US Treasuries: Should investors worry or climb the wall of worry?

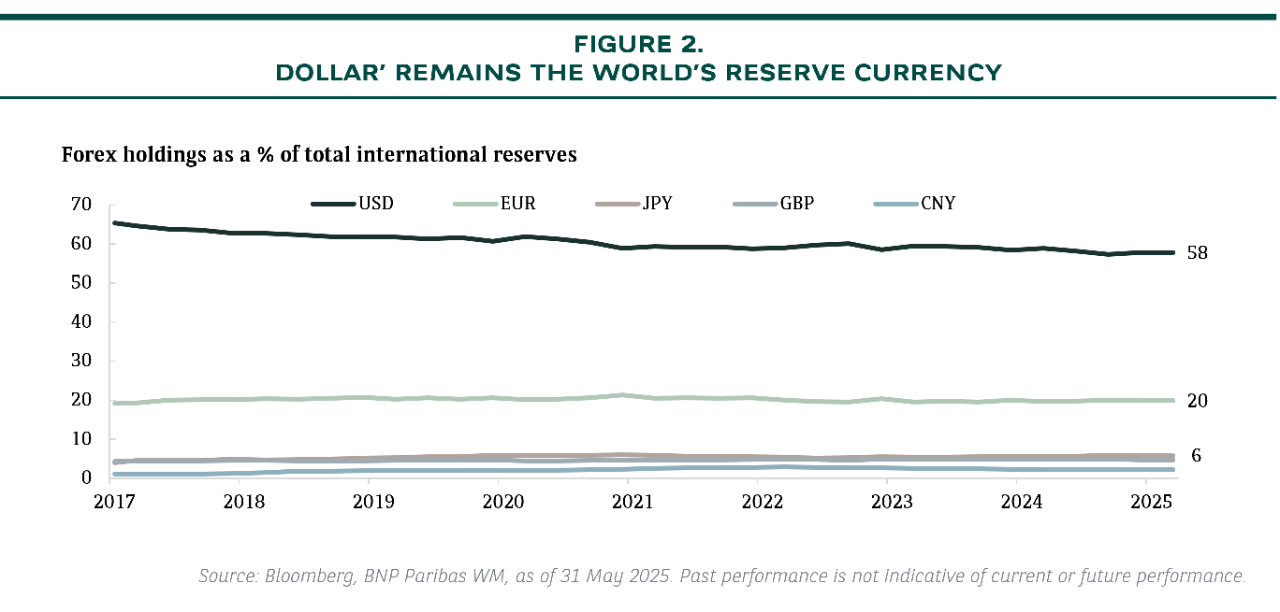

This edition of the Investment Navigator for June 2025 addresses the questions regarding investor concerns over US government bonds, stemming from key factors, such as, rising fiscal deficits, potential inflation, overall demand and supply dynamics, and the asset class’s safe haven status.

Key Questions

- What are the implications of recent Moody’s sovereign rating downgrade?

- Are foreign investors dumping US Treasuries?

- Should investors be concerned about a potential US sovereign debt crisis?

- Are US Treasuries no longer a “safe haven”?

- Can the massive supply of US Treasuries be absorbed?

Despite the recent volatility, US Treasuries remain the world’s dominant safe haven assets amid limited viable alternatives, underpinned by the dollar’s global reserve status and the market’s depth and liquidity. The risk of a US sovereign debt crisis is very low, as the Federal Reserve can always act as a “buyer of last resort” for US Treasuries during times of market stress.

WHAT ARE THE IMPLICATIONS OF RECENT MOODY’S SOVEREIGN RATING DOWNGRADE?

Unlikely to see forced selling of US Treasuries

US Treasuries has not been unanimously AAA-rated since 2011, and the fiscal and structural drivers of Moody’s action were well known. Most US institutional investors either limited a reliance on AAA ratings, or simply made a special carve out for US Treasuries in their internal mandates. Hence, they are insulating the risk of forced selling into another such downgrade. Furthermore, as there is a lack of comparable substitutes, international capital data shows that foreigners continued to be net buyers of US Treasuries after the last two rating downgrade events in 2011 by S&P and in 2023 by Fitch.

ARE FOREIGN INVESTORS DUMPING US TREASURIES?

No signs of significant foreign selling

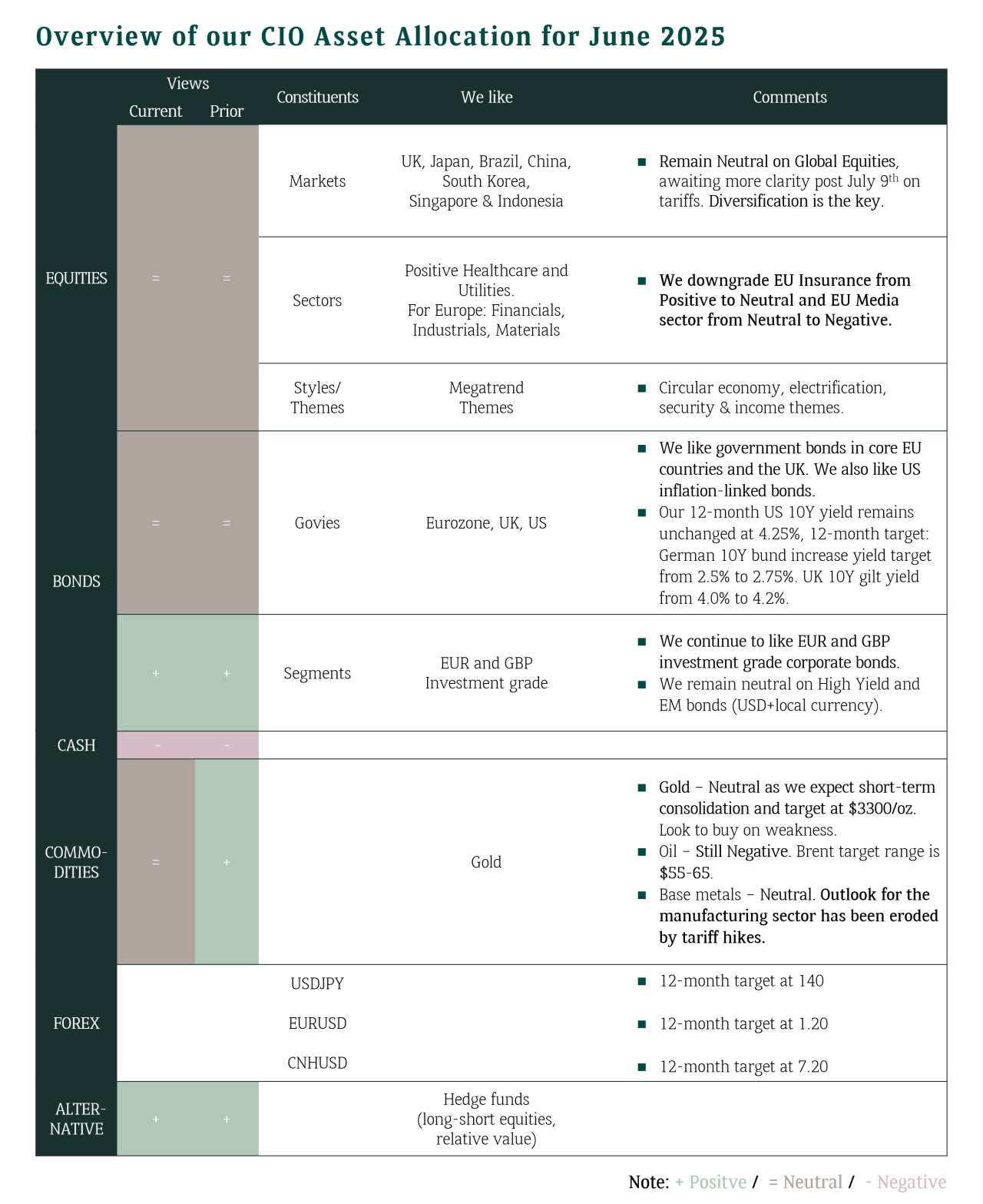

Foreign investors account for 33% of outstanding US Treasuries and are roughly evenly split between foreign official and private accounts (see Figure 1). Japan is the largest foreign holder, followed by the UK and China. There is little evidence of foreign net selling of US Treasuries in recent months though general perception remains. In fact, 67% of foreign official institutions’ holdings of Treasuries are in maturities 5 year or shorter. Foreign official institutions could just let their holdings run off and not reinvest, rather than sell securities outright that could incur losses.

SHOULD INVESTORS CONCERN ABOUT A POTENTIAL US SOVEREIGN DEBT CRISIS?

The Fed is a “buyer of last resort”

US as a nation holds the majority of US Treasuries (67%) with the Fed currently owning 17%. US is also not net borrowers in foreign currencies. The risk of a US sovereign debt crisis is very low as the Fed can always act as a “buyer of last resort”, meaning the central bank will purchase US Treasuries to restore market liquidity during times of stress and support the functioning of the broader financial system.

Furthermore, US regulators are reportedly preparing to make substantial cuts to bank capital requirements established after the 2008 financial crisis. This should be helpful for Treasury market liquidity in the long run.

ARE US TREASURIES NO LONGER A “SAFE HAVEN”?

US Treasuries are underpinned by the dollar’s global reserve status

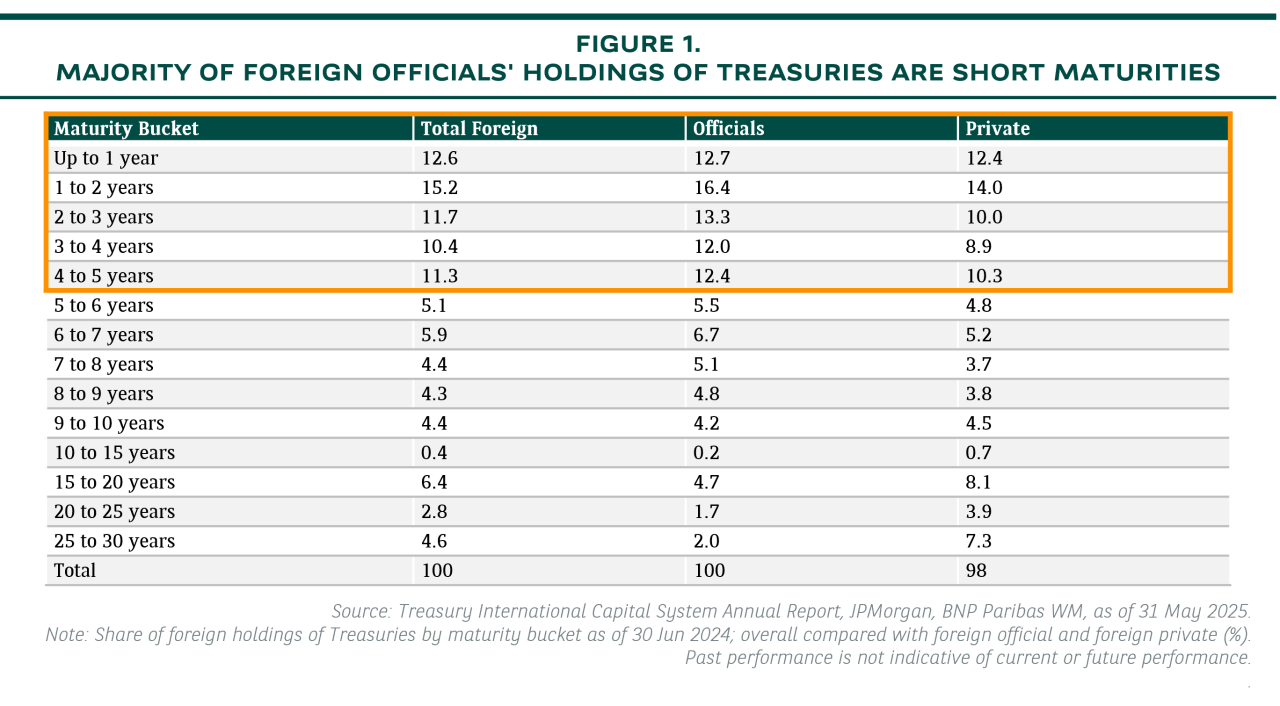

The US dollar’s unique status as the world’s reserve currency remains unchanged (see Figure 2). The deep and liquid US sovereign bond market as well as strong and stable institutions mean that Treasuries are effectively the definition of a “risk-free” asset, fully backed by the US government. De-dollarisation may be happening, but it is a very slow and gradual process. Strictly speaking, it is more about diversifying to other currencies and/or gold as reserve assets.

That said, volatility in the Treasury market will likely stay. The term premium, especially at the long end of the yield curve, has been rising amid fiscal sustainability concerns. In other words, investors demand for additional return for holding longer-term bonds compared to shorter-term bonds.

CAN THE MASSIVE SUPPLY OF US TREASURIES BE ABSORBED?

No practical alternative to US Treasury market

Investors concern about whether there are sufficient demand for US Treasuries as approximately USD 9.2 trillion in Treasuries, about one-third of total outstanding Treasuries, mature in 2025, with a significant portion due before July 2025. That said, US Treasury kept nominal auction sizes in 2Q, unchanged for the fifth consecutive quarter, and reiterated its forward guidance for no change for “at least the next several quarters”.

With no plausible substitute for the US Treasury market (its openness, depth and breath are unmatched by other markets), demand remains strong from banks and investment companies, as well as insurers and pension funds, especially for issuance towards the front-end of the curve. Vanguard, Blackrock, JPMorgan, Japan Government Pension, Allianz, Nomura and Prudential are some of the top holders of US Treasuries.

REBOUND IN YIELDS ARE OPPORTUNITIES TO ACCUMULATE US BOND EXPOSURE

We have a positive stance on US Treasuries with a 12-month 10-year yield target at 4.25% and prefer short to intermediate maturities. High volatility in US Treasury market also presents opportunity to monetise volatility to engage in Treasury-related structured solutions with enhanced yields.

With a US slowdown (no recession) our base case scenario, we expect the Fed to have two rate cuts (in September and December) this year and two more in March and June next year. Therefore, any bounce in yields due to US fiscal concerns or tariff-induced temporary inflation are buying opportunities for US Treasuries and investment grade corporate bonds.