This edition of the Investment Navigator for April 2025 focuses on how to navigate a volatile market in a world with heightened geopolitical and trade tensions that carry new risks and present new opportunities.

President Trump’s tariff wars create record high policy uncertainty and market turbulence globally. At the same time, there are two game changers to the world this year,

(1) DeepSeek in China, and

(2) Fiscal reform in Germany.

What are their economic and investment implications?

Investors should ensure that they have a resilient portfolio to take advantage of the emerging opportunities while navigating market volatility with escalating uncertainty.

President Trump is pushing for a new world order in his first 100 days

No “Trump put” and “Fed put” for now, but the “Bessent put”

US President Trump has signed over 100 executive orders within his first 100 days with major topics ranging from immigration reform, tariffs, cutting federal spending and workforce to foreign policy.

So far, the most unexpected by the market has been Trump’s very aggressive stance on tariffs. We may not be at peak tariffs yet, as the “discounted” reciprocal tariffs approach announced on the “Liberation Day” allows for further escalation in response to likely retaliations. The Trump administration is also aiming to use tariffs revenues to fund the potential tax cuts. Hence, there is likelihood that some individual countries’ tariff rates are lowered from elevated levels through bilateral negotiations, but the eventual baseline tariffs are higher.

Trump is also eyeing to position US to reshore important areas of manufacturing. The US accounts for 30% of global consumption. Hence, disruption to supply chains is inevitable as companies do not want to take risk of higher tariff exposure.

It is debatable whether tariffs will help him succeed in an American manufacturing renaissance, but the record high policy uncertainty is already hitting the US economy with consumer confidence tumbling to a 4-year low and ISM manufacturing PMI slipping back into contraction territory in March. The massive tariffs have also sparked recession fears and shaken up financial markets. In the near term, investors should stay cautious as market is pricing in the rising US stagflation and global recession risks.

The Trump administration acknowledged that tariffs will cause some short-term pain. Meanwhile, the Fed officials are cautious on rate cuts amid tariff-induced inflation risks. Hence, “Trump put” and “Fed put” are absent in the near term. That said, it appears that there is the “Bessent put” as US Treasury Secretary Bessent is aiming at pushing Treasury yields down. However, after the recent bond rally, yields are up again on concerns over China and other countries to “dump” US Treasuries as retaliation.

With the Trump administration’s stated aim of avoiding a recession, there could be a policy pivot in case of any fast deterioration in the US economic outlook. US initial jobless claims and US high yield CDS spreads are our key indicators to closely watch for. Will “Trump put” and “Fed put” be back earlier-than-expected? 2026 is America’s 250th anniversary and the mid-term elections will be held in November. So far, the administration is working on immigration, tariffs and DOGE’s federal cost cutting – the growth negative agenda. When will tax cuts and deregulation – the growth positive agenda – be put on the radar screen?

“Game changers” in China and Germany

China

China has been flooding the world with AI models after the success of DeepSeek, which is a “game changer” for the world’s AI ecosystem as it accelerates broader AI development and adoption. China’s cost-efficient models are also a challenge to America’s AI dominance. “Mag 7” has become “Lag 7” YTD amid crowded positioning, slowing earnings momentum and still relatively expensive valuations. Investors also question the hyperscalers’ return on investment (ROI) given their massive AI capex spending.

Germany

Another “game changer” is Germany’s fiscal U-turn from years of austerity to spending boost in defence and infrastructure. Although the positive growth impulse from fiscal stimulus will likely be fully offset by the negative impact of additional 20% tariffs this year, it remains a big positive fundamental change for Eurozone growth in the longer-term.

From MAGA to MCGA & MEGA

China and European equities have relatively outperformed US equities YTD (see Figure 1). Bottom-fishing opportunities, particularly on sectors, such as, China techs and European banks, are emerging amid the current global stock market corrections that are triggered by Trump’s sweeping tariffs.

There is still a big valuation gap between Mag 7 and China techs. Mag 7, despite the recent sell-off, is still trading on average 22x forward PE versus Hang Seng Tech’s 15x. European banks, despite the strong rally early this year, are trading on only 7x forward PE (see Figure 2).

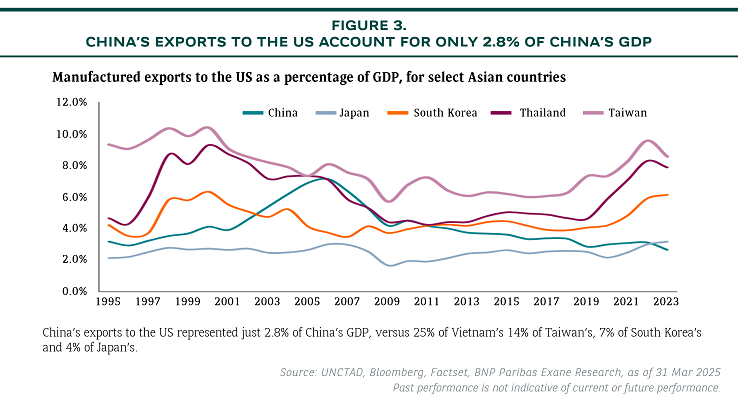

Is China relatively insulated from higher tariffs than its Asian peers?

China’s exports to the US represented just 2.8% of China’s GDP, versus 25% of Vietnam’s 14% of Taiwan’s, 7% of South Korea’s and 4% of Japan’s.

China equity markets’ foreign revenue exposure is only 12% versus Taiwan’s 70%, and South Korea’s and Japan’s 44%.

Fund flows back to China stock markets

We expect further domestic and foreign fund flows to both China A-share and Hong Kong stock markets driven by:

Build a resilient portfolio to navigate market volatility

Given the elevated policy uncertainty, investors should ensure they have a resilient portfolio to navigate this period of market volatility through: