BNP Paribas Wealth Management Luxembourg enables you to take advantage of a special partnership with Cardif Lux Vie, a Luxembourg life insurance company for which BGL BNP Paribas is a broker.

At BNP Paribas Wealth Management we are offering life insurance policies (including Cardif Lux Vie’s capitalisation contracts) for natural persons and legal entities.

Depending on different countries’ regulations these policies offer the following:

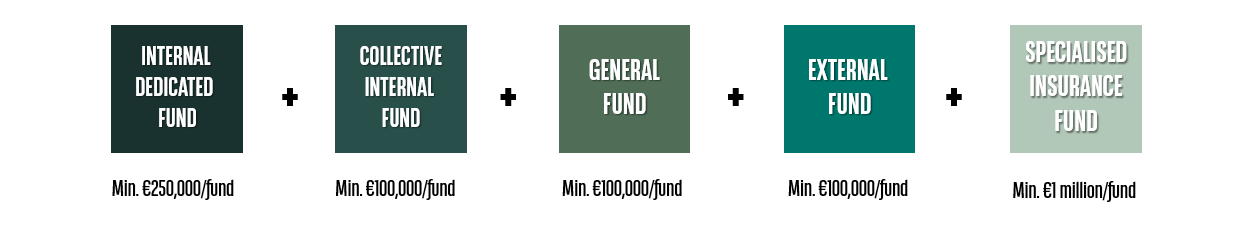

- A combination of 5 types of financial instruments in one policy

- The possibility of combining other Custodian Banks and Account Managers for asset management, according to your needs and situation.

THE BASICS OF THE LUXEMBOURG POLICY

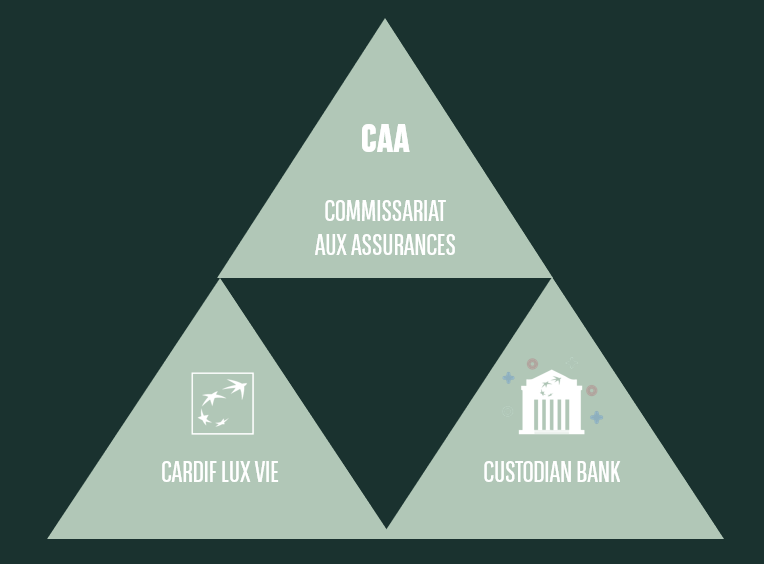

- STRICT SUPERVISION BY THE COMMISSARIAT AUX ASSURANCES (CAA): a public institution under ministerial authority

- TRIANGLE OF SECURITY AND SEGREGATION OF ASSETS: Life insurance policyholders in Luxembourg have the benefit of significant protection, which is a real advantage in terms of security.

- SUPER-PRIVILEGE in Luxembourg:

o The option to invest in foreign currencies

o Flexible product design

o Flexibility in the types of assets accepted in an Internal Dedicated Fund and management options (discretionary management, family management, multi-management, etc.)

- TAX NEUTRALITY: taxation in the policyholder's country of residence only

- SIMPLIFICATION OF TAX PROCEDURES (via the signature of a tax mandate)

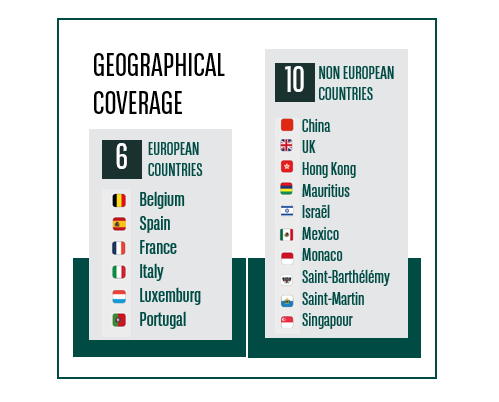

- EXTENSIVE GEOGRAPHIC COVERAGE

Benefit from solid international experience. For every country in which Cardif Lux Vie does business, an extensive legal study has been carried out beforehand.

HOW DOES LUXEMBOURG LIFE INSURANCE WORK?

Life insurance is a financial investment for investors looking for a tax-neutral way to supplement their income, build capital or pass on their assets.

A STABLE ENVIRONMENT

Luxembourg is an international financial centre. The country’s political, economic and social stability, its excellent sovereign rating (AAA) as well as a modern legal and regulatory framework are all advantages that guarantee the best environment for demanding clients.

INTERNATIONAL EXPERTISE

Established in 1994, Cardif Lux Vie has extensive expertise in insurance and financial products. Its in-depth knowledge of the needs of high-net-worth and ultra-high-net-worth individuals enables the company to offer life insurance policies that comply fully with market legislation in the European Economic Area. Individuals residing outside of the European Economic Area can also benefit from Cardif Lux Vie’s life insurance policies in certain regions.

A LEGAL FRAMEWORK GUARANTEEING THE BEST PROTECTION

Clients of an insurance company in Luxembourg benefit from a level of protection that is unique in Europe, which is a real advantage in terms of security.

TAILORED FINANCIAL MANAGEMENT

Luxembourg’s legal framework allows policyholders to have access to an enormous range of innovative and sophisticated financial assets.

TAX NEUTRALITY

The Luxembourg life insurance policy is tax-neutral in Luxembourg. Both the policyholder and the beneficiary of a Luxembourg life insurance policy are taxed in their country of residence.

WHY TAKE OUT A LIFE INSURANCE POLICY WITH

BNP PARIBAS WEALTH MANAGEMENT LUXEMBOURG?

Benefit from BNP Paribas Wealth Management and Cardif Lux Vie's respective expertise in wealth management and insurance.

Our top-of-the-range life insurance solutions enable us to meet your needs and savings objectives while complying with Luxembourg regulations and those of your country of residence.

|

Tailored pension and savings solutions |

|

Adaptable solutions to suit your circumstances |

|

A secure regulatory framework, all while benefiting from investment diversification within life insurance policies. |

Benefit from a high level of flexibility

If you are a high-net-worth individual (HNWI) or an ultra-high-net-worth individual (UHNWI) operating in an international context, Cardif Lux Vie offers you a range of life insurance and capitalisation products tailored to your needs in terms of flexibility, transferability and investment.

Control the risks

Luxembourg life insurance, a wealth management and estate planning tool, gives you access to several investment vehicles, depending on your financial and risk profile.

An adaptable solution

If you decide to move to another country for personal or professional reasons, our policies can be adapted under certain conditions to take account of the legal and tax environment in your new country of residence.