Summary

- Market has been aggressively pricing in US rate cuts for 2024. The Federal Reserve (Fed) has been actively downplaying an early rate cut, and reiterated for more evidence that inflation is moving sustainably down to 2%.

- We were not forecasting a March cut and see June as a likely timeline for the Fed to commence their rate cut cycle as it provides more time for monitoring.

- Given the general direction of interest rates this and next year, investors should take advantage of fixed income and lock in the high yields as an alternative to deposits and money market funds.

- China continues to face issues with domestic demand as the economy remains deflationary. Recent RRR cut was a positive surprise. More will need to be done at the upcoming National People Congress in March to achieve any sustained rally.

- Valuation in China remains very attractive at ~2 standard deviations relative to long-term averages. Sentiment remains weak, with investors severely under-allocated. Short covering and hence a decent sized bear rally is possible given the extreme pessimism and positioning.

Market’s obsession with rate cuts

Market seems to still be reminiscing the long period of low/negative interest rates pre-covid. Following the December FOMC where Powell signaled lower interest rates for 2024, the mood was clearly jubilant, shown in strong rallies into the new year. A probability of 80% was priced in at the start of the year for a March cut, as many investors hoped for interest rates cut come thick and fast.

That probability has dropped significantly and is now around 15%, in-line with our view of no March rate cut. The Fed had been downplaying the likelihood of an early rate cut, and Powell effectively took it off the table in the January meeting. Barring a significant deterioration of labour and inflation data, the Fed Chair has insisted that a more sustainable period of lower inflation is required before rates are reduced.

Importantly, it is crucial to differentiate between normalisation and emergency rate cuts. The period of low interest rates is, more likely than not, over. In fact, with the Fed targeting inflation at 2%, there is a low likelihood that the terminal rate for policy loosening would see interest rates end below 2%, thereby resulting in negative real rates without a deep recession.

When is the cut and what is the size?

The current state of the economy suggests that there is less urgency to cut rates, versus the initial expectations of a recession or hard landing. The Fed had hoped to see a softening of the labour market and further demand destruction before commencing rate normalisation, but that has not been the case. Growth remains slightly better than expected and the labour market remains at full employment. For now, soft landing seems achievable. As long as inflation can be sustainably low or around the 2% target, the Fed can begin cutting rates.

Timing wise, the current looser financial conditions should provide the Fed more time before commencing rate normalisation. Our base case is still for the Fed to commence rate normalisation in June. This should allow the Fed a runway of 4 months of data monitor, to avoid any policy error, which could be detrimental for their credibility.

As for size, we see around 4 cuts of 25bps for 2024, hence interest rates should be at 4.5% by year end. This should be followed by another 1% of cuts in 2025.

Direction of interest rates more important than timing and size!

Questions about the timing and size of cut are unlikely to disappear anytime soon. Nonetheless, US interest rates are much more likely to trend lower for both 2024 and 2025. Hence, the main focus should be to move away from money market and deposits. Cash deposits and money market have provided juicy yet safe returns over the last 1 year, but such returns are highly unlikely to continue.

Instead, investors should look to position themselves for the inevitable rate cutting cycle. Risk assets bode well during such a period. Even after recent inflows into fixed income and equities, the current cumulative positioning of equity and bond funds combined still dwarfs that of money market funds over the last 12 months by approximately 4x.

We have constantly reiterated our positive call for both high grade corporate bonds and Treasury (preference for shorter dated given the recent move of the 10Y treasury). Fixed income can exhibit equity-like return in a rate cut environment, hence this was also one of our key themes this year: Reaping Real Returns. Additionally, corporate yields remain highly attractive, at levels not seen since the 2008-2009 financial crisis. Hence it can also be ideal to tap on to structures and lock in the high yield as an alternative to deposits and money market funds.

Will the China weakness drag on?

China’s economy continues to slide, initially from the Covid-19 pandemic, followed by the burst of its property bubble. While the world was recuperating, China was left licking old wounds as the country was one of the last to exit their covid bubble. That has severely impacted trade and tourism, ultimately pushing the world’s largest manufacturer into a deflationary environment.

Consumer and producer inflation have both dipped substantially, following a sharp drop in domestic demand as confidence falters due to the property downturn. However, the silver lining now is that the Chinese authorities are seemingly willing to tackle the current slowdown with more priority.

Take for example the recent PBoC move of cutting the reserve rate requirement (RRR) ratio by 50bps. That was a positive surprise as the market only expected a 25bps cut. Interestingly, the move was preannounced in a press conference, in contrast to the typically method of publishing online and disseminating via state media. This at least suggests some urgency in addressing the structural slowdown China is facing.

Additionally, the recent quiet removal of the Online Game Management Regulations draft (which had led to Chinese gaming company stock corrections in December) also suggests that authorities may refrain from adopting restrictive measures in the near term.

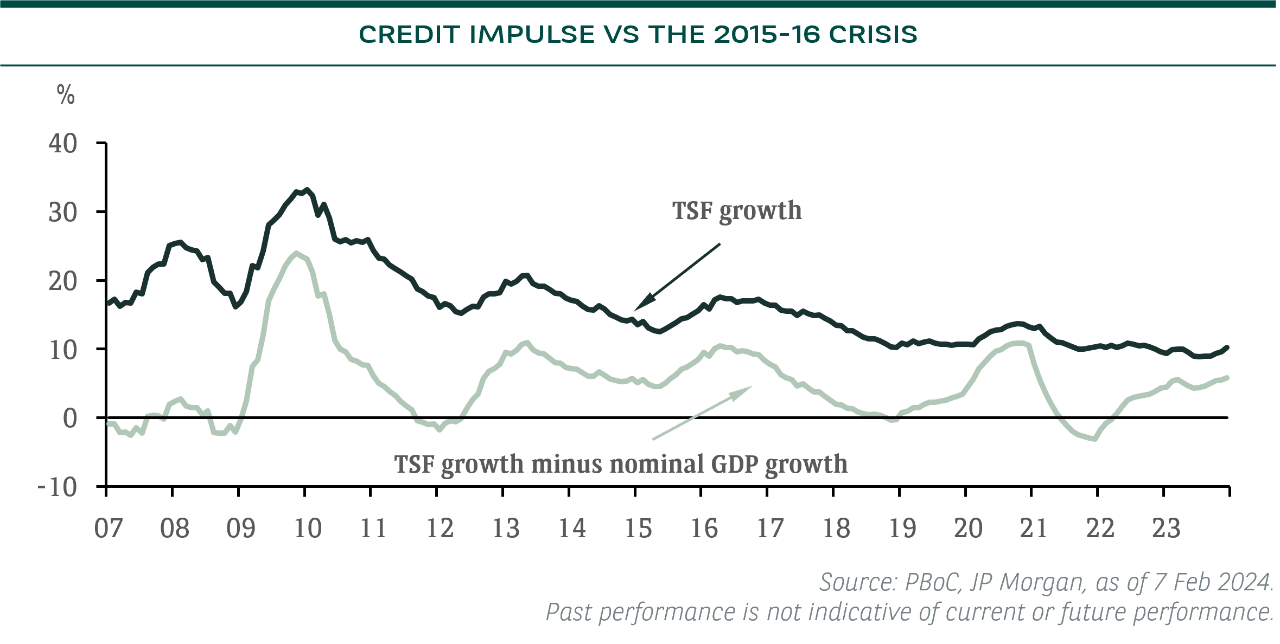

Comparison to 2015-2016 crisis

The current slowdown has also been likened to the 2015-2016 China bear market after suffering from an equity meltdown along with debt/property crisis. Monetary response (interest rates and RRR cuts) during the crisis was swift and significant. The strong credit impulse eventually aided China to turn the tide. This round however, the PBoC seems to be more handicapped given the weaker Yuan.

Looking at the equity market, valuations reflect the current sentiment while allowing for a margin of safety. The 12-month forward P/E of HSCEI or China stocks trading in Hong Kong still currently trade at below 7x earnings, or close to 2 standard deviations relative to long-term averages, at similar levels when the market bottomed in 2016 after China’s equity market bubble burst and October 2022 just before the U-turn on Covid policy.

Looking Ahead

Valuation has stayed attractive, at levels last seen since the 2015-2016 China bear market. The put-call ratio has also trended down over the last two years, suggesting a bottoming process is in the making. Nevertheless, sentiment remains very weak as many investors and asset managers remain severely under-allocated. Short covering and hence a decent sized bear rally can be expected given the extreme pessimism and positioning.

Given the structural nature of the current downturn, the property sector needs to show signs of recovery/bottoming before the economy can truly be well on its way to recover. There is also the additional political risk with Donald Trump likely returning as the republican candidate for the upcoming US elections 2024.

On the bright side, our forecast of a weaker greenback given the US rate cuts should play well for the Yuan. The PBoC has also intervened to ensure stability of the Yuan by orchestrating buying by state banks and giving market guidance to bankers. Therefore, there is hope that the monetary authorities can and will do more.

In the near to medium term, more pro-growth policies can be expected as the government is likely to show serious intent to prevent the economy from sliding further. Lately, we finally saw a more forceful and coordinated response. Therefore, all eyes will be on the upcoming National People Congress on 5th March, which may provide further clues on the direction of the economy.

CIO Asset Allocation