Chris ZEE Head of Equity Advisory, Asia BNP Paribas & Darren LEE Investment Adviser Equity Advisory Asia BNP Paribas

Summary

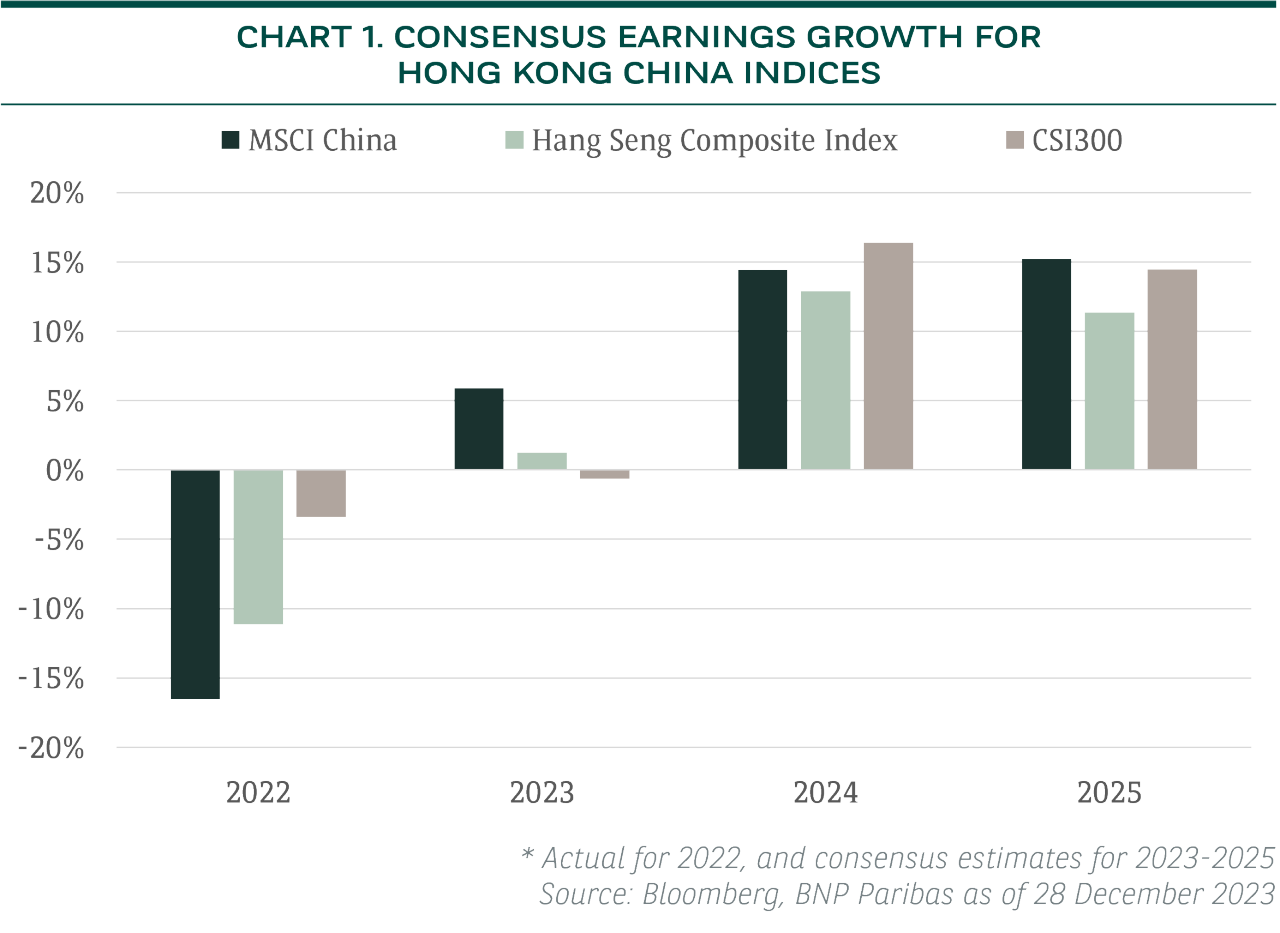

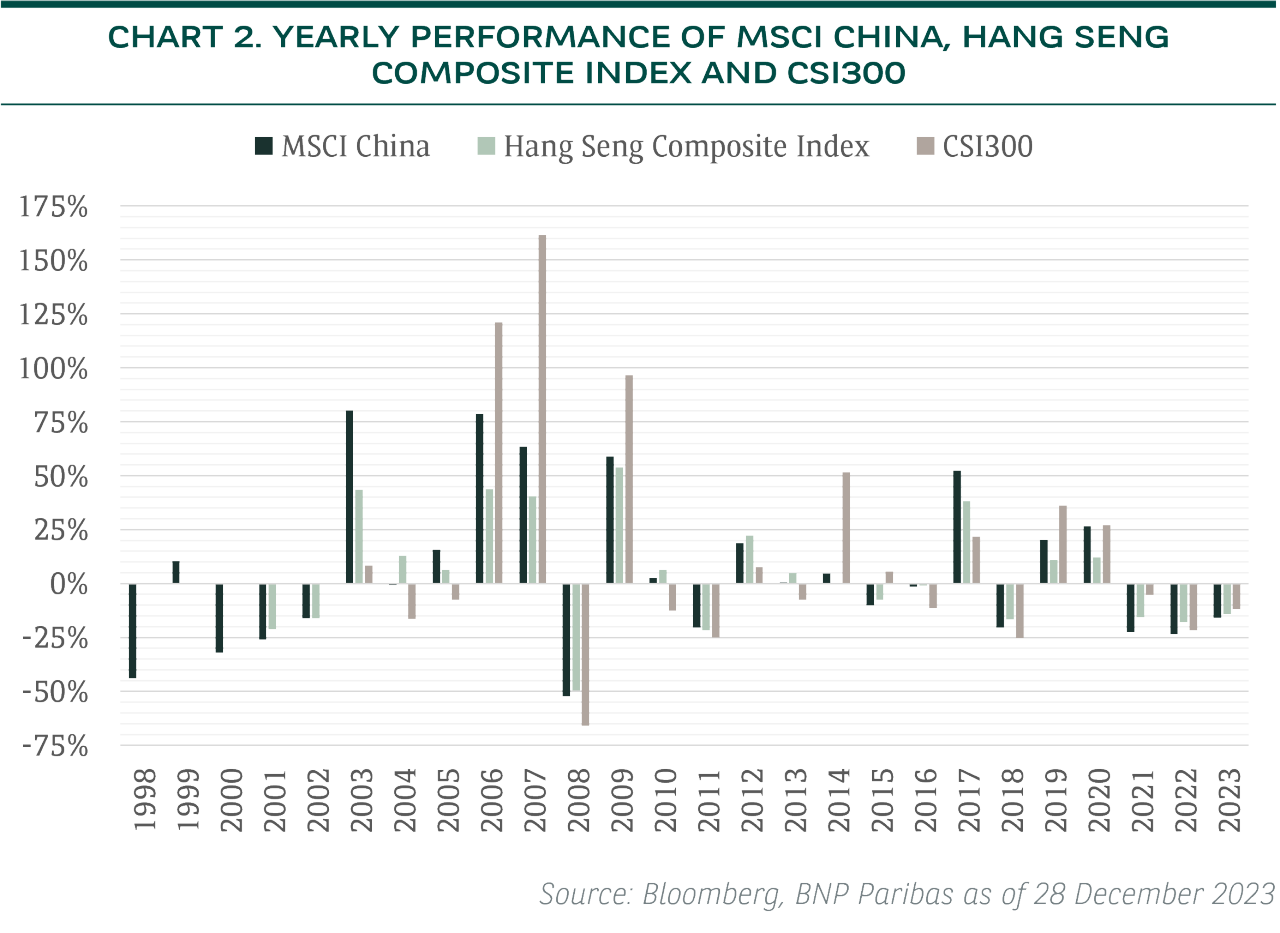

Both the onshore and offshore China markets experienced three consecutive years of negative return, which is the first time in the past 20 years. Although aggregate earnings of listed companies is expected to resume growth, the market indices headed south with collapsed price-to-earnings multiples.

We believe the key for market revival is whether the Chinese government will launch policies that are bold enough to restore investor confidence. In fact, China did not lack breeze of pro-economy policies in 2023. However, they were too gentle and fragmented that failed to boost investor confidence. We think things would be different if those polices were puffed out strongly in one-go. Mercifully, it appears that the top leaders share similar thoughts with us. Both the Politburo and the Central Economic Work Committee emphasised “to enhance consistency of macro policies” during the meetings in December 2023. Hopefully, all government departments and municipals will work closely together to synthesise coordinated fiscal stimuli in 2024.

Notable developments in selected sectors

- Hong Kong Properties and Utilities: We believe sooner-and-deeper than expected interest rate cuts will be powerful upside catalysts to the shares of Hong Kong property and utility companies in 2024.

- China NEV [1]: There are growing worries over the competitive landscape of China NEV industry, despite country-wide monthly unit sales growth staying in the double-digits territory.

- China E-commerce: The megatrend of consumer wallet shift towards low-price and SFV [2] sales channels accelerated in 2023. On the other hand, the legacy online platforms have been struggling to adapt to changing consumer preferences.

- China Financials: China’s financial policies have been less aggressive than market’s expectations in our view. Many market participants, including us, counted down to 2024 with unfilled hopes for interest rates and RRR [3] cuts in the last quarter of 2023.

Wake The Dragon Up in 2024

Both the onshore and offshore China markets experienced three consecutive years of negative return (see Chart 2), which is the first time in the past 20 years. Although aggregate earnings of listed companies is expected to resume growth (see Chart 1), the market indices headed south with collapsed price-to-earnings multiples.

We believe the key for market revival is whether the Chinese government will launch policies that are bold enough to restore investor confidence. In fact, China did not lack breeze of pro-economy policies in 2023, but they were too gentle and fragmented that failed to boost investor confidence. We think things would be different if those polices were puffed out strongly in one-go. Mercifully, it appears that the top leaders share similar thoughts with us. Both the Politburo and the Central Economic Work Committee emphasised “to enhance consistency of macro policies” during the meetings in December 2023 [4&5]. Hopefully, all government departments and municipals will work closely together to synthesise coordinated fiscal stimuli in 2024.

Notable developments in selected sectors and industries

1 ) Hong Kong Property and Utilities

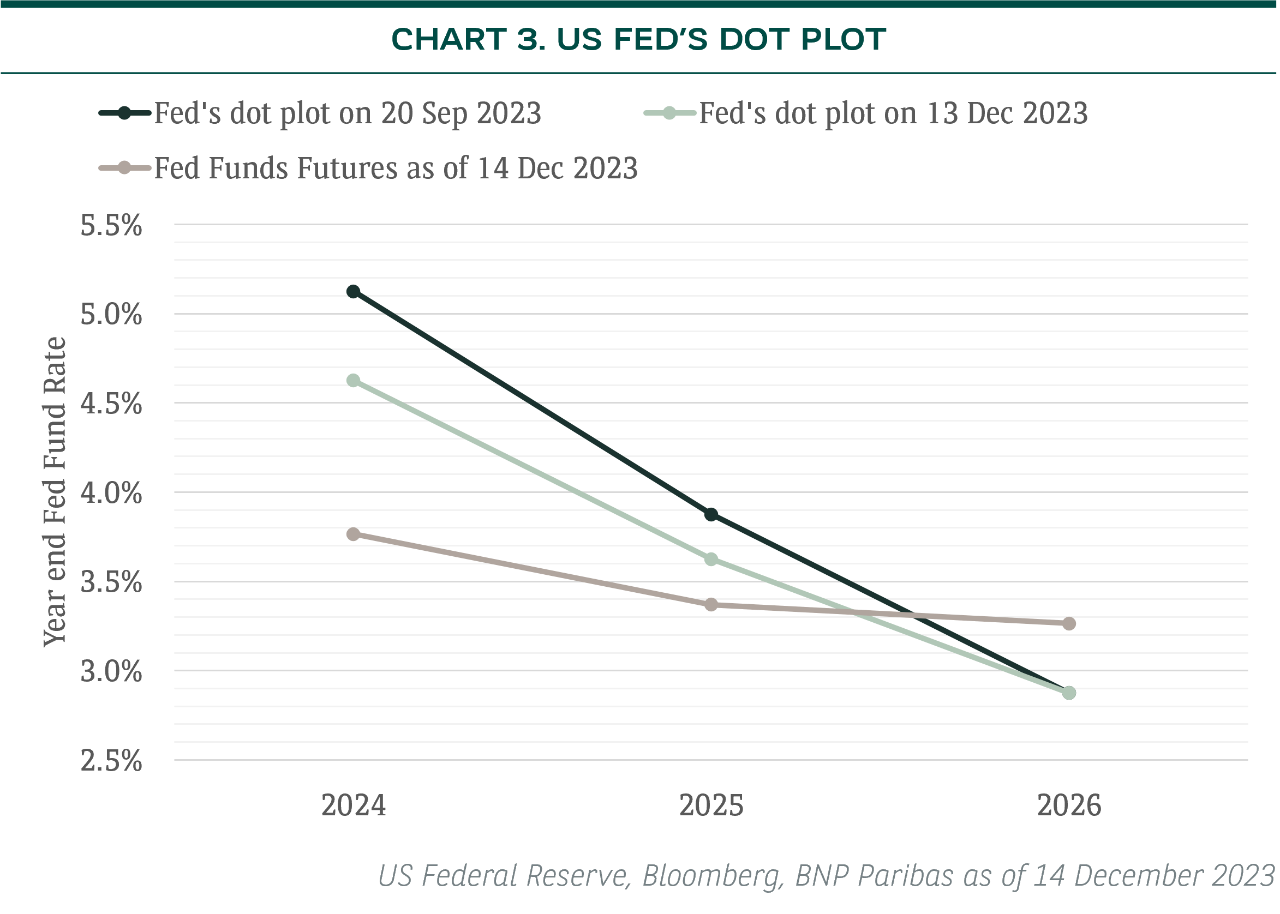

Shares of interest-rate sensitive sectors, such as property and utilities, rebounded on the surprisingly dovish turn by the US Federal Reserve on 13 December 2023. Federal Reserve Chair Jerome Powell said the US central bank will start to discuss policy easing even if the economy does not dip into a recession in 2024. The latest Fed’s dot plot projected steeper rate cuts of 75 basis points (bps) in 2024 and 100bps in 2025, while the target rate for end-2026 is unchanged (see Chart 3). However, the street immediately cranked up rate cut expectations to at least 150bps of rate cuts (6 rate cuts) in 2024 as of 14 December 2023, from 100bps of rate cuts before FOMC (Federal Open Market Committee) meeting.

Property sector

Lower interest rates are expected to benefit the real estate sector in multiple ways:

(1) Reducing debt burden of leveraged property developers;

(2) Improving affordability of residential properties which in turn may spur new home sales;

(3) Trickle-down effect that supports domestic consumptions and retail rents;

(4) The steady dividend from Hong Kong real estate companies may attract conservative investors again in a low interest rate environment.

In terms of sub-sector preference, we favor large residential property developers with low gearing ratios that should have greater financial flexibility to scoop up new projects at bargain prices. We also favor retail landlords focusing on domestic neighborhood shopping malls over tourist-oriented ones. For office landlords, the overall Hong Kong office vacancy rate showed signs of stabilisation in recent months (see Chart 4), while we remain cautious against office buildings in Central due to abundant new office space supply in 2024.

Utilities sector

Our back-testing shows that raising interest rate had been an overwhelming factor in driving share price performance of Hong Kong utilities. Investors tend to ask for higher dividend yield, which essentially means lower share price at constant dividend per share, to offset a higher cost of capital.

We believe sooner-and-deeper than expected interest rate cuts will be powerful upside catalysts to the shares of Hong Kong property and utility companies in 2024. Since the beginning of last interest rate hike cycle, Hang Seng Property Index (HSP) and Hang Seng Utility Index (HSU) significantly underperformed the broader Hang Seng Index (HSI). Between 16 March 2022 (i.e. the day before the first US rate hike) and 13 December 2023, HSP and HSU delivered lost -37.1% and -33.1% respectively, worse than the stricken HSI’s -19.2%. The relative performance of HSP and HSU against HSI started narrowing shortly after US Federal Reserve’s dovish tilt (see Chart 5).

2 ) China New Energy Vehicle

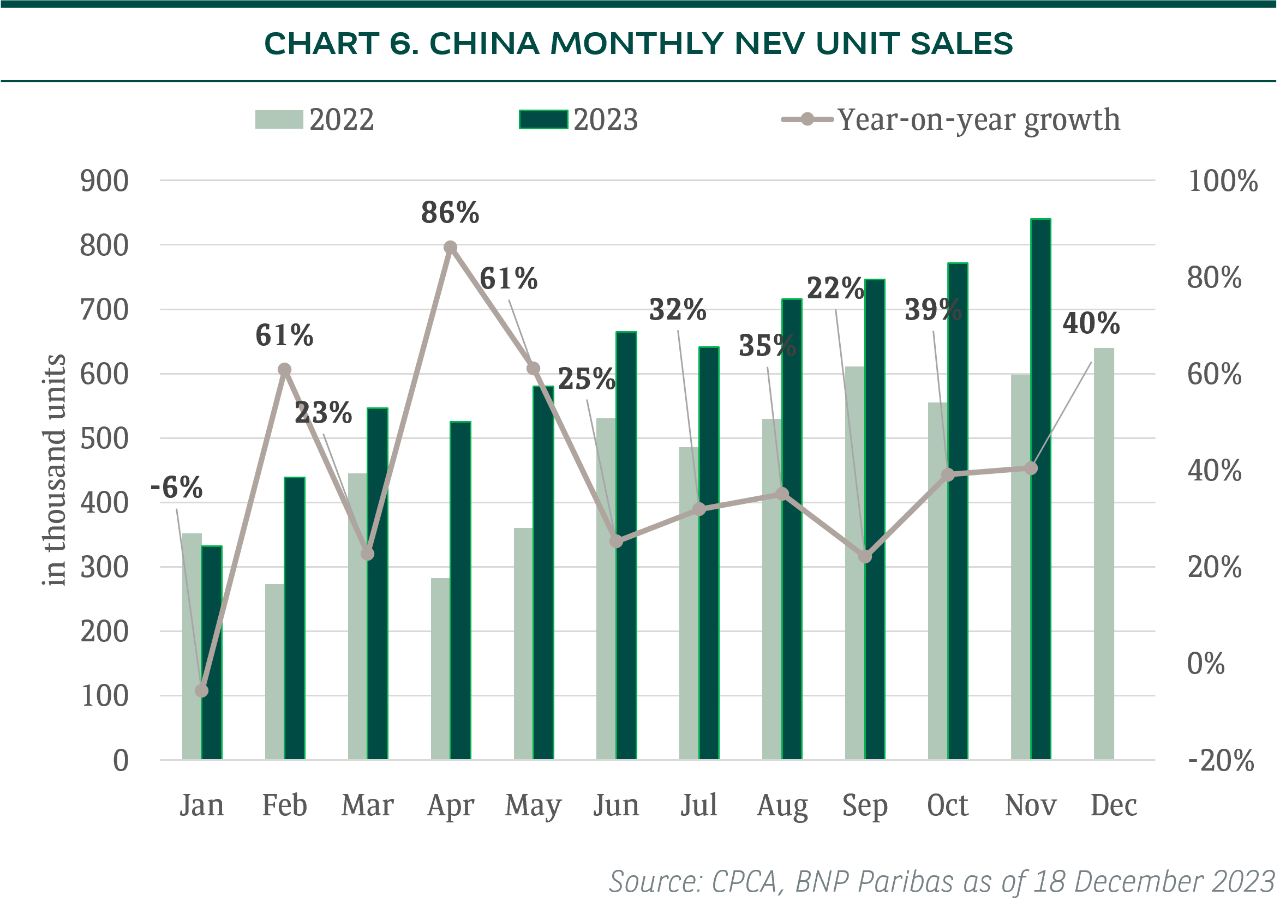

There are growing worries over the competitive landscape of China NEV industry, despite country-wide monthly unit sales growth staying in the double-digits territory (see Chart 6). We are expecting industry consolidation in 2024 and, therefore, prefer large NEV makers.

The conservatives may be right to point out that unit sales of individual NEV makers slowed sequentially in recent months, nonetheless industry growth has remained strong as pointed out above. China NEV sales penetration rate is just one-third of total and far from plateau-out in our view (see Chart 7).

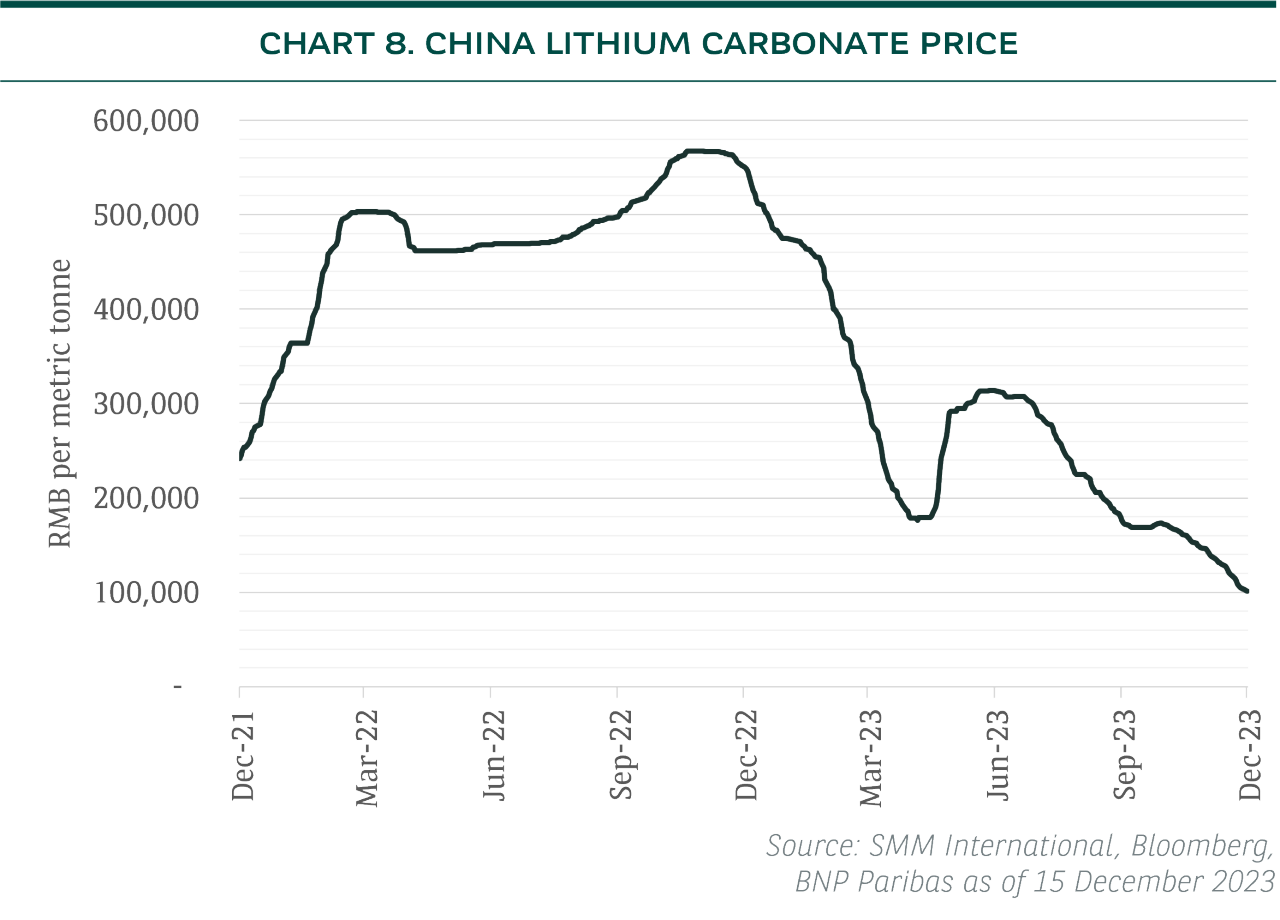

In late November 2023, two of the largest NEV makers in China, including a domestic brand and a foreign brand, launched promotional discounts and subsidies to boost year-end sales. Since then, about twenty other China NEV brands followed. Share prices of China NEV makers slid due to worries for an imminent breakout of price war. However, we reckon profit margins of leading NEV makers are likely to be unscathed, as the temporary price cuts are funded by an avalanche of lithium battery prices (see Chart 8) triggered by excess battery capacity.

3) China E-commerce

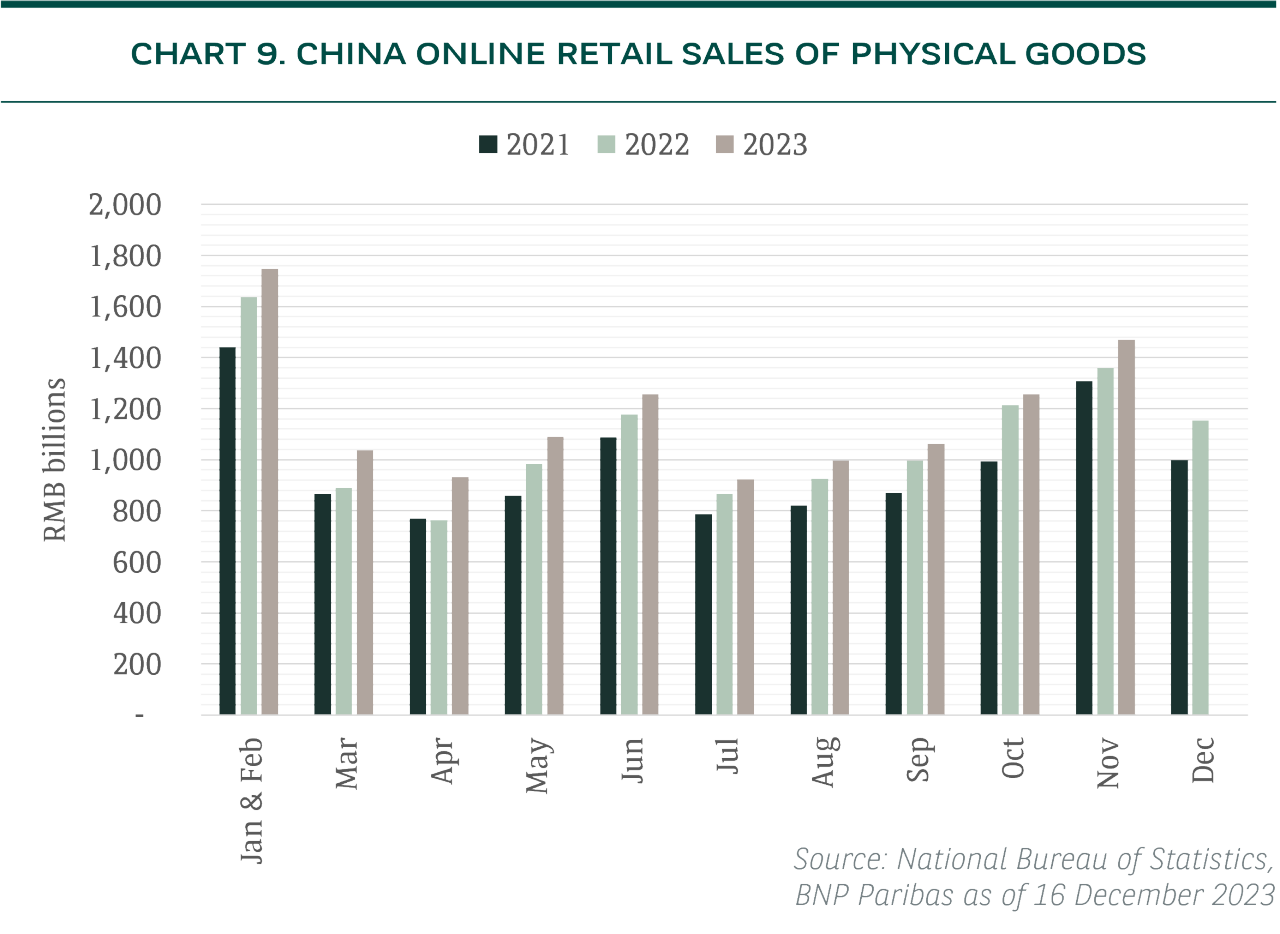

The megatrend of consumer wallet shift towards low-price and short-format video (SFV) sales channels accelerated in 2023. On the other hand, the legacy online platforms have been struggling to adapt to changing consumer preferences notwithstanding their strategic transformation plans announced in early 2023. However, we think it is worthwhile to mention that the legacy online platforms also managed to achieve revenue growth despite market share losses, while the low-price and SFV platforms grabbed most of the incremental market growth (see Chart 9).

For 2024, we expect this megatrend to continue. The founders of the two legacy online platforms had openly addressed the strategic mistakes made by their companies and called for changes. Meanwhile, shares of the legacy online platforms are traded at high single-digit price-to-earnings multiples which reflect low expectations for growth. We think a sooner-than-expected revamp of their service agreements with third party merchants will enhance goods price competitiveness, which in turn may help narrowing gap between legacy online platforms and their competitors.

4) China Financials

China’s financial policies have been less aggressive than market’s expectations in our view. Many market participants, including us, counted down to 2024 with unfilled hopes for interest rates and reserve requirement ratio (RRR) cuts in the last quarter of 2023.

In November 2023, a global financial news agency published separate reports quoting unnamed sources that China was to inject RMB 1 trillion into the banking system via Pledged Supplementary Lending [6], drafted a white list of property developers eligible for funding [7] and allowed banks to offer unsecured loans to property developers [8]. The stock market responded positively to those news, but retreated shortly after as the said stimulus did not materialise. While we refrain from commenting on the credibility of those news reports, we believe the episode did more harm than good by weakening the already fragile investor sentiment.

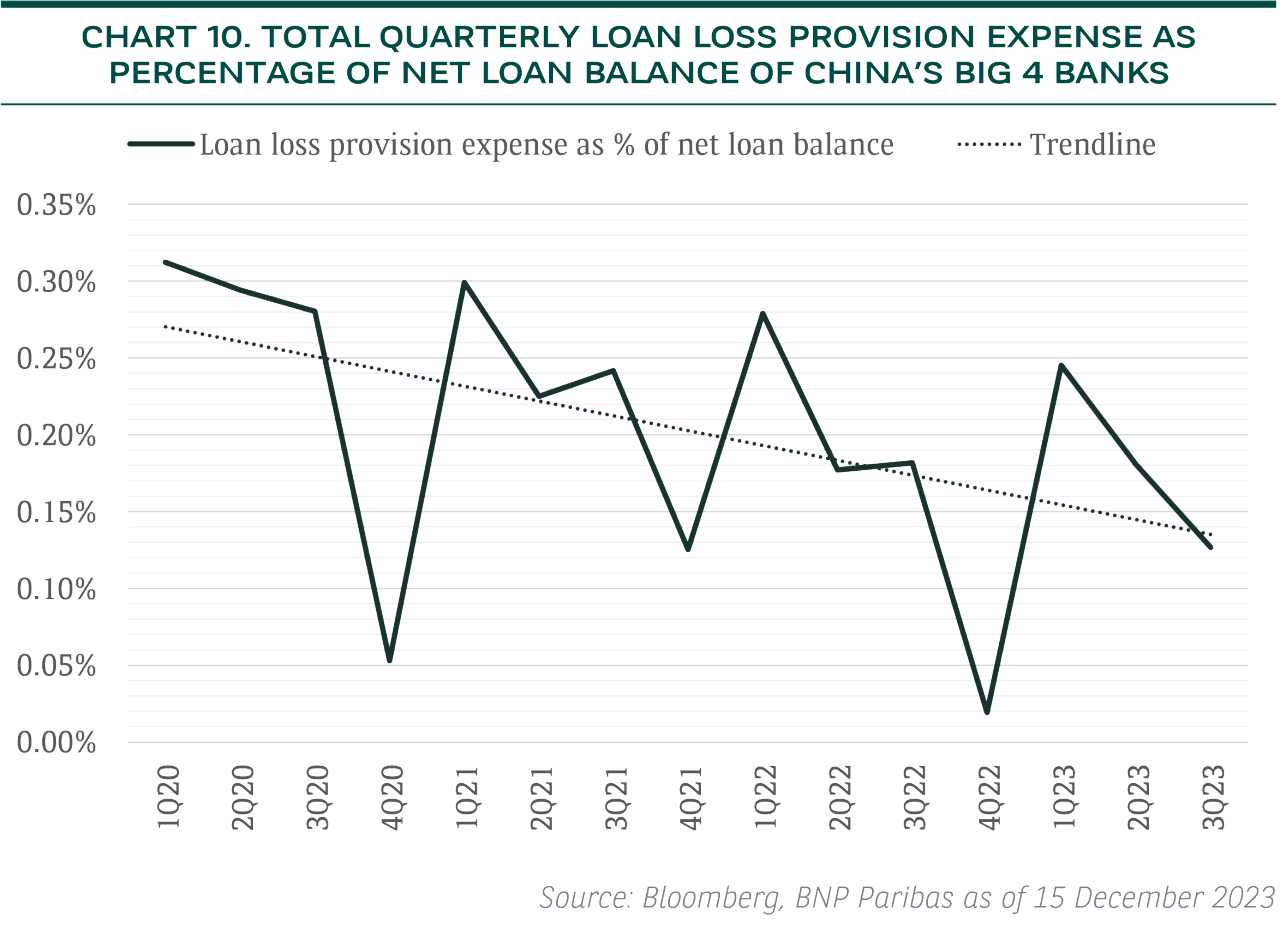

On the other hand, eight government departments jointly published a notice of 25 guidelines to support private economy [9] on 27 November 2023. Banks and financial institutions were instructed to increase private economy related businesses and the weights of private corporate loans in their loan portfolios. Moreover, the notice explicitly requested banks to “reasonably increase tolerance for non-performing private-corporate loans”. In the first three quarters of 2023, most of the major banks were able to report net income growth despite declining net interest income and net fee income, which had been more than offset by shrinking loan loss provision expenses. We believe the regulators’ request for higher tolerance towards non-performing loan would open the gates for banks to book significantly higher loan loss provision expenses in the coming quarters. Indeed, the quarterly loan loss provision expenses of banks have been trending down in the past few years (see Chart 10).

On 8 December 2023, China Securities Regulatory Commission (CSRC) started seeking public opinion on a proposal to tighten regulations on the transactions of and fees paid by public investment funds [10]. The key proposed changes are:

(i) to lower commission fees of public investment funds,

(ii) to forbid co-payments for research services, and

(iii) to enhance disclosure of commission expenses of fund managers.

Borrowing Europe’s experience in the implementation of Markets in Financial Instruments Directive 2014 (MiFID-II), the unbundling of trading and research services could stir up disruptions to securities brokers’ businesses. According to market data compiled by WIND [11] , sub-commissions from public investment funds contributed a total of RMB 9.735 billion revenue to brokers in the first half of 2023. It is estimated that the unbundling of research services would reduce average sub-commission rate paid by public investment funds by one-third.

1. New energy vehicle;

2. Short-format video;

3. Reserve requirement ratio

4. https://www.gov.cn/yaowen/liebiao/202312/content_6919152.htm

5. https://cpc.people.com.cn/BIG5/n1/2023/1218/c64387-40141037.html

6. https://www.bloomberg.com/news/articles/2023-11-14/china-mulls-137-billion-of-new-funding-to-boost-housing-market

7. https://www.bloomberg.com/news/articles/2023-11-20/china-drafts-list-of-50-real-estate-firms-eligible-for-funding

8. https://www.bloomberg.com/news/articles/2023-11-23/china-weighs-unprecedented-builder-support-with-first-ever-unsecured-loans

9. https://www.mof.gov.cn/zhengwuxinxi/caizhengxinwen/202311/t20231128_3918521.htm

10. http://www.csrc.gov.cn/csrc/c100028/c7448201/content.shtml

11. A financial news service provider in China