Whatever your objectives, our specialists design management mandates that are tailored to your requirements and your profile.

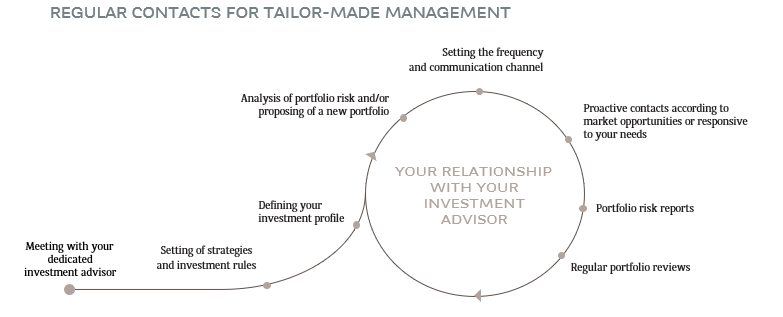

Our discretionary portfolio management service is ideal for clients who wish to entrust their portfolio to our dedicated team and benefit from their expertise. Free yourself from the constraints of day-to-day management by delegating the management of your assets to a portfolio manager. Our specialists will continuously monitor the financial markets on your behalf and closely follow their developments.

We have developed a full range of mandates to meet the needs of all customer segments. Responsible investment is also a pillar of our offering, with each range offering sustainable investment mandates, labelled by LuxFLAG. This label has been awarded for the third time in a row to our PMS[2] Balanced SRI Euro and PMS[2] Conservative SRI Euro Mandate, demonstrating the strength of our approach.

[2] PMS: Portfolio Management Solutions is a Luxembourg Undertaking for Collective Investment in Transferable Securities (UCITS).

Regular contact with our portfolio managers ensures a customised approach