Summary

The highly anticipated reopening of China happened to be a reset for Hong Kong/China stock markets, as investors’ risk appetite has been falling amid uneven economic growth for China, higher for longer global ex-China interest rates, unresolved geopolitical tensions and a strong US dollar. Entering into the last quarter of 2023, China will hold several important meetings which are expected to set the tone for 2024 economic policies:

- 17-18 October 2023 – The Third Belt and Road Forum for International Cooperation.

- October-November 2023 – The Third Plenary Session of the 20th Communist Party of China Central Committee.

- Early-December 2023 – The December 2023 meeting of The Politburo of The Chinese Communist Party.

- Mid-December 2023 – The Central Economic Work Conference.

The economic policies of China have become accommodative after the Politburo meeting in July 2023, with economic data improved in August 2023. Export data from South Korea and Japan also suggest that industrial production in China is finally stabilizing. Despite that, foreign investors had withdrawn from China equity markets in August and September 2023 amid skepticism over measures to stem economic growth. We believe future market return is skewed to the upside from the possibility that the Chinese government may ramp up pro-growth measures in the fourth quarter of 2023, which we see as a non-consensus view.

Notable developments in selected sectors

- China NEV [1]: EU [2] probe into China electric vehicle exports, Chinese Government policy tailwind and gross margin relief from falling lithium price.

- China IPP [3]: The NDRC [4] had circulated a draft plan to introduce capacity-based subsidies for coal-fired power units in September 2023. The plan is a major twist to China’s energy policy. There will be less demand for spare wind turbines & solar panels in our view.

- China Banks: In the past two months, the PBoC [5] proactively lightened funding costs for banks. NAFR [6] and PBoC jointly requested all banks to axe the floor rate for mortgage loans. However, we reckon net interest income growth for the second half of 2023 may disappoint shareholders.

- Hong Kong Property: In terms of sub-sectoral trends, retail landlords are recovering, office landlords may be bottoming out, but residential property developers are not out of the woods yet in our view.

Brisk Winter

The highly anticipated reopening of China happened to be a reset for Hong Kong/China stock markets, as Investors’ risk appetite has been falling amid uneven economic growth for China, higher for longer global ex-China interest rates, unresolved geopolitical tensions and a strong US dollar. Entering into the last quarter of 2023, China will hold several important meetings which are expected to set the tone for 2024 economic policies:

- 17-18 October 2023 – The Third Belt and Road Forum for International Cooperation. This year marks the 10th anniversary of the Belt and Road Initiative, which is considered as the centerpiece of China’s diplomacy. China’s Ministry of Foreign Affairs said over 130 countries have confirmed to attend the forum.

- October-November 2023 – The Third Plenary Session of the 20th Communist Party of China Central Committee (CPCCC). The national meeting is expected to be held in October or November 2023. Nearly every past third plenary sessions of CPCCC, except the 19th CPCCC, focused on economic issues. The upcoming one may customarily refresh China’s longer-term economic goals and development plans.

- Early-December 2023 – The December 2023 meeting of The Politburo of The Chinese Communist Party. China’s top political leaders will analyze the economic work plan for 2024, and review the work report from Central Commission for Discipline Inspection.

- Mid-December 2023 – The Central Economic Work Conference (CEWC). It is the annual meeting that sets the national economic agenda for the next year. This meeting is convened by the CPCCC and the State Council. Last year’s CEWC was held on 15-16 December 2022.

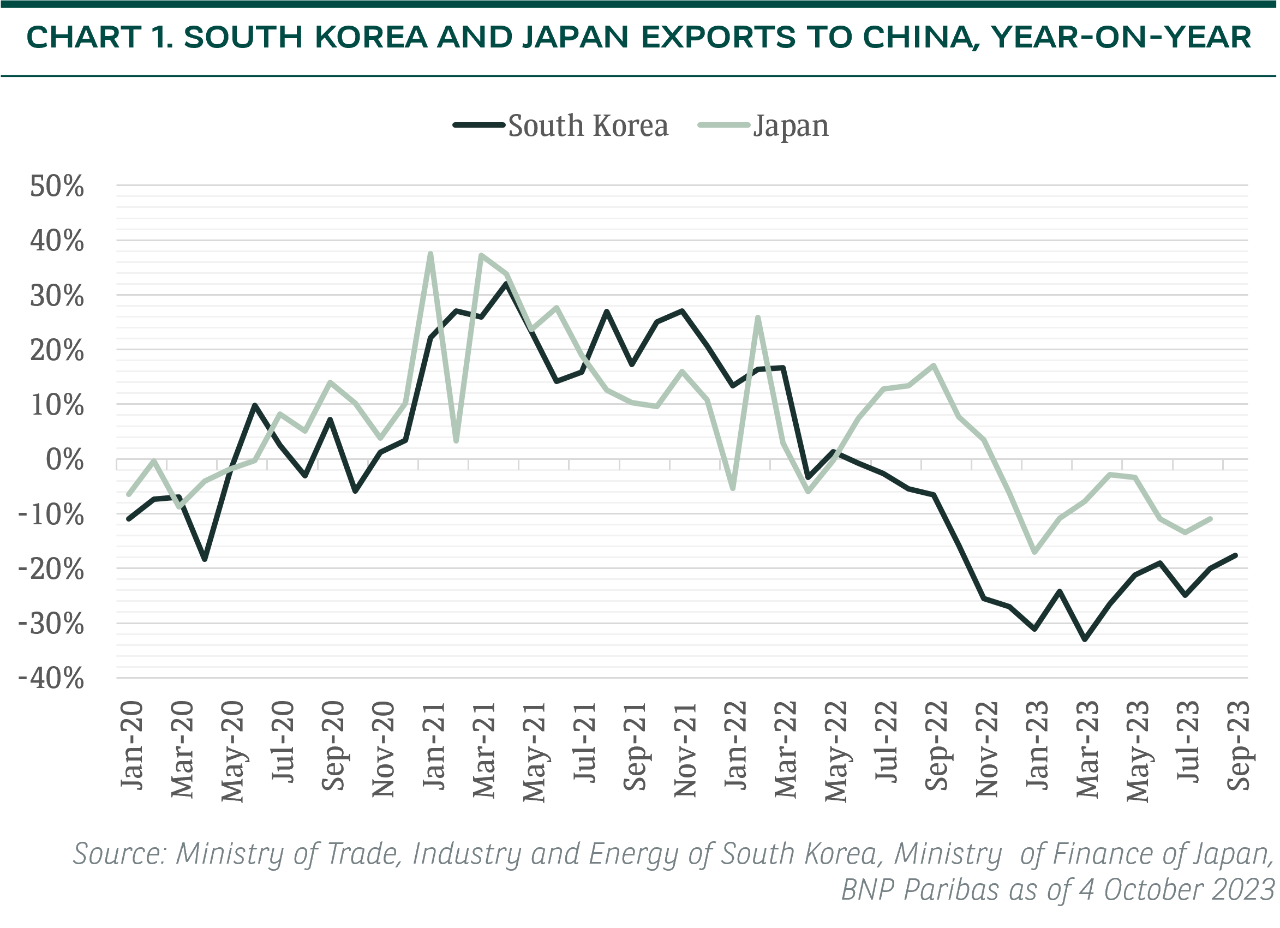

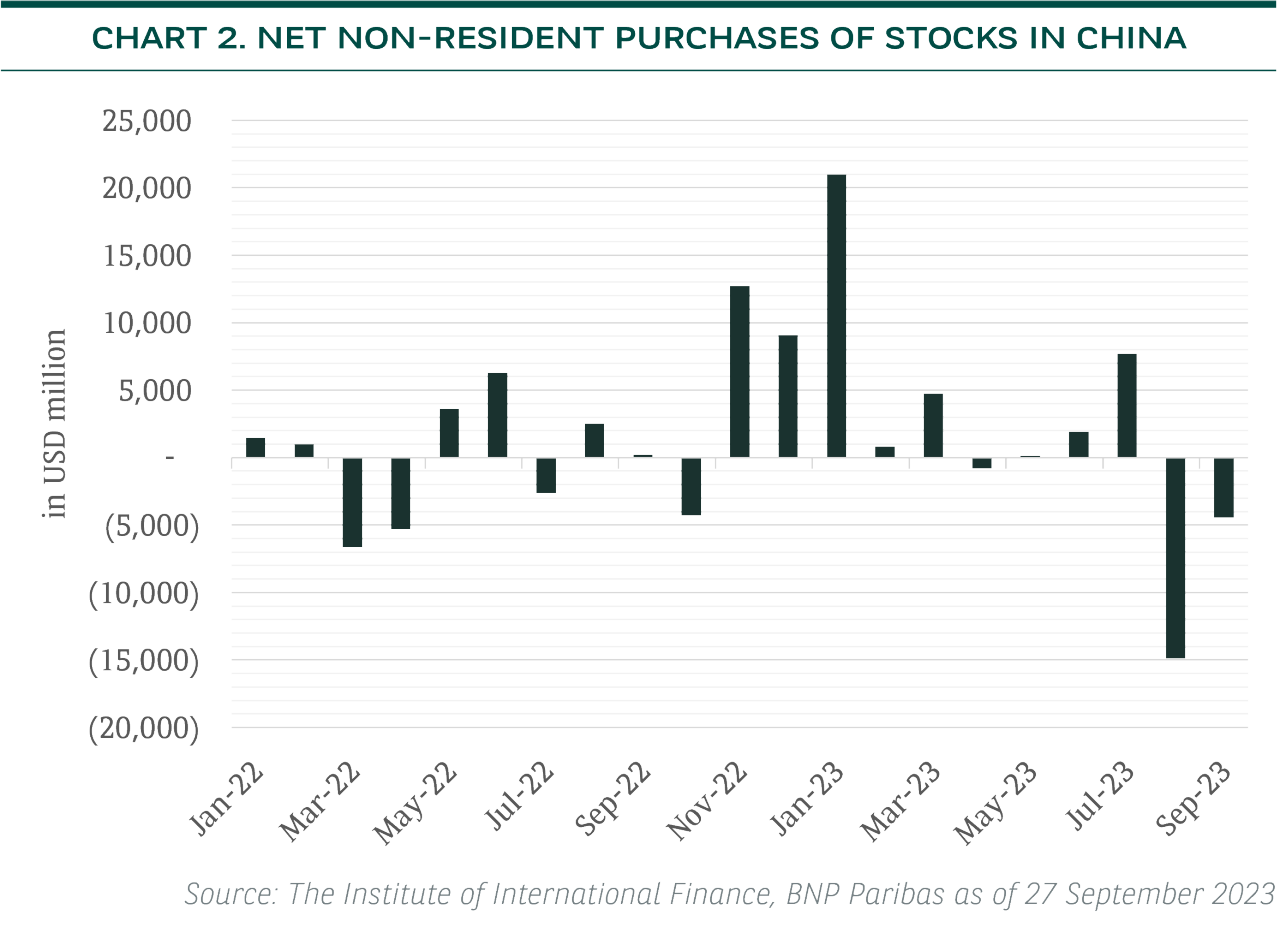

The economic policies of China have become accommodative after the Politburo meeting in July 2023, with economic data, such as industrial value-added, index of service production, total retail sales and consumer price index, improved in August 2023. Export data from South Korea and Japan also suggest that industrial production in China is finally stabilizing after massive slump between late 2022 and mid-2023 (see Chart 1). Despite that, foreign investors had withdrawn from China equity markets in August and September 2023 (see Chart 2) amid skepticism over measures to stem economic growth. We believe current market risk is skewed to the upside that the Chinese government may ramp up pro-growth measures in the fourth quarter of 2023, which we see as a non-consensus view.

Notable developments in selected sectors and industries

1 ) China NEV

EU probe into China electric vehicle exports

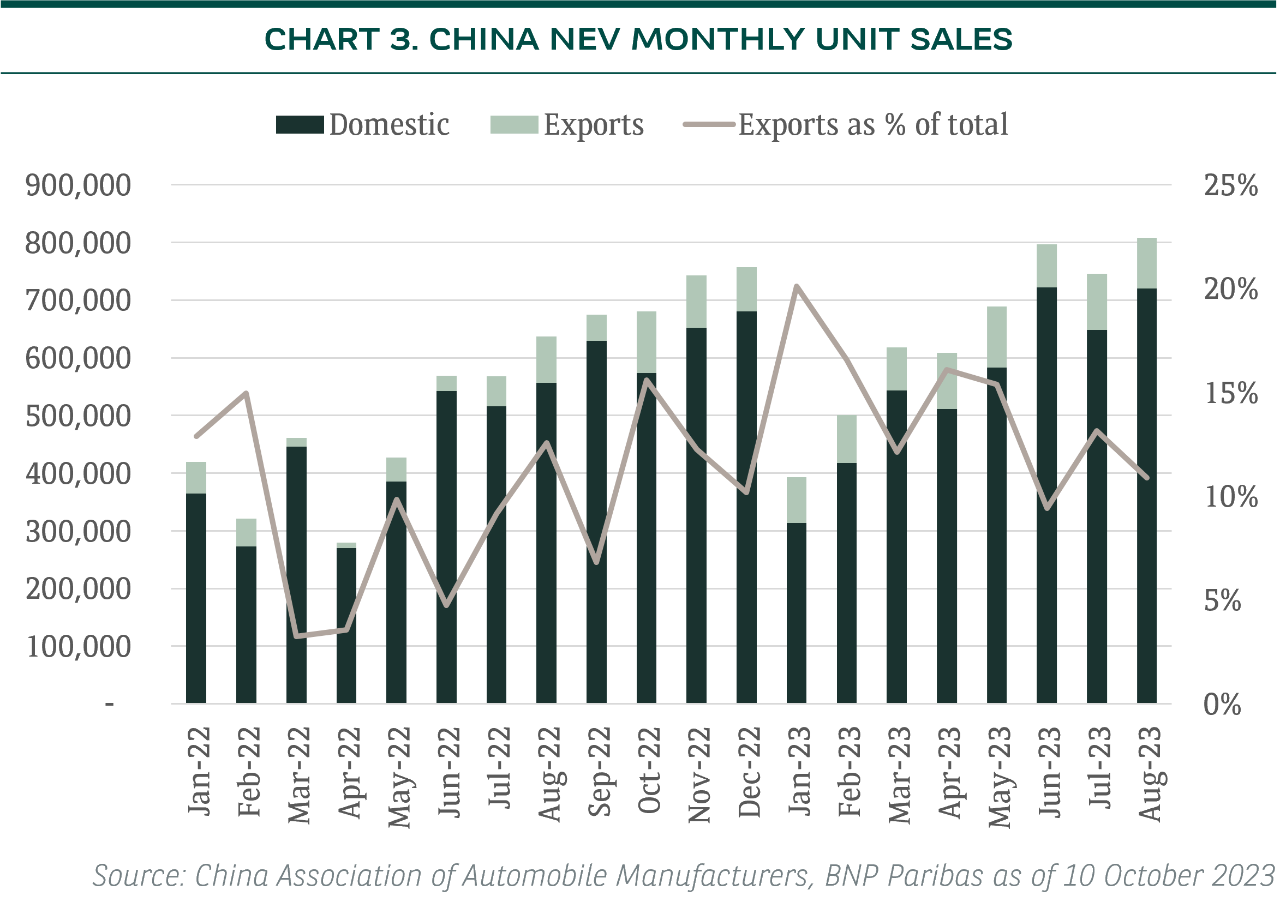

The EU announced an investigation into subsidies given to electric vehicle (EV) makers in China on 13 September 2023. European Commission President, Ursula von der Leyen, claimed “their price is kept artificially low by huge state subsidies. This is distorting our market.” [7] on 4 October 2023, the Commission gazetted to conclude the investigation within 12 months. They will then assess whether to impose tariffs above the standard 10% EU rate for made-in-China battery EVs. In the first half of 2023, the top exporting destination of China NEV (including both battery-EVs and hybrid-EVs) is Belgium [8], where the NEVs are redistributed to other EU countries. However, it is also noteworthy that the worldwide export volume of China NEV was less than 14% of total production of China NEV in January-August 2023 (see Chart 3). Meanwhile, leading US and European car brands are key exporters of made-in-China EVs to Europe. For instance, the largest US-based EV maker is estimated to have shipped over 271,000 units from its Shanghai factory to Europe and other markets in 2022. Their figures dwarf the exports of China battery EV makers that together had less than 10% of European market share in 2022.

Having said that, EU is an important growth market for global EV makers. In March 2023, EU approved a law banning sales of combustion engine cars from 2035, and new cars sold in the EU must achieve 55% emission reductions from 2030 to 2034 compared to 2021. This is while the sales penetration rate of battery EV was only 12% in 2022 according to European Automobile Manufacturer Association. This warrants a circa 10% compounded annual growth rate for battery EV sales between 2022 and 2035, assuming total car sales volume stays constant. While current exposure to EU zone is not high for listed China NEV makers, several of the leading Chinese EV makers are working on plans to build factories in Europe soon. These new EU-onshore factories should help the China NEV makers to mitigate regulatory risks in our view.

Chinese Government policy tailwind

On 1 September 2023, Ministry of Transport and six other government departments jointly published the “Work Plan for Maintaining Auto Industry Growth 2023-2024”. It has explicit unit sales targets for 2023 of 27 million cars including 9 million NEVs, which imply year-on-year growth rates of 3% and 30% respectively. The work plan also called for maintaining car sales at reasonable levels in 2024, raising the quota for new car plates, speeding up the car replacement cycle, launching NEV-to-rural area subsidies, encouraging development of export-oriented cars and other measures. Nonetheless, China has overtaken Japan to become the world’s biggest auto exporter.

Gross margin relief from falling lithium price

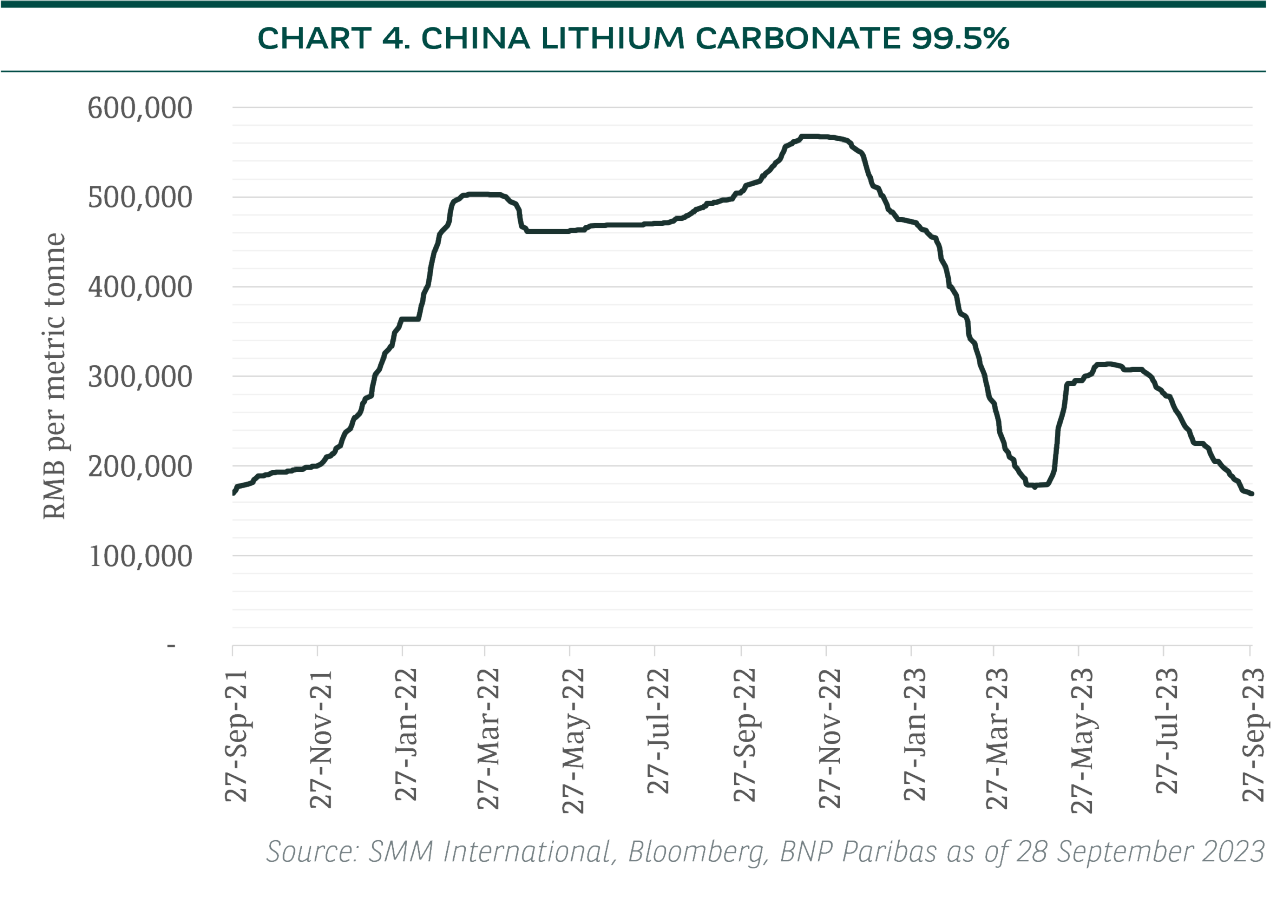

Lithium accounts for roughly 50% of battery material costs, while battery typically accounts for around 30-50% of EV cost. However, the decline in lithium price since late 2022 did not yield higher gross margin among China NEV makers, as raw material cost reductions have been mostly passed to consumers amid the price war started in early 2023. China lithium carbonate price staged a brief rebound in May-July 2023, but seemingly failed to hold since mid-July 2023 (see Chart 4). We think this time may be different on the back of tighter production capacity. We expect gross margin of leading China NEV makers to hold-up in the second half of 2023.

2) China IPPs

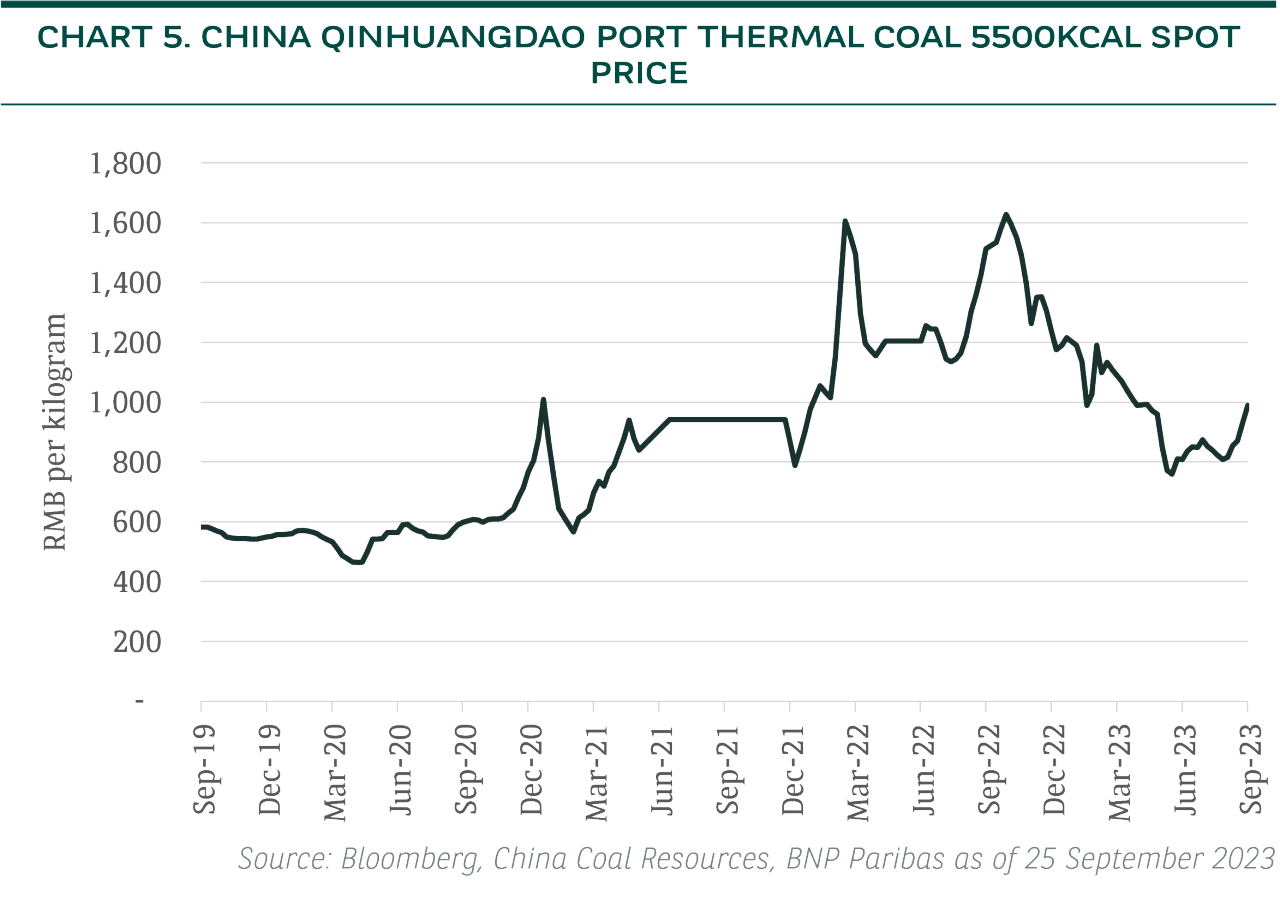

The NDRC had circulated a draft plan to introduce capacity-based subsidies for coal-fired power units in September 2023, according to Bloomberg. The NDRC’s plan would allow eligible power plants to claw back at least 30% of their fixed investment costs through an annual fee of RMB100 to RMB230 per kilowatt of capacity by 2025, which could rise to 50% by 2026. The plan is a major twist to China’s energy policy and may extend the life of coal-fired power units. At the United Nations General Assembly in September 2020, President Xi of China pledged to cut coal consumption from 2025 and reach carbon neutrality by 2060. The aggressive climate agenda led to an accelerated build-out of wind and solar energy plants in the past few years. According to National Energy Administration of China, total wind energy capacity and solar energy capacity stood at 390 gigawatts (GW) and 490GW, respectively, as of July 2023. That implied net installations of 30GW wind energy and 100GW solar energy from end-2022.

The capacity-based subsidies, if adopted, will change the competitive landscape of the utilities sector in our view. These subsidies will improve profitability of existing coal-fired power plants, which have been struggling to break even in the past two years (since 2021) amid escalated coal prices (see Chart 5) and competition from other energy sources.

On the other hand, we do not think the subsidies will derail China’s grand ambition to achieve carbon neutrality by 2060, although it may postpone the phase down of coal power. As a result, there will be less demand for spare wind turbines & solar panels in our view. The situation could be worsened by fiscal constraints of local governments to further invest in renewable energy in the near term. That should explain why price-to-earnings multiples of renewable energy companies have retraced to the levels before China’s carbon neutrality pledge in 2020. Yet, we believe it is overly pessimistic to assume that the growth rate of China’s renewable energy industry will fall back in the medium term.

3) China Banks

In the past two months, The People’s Bank of China (PBoC) proactively lightened the funding cost for banks in order to spur loan growth. On 15 August 2023, PBoC unexpectedly cut the 1-year medium-term lending facility rate (MLF) by 15 basis points (bps) to 2.5% from 2.65%. The rate cut was probably a response to the ongoing troubles surrounding property-sector bonds and the lower-than-expected total social financing growth for July 2023. Then on 14 September 2023, PBoC also lowered the reserve requirement ratio (RRR) for major banks and smaller banks by 25 bps, to 10.5% and 8.5% respectively, while RRR for rural banks was kept unchanged at statutory minimum of 5%. The RRR reduction is estimated to have released RMB500 billion of excess capital, which equaled to over 2% of total outstanding loans at China’s financial institutions as of August 2023.

Moreover, on 31 August 2023, NAFR and PBoC jointly issued a notice [9] that requested all banks to axe the floor rate for mortgage loans as well as trimming and unifying the mortgage down payment ratios across the country.

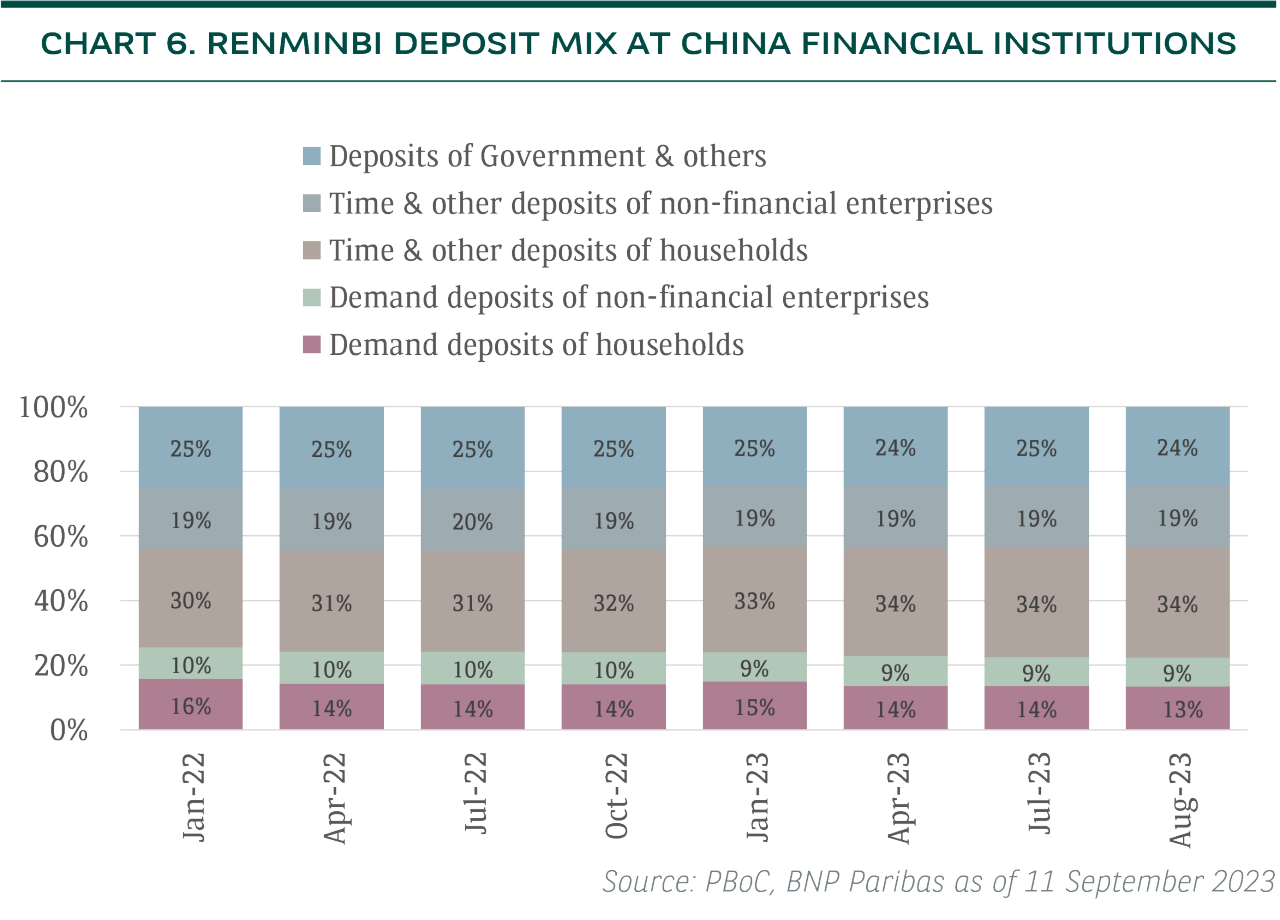

However, it takes time for the monetary easing measures to cascade down the real economy, thus total loan growth in China may not re-accelerate until late 2023 in our view. On the other hand, the stock market was disappointed at the unmoving 5-year loan prime rate (LPR), which is the benchmark rate for mortgage loans. We surmise that smaller banks and rural banks were reluctant to lower lending rates on the back of thin net interest margins. Although major banks initiated deposit rate cuts of 10-25 bps in September 2023, we think a continuing shift in deposit mix from demand deposits to time deposits (see Chart 6) have reduced the responsiveness of banks’ funding cost to interest rate cuts. As a result, we reckon sector-wide net interest income growth for the second half of 2023 may disappoint the shareholders of banks.

Notwithstanding our confidence in the asset quality of large state-owned Chinese banks, it appears that big banks in Hong Kong and other developed economies may offer better risk-reward amid higher-for-longer global interest rates.

4) Hong Kong Property

The Hang Seng Property Index has underperformed the Hang Seng Index by 17.5 percentage points in the first three quarters of 2023, with negative returns of -24.3% and -6.8% respectively. The poor performance of Hang Seng Property Index is mainly attributable to share price declines of Hong Kong property developers, which accounts for nearly two-thirds of the index’s weight. As we previously pointed out, there is a notable correlation between individual companies’ gearing ratio and the expected dividend yield for its shares. The increase in deposit rates and Hong Kong Interbank Offered Rate (HIBOR) over the past year (since 2022) have inevitably driven up the required dividend yield by investors and borrowing costs of the companies. Thus, it is not surprising that shares of cash-rich HK property companies fell less than the highly leveraged peers, which are struggling to avoid cutting dividends.

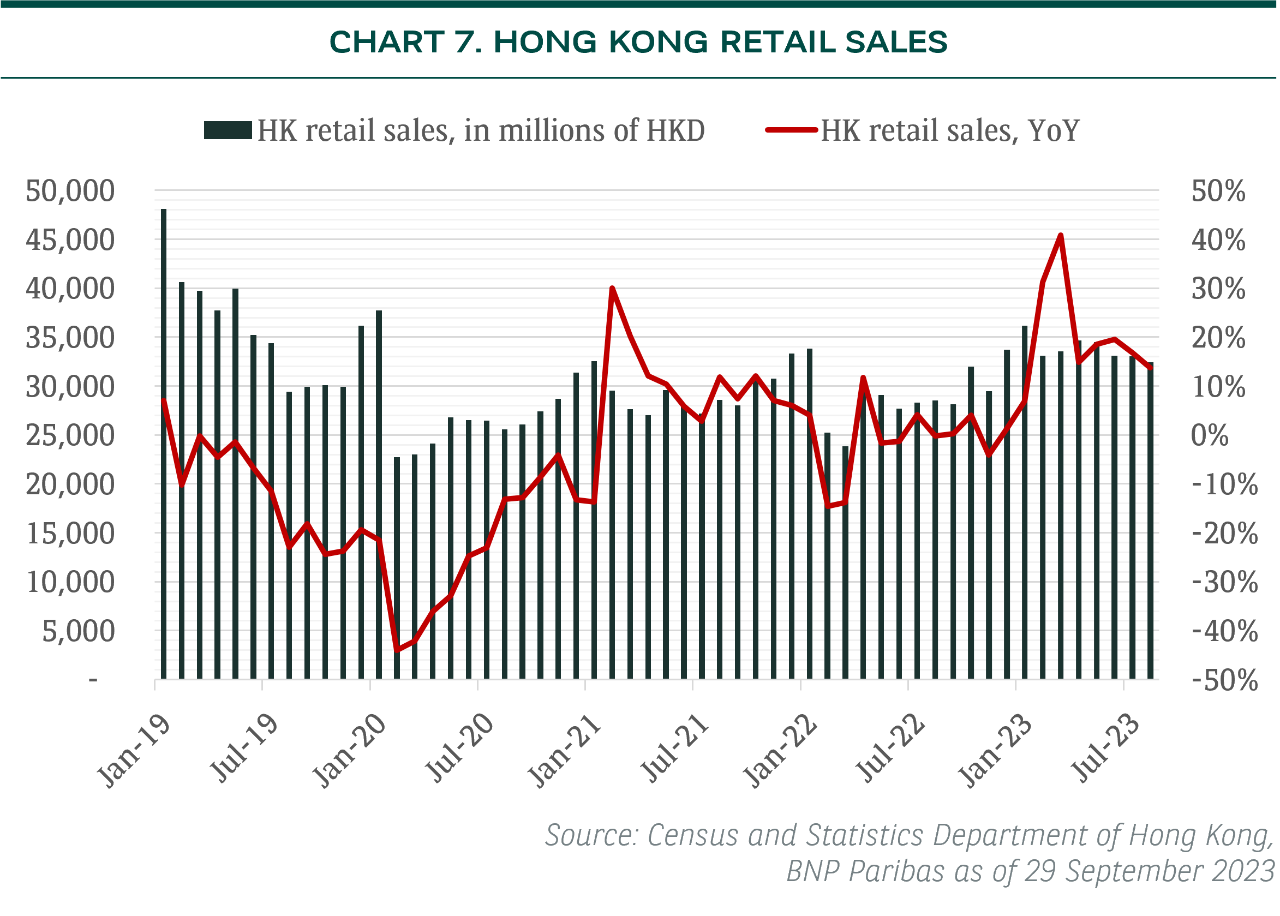

We have a neutral view on the Hong Kong property sector. In terms of sub-sectoral trends, retail landlords are recovering, office landlords may be bottoming out, but residential property developers are not out of the woods yet in our view. The recovery of retail sales is on track (see Chart 7), though the pace may be less than what the bulls wished for. We believe both turnover rent and base rent are skewed to the upside in the next 12 months.

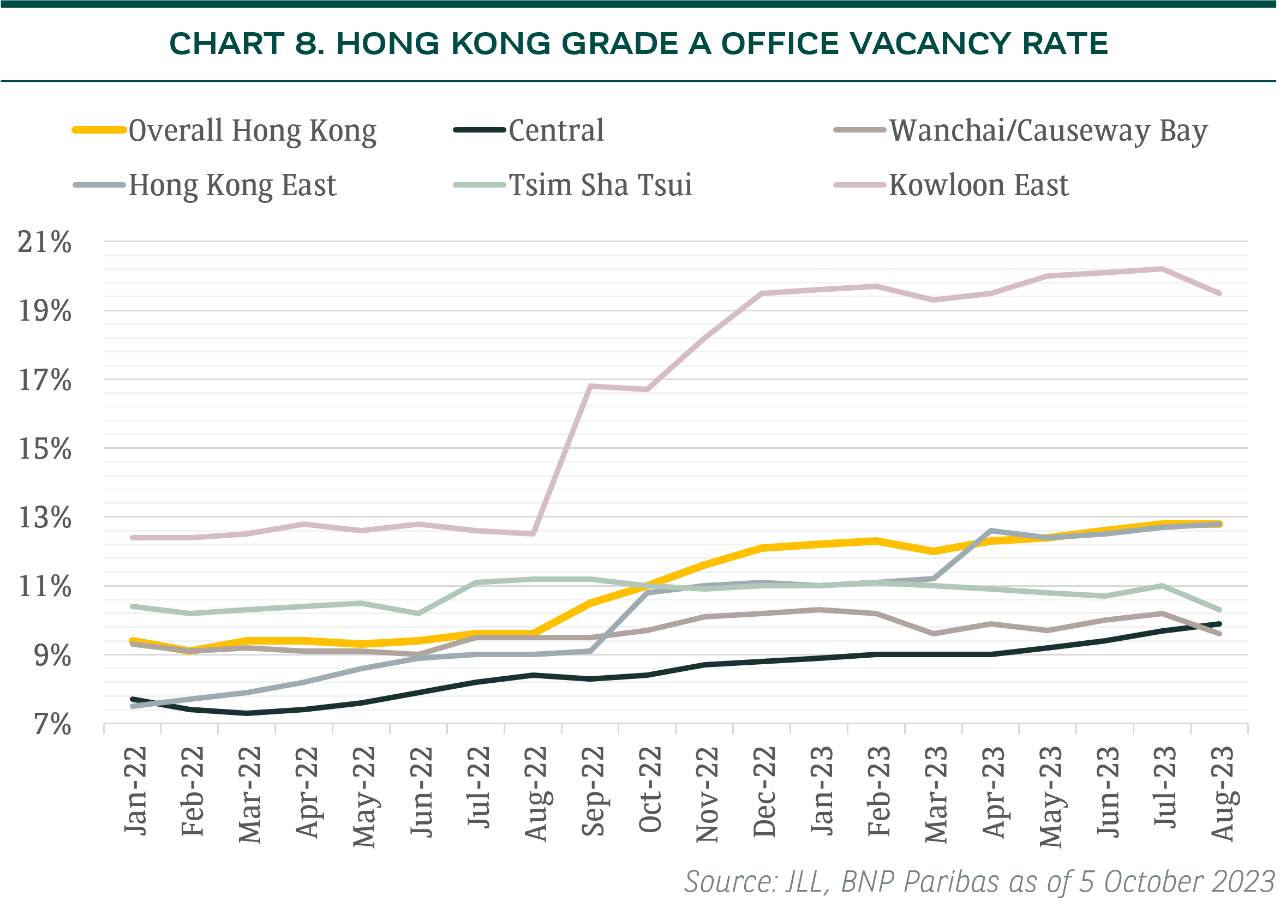

Hong Kong grade A office overall vacancy rate stayed at a record high of 12.8% in August 2023 (see Chart 8), but is also likely to peak out soon. The mega trend of flexible office and increasing supply in Central have been weighing on office rents. On the other hand, rental activities for offices in other areas are showing signs of life, evidenced by sequential decline in vacancy rates. Moreover, the government of Hong Kong will refrain from selling commercial sites in land tenders at least till end-2023. On 4 October 2023, the Secretary for Development of Hong Kong commented “it’s reasonable for us to pause” [10].

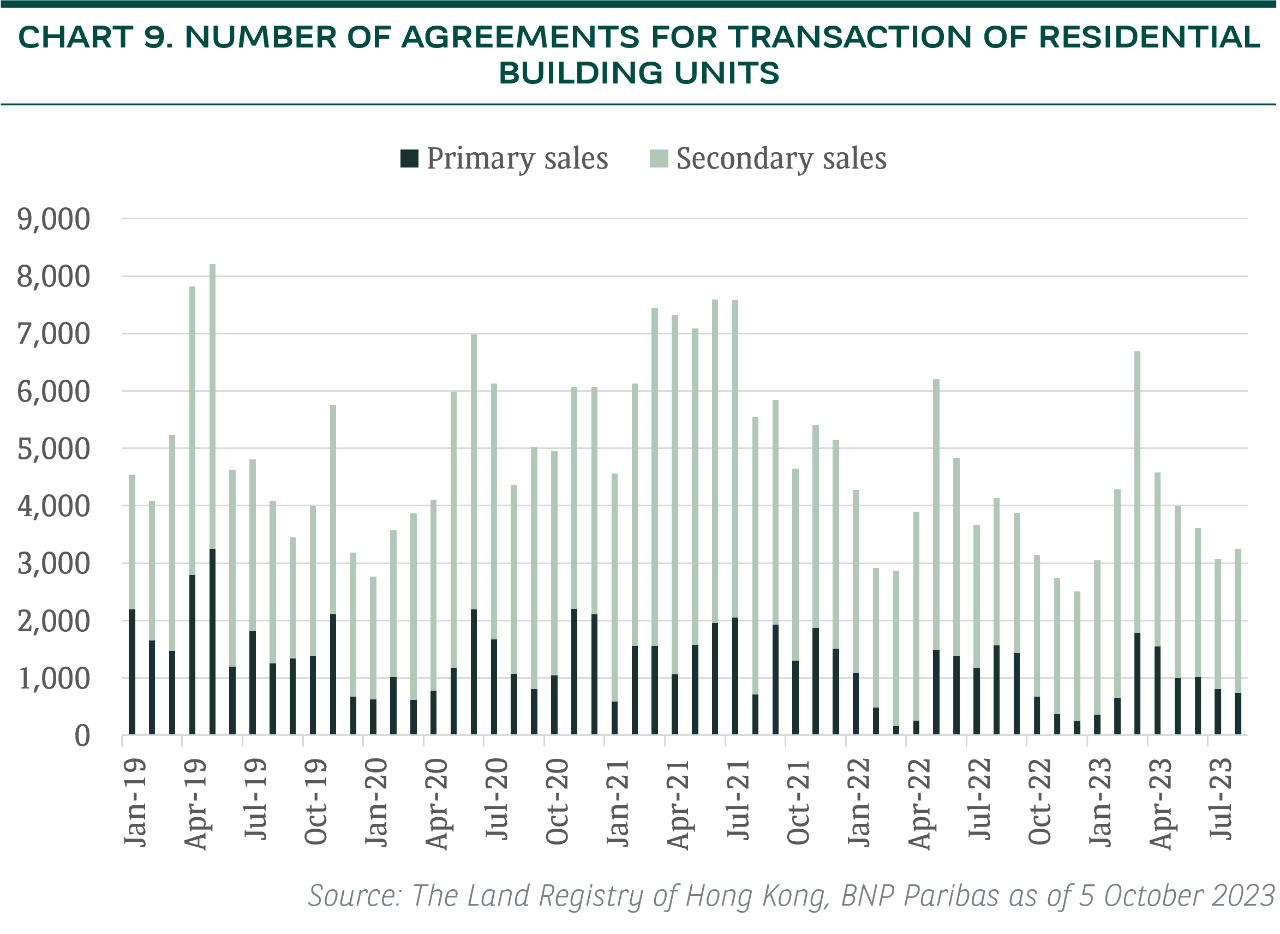

Rising mortgage rates in Hong Kong is adding straw on the camel’s back. Many banks in Hong Kong have raised the cap rate, by reducing rate-discount, for new mortgage loans by circa 50 bps in mid-September 2023. We notice that the buffer between base rate and cap rate has evaporated since the last cap rate adjustment in August 2022, as the 1-month HIBOR rose over 2% but prime-rate rose only by 0.875%. Thus, we deduce local banks are under pressure to either lift prime-rate faster or further reduce rate-discount. Shares of Hong Kong residential property developers reacted negatively to the mortgage cap rate hike, as well as lackluster residential property sales. In January-August 2023, the number of primary sales of residential properties was 28%, below the same period in 2021, though was 4% above the unusually low 2022 levels due to COVID lockdowns (see Chart 9). Meanwhile, the total consideration for all primary and secondary residential property sales fell 2% YoY in January-August 2023. The weak demand for residential properties and higher-for-longer interest rates are likely to induce property developers to offer more aggressive price discounts in the upcoming project launches, which in turn will weigh on their cash flow and dividend per share

1. New energy vehicle;

2. European Union;

3. Independent Power Producers;

4. China National Development and Reform Commission;

5. People’s Bank of China;

6. National Administration of Financial Regulation

7. https://ec.europa.eu/commission/presscorner/detail/en/speech_23_4426

8. http://www.caam.org.cn/chn/4/cate_34/con_5236151.html

9. https://www.gov.cn/zhengce/zhengceku/202309/content_6901354.htm

10. https://www.businesstimes.com.sg/property/hong-kong-pause-selling-commercial-land-market-falters