Key messages

- Powell's shift: he suggested a delay in rate cuts due to persistent inflationary pressures.

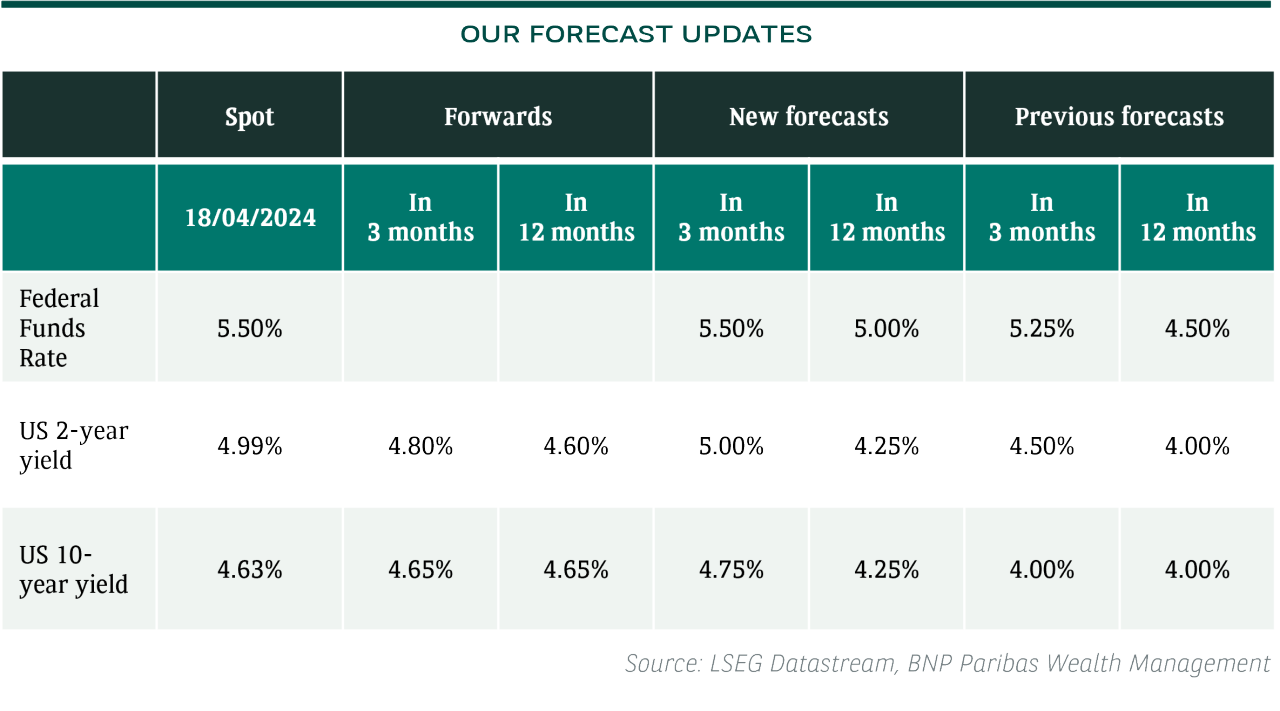

- US interest rate cut outlook: rate cuts are being pushed out including into 2026. We expect only one 25bps cut in 2024. We still expect four cuts in 2025 and two in 2026.

- We see a risk for higher bond yields in the very short term. On a 12-month horizon, we forecast lower bond yields with a new target of 4.25% for US govies.

- We remain Positive US government bonds: we currently prefer shorter maturities (3-5 years), and aim to lengthen maturities as the 10-year yield moves to our short-term target of 4.75%.

- For the EURUSD, we revise our 12-month target from 1.15 to 1.12. The same is true for our USDJPY 3- and 12-month target. The new targets are 150 and 140 respectively (value of one US dollar).

The Federal Reserve

There has been a notable shift in Federal Reserve Chair Jerome Powell's communication style. Following the March inflation report, he indicated that persistently elevated inflation would likely delay any Fed interest rate cuts until later in the year. Consequently, we believe that a June rate cut is no longer likely. We believe that the Federal Reserve still intends to implement rate cuts this year. Such a move would be an "insurance cut" for risk management purposes, as there are risks to cut rates too early, but also risks to cut rates too late since the Fed aims to engineer a soft landing of the economy.

Inflation remains hot and tricky to assess. Some parts have been accelerating (Core Services ex Shelter, accelerating for the third month in a row), while others have decelerated (wage growth). We still expect inflation to moderate this year, but more resilient non-shelter services is likely to make this moderation more gradual. Our projection is for inflation to reach 3.05% in 12 months' time, which is higher than the market pricing of 2.8%.

Meanwhile, economic growth continues to expand, despite a slight deceleration evidenced by the March Purchasing Managers' Index (PMI) readings. Nevertheless, robust March retail sales underscore the resilience of consumer spending.

The geopolitical tensions in the Middle East add another layer of complexity to the economic landscape, with the possibility of rising energy prices and increased volatility in inflation expectations, prompting the Fed to adopt a more cautious approach.

In summary, we believe that the Fed will be more cautious this year than the market is pricing in (1.7 rate cuts). We expect only one 25bps cut this year, at the FOMC meeting on 18 September 2024. Admittedly, it is very unusual for the Fed to initiate a rate cut cycle so close to an election (5 November 2024), as this has only happened once since the 70s, in 1984. However, rate cuts have been expected for so many months that it is unfair to say that they will interfere with the election. Looking ahead, we anticipate more rate cuts than what’s priced in, with a total of four cuts in 2025 and two in 2026. This would result in an end-of-cycle rate of 3.75%.

Outlook for bond yields

Bond yields could rise modestly over the next few months as a result of a number of factors. First, the appetite for government bonds has diminished, as evidenced by the recent weak Treasury auctions across all maturities. Second, we believe that the market will continue to scale back its expectations for policy rate cuts. Third, given the increased volatility in expected inflation and concerns about the US deficit, the term premium should rise. Note that the term premium has moved back to zero, and it was close to 50 bps in October 2023 when there were concerns about the fiscal deficit. Conversely, we expect bond yields to decline on a 12-month horizon. We forecast lower bond yields with a new target of 4.25% for US government bonds. This projection is in line with historical patterns, where bond yields fall when the Fed actually cuts rates.

We therefore remain Positive on US government bonds. Tactically, we prefer shorter maturities (3-5 years) for the time being due to the short-term risk of higher yields. We are looking for increasing maturities as the 10-year yield moves to our 4.75% target.

Outlook for currencies

The outlook for the EURUSD is highly sensitive to the interest rate differential and the outlook for future monetary policy changes. As mentioned, we now see the Fed cutting only once this year and only in September, while our outlook for the ECB remains unchanged. The ECB should start cutting rates in June, with 75bp cuts this year. Thus, the new expected policy rate differential justifies a lower depreciation potential for the USD over the next 12 months. We revise our target from 1.15 to 1.12 (value of one euro).

We also revise our targets for the Yen. We keep the view that the end of Japan’s negative interest rate policy in March should gradually increase the attractiveness of the Yen but the fact that the US Fed will cut less over the coming year reduces the potential for Yen strengthening. We adjust our USDJPY 3-month target from 145 to 150 and our 12-month target from 134 to 140 (value of one US dollar).