Summary

- Global equities and bonds continued to correct in October 2023 in a seasonally weaker period of the year. Rising yields, elevated geopolitical risk, and mixed earnings season weighed on global asset returns.

- Real yields rising, concerns over US government debt size and issuance (which has led to higher term premium*) are feeding into higher yields, albeit central bank rate hike expectations have not changed and longer-term inflation expectations also relatively anchored.

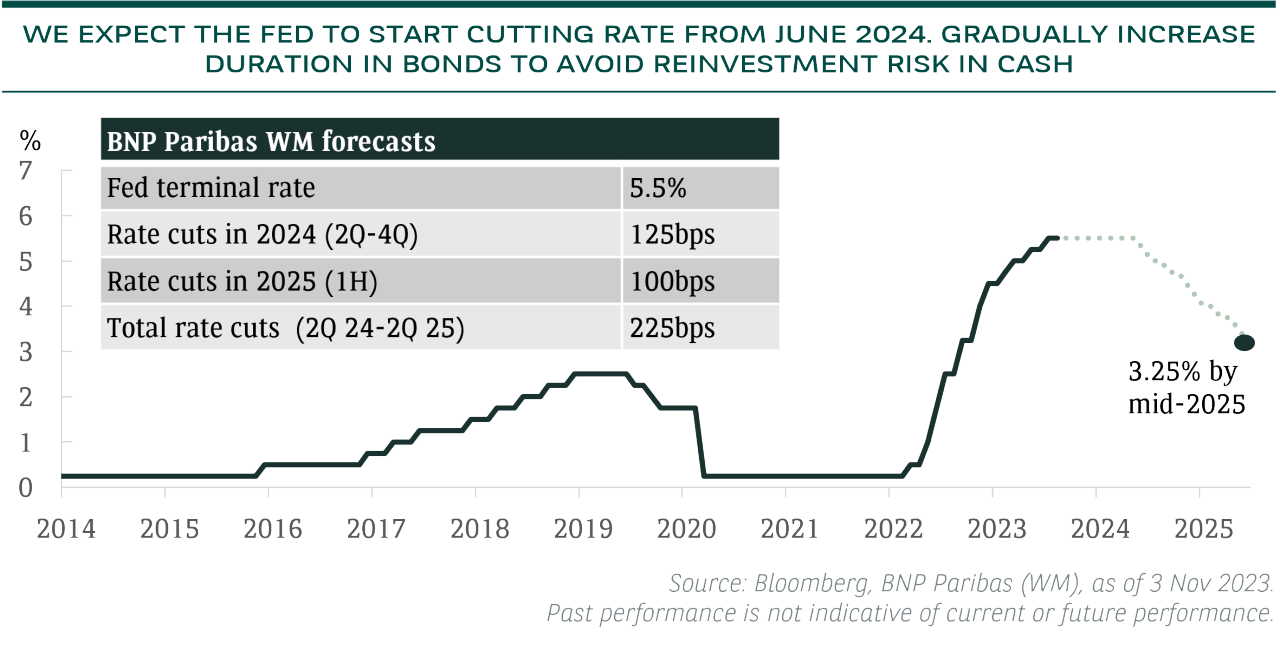

- The rise in yields provides a good entry point for quality bonds with attractive yields and a chance to even extend duration to achieve potential equity-like returns in the medium term as we expect the Federal Reserve (Fed) to cut rates from mid-2024 to mid-2025.

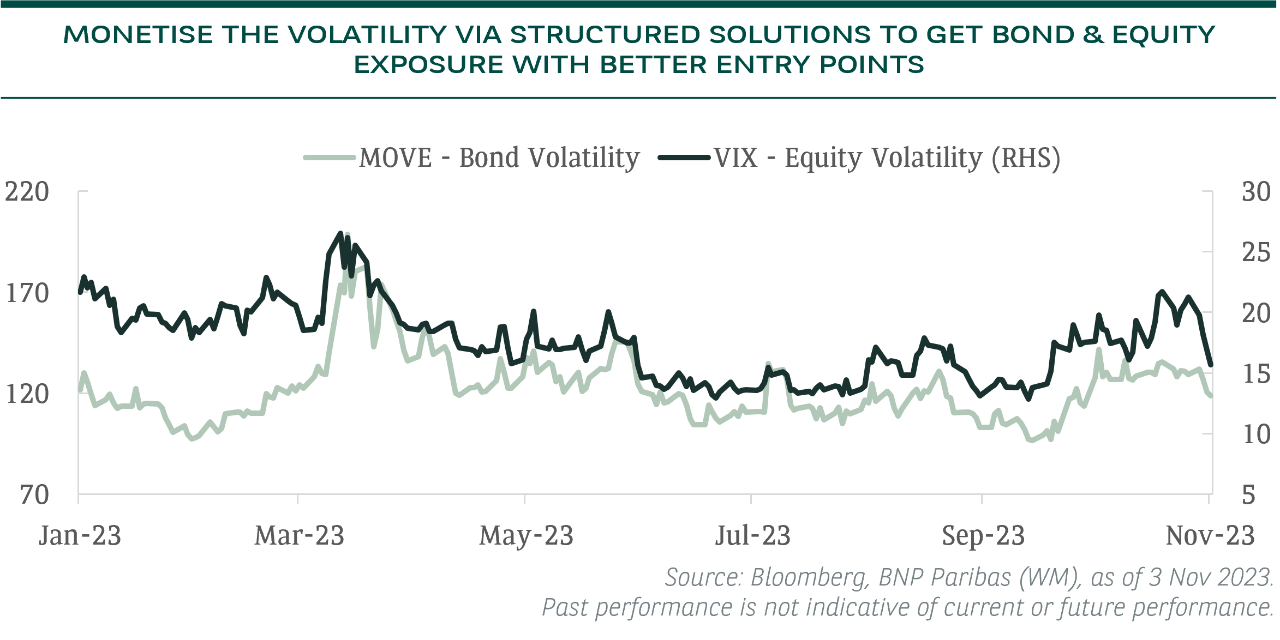

- US equities had corrected over the past three months. Investors should take this opportunity to monetise the volatility for better entry points in lagging sectors as the average stock is already down for the year.

1. Why are Yields Rising?

Firstly, the most interesting issue is government bond yields are rising despite the fact that rate hike expectations for the Fed and ECB have not changed. The market expects rates to be on hold for a long period of time, in-line with our view that the Fed and the ECB will hold rates steady until June 2024 and September 2024 respectively.

Secondly, medium-term inflation expectations have not increased much either with the 10-year inflation expectations rising only modestly.

Hence, most of the increase in yields are in real yields (i.e. market’s expected level on interest rates after adjusting for inflation), which act as a tightening of monetary policy. This brings up another crucial point - most of the rise in yields has been at the longer end of the curve. Since July 31st, the 2-year yields are up just +15 bps, while the 10-year yields are up +92 bps, leading to a bear flattening of the yield curve.

So, what are the key reasons for longer-dated yields to rise? The term premium that investors required has increased due to (1) increased issuance to fund higher budget deficits fueled by Programs including the CHIPs act and IRA which have led to reshoring boom and more resilient growth in the US, and (2) rising global yields as Japan has moderately loosened yield curve control.

On technical and positioning, yields breaking key levels and unwinding of long positions in US Treasuries by leveraged players also contributed to sharp rise in yields. That said, we have started to see some larger hedge funds covering their short positions in bonds recently and lower yields in early November.

We believe monetary policy acts with a lag. The impact of higher real yields, gradually slowing labour market illustrated by rising job claims, and early signs of slowdown in consumer spending will see the economy slowing and a peak in yields in the coming months if it has not already occurred.

While picking the exact top in yields won’t be possible, the return path for investors is asymmetric with the cushioning effect of attractive coupons versus potential downside risk of further higher yields, firmly in favour of bonds. Investors can consider gradually increase duration if you are overweight cash (to reduce reinvestment risk).

2. How Long Will the Equity Correction Last?

The S&P 500 broke its 200-day moving average at the end of October with a drop of 10%, entering correction territory and finally joining other global markets. Three factors drove the decline: (1) rising yields, (2) mixed earnings season with normal level of earnings beats for 3Q but modest downgrades for 4Q, and (3) an increase in geopolitical risk.

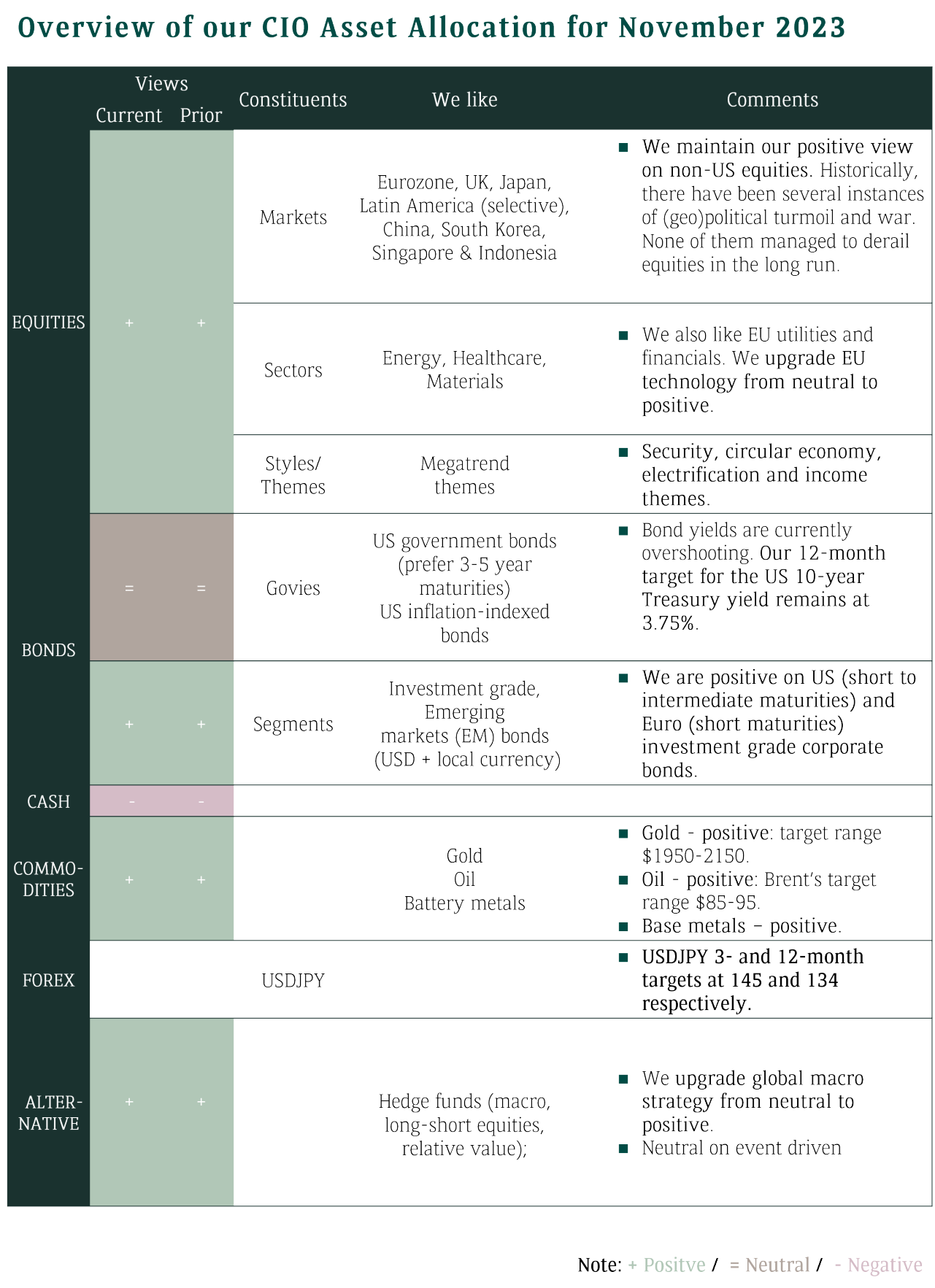

We believe yields are at or near a peak, and will be lower 12 months from now. However, earnings estimates are elevated for 2024 with earnings growth of 11%, which are vulnerable to downside revisions given the slowing US economy. Hence, we expect choppy markets in the short-term.

That said, we only have a moderate US recession projected for next year. The S&P 500 cap-weighted index has outperformed its equal-weighted peer by 13% YTD, the widest margin of outperformance in 30+ years, as the rally had been largely driven by the “Magnificent 7” stocks, which were the last to correct, while the S&P 500 equal-weighted index is actually down -3% YTD. Many sectors, such as energy, healthcare, materials and financials, have been left behind and already pricing in an economic slowdown.

Furthermore, non-US equity markets, including Japan, Europe, UK and Latin America, trade on low valuations with many stocks offering attractive dividend yields. We recommend gradually accumulating stocks on weaknesses. Normally, we are entering a traditionally stronger period of equity returns in terms of seasonality in November and December though volatility will likely remain.

3. What About the Conflict in the Middle-East?

In absence of a broadening of the Middle East conflicts, we expect Brent oil to trade in the $85-95 range. Geopolitical risks and OPEC+ production cuts

are putting a floor for oil prices. However, the key risk is stronger sanctions on Iran could cut exports by 1 mb/d and push Brent prices up to $110, a level that would lead to demand destruction.

Keep in mind that most geopolitical events do not have lasting impacts on the global economy. We make no changes to our views based on this situation. We will continue to monitor the fluid situation.

4. Let Volatility Create Cross-Asset Opportunity?

The recent rise in yields, questions over how long the central banks will remain on hold, and the increase in geopolitical risk, mean volatility has increased. Both the VIX index (implied volatility of the S&P 500 index) and the MOVE index (measure of US treasury bond volatility) were higher than previous months. The recent correction in global equities and increase in bond yields represent tactical opportunities to build strategic positions in bonds and equities.

Structured solutions allow customised entry points, offering better risk/rewards and more defensive strategies in this environment. Don’t forget always focus first on your strategic asset allocation and then take advantage of volatility to build longer-term positions.

Conclusion

The increase in bond yields, rising geopolitical risk and mixed earnings season led equities to enter correction mode in October. Yields have risen since July not because of market worries over additional rate hikes nor increased longer-term inflation expectations. The rise in yields was due to increase in real yields and increase in risk premium investors asked for holding longer-dated bonds.

The positive real yields will slow the economy as monetary policy acts with a lag of 12-24 months. There are early signs of slowing consumer, rising job claims in the US, and more cautious outlook by companies.

Any stabilization in bond yields would provide good entry points for quality bonds given attractive yields (16-year high) and chance to achieve potential equity-like returns (taking duration risks) in the medium term in the rate cuts environment in 2024 and 2025.

S&P 500 cap-weighted index has outperformed its equal-weighted peer by 13% YTD, the widest margin of outperfomance in 30+ years, as the rally had been largely driven by the “Magnificent 7” stocks, while the S&P equal-weighted index is actually down -3% YTD. Many sectors, such as energy, healthcare, materials and financials, have been left behind and already pricing in some economic slowdown. Furthermore, non-US equity markets, including Japan, Europe, UK and Latin America, trade on low valuations with many stocks offering attractive dividend yields. Investors should monetise the volatility via structured solutions for better entry points.

CIO Asset Allocation

*Term premium: compensation for uncertainty of holding longer maturities i.e. taking duration risk.