TUG OF WAR BETWEEN BULLS AND BEARS

"Our base case scenario is that the US could narrowly avoid a recession."

Markets have seen a relief rally following Trump’s tariff reprieve and the positive outcome from the US-China trade talks. Better-than-expected US earnings results helped improving sentiment as well. The “Bessent put” also seems to be in place, as the Trump administration remains sensitive to bond market stability. When yields spiked in the wake of tariff “Liberation Day” and the rhetoric around firing Fed Chair Powell, the White House responded with some kind of “policy pivot”.

Has the market hit bottom? The bulls (optimistic investors) argue that the peak of tariff tantrum may be behind us. They expect trade agreements with major countries in the coming weeks or months, along with growth-positive policies such as tax cuts and de-regulation soon.

The bears (pessimistic investors), on the other hand, remain concerned about rising risks of recession or stagflation which are not fully priced in the market. Passage of big tax cut packages could also create doubts on the administration’s commitment to fiscal discipline and put pressure to the long-term Treasuries.

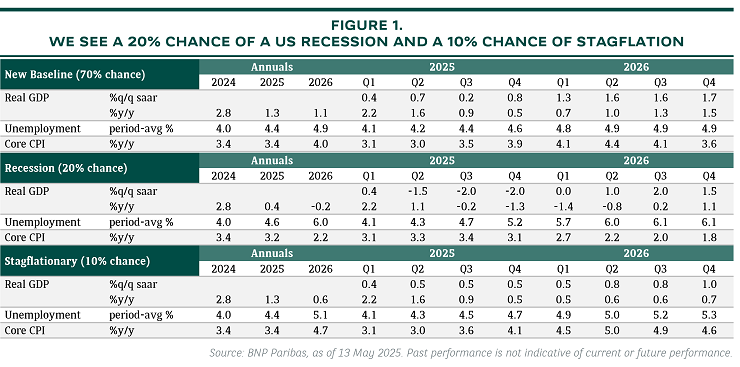

US growth slowing to the edge of recession with 4Q 2025 GDP growth at 0.5% is our base case scenario (70% probability) (see Figure 1). We maintain our view that the Fed would implement two rate cuts in 2H 2025, and expect two more rate cuts in 2026, with terminal Fed Funds rate at 3.5%.

We still assign a 20% probability to a significant recession. Despite the tariff de-escalation, fear and risk aversion grip the US economy, resulting in a more severe hit to economic activity and employment, with the unemployment rate rising to 6% in 1H 2026. As a recession is typically deflationary, the Fed would likely respond to a material increase in unemployment with more aggressive rate cuts.

The worst-case scenario is a stagflationary environment (10% probability), with US core CPI rising to 5% in early 2026. In this case, the Fed would have no choice but to hike rates.

THE EMOTIONAL BEASTS OF GREED AND FEAR

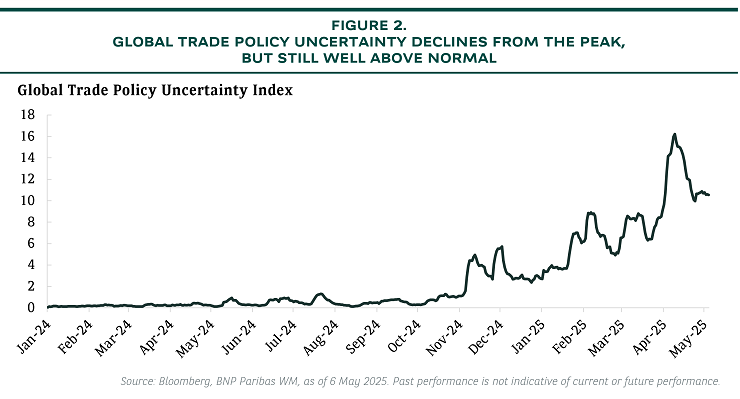

No doubt, global trade policy uncertainty remains high, though it has eased from its peak (see Figure 2). In this environment, investors should be mindful not to let the emotional beasts of greed and fear dominate investment decisions.

Investors who fear uncertainty and hold very conservative, cash-heavy portfolios could miss out if the bulls are right that the worst of the tariff turmoil is behind us.

Investors who positioned aggressively in risk assets based on recent positive newsflows could suffer if the “known” risk of recession or stagflation materialises.

Keep the beasts at bay: best to diversify

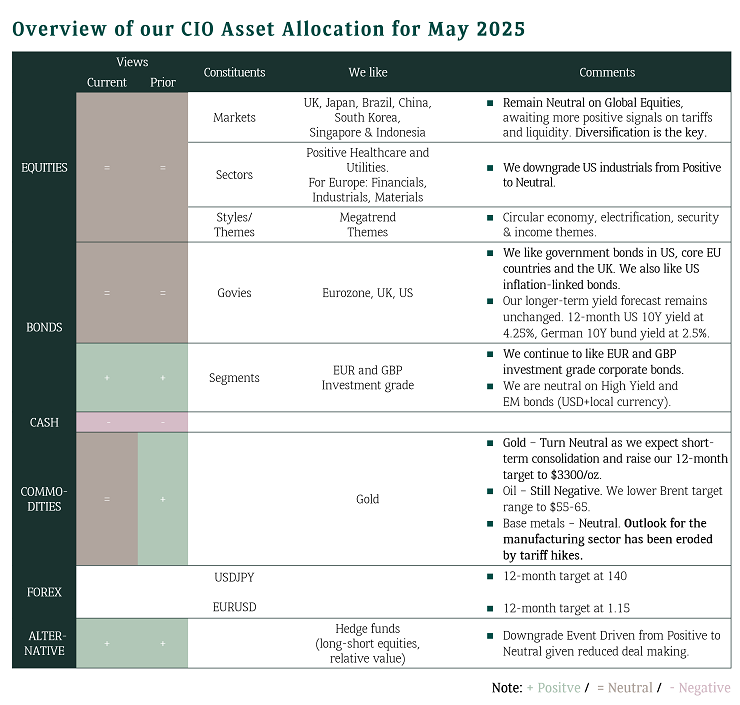

From a risk management perspective, the best strategy to navigate this uncertain environment is diversification through assets in multi currencies, stock and bond exposures from various economies, precious metals, hedge funds and private assets. A multi-asset portfolio can help lower overall portfolio volatility, as it incorporates asset classes with low or even negative correlation, while investors can still participate in the market in case of any pro-growth policy pivot. The latest market rebound provides a window to rebalance from a relatively concentrated portfolio to a more resilient and well-diversified one.