Chris ZEE. Head of Equity Advisory, Asia, BNP Paribas Wealth Management & Godfrey OYENIRAN, Senior Adviser, Equity Advisory Asia, BNP Paribas Wealth Management

September 2023 followed a predictable path. The end of summer, back to school, and the return of market volatility.

The Stoxx 600 pulled back over the course of the month although European equities have essentially traded in a narrow range since springtime. Back then, regional investors appeared to be less fixated compared to their US peers on how AI was going to revolutionise the world, and more focused on how economic growth and monetary policy would challenge corporate profits. More broadly, the market has undergone a shift into value sectors such as energy, and defensive areas, notably healthcare.

A weakening European economic picture has certainly provided pause for thought. The European Central Bank (ECB) recently revised average annual real GDP growth forecasts to just 0.7% in 2023, plummeting from 3.4% in 2022, though recovering modestly to 1.0% in 2024 and 1.5% in 2025.

Germany is emerging as Europe’s laggard and one of the factors that led the ECB to cut its growth forecast for the eurozone for 2023 and 2024. The country’s economic problems are compounded by longer-running structural problems, including labour shortages, rising barriers to trade and a lack of investment. This could suggest challenges for the industrial sector. That said, areas like defence are experiencing unprecedented demand.

Despite Europe’s bleak economic landscape, the Eurozone’s annual core inflation hit its lowest level since October 2021 at 4.3% in September 2023, below 4.5% expectations and 5.2% in August 2023. This could counter concerns that Europe is facing a stickier inflation problem than the US, which risks a divergence both in economic fortunes and policymaker responses. Core inflation has fallen more consistently in the US than Europe, as has wage growth. Going forward, after peaking at an average of 8.4% in 2022, the ECB forecasts headline inflation to decrease to 5.6% in 2023, 3.2% in 2024, and 2.1% in 2025. However, higher oil prices add to inflationary fears, even if it does provide support for the energy sector’s performance.

Some of the recent price action reflects caution towards earnings. Luxury names have been vulnerable to weaker US and Chinese demand, while we also saw automakers come under pressure after China hit back at the EU’s investigation into electric vehicle subsidies, suggesting this key market could become more challenging for future revenue generation. For European airlines, there is a concern about earnings sustainability, given persistent cost inflation from high jet fuel prices, as well as weaker post-summer demand. On the flipside, the financial sector has benefited from higher rates, leading to earnings upgrades. Industrial names have also continued to see healthy order books, aided by post-Covid investment and reshoring as companies realign their supply chains.

In the face of market volatility and macro concerns, European stocks held up well relative to the US. Having lagged the S&P 500 for four straight months, the Stoxx 600 staged a relative recovery in September 2023 that led to outperformance on both a monthly and quarterly basis against its US peer.

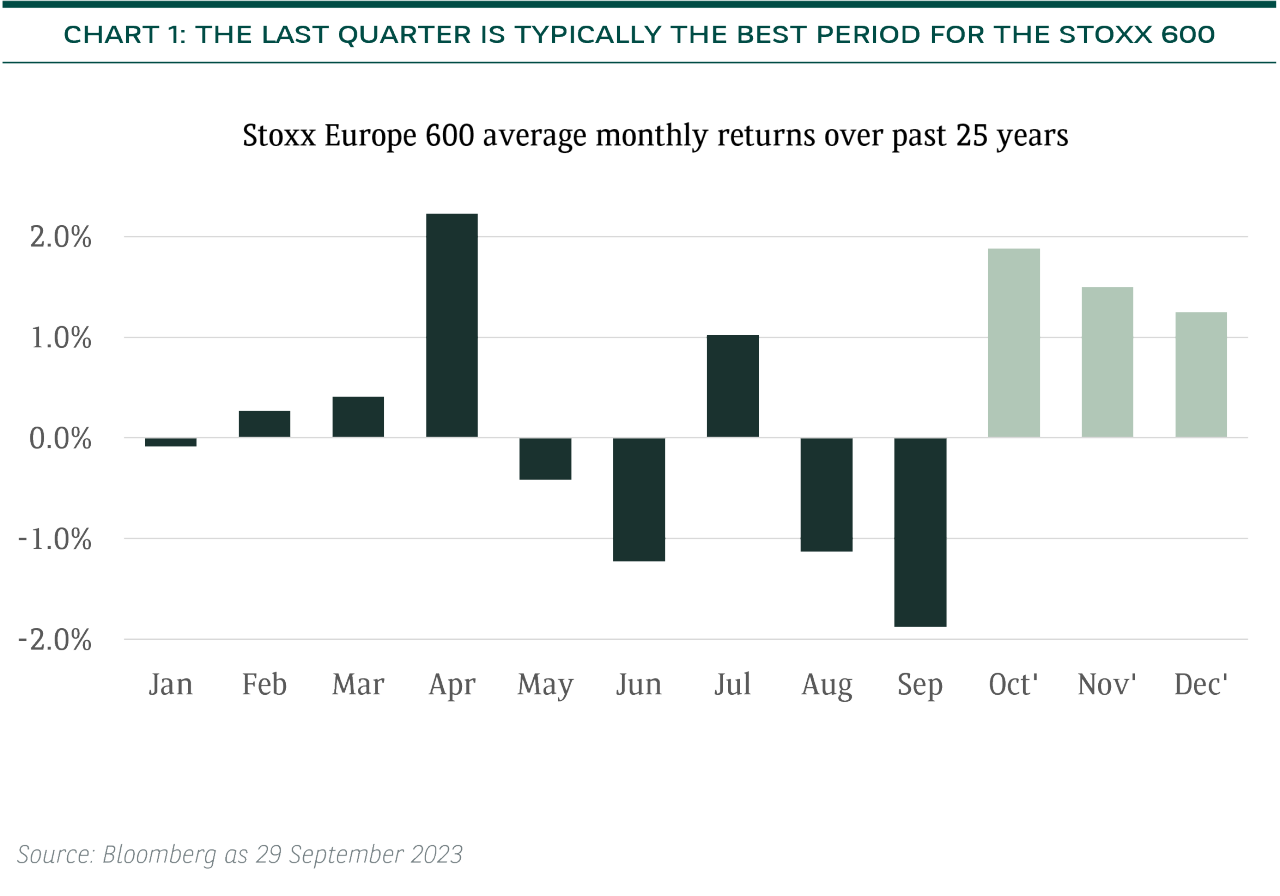

The final three months of the year are typically the best for European equities (see Chart 1). October in particular can be volatile, but the Stoxx 600 has ended the fourth quarter (4Q) with positive returns in 18 of the past 25 years.

Admittedly, the market must still contend with a deteriorating macro backdrop and higher-for-longer rates making bond yields a more favorable alternative to stocks. Nonetheless, cheaper valuations make Europe a lower-risk proposition in the event of weaker global growth. European equities continue to offer lower valuation, with the Stoxx 600 trading on 12.2x forward price-to-earnings (P/E) versus 17.8x for the S&P 500.

UK: The case for the defence

Unloved for much of 2023, the UK’s defensive merits are finally back in fashion.

The FTSE 100 outperformed all major markets not just over what was a challenging September 2023 for global markets, but also over the course of 3Q 2023, and it did so as the only positive performer in local currency terms over both time periods. A spike in oil prices, supporting the UK’s international energy companies, and a dip in the pound to bolster exporters, have started to turn things around for the UK.

This favourable performance came despite headwinds playing out across the economy. A survey from the Confederation of British Industry1 indicated that August 2023 retail sales fell at the fastest year-on-year rate since March 2021. Meanwhile, the unemployment rate hit 4.3% in the May-July quarter of 2023, up from 3.8% in the previous quarter. Economic activity is also being weighed down by the worst run of strikes since the 1980s, impacting consumer discretionary sector sentiment.

The consumers have also had to counter challenges from the housing market. Data from the Office for National Statistics (ONS) show annual UK rents rising by 5.3% in the 12 months to July 2023, with London at a record 5.5%2. The gauge for new tenancies is running at least twice as hot, outstripping record private-sector wage growth. Some 43% of renters surveyed by the ONS say they’re having difficulties affording higher payments. At the same time, The Royal Institution of Chartered Surveyors also said almost every region is now experiencing “relatively steep” falls in housing prices3.

However, when it comes to inflation and its policy response, there are reasons for optimism. Inflation fell for a third consecutive month, declining to 6.7% in August 2023 from 6.8% in July 2023 and below market expectations. Grocery price inflation slowed to its lowest level since September 2022. The headline rate is still much higher than in the US and the eurozone, but progress has been made.

In turn, the Bank of England paused at its September 2023 monetary policy meeting versus expectations of a 25-basis-point rate hike, maintaining a current bank rate of 5.25%. This ended a streak of 14 straight interest rate hikes, providing a relief for markets and mortgage holders alike.

Still, investors remain mindful. While UK energy bills are set to fall in October 2023, fresh increases are expected again in January 2024. Global investor sentiment still needs to improve towards the market, with the UK also suffering from a lack of new listings. The recent decision by British chip designer Arm Holdings to list in New York rather than London reflects the mood.

Valuation remains at lower levels. The market has de-rated strongly since the 2016 Brexit vote and the FTSE 100 trades on 10.7x forward P/E, a 35% discount to the MSCI World Index, and close to the widest spread in the last three decades. The UK is also a relatively stable market and could hold up better during periods of volatility as market uncertainty once again rears its head.

1.Source: CBI, 24 August 2023

2.Source: ONS, 16 August 2023

3.Source: Bloomberg, 14 September 2023