Impact of latest US tariffs is symbolic but insubstantial

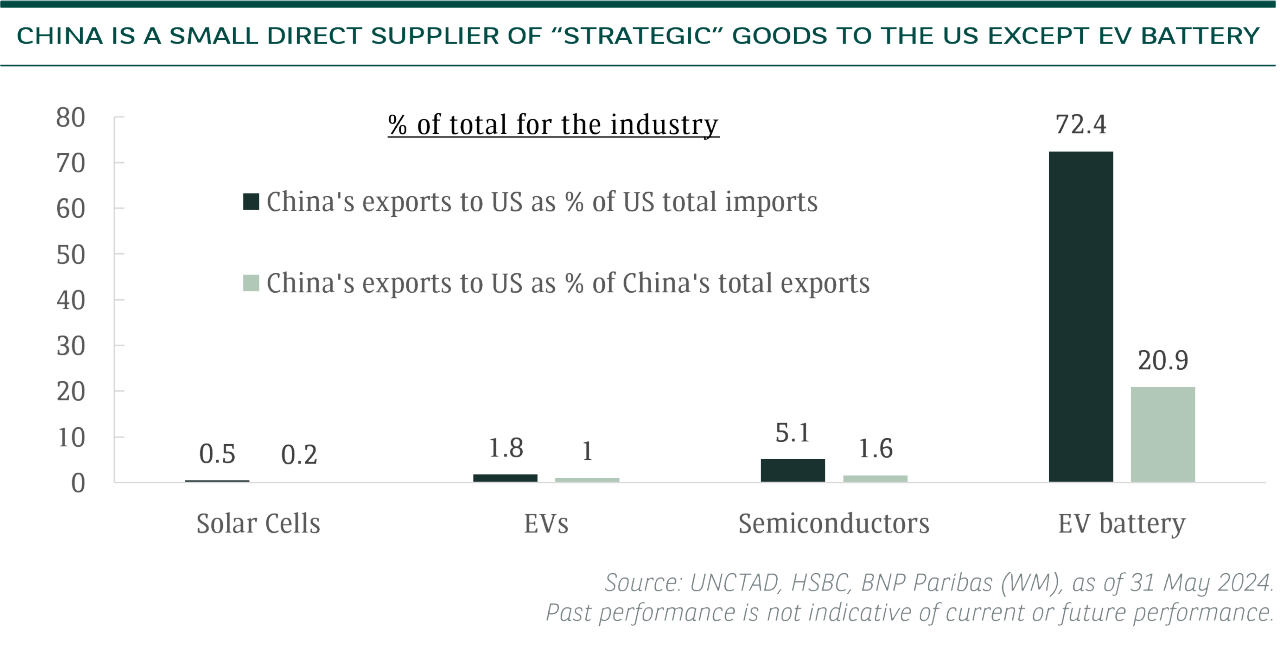

The impact of the new round of US tariffs on China’s imports, including electric vehicles (EVs), batteries, solar cells, semiconductors, selected materials and medical products, is more symbolic than substantial. The direct impact on China’s economy is likely to be limited as the USD 18bn of affected exports only account for less than 5% of China’s exports to the US and less than 1% of China’s 2023 total exports.

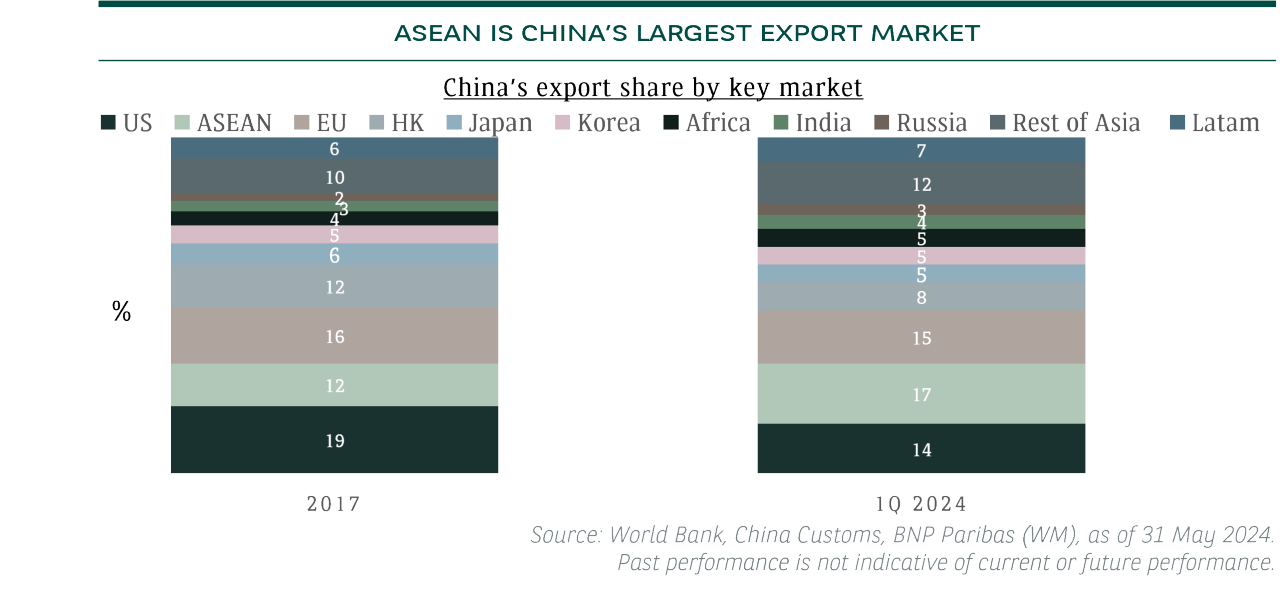

ASEAN has replaced US as China’s largest export partner

ASEAN countries account for 17% of China’s total exports in 1Q 2024 and up from 12% in 2017, while US share of China exports declined from 19% in 2017 to 14% in 1Q 2024.

China has limited exposure to the “strategic” goods subject to new tariffs

For this latest round of tariffs, there may be relatively higher impact on China’s EV battery, while impact on China’s EVs is minimal despite a 100% tariff given the country’s almost negligible direct US exposure.

China’s solar products are largely traded through ASEAN markets to the US, with 28% of US solar products importing from Vietnam, 22% from Thailand, 17% from Malaysia and 12% from Cambodia. However, solar equipment imported from these four countries may be subject to additional duties of as much as 271% once a two-year moratorium expires in June 2024. Some Chinese solar companies are halting their production at their Southeast Asia factories, as a result.

The EU has announced new additional tariffs of up to 38% on China’s EV imports, which is probably high enough to weigh on some Chinese EVs exports to the EU and increase risk of China’s retaliation on EU-made cars. The latest actions only reinforce the supply chains reshoring theme.

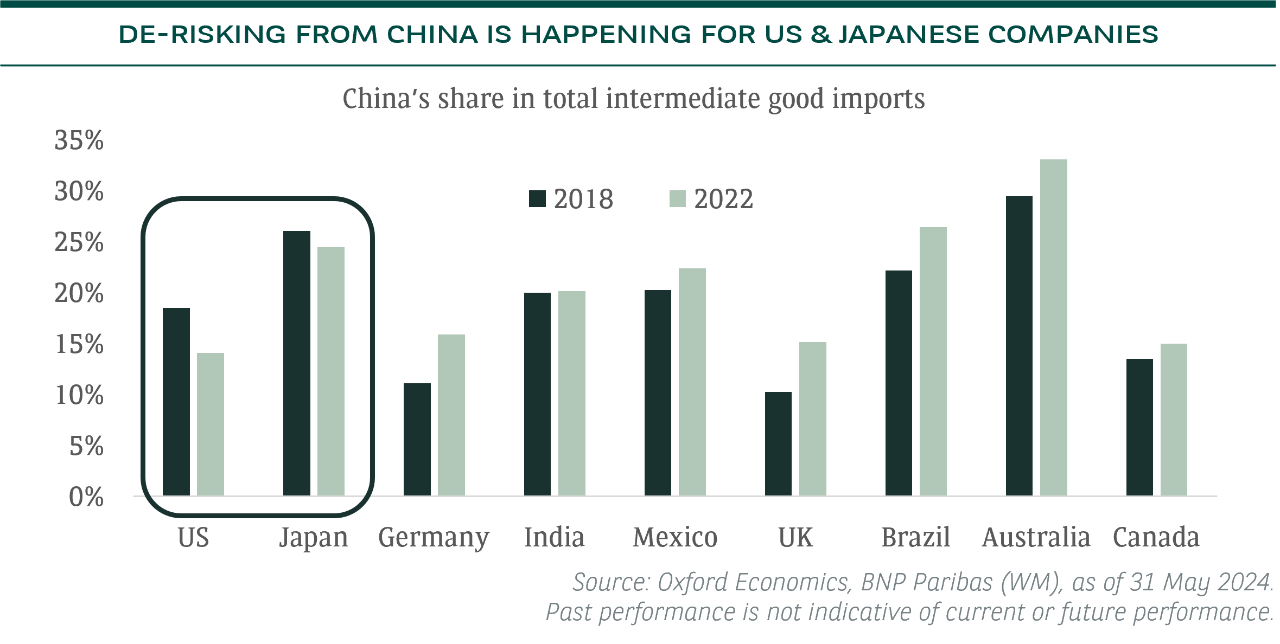

A gradual supply chains diversification from China is in motion

Increasing geopolitical conflicts and rivalries have pushed major economies and multi-national companies to re-think supply chains and their trading partners, leaning towards a more diversified model to minimise reliance and avoid a single point of failure.

Who are the potential winners in the reshoring trend?

BENEFICIARIES BY COUNTRY

Key question: Which countries are most likely to be targets for supply chain diversification?

India: Rivals China in scale and wages, with support from major policy reforms

Japan: A major hardware producer and the perfect choice for more cutting-edge operations

Vietnam: An established early mover with strong infrastructure and geographical advantage

Malaysia & Thailand: Winners in certain niches (semiconductors and auto respectively)

Mexico: A major beneficiary as it takes a large chunk of China’s export share to the US

Brazil: A great alternative for both energy and food imports

It is a zero-sum game as export demand and foreign direct investment (FDI) will eventually be allocated elsewhere. Reshoring and supply chain resilience have also been at the forefront of corporate planning.

Global policy announcements to de-couple trade and de-risk investment have increased significantly in recent years. At the same time, some countries have been proactively enacting reforms and incentives measures to attract manufacturing friend-shoring and relocation.

BENEFICIARIES BY SECTORS

“Concentration” of key products as a driver of government support

Semi-conductors Is critical to the continuity of digitalisation and AI development, and “concentration” is making governments pour billions into the subsector

Renewable Energy Can help alleviate risk from the current “concentration” in energy production

Other subsectors may also benefit indirectly from the government push

Robotics & Automation Are Beneficiaries as newer, more modern factories are built on the back of the supply chain diversification push

EV & its Batteries “Concentration” is high and governments support is strong, though recent setbacks make selectiveness the key in playing the theme

“Concentration” arises as a certain key products are sourced from only relatively few economies, and therefore, those subsectors become potential winners in the reshoring trend.

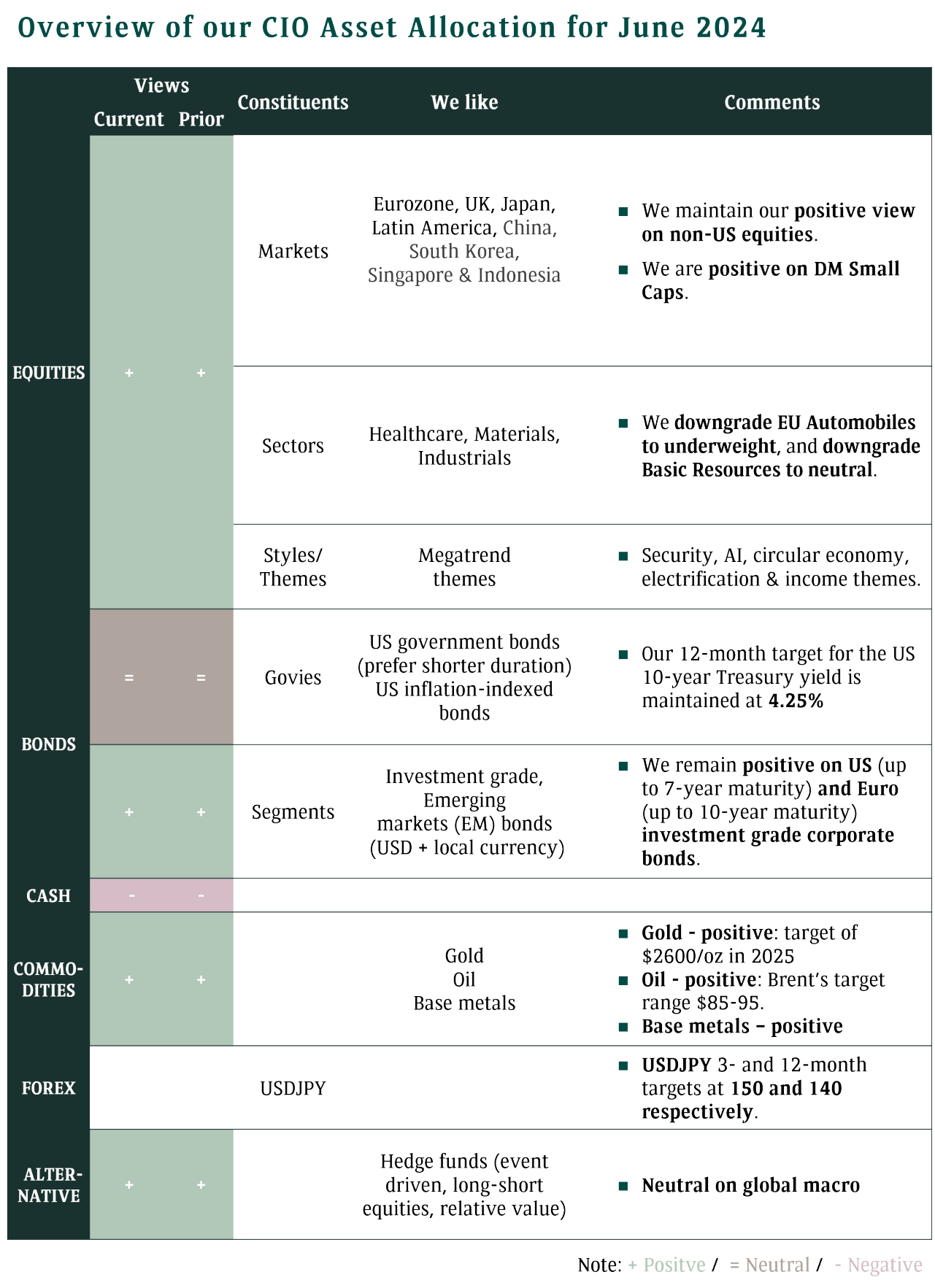

CIO Asset Allocation