Summary

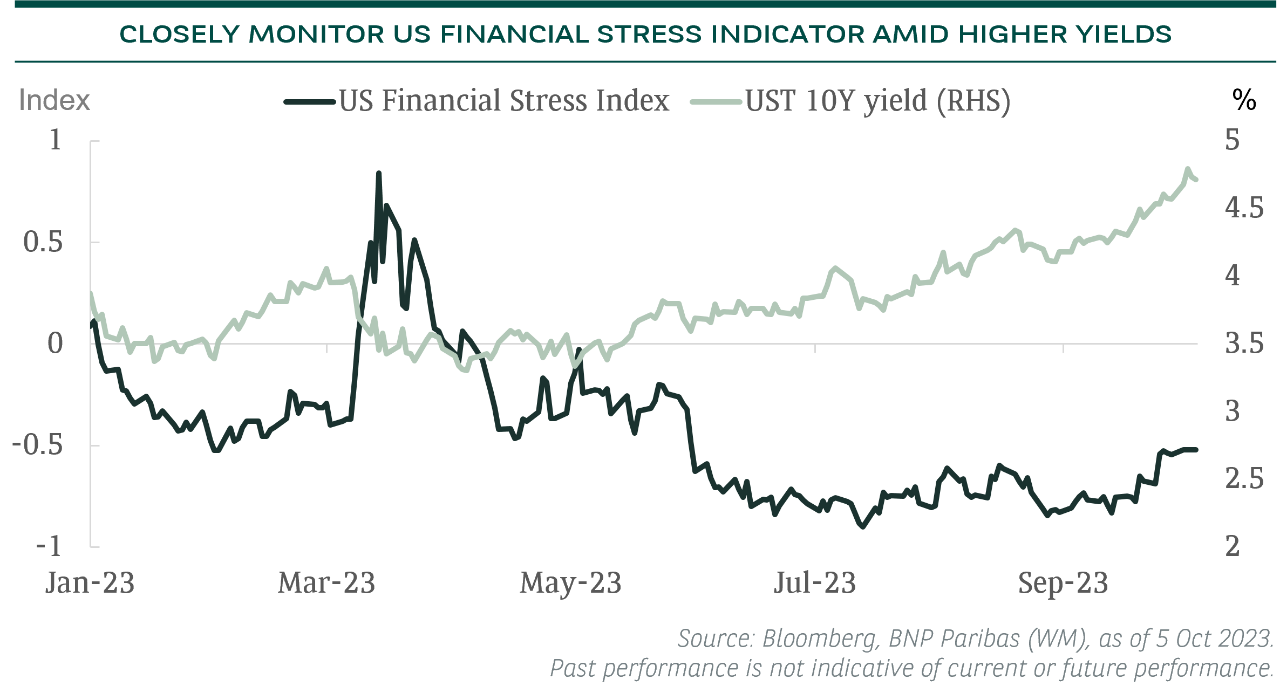

- Global equities and bonds corrected with both nominal and real yields rising as increase in oil prices coupled with the supply and demand imbalances in US Treasury markets as well as the Fed’s hawkish messages boosted the case for the “higher for longer rates” narrative. The recent sell-off was also driven by positioning and technical factors.

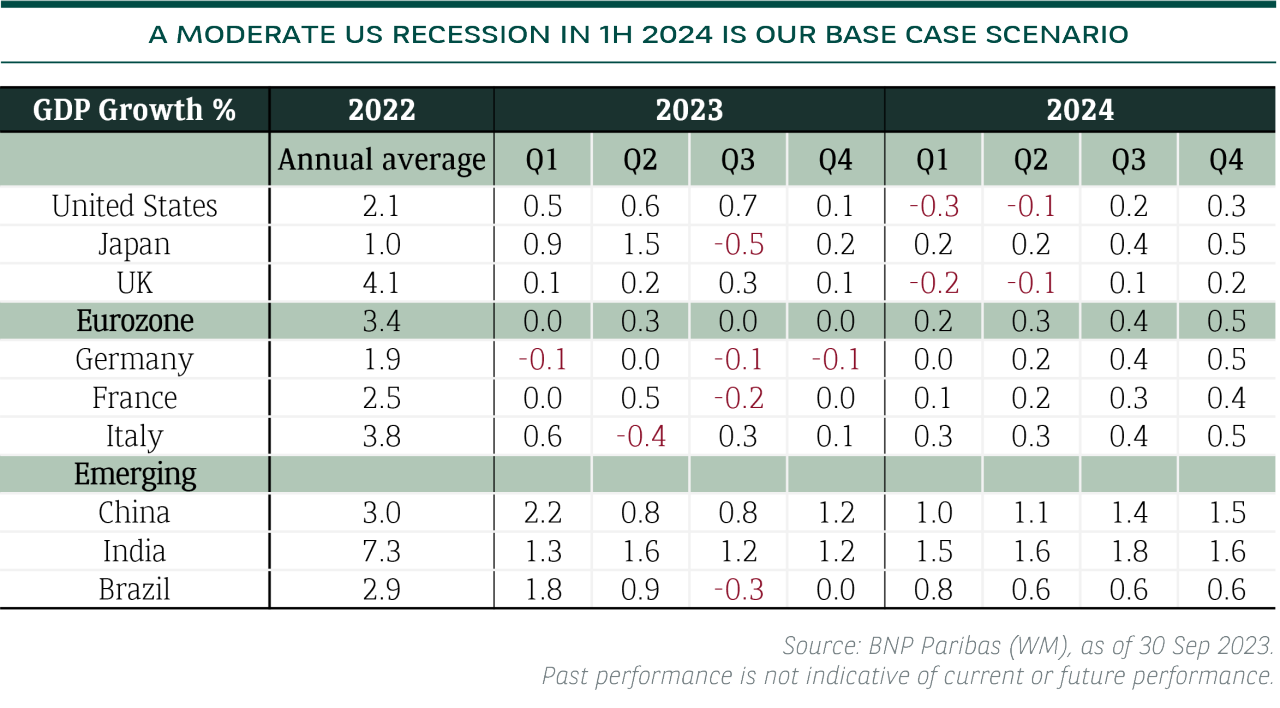

- We expect the US economy to weaken further into year end and our base case is still a moderate recession in 1H 2024 (an out of consensus call as consensus sees a soft-landing scenario), which would offset some “higher for longer” momentum.

- The current sentiment towards bonds reminds us of the sentiment towards equities in November 2022, when consensus saw new bear market lows in 2023. We took that opportunity to upgrade equities. Presently, the same consensus expects a soft landing with uncertainty on what is the ceiling on rising bond yields. Volatility creates opportunity.

- Any stabilisation in yields provides good entry for quality bonds with attractive yields and a chance to even extend duration to achieve potential equity-like returns in the medium term as we expect the Fed to cut rates from mid-2024 to mid-2025.

With the global equity markets sell-off, global bond yields at multi-decade highs, accompanied with strengthening greenback, there have been a lot of questions about the economic impact and investment implications of higher oil prices and our latest views on the “higher for longer” narrative. We attempt to address them in the Q&A below.

1. Is the recent rise in oil prices a major factor for higher US long-end yields?

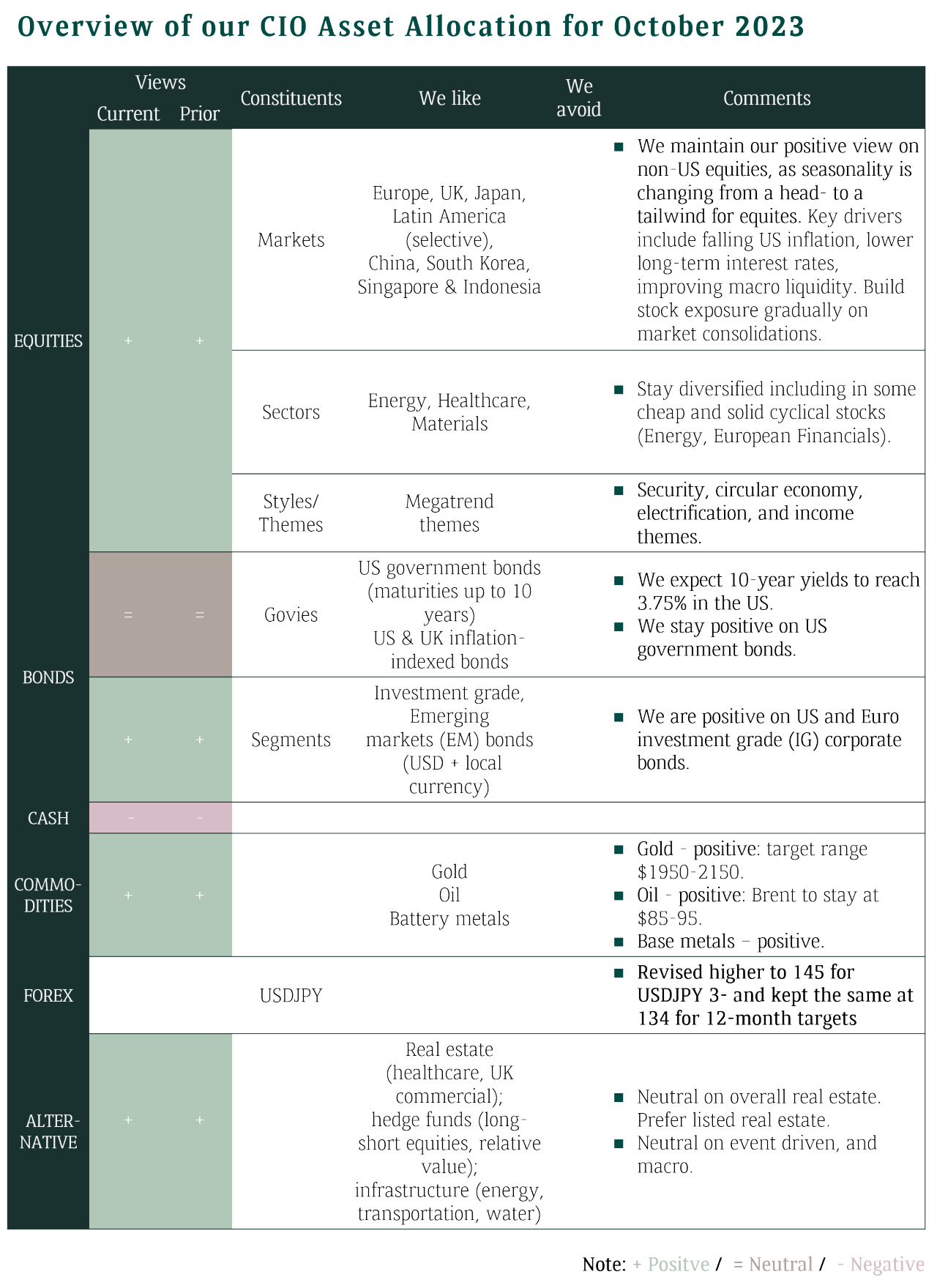

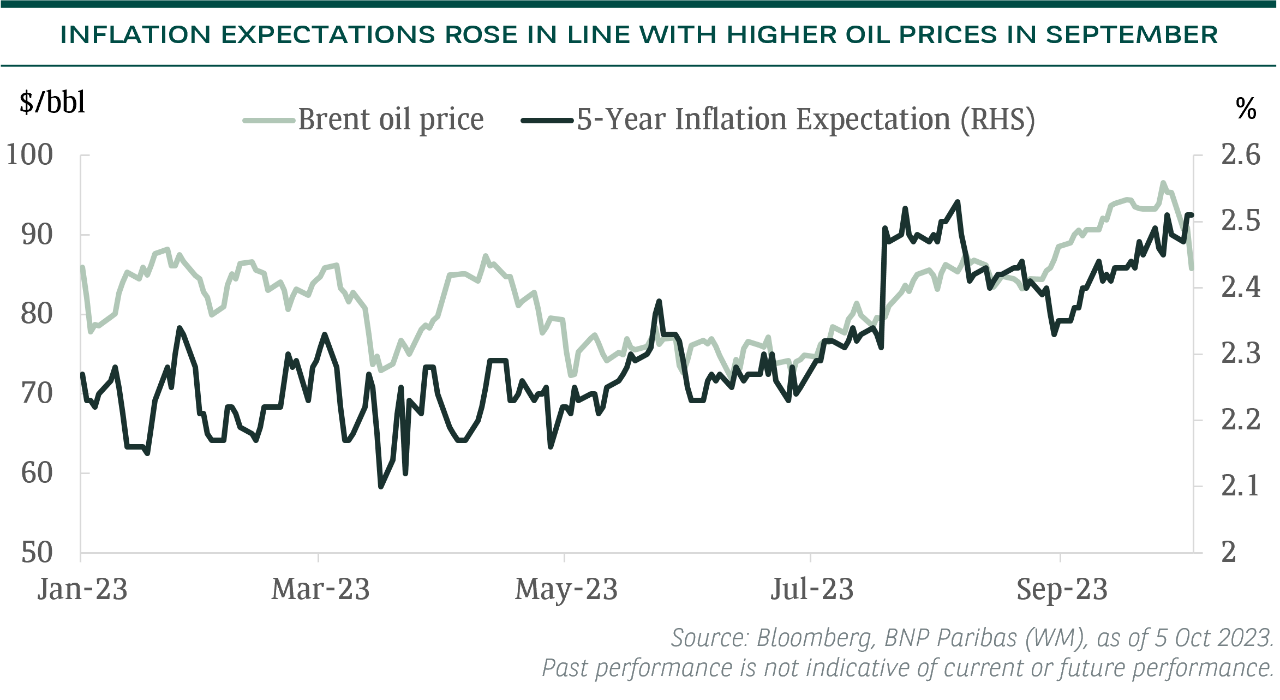

Besides the hawkish Fed projections and comments in the latest FOMC meeting and the recent surprisingly resilient US economic data, the rebound in oil prices given the tighter supply outlook could be one of the reasons that contributes to “higher for longer” narrative amid concerns over inflation risk. In fact, US longer-term inflation expectations are moving up again, in line with rising oil price, although recent inflation data generally continued to come out lower than expected (downside surprise).

There are also other key factors. Massive supply in long-end Treasuries accompanied by increasing fiscal burden in the US are bringing more uncertainty which has been driving up the “term premium” (compensation for uncertainty of holding longer maturities i.e. taking duration risk).

On technicals and positioning, yields breaking key levels and the huge unwinding of long positions in US Treasuries by leveraged bond funds after the hawkish Fed messages also contributed to sharp rise in yields.

2. Is oil price going to break $100/b?

Saudi Arabia’s unilateral production cuts by 1 mb/d till the end of the year on top of the OPEC+/Russia restrictions are very significant. Furthermore, the Middle East conflicts over the weekend (7 October) raise risk premium in oil in the short-to-medium term though immediate areas involved do not have significant oil reserves.

Thus, a spike above $100 is possible if geopolitical tensions escalate further. However, we do not expect Brent oil prices to sustain above $100 for a long period of time due to demand destruction driven by expensive energy prices and macroeconomic headwinds after aggressive rate hikes. We also expect a reasonable “supply management” by Saudi Arabia to avoid a sharp economic downturn. We expect Brent oil prices to go back to our target range of $85-95 in the medium term. In fact, recently oil prices are falling back on demand worries and the reduction of speculative longs in the market.

3. Does higher oil price accelerate the chance of a US recession?

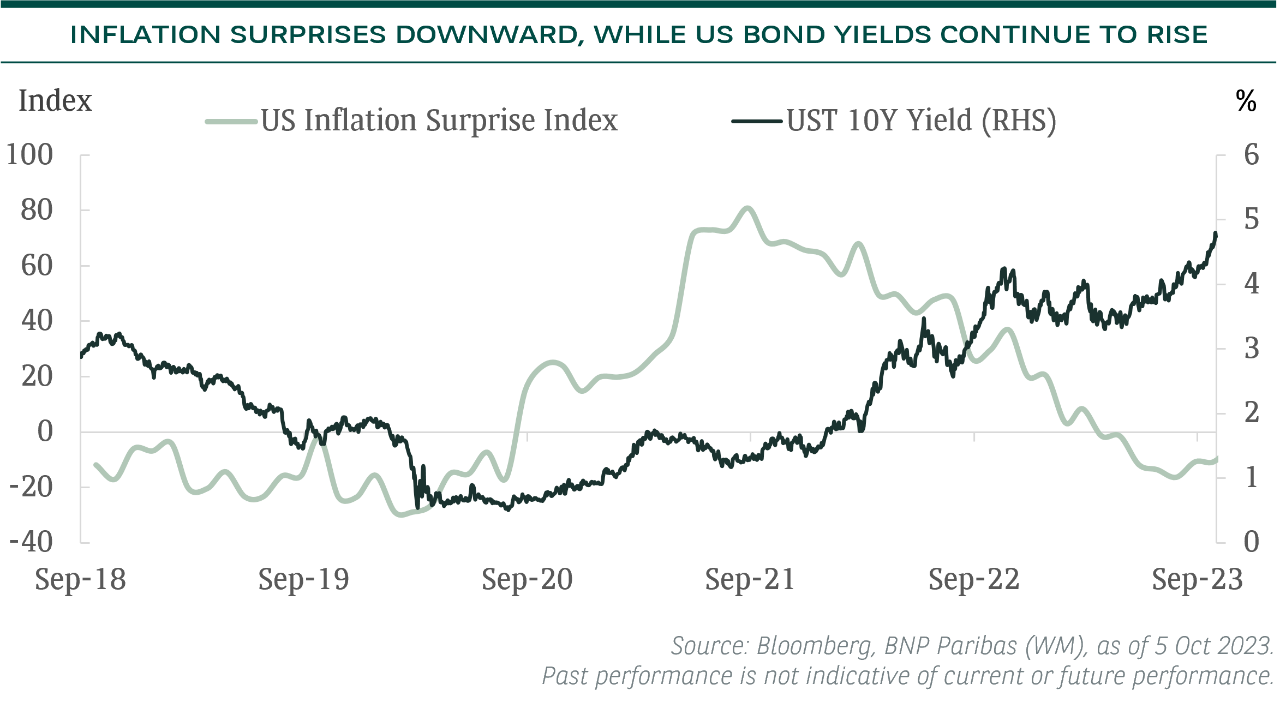

Higher oil prices, rising bond yields and strengthening dollar are all “tax” on the US economy. Financial stress in the US banking system has been rising again in recent weeks (though a negative number means stress levels are still below average for now). The unrealized loss in some US lending institutions is getting bigger again with US bond yields moving up significantly.

Our base case scenario is still a moderate (not hard) US recession in 1H 2024 (an out of consensus call as consensus now is a soft-landing scenario). The lagged negative effects of aggressive rate hikes would be felt more significantly towards the end of this year. A steady cooling in the pace of US job creation on the order of about 30k per month year to date is estimated to drive job growth into negative territory by February 2024.

Consumption growth is under increasing pressure from tightening lending standards and fading excess savings. Higher energy prices also lower consumer sentiment when interest costs are already high.

Lastly, fiscal drag with expiring consumer support programs such as childcare subsidies and food assistance, resumption of student loan repayments, as well as the caps in the debt limit deal would have negative impact on growth.

4. Are we expecting interest rates “higher for longer”?

Higher oil price is no doubt a moderate stagflationary shock i.e. putting upward pressure on headline inflation while weighing on economic activity. The extent of any oil move increases the risk of requiring tighter policy, which could either be achieved through a higher peak rate or a longer duration of restrictive rates. However, other key indicators of inflation: goods prices, wages, and rents are solidly in a down-turn. These are much larger components of overall inflation. Hence, given our oil view, we don’t expect inflation surge aggressively in a slowing economy.

We maintain our view that the Fed and the ECB have reached the terminal rates: (1) recent inflation data largely suggested a continued disinflation trend in the US and Eurozone; (2) we expect second-round effects in core inflation will be more contained this time around as the magnitude of the shock is smaller and generally less excess demand in the economies. That said, higher oil price reinforces the “high for longer” environment and we expect rates to stay at current levels at least until mid-2024. Keeping nominal policy rates unchanged still implies a significant increase in real rates in a disinflation period, which are additional tightening to the economies. We expect the Fed to cut a total of 225bps from June 2024 to mid-2025, and the ECB to cut a total of 100bps from September 2024 to mid-2025.

5. What factors will drive US bond yields down again?

Significant decline in oil prices and/or worse than expected economic data especially some meaningful deterioration in the US job market would offset some of the momentum behind “higher for longer” narrative.

We stay with our view that rates have peaked and favour US Treasuries, Investment Grade bonds and TIPs. Any stabilisation in bond yields would give a good entry point to add to quality bonds with attractive yields and to take advantage of potential equity-like returns in the medium term by extending duration in the rate cuts environment. Our 12-month 10-year Treasury yield target is revised up to 3.75% from 3.5%, still representing good opportunities from the current yield levels.

6. What are the implications on equity markets?

Higher real yields tend to have a negative correlation to equity returns in the past. Therefore, any retreat in long-term bond yields could give some relief to equity markets.

We remain our preference for value stocks (vs growth stocks). Energy stocks still offer a catch-up potential. Recent rise in oil prices was barely followed by energy stocks. With consensus oil price forecasts still below current levels, we expect to see EPS upgrades in energy stocks. We also like healthcare and European financials. We are cautious with some expensive segments, such as consumer staples, consumer cyclicals and mega-cap US techs. Country and region wise, Japan, Europe and Latin America look more attractive than the US.

7. Why didn’t gold perform as an inflation hedge in this environment of higher oil prices?

The sharp rise in longer-term real bond yields is a strong headwind for gold together with a strong dollar and AUM outflows out of gold ETFs. However, continued EM central bank purchases to diversify their reserves away from the greenback are downside support for gold. We remain medium term positive on gold as geopolitical risks, macroeconomic uncertainties and changing equities-bonds correlation persist. We expect gold to trade in the $1950-2150 range next year helped by the end of the tightening cycle and an expected weaker USD.

8. What are the key risks?

The key risks are that major central banks continue to raise interest rates more than expected, triggering sharper rise in yields, credit events and/or a deeper recession, which have not been priced by the markets.

Conclusion

The “higher for longer” narrative dominates current market sentiment and is driven by multiple factors including the Fed’s hawkish tone, higher oil prices, resilient US data, rising term premium (requiring more compensation for Treasuries with longer maturities given uncertainty over US Treasury supply and US fiscal outlook) as well as yields breaking key resistant levels together with unwinding of US Treasury positions by leveraged funds.

Higher oil prices, rising bond yields and strengthening dollar are all a “tax” on the US economy. Our base case scenario is still a moderate US recession in 1H 2024 (an out of consensus call as consensus now is a soft-landing scenario).

Higher oil price is no doubt a moderate stagflationary shock, but we maintain our view that the Fed and the ECB have reached the terminal rates, though rates will stay at high levels until at least mid-2024. We believe more evidence of a weakening US economy would see yields peaked out.

Any stabilisation in bond yields would provide good entry points for quality bonds given attractive yields (16-year high) and chance to achieve potential equity-like returns (taking duration risks) in the medium term in the rate cuts environment in 2024 and 2025.

Higher real yields generally do not favour equity performance. Therefore, any retreat in long-term bond yields could give some relief to equity markets. We prefer value stocks (vs growth stocks) at economic turning points.