Chris ZEE Head of Equity Advisory, Asia BNP Paribas Wealth Management, Godfrey OYENIRAN Senior Adviser, Equity Advisory Asia BNP Paribas Wealth Management & Camilia GOH Senior Adviser, Equity Advisory Asia BNP Paribas Wealth Management

The US equity market has seen a downward adjustment in valuation multiples over the past month (as of October 2023) as expectations shifted to reflect higher for longer interest rates. Though despite the September 2023 correction, US equities continue to outperform world equities, driven by gains from the Magnificent Seven stocks. Breadth has been a concern for equity investors in 2023, given the narrow concentration of gains in these Magnificent Seven stocks.

As we start the fourth quarter of 2023, we still expect some volatility ahead of the next Federal Open Market Committee (FOMC) meeting on 2 November 2023 and think that the market will take its cue from the tone of management guidance in the current reporting season as investor attention will start to shift to 2024’s earnings growth outlook, which currently looks optimistic at about +12% for the MSCI US Index (versus a muted +2% earnings growth forecast for FY23E).

In terms of sector outlook, we continue to see brighter spots in AI supply chains within the technology sector although the broad outlook for corporate IT spending remains modest into 2024, below pre-pandemic historical average levels, which reflect the increased caution and focus on financial discipline by corporates. On the topic of AI, we see an exciting landscape with opportunities evolving over the medium term in the different layers of the cloud and AI ecosystem, and favour quality as well as profitable technology leaders which are better positioned to compete in this multi-year race.

On other sectors in the US, online advertising demand still looks relatively healthy with a gradual trend of improvement expected as the shift from traditional advertisement continues.

Consumer confidence in the US economy has slightly deteriorated with softening sentiment observed across various income groups as savings reserves trended lower from 2022. Within the consumer space, we have seen some downtick in demand trends across various segments such as consumer goods, retailers, restaurants, as well as travel and leisure, which is unsurprising in a late cycle stage. Payments companies’ commentaries however have been fairly constructive, with continued stability in expenditures. This is while real estate continues to see headwinds from refinancing worries, commercial real estate price and transaction activity declines. Within Industrials, broad earnings estimates have moderated to reflect slower construction markets and a softer China reopening while the narrative on destocking trends is expected to continue into year end.

Moreover, the inflation story hasn’t gone away. The United Auto Workers (UAW) strike impacting the Big Three US automakers could provide unwanted upward pressure on wages, potentially stalling the Federal Reserve’s fight to tame inflation.

What does the rest of the year have in store?

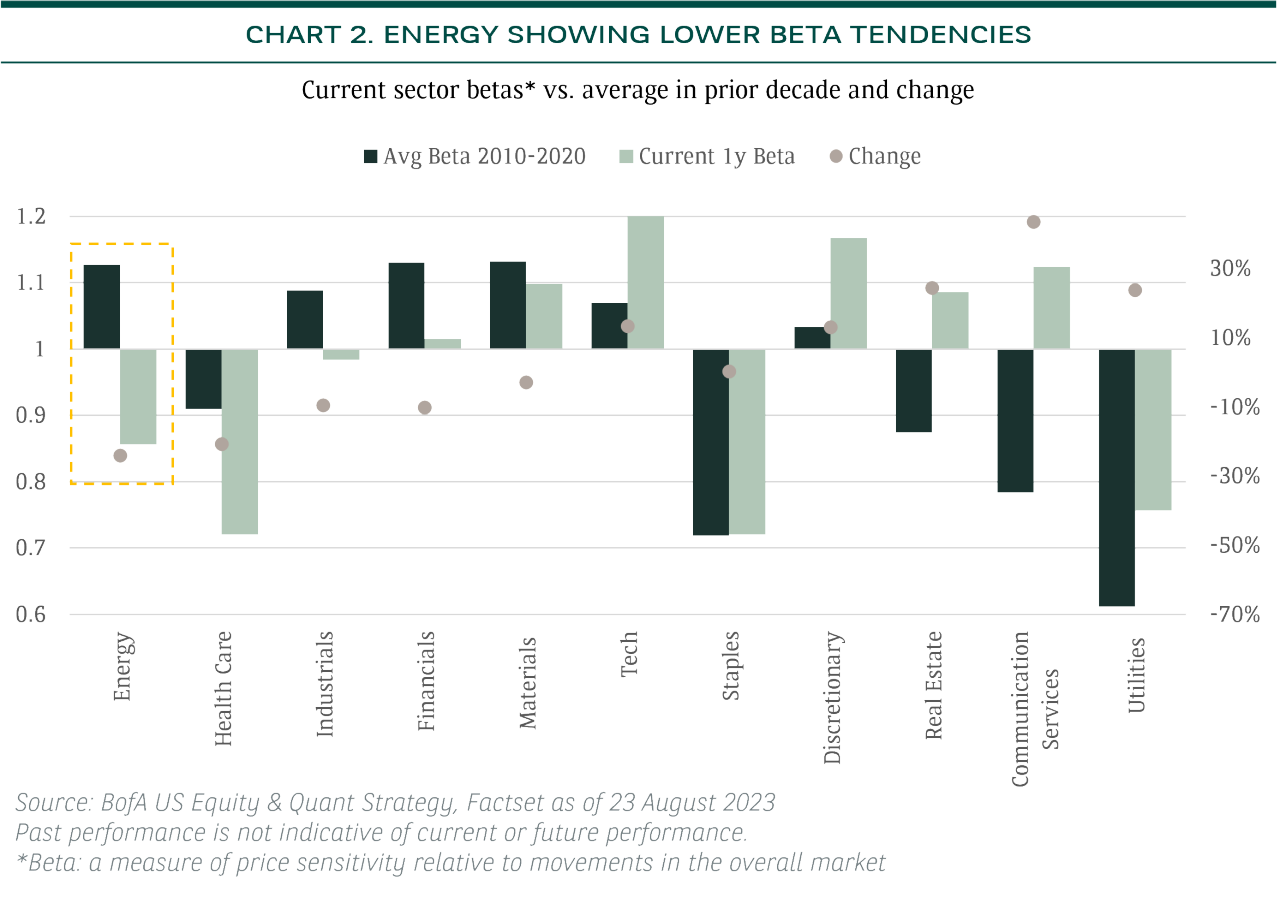

The outsized impact of the Magnificent Seven stocks has been clear (see Chart 1). The market-cap weighted S&P 500 index rose by 11.68% through the first three quarters of 2023 compared to a gain of just 0.27% for the S&P 500 Equal Weight index. According to Bespoke Investment Group, the 11.42 percentage-point spread in favour of the market-cap weighted index over the Equal Weight index was the widest on record for that time period since 19901.

Taking an optimistic view, October 2023 kicks off what has historically been the best four-month period of the year for stocks with the S&P 500 averaging gains of over 1% in each month from October through January. October is also known as the month of market bottoms. Of the 60 market corrections since 1945, 18 of them have bottomed during the month.

Investors may take some comfort from this positive seasonal dynamic that has worked in the US market’s favour since 1945. However, there have also been some big exceptions, notably 1987 (-22.7%), 2008 (-25.2%), and 2018 (-14.4%). Still, the S&P 500’s median gain in the final 100 days of the year has been 4.1% with positive returns 78% of the time. That’s something worth acknowledging.

The challenge for large banks

The acute phase of bank stress is clearly over, but the sector has failed to stage a meaningful rebound since the regional banking crisis. With banks still facing a range of issues, including funding challenges and weaker loan demand, market expectations were low heading into the earnings season. Against all odds, the results season kicked off with positive performances from JP Morgan, Citigroup and Wells Fargo to suggest the big banks are still doing just fine.

Higher-for-longer rates have raised questions about lenders’ bond holdings and whether they will need to pay more to retain deposits. Banks are also contending with tighter regulations and mounting concerns about credit. Still, it’s worth keeping in mind that the bigger banks should be better positioned than their regional peers across all these areas.

Sector stocks remain cheap on Price-to-Book (P/B) and on Price-to-Earnings (P/E). About two-thirds of the benchmark KBW Bank Index and the KBW Regional Bank Index are trading for less than book value. A year ago, only ~20 banks traded below.

Energy to the rescue?

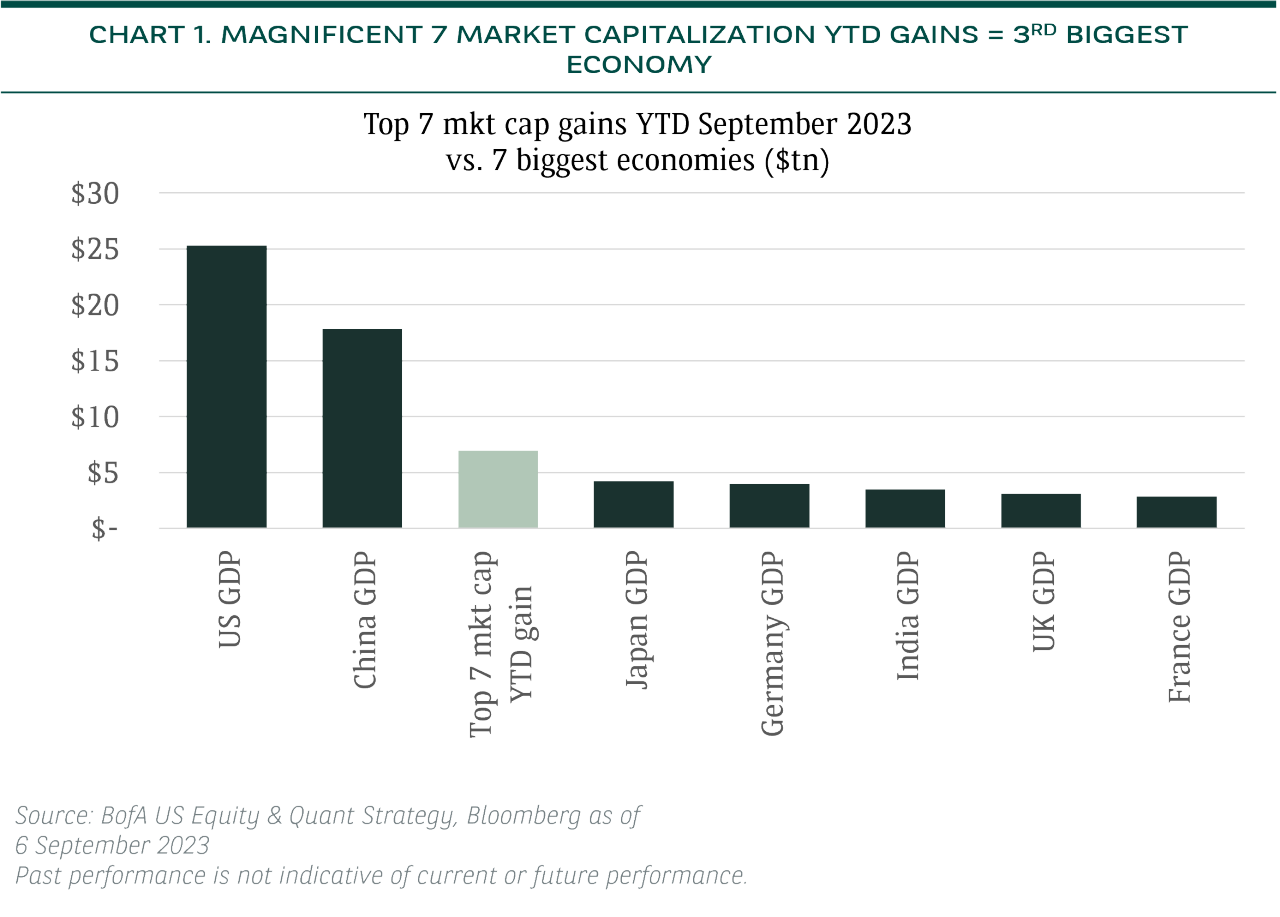

Early-2023 performance for Energy names had been indifferent amidst macro and micro headwinds, centred on oil price volatility, uncertainty about the resilience of global energy demand and negative Earnings per Share (EPS) revisions (see chart 2). However, we have seen a major recovery in recent months (as of October 2023). Having been the worst-performing sector in the first half of 2023, Energy has been the best performer in the S&P 500 since the beginning of June 2023. Geopolitics has been a major driver.

In June 2023 Saudi Arabia Energy Minister Prince Abdulaziz bin Salman said he “will do whatever is necessary to bring stability to this market.”2 OPEC+ leaders Saudi Arabia and Russia subsequently announced they would extend supply cuts through to the end of 2023, tightening the global market. The strategy should help to drain inventories further. More recent events in Israel and Palestine have further unsettled oil markets.

We see this geopolitical underpinning supportive for sector share price performance, particularly as it could lead to rotation out of sectors negatively impacted by higher energy prices. Some airlines, for example, have already lowered earnings guidance due to higher fuel costs. With investors hoping to see broader leadership to steer the market, maybe the Magnificent Seven won’t be required after all.