Navigating Volatility

Equity markets, particularly Asian equities, had a strong start to the year despite heavy geopolitical newsflows, including developments in Venezuela, Greenland and Iran, while the USD Index was down by 3.2% peak-to-trough in January. Precious metals also saw a “boom and bust” within two weeks of January 2026. In this edition, we hope to help investors navigate market volatility by addressing two key questions: (1) whether the bull cycle for precious metals remains intact, and (2) why investors should focus on policy, not politics.

1. Bullion Bloodbath: A Healthy Market Correction or the End of the Gold Rush?

The precious metals market has entered 2026 not just with a “sparkle” but with a full-blown roar. After a historic 2025 that saw gold gain over 40% and silver more than double, the first few weeks of 2026 have delivered a masterclass in market volatility. Gold surged past the psychological $5,000/oz mark in January 2026, peaking near $5,608 on January 30. Silver, having ended 2025 near $80, rocketed to a record $120/oz in late January. Then came the “crash”. On Friday, January 31, gold suffered its sharpest one-day decline in decades, down by around 11% intraday, while Silver plummeted 31%, falling as low as $78, and reminding traders of the infamous Hunt Brothers collapse of 1980. The massive “liquidation event” wiped out trillions in market capitalisation. Despite investors having to cautiously navigate such a landscape where record highs are being met with historic single-day crashes, the increasingly greater risk is simultaneously creating immense opportunity.

What are the reasons for the precious metals “crash”?

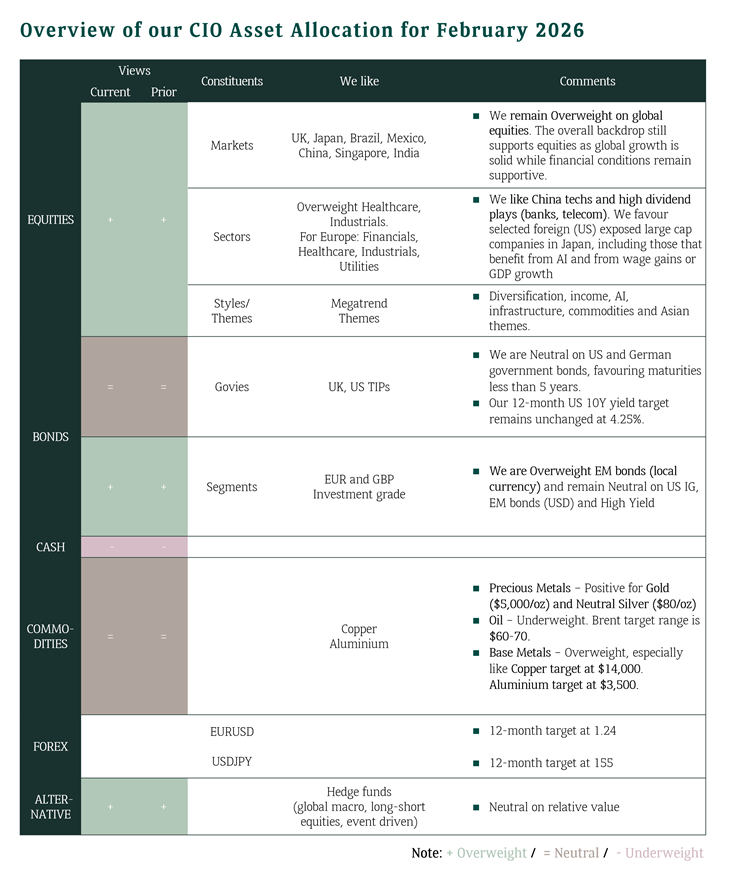

The vertical move upwards in precious metals has been the result of a perfect concoction of geopolitical instability, shifting US economic policies, central bank accumulation, weakening USD, surge in ETF inflows (see Figure 1) and a supply-demand mismatch (notably the “Silver Squeeze”). Likewise, the sharpest decline in the precious metal space we have seen in decades is also the result of a “perfect storm” of macroeconomic and technical factors.

The “Warsh” shock

The market viewed Kevin Warsh as an inflation hawk who favours a smaller Fed balance sheet. Hence, concerns about the Fed’s independence eased, and the greenback saw some level of recovery. Delays and reductions in Fed rate cuts are also priced in, and this traditionally strengthens the US Dollar and hurts non-yielding assets like gold and silver.

Profit taking

After a blistering rally where silver rose nearly 70% and gold 30% in January 2026 alone, the market was clearly overbought. Compared to the start of 2025, gold and silver were up by more than 2x and 4x respectively. Unsurprisingly, traders rushed to lock in such unprecedented profits, initiating the start of the downward move.

Extreme margin calls and deleveraging

Aside from being overbought, the precious metal market was also overly leveraged. To curb volatility, the CME Group significantly raised margin requirements for gold and silver futures. This resulted in a liquidation cascade as leveraged traders who were unable to meet the new requirements were forced to sell, triggering a waterfall sell-off.

Read the earlier edition of Investment Navigator 2026 Outlook: Out With The Old, In With The New

What is our outlook for gold and silver?

Despite gold experiencing its steepest decline in 13 years, it’s still up by 17.5% this year. Likewise, silver remains the best-performing asset class this year with a 21.5% gain, even after the historic collapse of approximately 30%, which firmly surpasses the 1980 “Silver Thursday” collapse. While the recent volatility is stomach-churning, the underlying fundamentals suggest that the “glitter” isn't going away anytime soon.

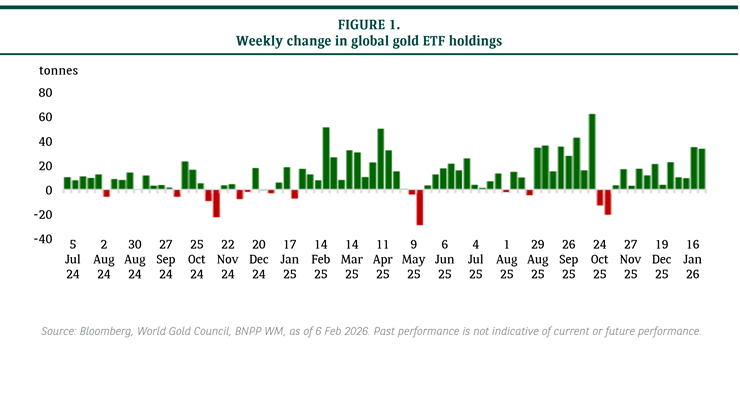

On the monetary front, we are still expecting two more rate cuts from the US Federal Reserve this year. In short, the Fed’s policy direction is unlikely to change — which has historically triggered the end of bull markets for gold — in the near to mid-term. Therefore, we remain buyers of gold on dips. The trend of “de-dollarisation“ (particularly in emerging markets) suggests a continuation of central banks accumulating gold as an alternative “sanction-proof” reserve (see Figure 2). This should provide a high floor to the yellow metal.

On the other hand, silver is more speculative than gold. However, like other commodities, silver seems to be going through an industrial “super-cycle,” and is no longer just a "monetary" metal. The aggressive push into solar energy, EVs, and AI-linked semiconductors has created a much stronger demand than expected. Furthermore, silver mining investment has experienced a “winter” of nearly 10 years. Although this has finally ended, lead times for new silver mining projects are typically very long (7-10 years from discovery to production). The result is a structural supply deficit, and this reason alone should help to support the silver price. Therefore, we remain constructive on silver in the longer term but turn neutral tactically following the “blow-off” top experienced in late January.

2. Why Focus on Policy, Not Politics…

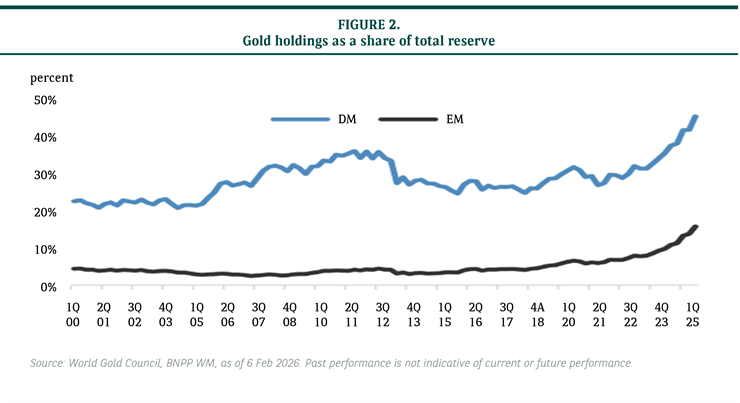

Risk assets are far more strongly correlated at this current juncture in the market cycle. Global risk-on sentiment carried through to January, following the “Santa Rally” in December 2025. Familiar narratives returned, including looser monetary policies, AI optimism and cash positioning. Markets heated up rapidly, and by then, de-risking was a matter of “when”, not “if”. The canary in the coal mine was the USD/JPY and JGB yields’ move in the second half of January 2026.

JPY and JGB already flashed warning signals on de-risking

Taking advantage of a high approval rating among the Japanese population, Prime Minister Sanae Takaichi called for an early snap general election. Her push for looser fiscal and monetary policies drew criticism for fiscal ill-discipline and should continue to pressure the JPY further. Following the announcement, the yen weakened and JGB yields rose. The 40-year yields moved above 4%, while 30-year yields moved above 3% (see Figure 3). This resulted in the “yen repatriation scare”, which was the first warning shot for global risk assets, and in particular US treasuries where Japan is the largest foreign holder. As the JPY neared 160, we finally got a more hawkish BoJ. The Yen-strengthening that followed invited speculations about an intervention from the BoJ and the Fed. We expect the BoJ to raise rates at least twice this year. With Takaichi’s landslide election win and pushing forward the consumption tax cut, we expect JPY weakness in the short term, with our 3-month target of USDJPY at 158, and 12-month target at 155.

Is the weaker USD a “disruption by design”?

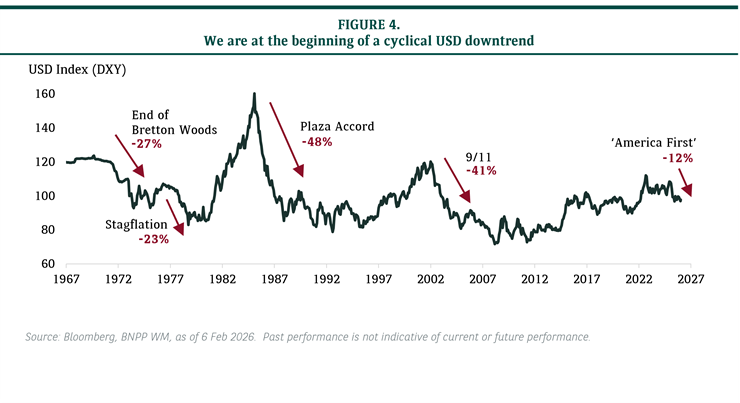

History shows that some Asian currencies have generally been managed by local governments to be weaker compared to the US Dollar. This was typically done to boost export competitiveness. However, it also drove global imbalances, export and import deficits, and encouraged populism. While we do not expect a repeat of the 1985 Plaza Accord where several central banks intervened to weaken the US Dollar, an alternate version (Trump’s very own “New Plaza Accord 2.0”) could emerge. In this scenario, Asian governments might face greater pressure to allow modest, market-driven appreciation of Asian currencies.

The current restructuring of the global trading system, driven by higher US tariffs, is boosting re‑industrialisation in the US and the West. Over time, this restructuring could lead to lower populism, rising real wages, and higher incomes. It will also help reduce trade deficits, thereby lowering global imbalances. In our view, this should lead to a soft dollar, and we have a 12-month target of 93.9 for the DXY index.

Importantly, appreciating currencies and equity markets go together. In this context, Asian equities should benefit from likely Asian FX appreciation, aligning with our bullish conviction. Japan will continue to benefit from improving corporate governance, while India remains focused on longer‑term growth. In addition, Asian technology—which forms the foundation of the AI build‑out, particularly through companies in Korea, Taiwan, and China—continues to benefit from the AI capex cycle.

Overall, we also expect the trend of moving away from US assets to continue. Majority of investors are heavily overweight in US equities due to their strong outperformance in the past years. This rebalancing is already underway, as evidenced by the massive inflows recently seen in regions such as Europe and Japan. Chinese equities will likely benefit from this shift, given the low position of global fund managers. That said, investors are not abandoning US assets entirely but are merely rebalancing their portfolios to manage risk and reduce high exposures.