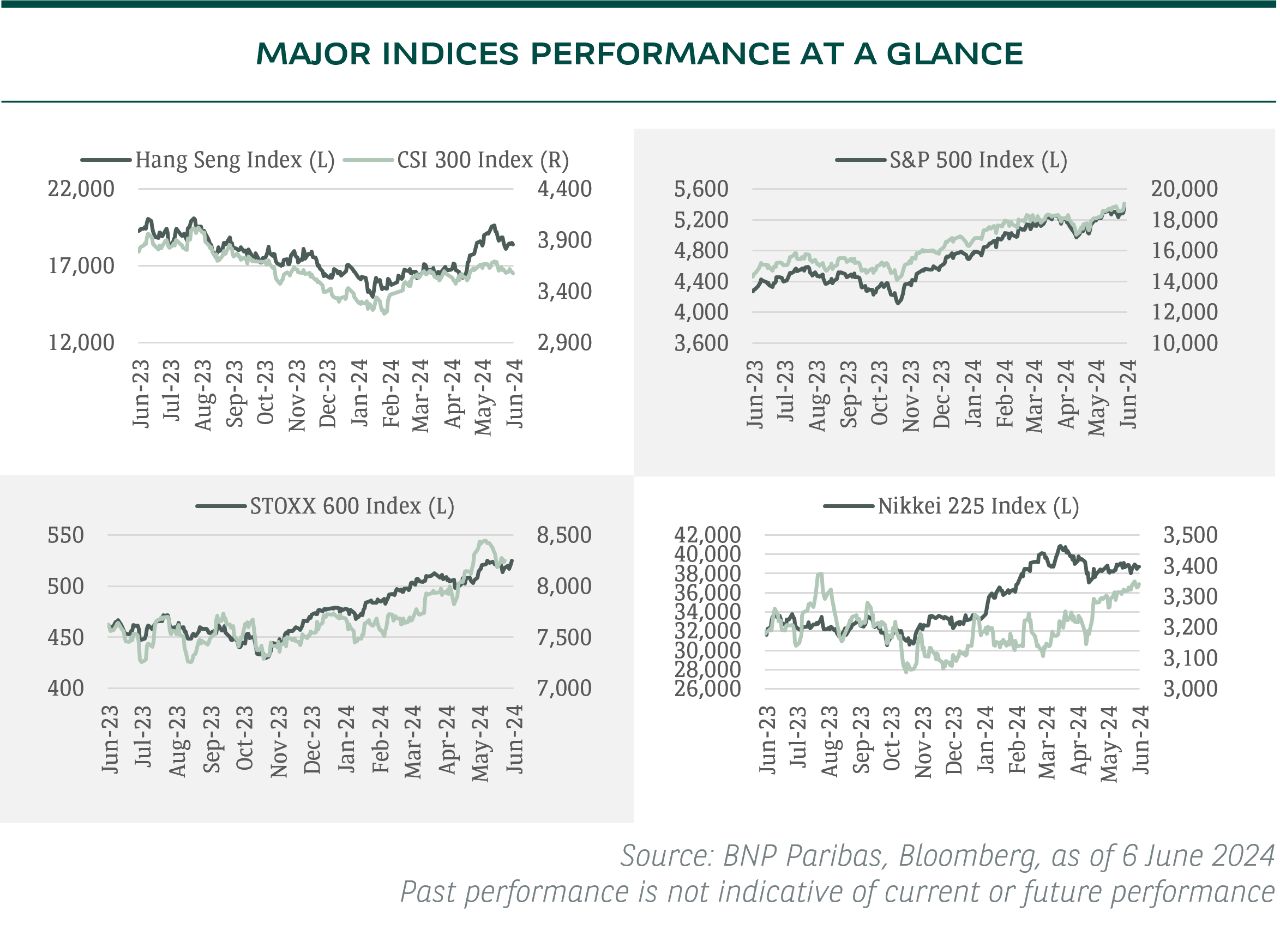

US continues to maintain its outperformance over World equities, underscoring our earlier constructive stance on US equities.

The Stoxx Europe 600 continued its early-year momentum to hit record highs in May 2024. DAX, CAC 40 and the UK FTSE 100 indices all achieved new highs, benefiting from a rotation into value stocks.

In Asia, Hong Kong stock market staged a powerful rally since mid-April, driven by the most comprehensive easing of property policies since the introduction of “three red lines” in August 2020.

Japanese equities have continued to deliver solid gains year to date, driven by multiple tailwinds which include an ongoing economic recovery, weak JPY, improving corporate governance and re-opening tailwinds.

HK / China: Rising Tide

A swift turnaround of China property policies has reset expectations for higher economic growth. China’s 3rd Plenum in July may release new catalysts.

What happened?

Hong Kong stock market staged a powerful rally since mid-April, driven by the most comprehensive easing of property policies since the introduction of “three red lines” in August 2020.

The pivotal change unfolded quickly, which delivered a clear signal that government is eager to lift the property market from a downward spiral.

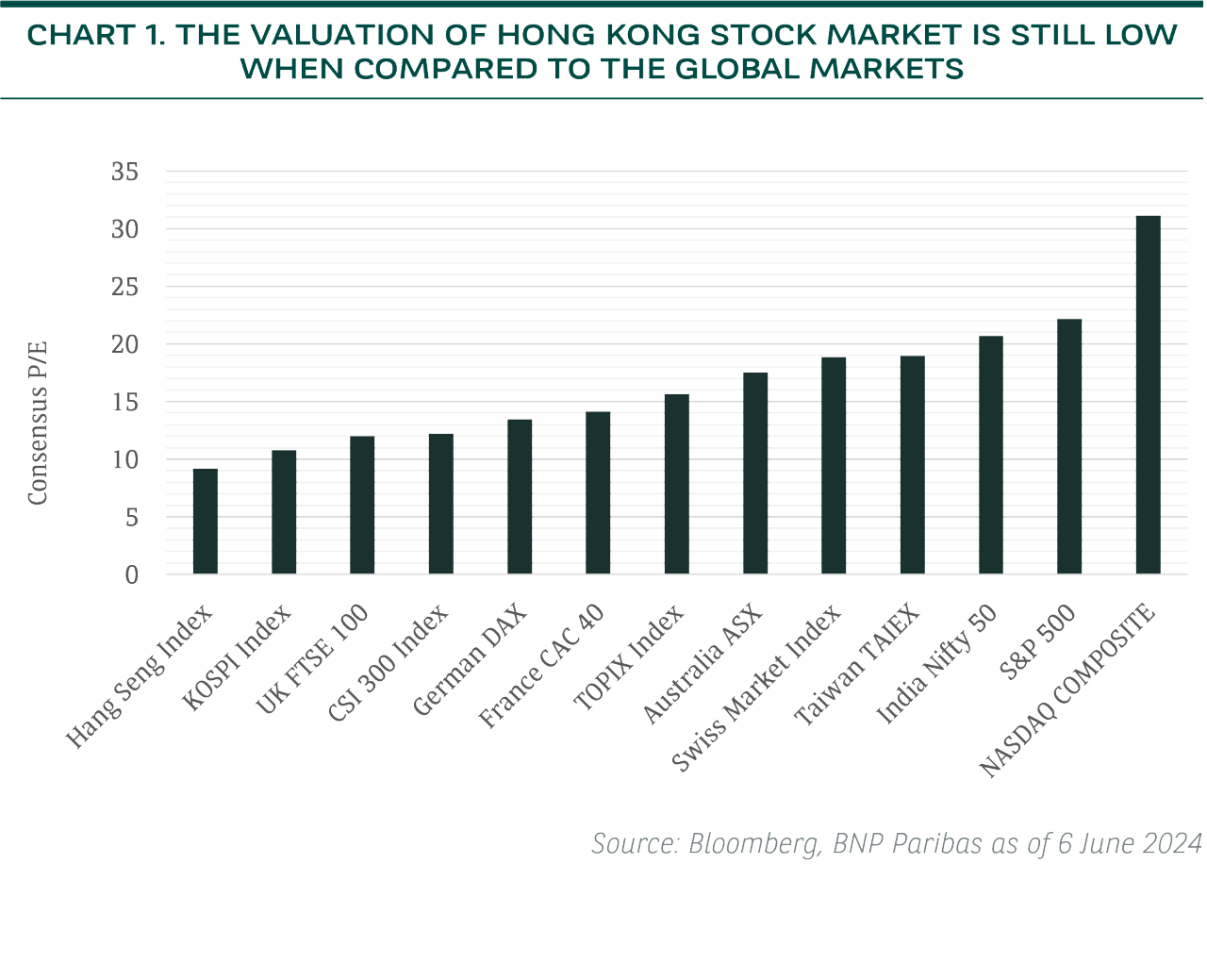

Although Hang Seng Index rebounded as much as 21% since 19 April 2024, valuation remains cheap at less than 10 times forward price-to-earnings multiple (see Chart 1).

Looking ahead, the 20th Central Committee of Chinese Communist Party will hold the 3rd Plenum in July 2024. The top leaders are expected to lay out the strategic plan for deepening market reform and Chinese-style modernisation.

Our view

The swift turnaround of property policies appears to be the inflection point that we have long awaited. Expectations for more stimulus and market-friendly policies are likely to build up in the run-up to the 3rd Plenum in July 2024, in our opinion.

High-beta large-cap stocks are bound to catch more attention should institutional investors continue reloading their portfolios. Net fund flow and volatility tend to play bigger roles than individual companies’ fundamentals in the short-term when market sentiment reverses.

Notable Developments in Selected Sectors

- China Property: Comprehensive policy easing ignited a strong rally across the sector. In our opinion, a sooner-than-expected stabilisation of home prices will restore stock market confidence.

- China E-commerce: E-commerce platforms have delivered stronger-than-expected gross merchandise value growth, year to date. We expect take-rate adjustments at individual platforms to end soon.

- H-shares and Red-chips: The China Securities Regulatory Commission reportedly weighed a proposal to waive dividend tax on HK-listed shares bought via Stock Connect by individual mainland China investors. High dividend H-shares and red-chips caught more investor interests because of the news.

- China New Energy Vehicle: The State Council proposed to gradually remove purchase restrictions and speed up the transition to low-emission transportation.

- China Renewable Energy: The State Council released a work plan for energy conservation and carbon emission reduction. China is targeting to increase non-fossil fuel electricity generation from 36.2% of total in 2023 to 39% by end of 2025.

How to play the game?

High-beta index constituents - Internet companies, new energy vehicle makers, non-bank financials and sportswear makers.

US: Expect increased election focus in 2H24

US continues to maintain its outperformance over World equities, underscoring our earlier constructive stance on US equities.

What happened?

Key drivers of the outperformance include better-than-expected earnings growth in the recent 1Q24 corporate reporting season and supportive financial conditions. At a sector level, Information Technology and Communication Services and were amongst key drivers of overall earnings growth in the US.

For FY24E and FY25E, consensus forecasts for MSCI US index’s earnings per share (EPS) growth are for 10.3% and 14.3% respectively, higher than World equities’ EPS growth forecast at 8.1% and 12.6% respectively.

We observe investor positioning remaining in key US mega caps which have continued to deliver higher than market average earnings growth. This is unsurprising given that S&P500 index’s EPS growth excluding the “Magnificent Seven” stocks is estimated to be more muted at about -2% year-on-year (YoY).

Our view

The AI theme continues to exert a dominant influence on the US equity market this year, which has been reflected in the strong outperformance of semiconductor related stocks within the information technology sector.

While valuations of the tech sector appeared extended, we maintain a constructive outlook based on our expectations of above average market growth and the potential for peaking interest rates to provide further support.

Within Pharma, contributions from key existing products and newly launched treatments focused on obesity and oncology should remain key growth drivers.

We continue to see attractions in healthcare’s defensive-growth meris, while AI also has the potential to transform the industry, reducing costs and improving savings in the long run.

Looking into 2H24, we expect increasing investor focus on November’s election in the US, which could translate into higher volatility for any industries that could be affected or benefit from potential policy changes and provide fresh tactical opportunities for investors.

How to play the game?

Areas on our radar - Healthcare policies, AI regulation, energy permits, trade and tax policies.

Investment implications - To pay attention to core asset allocation and diversification of portfolio holdings.

Notable Developments in Selected Sectors

- Financials: On the back of trends seen in the results season, our preference is for banks with larger bias towards investment banking activities over money center banks due to the latter’s higher sensitivity to the “higher for longer” rate narrative.

- Industrials: While we have a selective stance on the sector in view of more modest earnings growth expected this year, the reshoring theme should remain relevant given a continued climate of geo-political tensions. Industrial automation ideas should also see medium term support from ageing population and manufacturers’ increased focus on efficiency.

- Information Technology: AI continues to be a key narrative driving investor flows in the sector. While overall sector valuations are extended, we expect above market average growth and falling interest rate environment to remain supportive for the sector. We have a selective stance following the sector’s strong outperformance over global equities and advise fresh positions to accumulate quality names in stages.

Europe / UK: Europe still performing

The Stoxx Europe 600 continued its early-year momentum to hit record highs in May. DAX, CAC 40 and the UK FTSE 100 indices all achieved new highs, benefiting from a rotation into value stocks.

What happened?

Macro challenges remain a consideration for investors. Ratings agency S&P downgraded France's credit score for the first time since 2013, citing a deterioration in the country's budgetary position.

Germany has been a notable struggler with growth, skirting a recession at the start of the year. However, the prospect of interest rates cuts has been taken favourably by investors, as having more recent signs of macro stabilisation.

The European Central Bank (ECB) didn’t disappoint the market, cutting rates by 25 bps to 3.75% in June while embracing a data dependent path for future reductions. We forecast up to two further cuts this year.

Our view

Europe

Earnings season supportive. The recent earnings season was also encouraging, with market cap weighted EPS coming in ~8% ahead of consensus. A larger-than-expected percentage beat EPS estimates (59% vs. 53% 10-year average), driven by Financials, Consumer Staples, Real Estate and Consumer Discretionary.

China remains an important risk factor for revenue, given Europe derives ~8% of revenue from this market (vs. ~2% for the S&P 500) and signs of government stimulus in this market provide a positive backdrop.

European stocks still trade at low valuation levels (S&P 500 P/E of 22.1x compared with Stoxx 600 of 14.3x).

UK

UK hits new highs and awaits an election. The UK bounced back strongly from a shallow recession, providing some relief for the ruling Conservative Party as it heads into a general election in July. GDP jumped 0.6% in Q1 2024 compared to the previous three months, the best reading since late 2021.

This has underpinned market performance, with the UK being one of the best performers globally quarter-to-date. The UK still offers value, trading on 12.0x forward P/E, with the valuation discount attracting M&A suitors.

How to play the game?

European Market - Healthcare, Industrials, Materials (e.g., Metals, Mining & Construction Materials), Financials, Tech and REITs. In addition, domestic consumption plays also look interesting as we enter a big summer of sport in the region.

Notable Developments in Selected Sectors

- Technology: Technology has been one of Europe’s best-performing sectors year-to-date, benefiting from secular growth momentum. European fund managers are seeing opportunities in the space, as reflected in recent survey data, while valuations remain attractive relative to US peers.

- Financials: Confidence remains healthy, with the banking sector set to return >EUR120bn to shareholders via buybacks and dividends in 2024 on the back of strong earnings. The net interest income story may transition towards UK and French banks, which could be better positioned for falling rates. European insurance names should benefit from higher insurance premia, containing underwriting costs and demand for savings products.

- Materials: A combination of stronger global end-demand and restricted supply has fuelled the surge in the copper price. The outlook remains bright for copper producers. We remain selective within Chemicals. The sector should benefit if the uptick in the manufacturing cycle in Europe proves to be sustainable. However, although demand could be picking up, supply from China is also rising. We prefer Industrial Gases within the sector.