The Japan equities market has garnered a lot of attention since 2023, where we reiterated our positive call on Japan equities. We continue to be positive on Japan including small and mid caps despite Bank of Japan’s potential future interest rate hike. Full year 2023 performance for the TOPIX was 25.3%. YTD the TOPIX gained 15.9%, and saw new highs in March, outperforming most markets in local currency.

How is the Japanese economy faring?

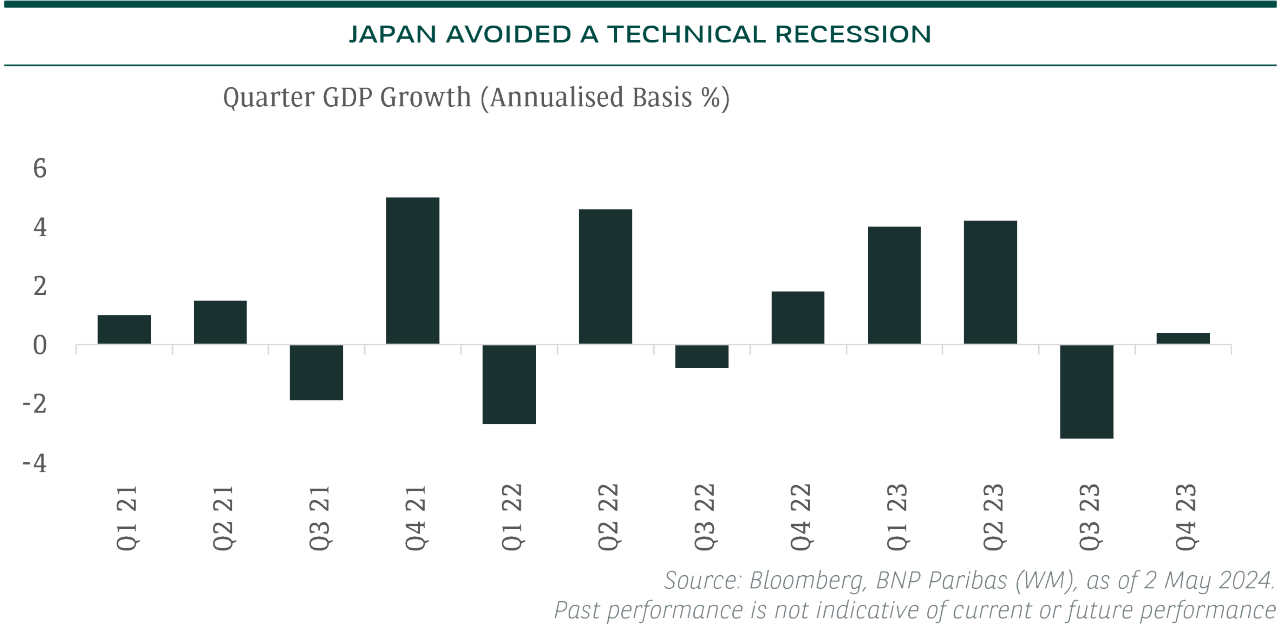

The Japanese economy narrowly avoided a technical recession. The recently revised data shows gross domestic product (GDP) was 0.4% higher in the last three months of 2023 compared to a year earlier. Net trade remains a positive contribution, spurred likely by the weakness in the yen. Sentiments continue to improve, albeit domestic demand remains a concern. There are also growing doubts on whether inflation can stay near the 2% target.

Interestingly, March saw the largest ever wage hike in the spring wage negotiation. Rengo, the country’s largest union group, confirmed that Japanese firms have agreed to raise pay by 5.25% on average this year. The wage rise could have a significant impact on inflation going forward.

Bank of Japan remains accommodative

The unprecedented March wage negotiation allowed the BoJ to finally exit their negative interest rate policy (NIRP) and terminate the yield curve control (YCC) framework. The most recent April meeting unsurprisingly saw policymakers keep interest rate unchanged at 0% to 0.1%, while maintaining its current JGB purchase amounts.

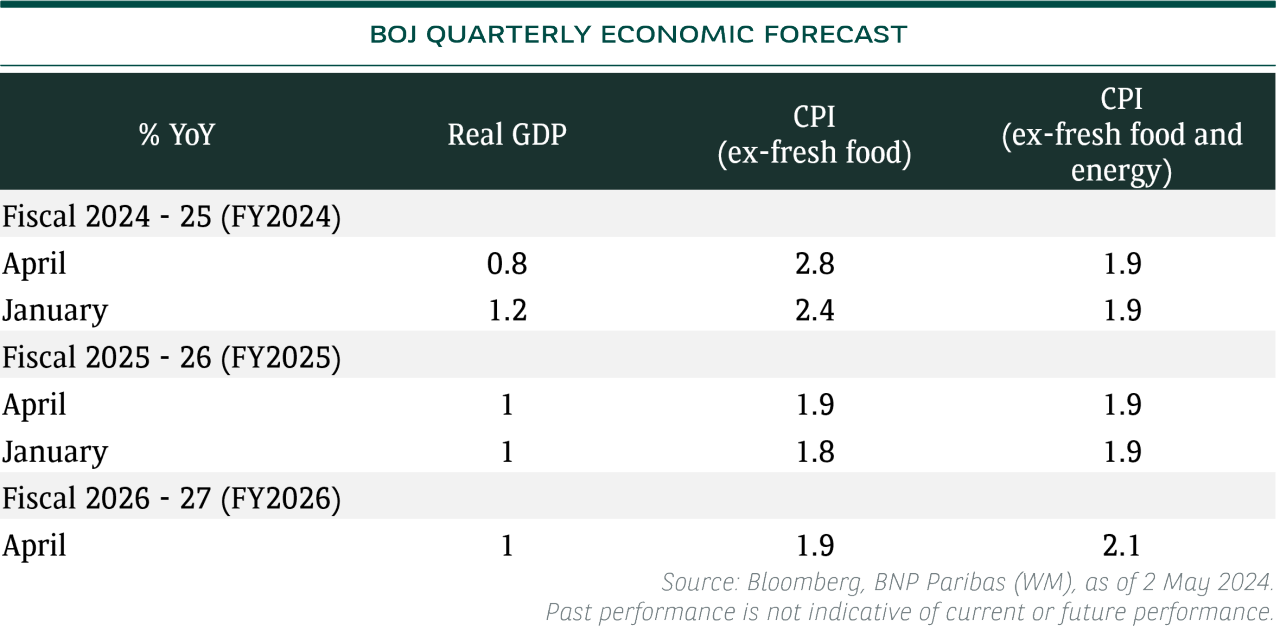

The central bank also revised its forward guidance. CPI print for FY 2024 has been revised higher to 2.8%, from January's projection of 2.4%. This is largely due to the waning effects of higher import prices and fewer government support measures. The bank made it clear that it intends to raise rates further if the economy and inflation evolve as it expects.

Our base case is still for the BoJ uncollateralised overnight call rate to be at around 0.75% by September 2025.

We still see a 15bp rate hike in September 2024, followed by 25bp hikes semi-annually, although the risk of a quicker than expected rate hikes is increasing.

What can cause the BoJ to hike quicker than expected?

Crucially, the yen would have to weaken further. As of now, Governor Ueda does not appear overly concerned. He noted that the yen depreciation has yet to materially influence their inflation outlook, although that sparked more selling pressure on the yen. Interestingly, there have been reports on suspected intervention as the USDJPY approached 160. This constant threat of MoF intervention likely implies that any further weakening of the yen will be gradual in nature.

The continuing yen weakness will be monitored for further fueling of import inflation. The BoJ will prefer to prevent any unexpected re-acceleration of inflation, and manage inflation around their 2% target level.

Ultimately, the BoJ will want to avoid the risk of an early rate hike. There is potential to cause a rapid repricing of the terminal rate and thereby causing instability in the JGB market.

BoJ impact on markets

The central bank stressed that they are merely reducing the amount of stimulus, instead of tightening its grip on the supply of money. The preference is still to move as gradually as possible, to minimise any shocks associated with the transition away from three decades of near-zero interest rates.

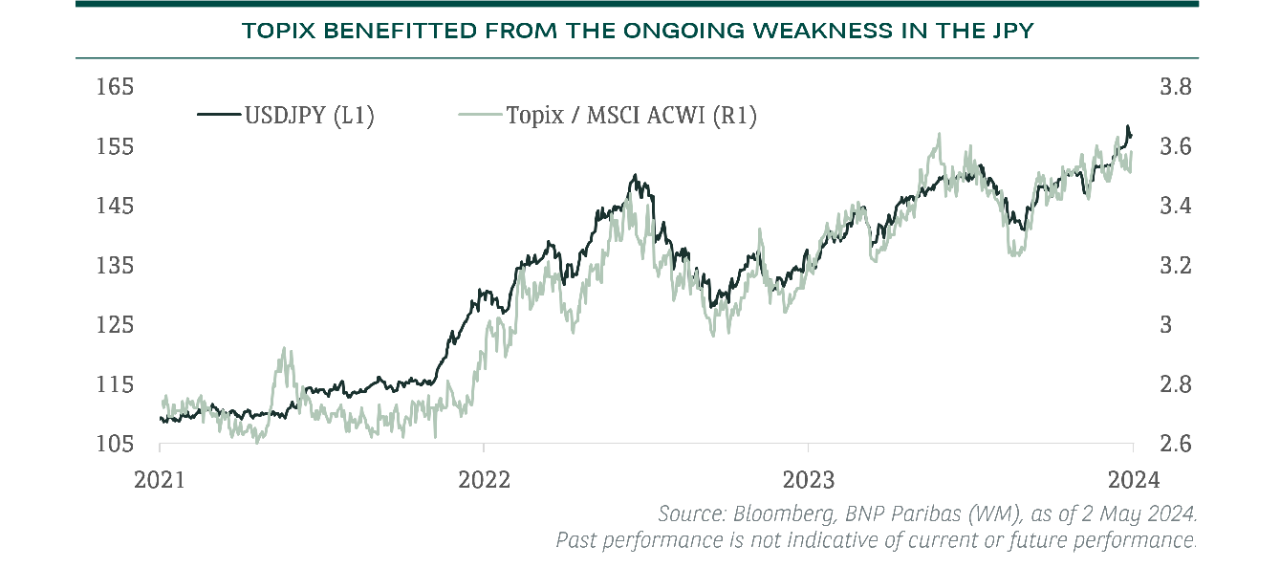

This accommodative message has been well-received by the market. Japanese stocks hit record highs for the first time in 34 years. The weak yen against the dollar also greatly benefitted Japanese exporters.

The market continues to challenge BoJ’s narrative on rate hikes. However, we keep the view that the potential Fed rate cuts and the BoJ rate hikes should gradually increase the attractiveness of the JPY. However, the USD strength (with fewer cuts priced in this year) reduces the potential for yen strengthening. Hence, we adjust our USDJPY 3-month target from 145 to 150 and our 12-month target from 134 to 140.

Japan Equity: Earnings

The earnings season has been pretty decent thus far. 14% of TOPIX companies have reported Q4 2024 results, and 59% beat EPS estimates. Overall EPS growth is +1% YoY, with 6 of 10 reporting sectors seeing positive growth. On the topline, 51% of the companies beat sales estimates, delivering +2% YoY revenue growth, with 9 out of 11 sectors are recording positive growth.

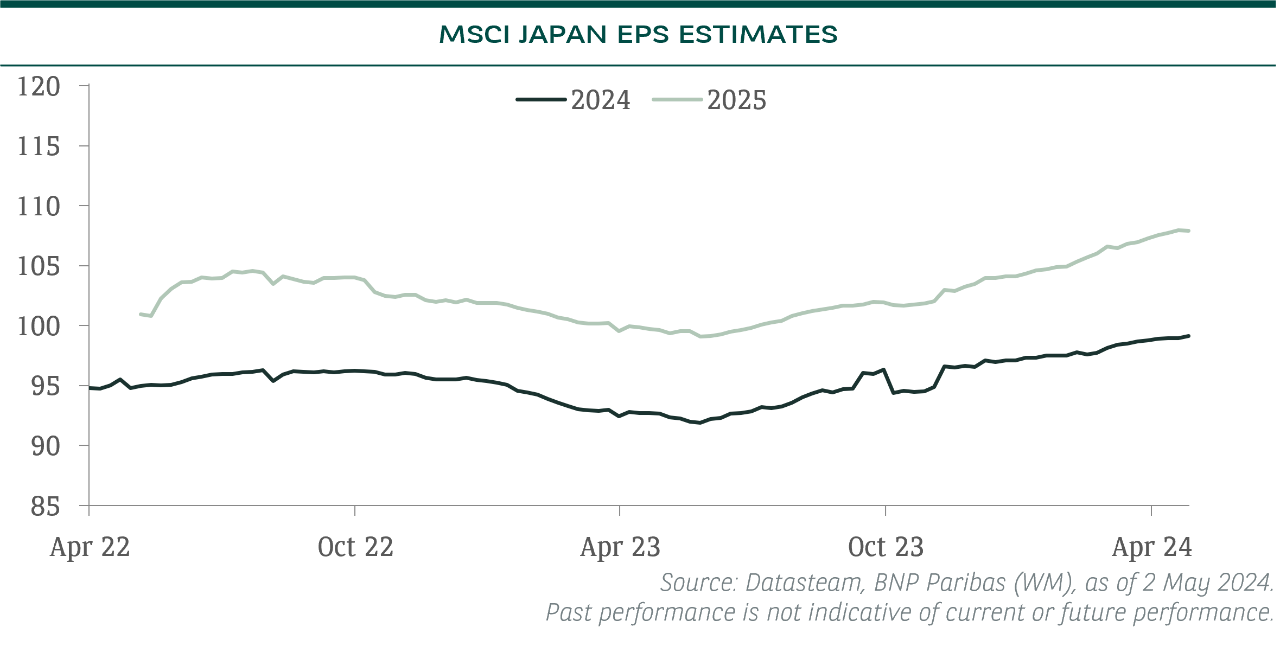

Additionally, the current weakness in the JPY is also pointing to a material upside for EPS growth in Japan. It is also no coincidence we are seeing positive FY2024 earnings revisions for MSCI Japan EPS.

Japan Equity: Other catalysts

For FY2023, TOPIX companies announced a record high of JPY10.1 trillion of share buybacks. Furthermore, the number of companies announcing YoY dividend increases is also much higher versus the same period of the previous year.

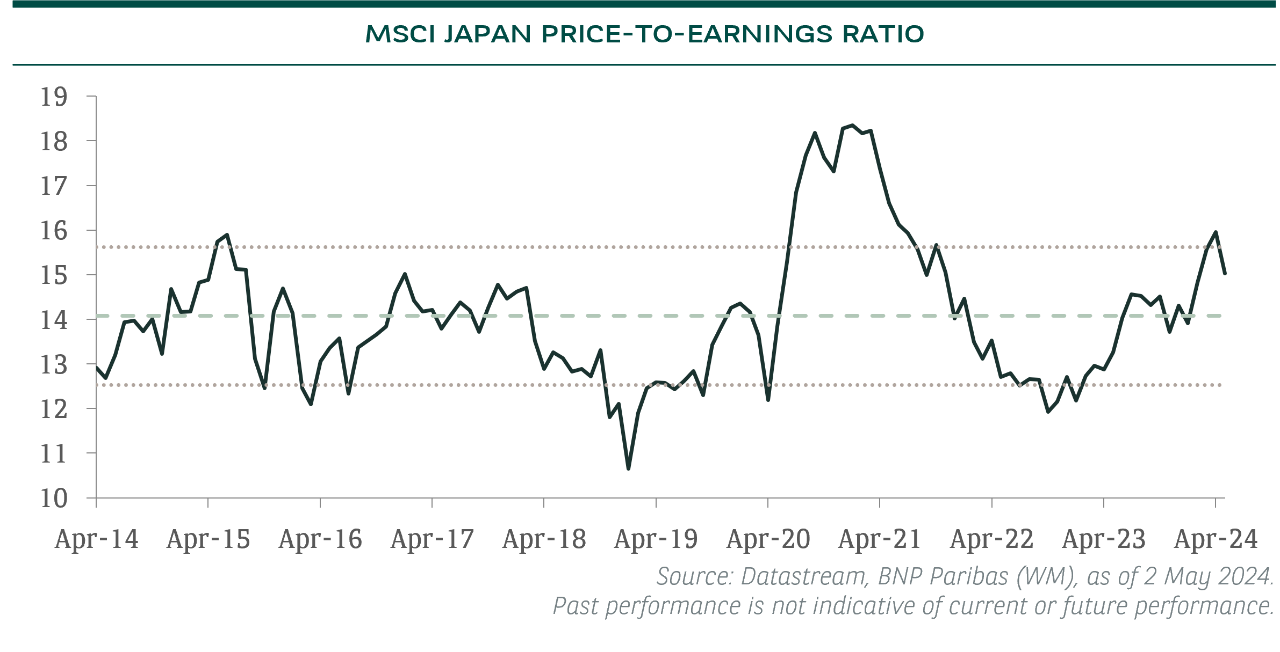

Valuation also remains fair. MSCI Japan is trading at 15.1x PE ratio (vs 15.0x 20y average), while also being within 1 standard deviation of the 10y average PE.

The structural trends of economic reflation and corporate governance reform are still on track. Although rising rates tend to be perceived as headwinds for equities, we see Japan’s exit from negative interest rates a tailwind.

➤ We continue to stay positive on Japan including small and mid caps. Stock price reactions to earnings announcements had a somewhat negative bias, as profit-taking became apparent following a >15% 1Q return. Overall, the current pullback in Japan equity market can represent a good opportunity for accumulation.

Conclusion

BoJ continues to act in an accommodative fashion, despite moving out from NIRP. They are likely to stay flexible/data-dependent, and hike gradually, although the fast depreciation of JPY may force them to move quicker.

We continue to favour Japan on its economic reflation and corporate governance reform story. Earnings and shareholder returns reinforce the attractiveness of Japan equity. Softer JPY is also a tailwind for the land of the rising sun. Pullbacks represent opportunities to accumulate.

Key Risk

While BoJ remains accommodative to minimise the impact of transiting away from negative rates, further weakening of the yen may pressure the central bank to hike earlier than expected.