By investing in Private Real Estate, you...

Thanks to our expertise in international Real Estate and our strong BNP Paribas network, we partner with the leading asset managers in the industry and offer access to the most sougth-after funds.

Maxime Jouret

Global Head of Private Real Estate

By investing in Private Real Estate, you...

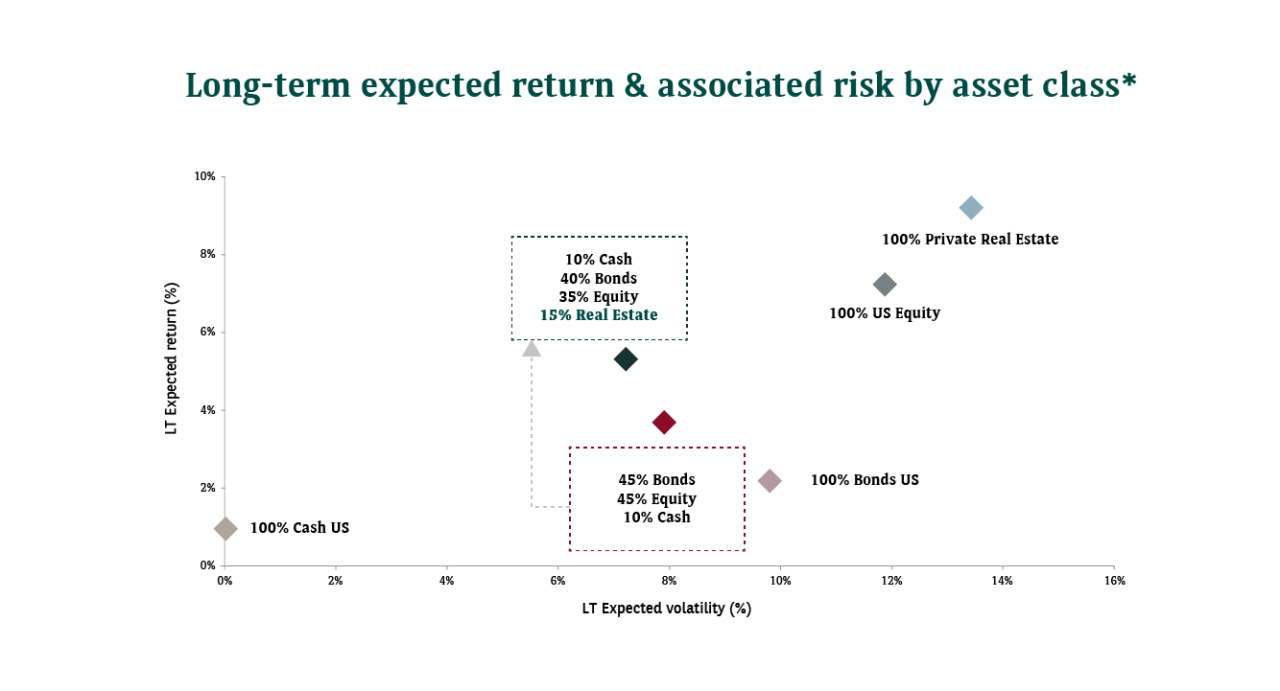

*Past performance is not a reliable indicator of future performances.

Source: Strategic-A (BNP Paribas Wealth Management proprietary tool). Data as of October 2022. Gross expected returns (excluding tax and transaction costs) which include price variations and yield, and expected volatilities p.a. over the long term (8-10 years). Cash is composed of 100% of Cash USD. Bonds is composed of 100% of US IG Corporate Bonds (Barclays US Corp IG index). Equity is composed of 100% of S&P 500 index. Private Real Estate is composed of 100% of the Cambridge Associates index.

Benefit from a privileged access

Thanks to our strong network and unrivalled real estate expertise, BNP Paribas is able to offer to its clients an exclusive access, with a reduced minimum entry ticket, to the best funds available on the market, traditionally reserved for institutional investors.

BNP Paribas Wealth Management chooses the opportunities which offer the best risk/return ratio among the following two dynamic strategies: "Value-Add" and "Opportunistic"